An NRI needs to pay tax only on the income they earn from an Indian source. This may include income from bank deposits, shares of listed companies, jewellery, business ventures, and any immovable property. The most common transaction that an NRI does is selling a property in India. However, do you know that these transactions are subject to capital gains taxes? In this blog, we will discuss everything you need to know about applicable taxes, their meaning, and the impact of capital gains on an NRI in India.

Key Takeaways

- NRI capital gains tax on shares is a tax that NRIs need to pay on the profits acquired from the sale of a capital asset.

- Capital gains tax is attracted when an NRI sells an immovable property.

- There are two types of capital assets: Short-term capital assets (STCA) and Long-term Capital Assets (LTCA).

- TDS must be deducted on capital gains

- 12.5% or 20% must be deducted from long-term capital gains.

- 30% must be deducted from short-term capital gains.

- Capital gain exemptions are available under Section 54 series.

What is Capital Gains Tax in India?

Any profit or gain that is derived after selling a "capital asset" is known as income from capital gains. Capital assets include land, buildings, house property, patents, machinery, and leasehold rights, among others. It can also include having rights, management, and control in an Indian company or any other legal right. These gains are taxable in the year in which the capital assets are transferred. There are two types of Capital gains: short-term capital gains, known as STCG, and long-term capital gains, or LTCG. Before discussing the types of capital gains, let's understand the types of capital assets:

What are the Types of Capital Assets?

There are two types of capital assets, which are as follows:

Short-Term Capital Asset (STCA)

Any assets held for less than 36 months will be considered short-term capital assets. Therefore, if the asset is sold within 36 months of acquisition, it will be viewed as a short-term capital asset.

The following are the assets that will be determined as Short-term capital assets even when they are held for 12 months or less:

- Units of UTI don't matter if quoted or not.

- Equity-oriented mutual fund units or zero-coupon bonds, whether quoted or not.

- A recognized Indian stock exchange company's equity or preference shares.

- Any security that is listed on a recognized stock exchange in India. It can include debentures, bonds, government securities, and other similar instruments.

Long-Term Capital Asset (LTCA)

An asset held for more than 36 months will be classified as a long-term capital asset. In short, if you sell the asset after a specified 36-month period of acquisition, it will be considered a long-term capital asset. Capital assets, such as land, buildings, and house property, will be regarded as long-term capital assets if the owner does not sell them within 24 months or more.

The following assets shall be considered as Long-term capital assets if held for more than a period of 12 months:

- Equity-Oriented Mutual Fund Units

- A recognized Indian stock exchange company's equity shares.

- Units of UTI.

- Listed securities include debentures, bonds, and government securities traded on a recognized Indian stock exchange company.

STCG vs LTCG Holding Period

| Asset Type | STCG Holding Period | LTCG Holding Period |

|---|---|---|

| Listed equity shares, equity MF, UTI units | < 12 months | ≥ 12 months |

| Unlisted shares | < 24 months | ≥ 24 months |

| Immovable property (land/building) | < 24 months | ≥ 24 months |

| Debt funds & other assets | < 36 months | ≥ 36 months |

Things that Will Not Be Considered as Capital Assets

- Special bearer bonds (1991).

- Stock, consumable, or raw materials that are kept for professional or business purposes.

- Items held for personal use, such as clothes and furniture.

- Gold deposit bonds issued under the Gold Deposit Scheme (1999) or a deposit certificate issued under the Gold Monetisation Scheme 2015, and 2019, notified by the Central Government.

- 6% gold bonds (1977) 7% gold bonds (1980), or national defence gold bonds (1980) issued by the Central Government.

- Agricultural land in rural India.

What is a Rural Area?

To determine if a land is rural agricultural land, we need first to identify if it is rural land. In terms of capital gains, the value of rural land is determined by the distance of the land from its nearest municipality or cantonment board and its surrounding population. The following will be considered as rural land:

| Shortest aerial distance from the local limits of the cantonment board or municipality | The population as per the last census. |

|---|---|

| Outside the limits |

≤ 10,000 |

| > 2 km | > 10,000 |

| > 6 km | > 1,00,000 |

| > 8 km | > 10,00,000 |

Taxation for NRI Capital Gains in India

Depending on a person's residential status, the applicability of Indian Tax laws will be determined. An Indian resident is liable to pay taxes on global income, while an NRI (Non-Resident Indian) will have to pay taxes on the income that is accrued in India. The tax effects of investments made by an NRI will depend entirely on the nature of the investment, which can be either Short-term Capital Gains (STCG) or Long-Term Capital Gains (LTCG):

- Short-Term Capital Gains (STCG): STCG refers to the income derived from the sale of capital assets held for less than the specified holding period. The holding period may differ based on the asset type:

- Debt mutual funds, Market-linked debentures, and Unlisted bonds or Debentures are considered short-term always.

- An equity-oriented mutual fund, units of UTI, and listed equity shares: Held for less than 12 months.

- An Immovable property, such as land or a building: Held for less than 24 months.

- Long-Term Capital Gains (LTCG): In contrast to STCG, Long-Term Capital Gains are derived from the sale of capital gains held beyond the specified holding period.

- Listed equity shares, units of UTI, and equity-oriented mutual funds: Held for either 12 months or more.

- An immovable property, such as land or a building, held for 24 months or more.

Investment Types and Their Tax Implications

Understanding the tax implications of different types of investments is crucial for NRIs seeking to maximize their returns while adhering to Indian tax law rules. Below are the main types of investments and their tax implications:

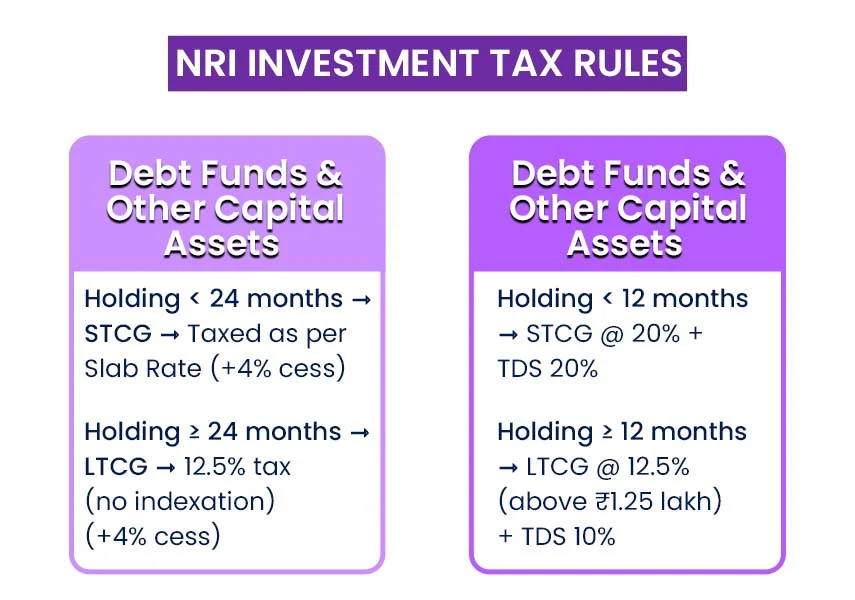

Debt Funds and Any Other Capital Assets Taxability

This refers to investments in shares, excluding unlisted securities and other capital assets; the distinction between short-term and long-term investments is crucial. If kept for nearly 24 months, it's considered long-term, and if not, then it is deemed as short-term. Long-term gains from these types of investments are liable to a tax rate of 12.5% without indexation. While short-term gains are combined into taxable income and taxed at the applicable slab rate. Moreover, both gains are subject to an extra education and higher education cess of 4%.

Capital Gains on Shares for NRI

Based on the duration of the investment, the tax implications for capital gains on a listed equity share or an equity-oriented mutual fund will differ. A shorter duration of less than 12 months falls under the category of short-term capital gains, in which the NRI is liable for a tax rate of 20% along with a corresponding TDS of a similar rate.

Investments held for more than 12 months are considered long-term capital gains. A tax rate of 12.5% is applied here; however, it is only applicable to gains that exceed Rs. 1.25 lakhs. Furthermore, a TDS deduction of 10% applies to these long-term capital gains. The difference between short-term and long-term capital gains provides a more nuanced understanding of tax liabilities. Along with offering incentives for long-term investments, it also ensures a fair taxation system for short-term gains.

Did you earn capital gains as an NRI recently? Don't worry, if you want to know how your gains and dividends will be taxed, contact the experts at Savetaxs and minimise your taxes. Their experts can guide and help you with everything you need to know to comply with the Indian Tax Laws.

Fixed Deposit Investments Taxability for NRIs

NRO Account Fixed Deposits

- A 30% TDS (Tax Deducted at Source) will be applicable on all interest earned, without any threshold exceptions.

- The interest on fixed deposits earned from an NRO (Non-Resident Ordinary) account will be fully taxed in India.

- It includes FD interest received from various income sources, such as rent, dividends, pensions, and any other earnings generated within India.

- NRIs are required to pay TDS on the entire interest amount, unlike Indian residents, who are entitled to a deduction threshold of nearly 40,000 rupees.

NRE Account Fixed Deposits

- An NRE account can be an ideal choice for an NRI looking to invest in India with better tax efficiency.

- In contrast to an NRO account, interest earned on FD or savings from an NRE (Non-Resident External) account is entirely free from any tax liability in India.

Tax Rate When Selling Unlisted Shares

If you sell the unlisted shares within 2 years of purchasing them, the gains will be considered Short-term capital gains (STCG). The applicable tax rate will depend on the individual's income tax slab. In contrast, if sold after 2 years, the gains will be classified as Long-term capital gains (LTCG), and the tax rate will be a flat 20%.

Instantly calculate short-term and long-term capital gains tax on your investments with ease.

Tax Rates on Capital Gains on Sale of Property by NRIs

An NRI faces specific tax rates on capital gains earned from property sales. LTCG on property is taxed at a flat rate of 12.5% without indexation. For Long-term Capital gains on equity shares and equity-oriented mutual funds, the tax rate is also 12.5% on gains exceeding the limit of Rs. 1.25 lakhs, while other assets incur a tax of 12.5%. Notably, taxpayers can choose between a 12.5% tax rate without indexation or a 20% tax rate with indexation for any immovable property purchased before July 23, 2024.

Short-term Capital gains will depend on whether Securities Transaction Tax (STT) is applicable or not. If STT applies, a tax rate of 20% is charged. However, if STT is not appropriate, then STCG will be taxed at the regular income tax slab rates.

What Tax Applies If I Sell My Property in India?

- STCG (Short-Term Capital Gains): These are taxed at the applicable slab rates, provided that the property is sold within two years from the purchase date.

- LTCG (Long-Term Capital Gains): If you sell the property after 2 years from the purchase date, then the profit will be considered as LTCG. So, it will be taxed as follows:

- If the property is purchased before 23rd July, 2024, then it will be taxed at 20% with indexation benefit.

- If the property is purchased on or after 23rd July, 2024, it will be taxed at 12.5% with no indexation benefit.

Tax Implications on Purchase or Sale of Property by NRIs

For property valued over Rs 50 lakhs, an NRI must deduct 1% TDS from the payment made to the seller under Section 194-IA of the Income Tax Act. The applicable tax rates will depend on the period of ownership or holding period, which are as follows:

| Holding Period | Type of Capital Gain | Tax Rate |

|---|---|---|

| Less than 2 years | Short-term capital gains (STCG) | Applicable Slab Rate |

| 2 years or more | Long-term capital gains (LTCG) | 12.50% without indexation |

Tax Rates on Capital Gains for NRIs

| Type of Asset | STCG | LTCG |

|---|---|---|

| Listed Shares | 15% | 10% (Above Rs 1 lakh) |

| Debt Mutual Funds | Slab Rate | 20% with indexation (if eligible) |

| Real Estate | Slab Rate | 20% with indexation |

| Unlisted Shares | Slab Rate | 10% without indexation |

Tax Savings Option for NRIs on Capital Gains

An NRI can take several exemptions and investment advantages for long-term capital gains and use them to enjoy tax benefits:

- Section 54: This applies to LTCG from the sale of a residential property. An NRI can claim an exception if they reinvest the LTCG amount in any other residential property within two years or construct a new property within three years.

- Section 54EC: This section is relevant to long-term capital gains from the sale of land or buildings. To avail of this exemption, an NRI must invest the LTCG amount in specific bonds, such as those issued by REC (Rural Electrification Corporation) or NHA (National Highway Authority of India), within six months of the sale. These bonds have a five-year lock-in period.

- Section 54F: It applies to LTCG from the sale of any asset other than a residential property. An exemption is available if the LTCG amount is reinvested in a residential property within 1 year before or 2 years after the sale. Or if a new residential property is constructed within 3 years.

How to Calculate Capital Gain Tax for NRIs?

To calculate capital gains tax for an NRI, you need to follow a simple formula:

Short-Term Capital Gains (STCG)

Step 1: Start with the sale price

Step 2: Add purchase price and transfer expenses

Step 3: Subtracted the added value from the sale price

Step 4: The resulting amount represents the short-term capital gain that is subject to taxation.

Formula to calculate Short-term capital gains

STCG = Sale Price - (Purchase Price + Transfer Expenses)

Long-Term Capital Gains (LTCG)

Step 1: Start with the Sale Price

Step 2: Add Indexed Cost of Acquisition and Indexed Improvement.

Step 3: Subtract the added value from the sale price

Step 4: The final amount will be the long-term capital gains.

Formula to calculate Long-term capital gains

LTCG = Sale Price - (Indexed Cost of Acquisition + Indexed Improvement)

Special Tax Regime for NRI Investors

NRIs investing in certain specified Indian assets, whose income is the only income during the year and for which the TDS has been deducted, do not require an NRI to file an ITR. Investments that qualify include:

- Any security of the Central Government.

- Deposits made with any public company or bank.

- Shares of public and private Indian companies.

- Debentures from a publicly listed Indian company

- Any other Central Government assets as stated in the official gazette for this purpose.

Note that no deductions under section 80 can be claimed while calculating investment income.

Special Provisions for Long-Term Capital Gains

For LTCG from the sale of these assets, indexation and deduction under section 80 are also not available. However, an exemption under Section 115F is available if the profit amount is reinvested into any of the following assets:

- NSC VI and VII issues.

- Securities of the Central Government.

- Indian company shares.

- Debentures of an Indian public company.

If the newly acquired assets are sold within 24 months, the previously exempted profit will be added to the taxpayer's income and taxed accordingly. NRIs can benefit from these provisions even if they later become residents, as long as they do not convert the funds to cash. Additionally, if the NRI wishes to withdraw these special provisions, the income will be subject to tax under the regular provisions of the Income Tax Act.

Considerations for Choosing the Special Tax Regime

NRIs should carefully consider the following before choosing the special tax regime:

- Loss of Deductions: Choosing this regime means forfeiting deductions available under Chapter VI-A and the benefits of indexation.

- Simplified Compliance: To simplify compliance, NRIs with income from only specified assets, from which TDS has been deducted, do not need to file a tax return.

Terms You Must Know

- Cost of Acquisition: The amount for which the seller obtained the capital assets.

- Cost of Improvement: Costs associated with a capital nature that arise while making improvements or modifications to the capital assets by the seller.

- Full Value Consideration: The consideration that is received or to be received by the seller against the transfer of his capital assets. Capital gains are subject to taxes in the year of transfer, regardless of whether any consideration has been received.

To Conclude

Being an NRI, this blog will help you learn about the tax implications on capital gains earned from different sources and the exemptions under Section 54 and Section 54F. Understanding these provisions is not only crucial for making timely investments but also for availing of all the tax benefits available to an NRI. If you are an NRI seeking to reduce your capital gains tax burden, then Savetaxs is the perfect destination for you. Our experts can assist you in navigating complex tax obligations and provide you with the best solutions for tax situations. Please book an appointment with our expert team today.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- NRI Repatriation Guide 2026: How to Legally Send Money Abroad from India

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- Section 54EC of Income Tax Act: Capital Gain Exemption

- What is Section 54 and Section 54F for NRIs?

- Residential Status Under Section 6 of the Income Tax Act

- Complete Guide for Double Tax Avoidance Agreement (DTAA) for NRIs

- NRI Selling Property in India

- What is ITR 3 and How Can an NRI File It Online?

- TDS on Sale of Property by NRIs in India

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Frequently Asked Questions (FAQs)

From property sales to mutual funds - get answers to the most common NRI capital gains tax questions.

Yes, NRIs do have to pay capital gains taxes in india. Capital gains tax is charged on the profit earned after selling a capital asset, like real estate, stocks, bonds, etc.

The basic formula to calculate capital gains tax is: capital gain = (net sale value) - (indexed cost of acquisition + indexed cost of improvement). The final amount calculated will be your taxable capital gain.

As per the Guidelines of FEMA, There Are No Penalties for Not Declaring Your NRI status.

Any profit or gain received after the sale of a Capital asset is known as income under capital gains. These gains are liable to taxation in the year in which the transfer of the capital assets occurs, and there are two types of capital gains: short-term capital gains and long-term capital gains.