A non-resident Indian (NRI) is a person who is an Indian citizen but lives overseas due to employment, studies, or business. However, even being an NRI, an individual needs to pay tax in India if he/she receive or earn an income in India. For non-resident Indians, the Income Tax Act 1961 has different tax rules, and over time, changes have been made to them. Considering this, on 13 February 2025, the central government of India introduced the 2025 Income Tax Bill in parliament. To simplify the compliance process, the officials propose a big overhaul of the tax system. In this, the key aspect involves a significant revision to the rules associated with tax residency, which come into effect from 1 April 2026. Also, it is stated that these changes will create an impact on the NRIs, Persons of Indian Origin (PIOs), and frequent foreign visitors to India. For effective planning and compliance, knowing about these rules is essential. Want to know about it? Then you are on the right page. Here, this blog talks about the new NRI taxation and residency rules under the Income Tax Act. So, let's begin reading.

Key Takeaways

- The NRI status in India is governed by two main laws, which are the Income Tax Act 1961 and the Foreign Exchange and Management Act (FEMA).

- Resident status determines the tax liability of an NRI. While residents are taxed on their global income, non-residents are taxed only on their Indian-sourced income.

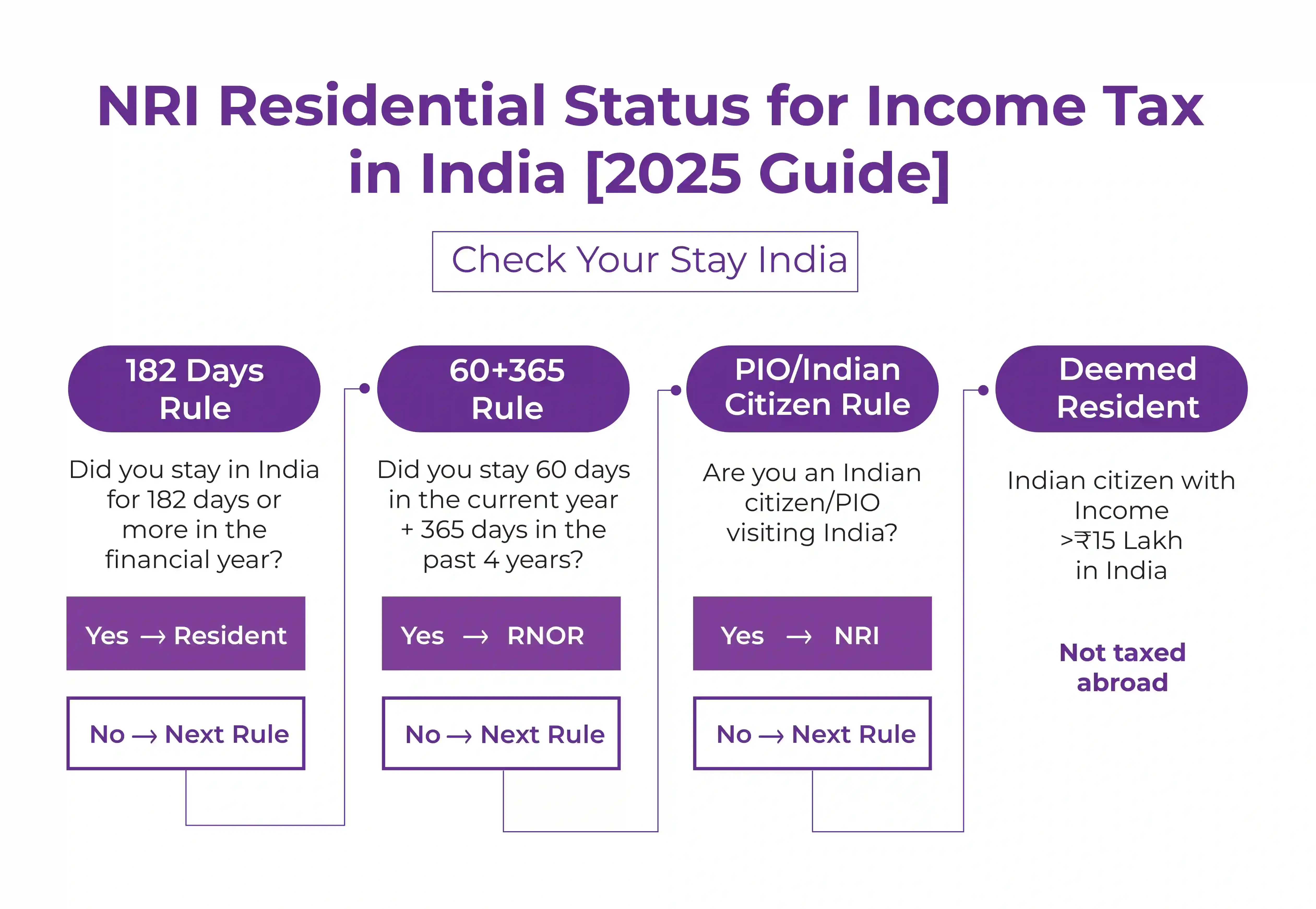

- You will be considered a resident if you stay ≥ 182 days in India in a year, or 365 days in the past four years, along with 60/120 days in the current year.

- Some common sources of income tax for NRIs include rent, capital gains, and NRO account interest.

- Interest acquired from an NRE and FCNR account remains tax-free.

- An NRI has the option to avoid double taxation by claiming the benefits of the DTAA treaty. They need to submit a tax residency certificate and Form 10F to do the same.

Rules Governing NRI Status

In Indian, the NRI status is prescribed and governed by two main laws. These are as follows:

- Income Tax Act 1961: It states the NRIs' tax liabilities in India

- Foreign Exchange and Management Act (FEMA): This act governs all investments and transactions, opening of bank accounts, and more of NRIs in India.

Under both acts, the definition of an NRI is different. Also, the NRI status of a person is calculated by the number of days he/she stayed in Indian during a financial year.

New Definition of Tax Residency in India

Under the revised 2025 income tax bill, a person will be considered an Indian resident if he/she fulfil either of the following conditions:

182-Day Rule (Unchanged and is as per the Income Tax Act 1961)

A person will be considered a tax resident in India if he/she stay in the country for 182 or more days in an accounting year. To know the residential status, this remains a primary factor. Whereas, if a person remains less than 182 days in India, he/she will continue to be known as an NRI. With no additional conditions mentioned in the new income tax bill issued by the Indian government, the 182-day rule remains the same.

60-Day + 365-Day Rule (Revised)

Previously, a person who stayed in the country for 60 or more days in a financial year was considered a tax resident in India and lived in India for 365 days over the last four years. While the rule is the same but some exemptions have been made. These are as follows:

- Under the new tax regime, Indian citizens who are working overseas or are members of the crew are no longer part of the 60-day rule.

- Additionally, if the NRIs and PIOs have earned INR less than 1.5 million in India, they are also not a part of this rule.

For instance, Shivam, an Indian citizen working in Australia, came to India for 100 days in a financial year. As per the old 60-day rule, here Shivam might be classified as a resident in India. However, since he moved overseas for a job, he is now exempt from paying tax and remains an NRI.

*Note: In India, according to the residential status of the person, the tax liability of a person is calculated in that financial year, not according to his/her citizenship in the country. For tax purposes, a person who is a citizen of India can be considered an NRI for a specific year. Also, a foreign national can be considered an Indian resident under the tax laws.

Classification of Taxable Individuals in India

For income tax purposes in India, individuals are classified into three groups:

- Non-Resident (NR)

- Resident and Ordinarily Resident (ROR)

- Resident but Not Ordinarily Resident (RNOR)

The Key Change in Rule: 120-Day Rule for High-Income NRIs and PIOs

Under the new income tax bills, for NRIs and PIOs who earn INR 1.5 million or more, an essential change has been made under the high-income category. Considering this, the 120-day rule has officially replaced the 60-day residency rule. According to the new rule, an NRI or PIO will be considered resident but not ordinarily resident if their income is more than 1.5 million in India and if they:

- In a financial year, they live in India for 120 or more days

- Have lived in India for 365+ days in the last four years

For instance, Ravi is an NRI, earning an income of INR 2 million from India, and visits the country for 30 days. According to the previous rule, he would be classified as an NRI, but as per the new rule, he is now known as RNOR.

Why is this Essential?

Here are the two key reasons why this new rule is essential for NRIs:

- As an RNOR, only the income that a person earned in India is taxable, while his/her global income remains tax-free in India.

- If a person lived in India for 182 days, he/she become an Indian resident and their now their global income is also taxable in India.

Understanding the Not Ordinarily Resident Status

A person is classified as not ordinarily resident (NOR) in India if he/she fulfils any of the following conditions:

- For nine out of the last ten years, they were an Non-Resident Indian

- Over the last seven years, they have lived in India for 729 days or fewer

- They are citizen of India or PIOs with Indian income of more than INR 1.5 million and have lived in the country for 120 to 180 days in an accounting year.

For instance, Avinash, a non-resident Indian, came back to India and has lived only 500 days here over the last seven years. He will be classified as NOR. It means he is liable to pay tax on the income that he earned in India, while his global income is tax-free in the country.

Deemed Residency Rule

Under the new income tax bill, a debatable provision is the deemed residency rule. The deemed residency rule is applicable to Indian citizens whose income is INR 1.5 million or more in India, but they are not paying tax in any other foreign nation. This rule creates an impact on Indian residents who are living in tax-free jurisdictions like Monaco, the UAE, or Saudi Arabia, who have significant income from India. Here, it is worth noting that even if that person never visited India, he/she can still be known as a tax resident in India, making their global earning taxable in the country.

For example, Amit, an Indian citizen employed in Dubai who does not pay income tax, has income of INR 2 million from India but does not visit the country. According to the new income tax rule, he will still be known as an Indian resident and needs to pay tax on his global income in India.

Other Important Residency Rules

Here are the other important residency rules associated with the income tax laws in India:

- Crew Members of Foreign Ships: The time of the crew members who are Indian residents is calculated in India under special rules.

- Association of Persons (AOPs), Firms, Trusts, and Hindu Undivided Family (HUF): Unless the entire control and management of these entities is outside India, these are considered Indian residents.

- Companies: A company is taxable in India if:

- If the company is an Indian-incorporated entity

- The Place of Effective Management (PoEM) of the company is located in India

For example, if the main management decisions of a foreign company are taken in India, it will be known as a tax resident in India.

Taxability of Income of NRIs and RNORs in India

If you are an NRI, and if you are earning any income in India or any income is accrued in India, then on that money, you need to pay tax in the country. Here, the money you earned outside the country is not taxable. Additionally, the income of a non-resident seafarer for the services they provided outside the country on a foreign ship is not included in their income taxable in India, even though they receive their salary in the NRE account with an Indian bank account.

For example, a seafarer rendered services in Europe and lived in India for less than 182 days. He received his salary in his NRE Account with an Indian bank. Here, his income will not be taxable in India.

In case if you are RNOR and have just come to India, you can maintain this status for a maximum of three accounting years post your return to the country. It can assist you with tax in a big way since your Indian taxation will be in line with that of an NRI. Hence, the money that you earn outside India will not be taxable in the country. Therefore, like a non-resident India (NRI):

- Any income that you earn inside India is taxable.

- The income that you earn outside India, for which you do not need to pay tax for up to three years after your return

However, once you become an Indian resident, all your income, whether you earn inside or outside India, will be taxable in the country, barring any claims that may be applicable under the Double Taxation Avoidance Agreement (DTAA) between India and other foreign country from which you earned your income.

What Foreign Income Is Taxable in India Under the New Bill?

Income that you earned outside Indian is considered as foreign income, except for these:

- Professional earnings, if the professional practice was situated in India

- Income from business, if it is controlled and managed from India

For example, Anshul is an NRO, and he earned an income of INR 50 million from his business in Dubai. Since his business is set up in Dubai, he did not need to pay tax in India. However, in case his Dubai business was managed from India, it would become taxable in the country.

What Is Considered 'Earned in India?'

Any income that you or someone on your behalf received in India is known as 'income earned in India.' Additionally, any earning that arises or accrues in India or income that Indian tax law believes to arise or accrue in India are a part of income earned in India. According to the Income Tax Act 1961, whether an Indian resident or an NRI earns it, these incomes are taxable in India, and to avoid paying double tax on the same income, a person can claim under the DTAA Agreement for tax relief.

What Is Considered 'Accrued in India?'

It is mentioned in Section 9 of the Income Tax Act, 1961. This tax rule applies to everyone whose income arises or accrues in India, irrespective of their residential status in the country. Confused? To help you out, there are some questions mentioned. If any of the following questions have a Yes answer from your side, then your income will be considered accrued in India:

- Income generated from a business connection in India.

- You receive money from any asset, property, or source of income in India.

- From the assets transfer situated in India, a capital gain was received.

- Salary payable to you by the government of India for services rendered outside the country when you were a citizen of India.

- Received salary for services rendered in India.

- Technical fees, royalty, or interest, from the State or Central government, or from a specific person in certain situations.

- Even though you already paid outside India, the dividend paid by an Indian company.

Instantly determine if you qualify as Resident, RNOR, or NRI under Indian Income Tax rules.

Tax Deductions for NRIs under Section 80C

While filing ITR, NRIs under Section 80C can claim the following tax deductions in India:

- Payment made towards Life Insurance Premium

- Investment made in Equity Linked Savings Scheme (ELSS)

- Tuition fees paid for children

- Paid for Unit Linked Insurance Plan (ULIP)

- Amount spent to repay the main loan amount taken for the construction or purchase of a residential property

Apart from section 80C, NRIs can also claim tax deduction for certain circumstances under Section 80G, 80D, 80TTA, Section 54, and Section 54EC in India.

How NRIs Can Avoid Tax Residency in India?

To avoid tax residency in India, NRIs or any foreign resident can follow the below-mentioned things:

- If your income is INR 1.5 million or more in India, visit the country for less than 120 days.

- Strategically plan your visit across different assessment years.

- If you are living overseas in a tax-free country, wisely structure your income.

- To avoid deemed residency, keep your income below INR 1.5 million.

- To minimise tax liability in India, invest smartly in business and property.

Summary of NRI Taxation & Residency Rules

From the above guide, i.e., new NRI taxation and residency rule under the Income Tax Act, these are the following takeaways:

- There are no changes in the 182-day rule; it remains the primary standard for residency.

- The 60-day residency rule now does not apply to crew members, NRIs, and Indian citizens working overseas.

- The 120-day rule applies to the high-income NRIs, who earn INR 1.5 million or more in India.

- Additionally, the deemed residency tax rule is applicable to NRIs who earn 1.5 million or more in India, but do not pay tax in any country.

- Through RNOR status, individuals can avoid paying global taxation on the same income.

Final Thoughts

This was all about the new NRI taxation and residency rules under the Income Tax Act. The 2025 Income Tax Bill has made significant changes in the tax rules that impact NRIs, PIOs, and citizens of India living overseas. Considering this, to avoid paying unexpected tax in India, proper tax planning and maintaining residency status are vital. Apart from this, understanding these new tax provisions will assist people in making informed decisions related to finance and ensure compliance with the tax laws of India. Furthermore, if you need more information on NRI taxation or are facing issues in filing ITR, connect with Savetaxs. We have professionals by our side who can help you in solving your tax-related queries and assist you in filing your ITR on time in India without any issues.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- Residential Status Under Section 6 of the Income Tax Act

- Advance Tax Planning For NRIs (Non-Resident Indians)

- What is a Tax Residency Certificate (TRC) and How to Get It?

- Complete Guide for Double Tax Avoidance Agreement (DTAA) for NRIs

- NRI Repatriation Guide 2026: How to Legally Send Money Abroad from India

- Section 80TTA of Income Tax Act – All about Claiming Deduction on Interest

- Section 115H Of Income Tax Act: Benefits & Provisions

- A Comprehensive Guide to the Annual Information Statement

- What are the NRI Tax Slab and Rates for FY 2024-2025 For NRIs?

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

Frequently Asked Questions (FAQs)

Confused between NRI, RNOR, and ROR? Our FAQs simplify it.

According to Income Tax rules, an Indian citizen who has stayed overseas for carrying out business/ employment or vocation for 182 days or more during a financial year is considered an NRI. An NRI is liable to pay tax in India on income he/she received or earned in the country.

If an individual is 9 out of 10 accounting years a non-resident or lived in India for 729 days or fewer in the last 7 accounting years, that person will be considered as RNOR (resident but not ordinarily resident) in India.

In India, a resident is taxed on their total income that includes both the income they generate in the country as well as money received outside India. The tax burden on them is limited in the country to the money they earn in the country. Considering this, in case of NRI, the taxation rules change; they need to pay tax in both countries, in India or the foreign country from where they are generating money.

The concept of deemed residency was introduced in the Finance Act 2020. As per this, Indian citizens or NRIs whose income is 1.5 million or more in India but are not paying any tax on this in any other country. According to this, if a person never even visited India, they are still classified as a tax resident in the country, making their international income taxable in the country.

Generally, the foreign income is not taxable for NRIs and RNORs in India. However, they need to pay tax in India on the capital gains from fixed deposits, mutual funds, rental income from property and shares, applicable according to the income tax slab. Furthermore, from time to time, these rules are subject to change.

NRIs can maintain their non-resident status in India by strategically planning their visit to the country during an accounting year, staying in the country for less than 120 days per visit, and not living the country for at least 60 days in a financial year and should not spend 365 days in the coutry for last four years.

An NRI should file ITR-2 and ITR-3. Generally, the NRI files ITR-2 while paying tax in India and fulfilling their tax liabilities in the country.

No, NRIs cannot hold a resident account in India. In case they are found doing so, they need to pay a penalty fee of up to three times more than the amount they have in their resident account, or INR 2,00,000 if the amount in the account is not quantifiable.