WhatsApp Community

- Whatsapp CommunityWhatsapp Community

Connect with us in just a click!

- Chat WhatsappChat Whatsapp

Fast replies, simple and direct!

In India, non-resident Indians (NRIs) must file taxes if they have taxable income in the country. ITR filings for NRIs are subject to specific rules. Further, these rules are subject to change from time to time. Considering this, for the Assessment Year (AY) 2026–27, the income tax authority has implemented several revisions to ITR forms and filing rules.

Having information about them will help NRIs claim refunds on TDS, maintain financial records in India, and more. Want to know all about this? This guide contains all the information on ITR filings for NRIs, including income tax slabs, due dates, forms, and updated rules. Read on for all the details.

An individual is considered a resident if he/she satisfies either of the following conditions:

If you do not meet any of the above conditions, you are treated as an NRI for tax purposes.

As an NRI, you only pay tax on income that arises, accrues, or is received in India.

Residents and NRIs follow the same tax slabs. Taxpayers may choose between the old and new tax regimes, each having different benefits.

Under the new tax regime, most exemptions and deductions such as HRA, LTA, 80C, 80D, PF, etc., are not available. The old regime continues to allow them.

Below are the correct slabs for AY 2026–27:

| Old Tax Regime | |

|---|---|

| Income Level (in INR) | Tax Rate |

| 0-2,50,000 | Nil |

| 2,50,001 - 5,00,000 | 5% |

| 5,00,001 - 10,00,000 | INR 12,500 + 20% of the amount more than INR 5,00,000 |

| 10,00,001 and more | INR 1,12,500 + 30% of the amount more than INR 10,00,000 |

| New Tax Regime | |

|---|---|

| Income Level (in INR) | Tax Rate |

| 4,00,000 | Nil |

| 4,00,001 - 8,00,000 | 5% |

| 8,00,001 - 12,00,000 | INR 20,000 + 10% of the amount more than INR 7,00,000 |

| 12,00,001 - 16,00,000 | INR 60,000 + 15% of the amount more than INR 12,00,000 |

| 16,00,001 - 20,00,000 | INR 1,20,000 + 20% of the amount more than INR 16,00,000 |

| 20,00,001 - 24,00,000 | INR 2,00,000 + 25% of the amount more than INR 20,00,000 |

| 24,00,001 and above | INR 3,00,000 + 30% of the amount more than INR 24,00,000 |

The new tax regime aims to significantly reduce your tax liabilities. Considering this, NRIs paying taxes on Indian-sourced income may receive lower tax rates. Additionally, get higher tax returns.

Moving further, let's know when an NRI should file taxes in India.

NRIs need to file ITR in India when they have taxable income in the country. Considering this, according to the Income Tax Act, 1961, NRIs must file an ITR if their gross income in India is more than:

This was all about the income tax regimes and slabs for ITR filings for NRIs in AY 2026-27. Further, the deadline for ITR filings for NRIs and residents for AY 2026-27 will be July 31, 2026.

Moving ahead, let's know about the ITR form available for non-residents.

Depending on the source of income, there are two types of forms that NRIs can fill out. These are as follows:

So, depending on your source of income, you can choose from any of these NRI ITR forms. Moving further, let's know the key changes for AY 2026-27 impacting NRIs.

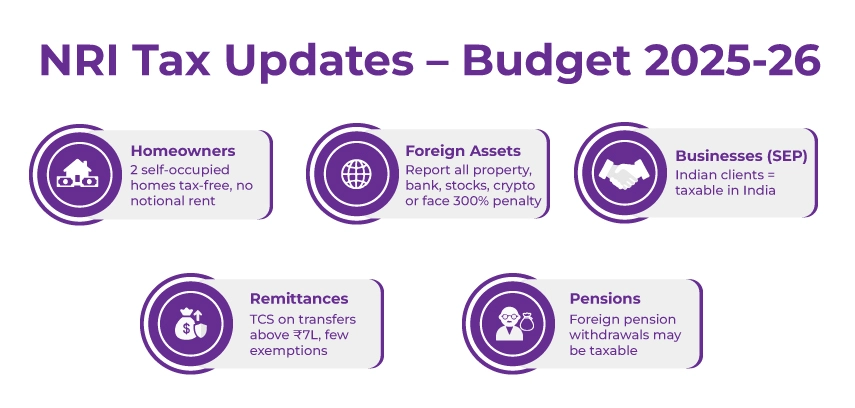

Here is the list of key changes for AY 2026-27 impacting NRIs:

Many NRIs in India own properties that are either occupied by family or vacant. In the past, these properties were treated as "deemed to be let out," where owners needed to pay tax on notional rent. Subject to specific conditions, up to two self-occupied properties were exempt from notional rent tax. However, in the Budget 2025-26, these conditions were removed. This allows NRIs with up to two self-occupied properties to enjoy tax-free ownership in India.

To enhance curb tax evasion and transparency, the government of India for foreign assets has imposed stricter reporting requirements. Considering this, now every NRI should declare:

Failure to disclose correctly these assets could result in facing severe penalties. These include:

This further underscores the importance of NRIs maintaining detailed records of their foreign assets and income.

A major concern for NRIs who operate businesses overseas is the SEP rule. Considering this, even though the business is not physically present in India, if it includes Indian customers, then they are liable to pay tax in India. The SEP rule applies to:

Hence, having a business in tax-friendly destinations like Singapore or Dubai no longer protects NRIs from Indian taxation. NRIs with international business should restructure their functioning and assess their tax obligations.

The Liberalized Remittance Scheme (LRS), which allows people to send money overseas, now has strong tax collection at source (TCS) regulations:

So, those days are gone when you make cross-border transactions hassle-free. Now, you should carefully plan things and document your remittances.

NRIs who have a foreign pension scheme, such as EPF in the UAE, 401(k) in the US, or Superannuation in Australia, should be careful that:

These are some of the key changes made by the Indian government in Budget 2025-26. This will come into effect from April 1, 2026. As an NRI, it is vital that you understand these changes and work accordingly.

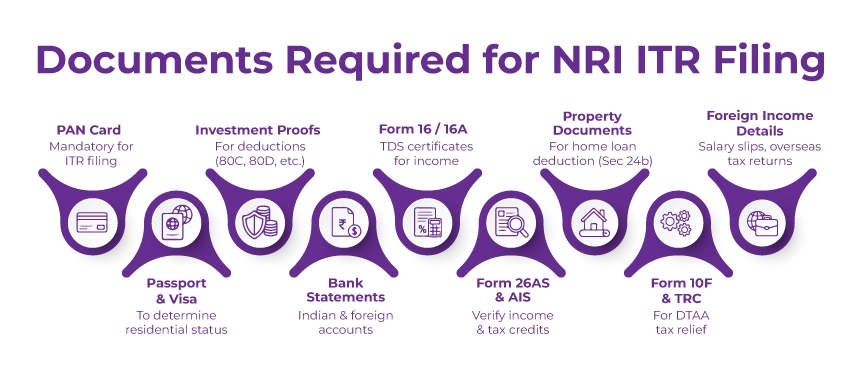

Now, moving ahead, let's know the required documents for NRIs filing ITR in India.

Here is the list of the following documents that NRIs are required to submit to file ITR in India:

These are the documents NRIs need to submit when filing their ITR in India. Moving on, let's look at the steps to file an ITR.

Here is how NRIs online can file ITR in India:

This is how you can file your ITR online in India. Additionally, the process of ITR filings for NRIs and Indian residents is the same.

Conclusion

This was your complete guide for ITR filings for NRIs in AY 2026-27. Hope that after reading it, all your doubts will be clear. However, if you are still confused and need help with your ITR filing, contact Savetaxs. We have a team of professionals who can guide you in filing your ITR as an NRI. Additionally, the expert can also assist you with better tax planning.

Income up to INR 2.5/4.0 lakhs is tax-free for NRIs in India. This tax exemption is the same for both Indian residents and NRIs in India.

If the total income of the OCI is less than Rs 250000, then it is tax-free in India, if the income is between Rs 250000- Rs 500000, then they need to pay 5% tax, if the income is between Rs 500000- Rs 100000, then they need to pay 20% and if the income is more than Rs 1000000 then they need to pay 30% tax.

If an NRI sells an Indian property, the buyer has the right to deduct 20% TDS as long-term capital gains tax for properties sold after 2 years. However, if the property is sold within two years after its purchase, 30% TDS is deducted as short-term capital gains tax in India.

Yes, you can keep money in USD in your NRE account in India. However, once you deposit your foreign currency in this account, it will be converted into Indian INR, as these accounts are designed to manage and hold funds received outside India in Indian currency.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.