WhatsApp Community

- Whatsapp CommunityWhatsapp Community

Connect with us in just a click!

- Chat WhatsappChat Whatsapp

Fast replies, simple and direct!

Think of a PAN card like VIP access to the Indian financial market. Without one, you cannot carry out any financial transactions in India. A Permanent Account Number (PAN) is a mandatory document to conduct any financial transaction in India. The primary use of a PAN card is for tax purposes; however, it is also required to invest in the Indian market, open a bank account, or purchase or sell property or other assets.

A PAN Card for NRIs is a PAN explicitly issued to Non-Resident Indians to comply with tax regulations and manage financial operations in India. This guide breaks down every aspect of the NRI PAN Card - from the process to the benefits, the document checklist, and more.

A Non-Resident Indian must have a PAN card if they engage in any of the following activities:

Investments: As an NRI, if you wish to invest in the Indian stock market, mutual funds, or other government securities, having a PAN is non-negotiable; without one, a broker won't be able to open your Demat or trading account.

Property Dealing: As an NRI, whether you want to buy, sell, or rent a property in India, a PAN card becomes mandatory for registration and other compliance purposes.

Earning Income: If you are earning any taxable income in India as an NRI, filing for a PAN is mandatory.

Banking: To manage your earnings and finances in India as an NRI, you need to open an NRI bank account. There are three types of NRI bank accounts: NRE, NRO, and FCNR. Hence, to open a bank account in India, you need to have a valid PAN.

Repatriation of Funds: To validate the source and amount of the repatriated funds, you need a PAN card.

Corporate or Partnership: As an NRI, if you're acting as a director or partner in an Indian company or LLP, you need a PAN card.

Loan Application: You are not eligible to get a loan sanctioned from an Indian bank without a PAN card.

Type of PAN card needed, spending status of the NRI

To obtain a PAN card, you must complete Form 49A. This form must be filed by both individual and non-individual entities in India, including new PANs for Indian citizens, non-resident Indians, entities incorporated in India, and any other unincorporated entity formed in India.

Form 49A must be filed by:

Form 49AA is for foreign citizens and foreign entities with income or financial transactions in India, such as:

Who should use it?

Apply, update, or correct your NRI PAN card online with ease — hassle-free process, expert guidance, and quick support.

As an NRI, you must complete Form 49A or Form 49AA accurately to get a PAN Card. Keep the following points in mind when you apply for an NRI PAN Card.

When signing the form or placing your thumb impression, ensure that your signature or thumb impression is partially on the photo and partially on the form. Lastly, please ensure that the signature or impression is placed on the left side of the form, not on the right.

The AO (Assessing Officer) Code defines your tax jurisdiction. It determines which tax laws apply to you.

You can obtain your NRI AO Code from:

You can obtain your Assessing Officer code for NRIs, along with related information, on the NSDL website (now Protean), at PAN centers, or at the Income Tax office.

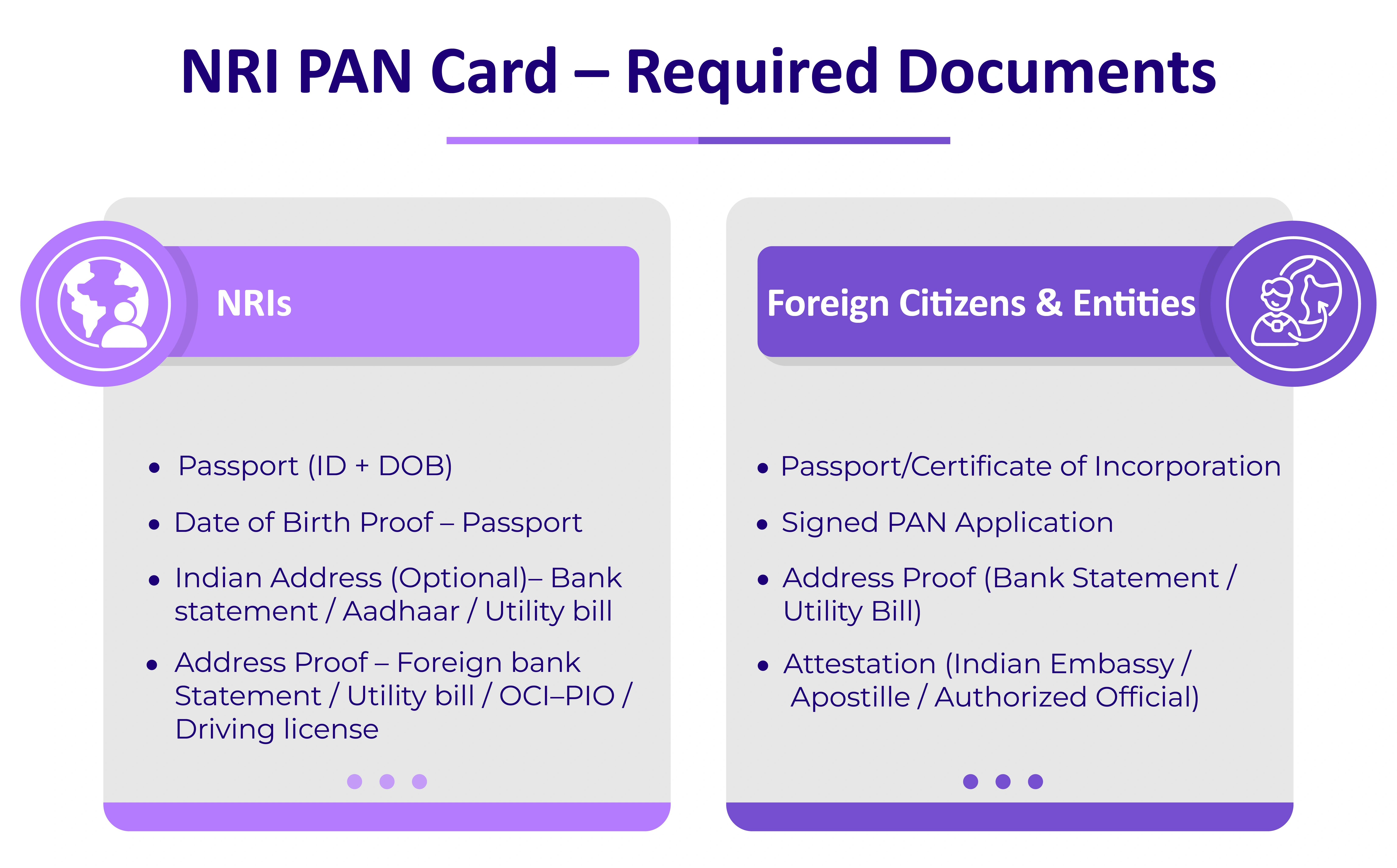

To apply for a PAN for NRIs or foreign nationals, please be prepared with the documents listed below to ensure a smooth process.

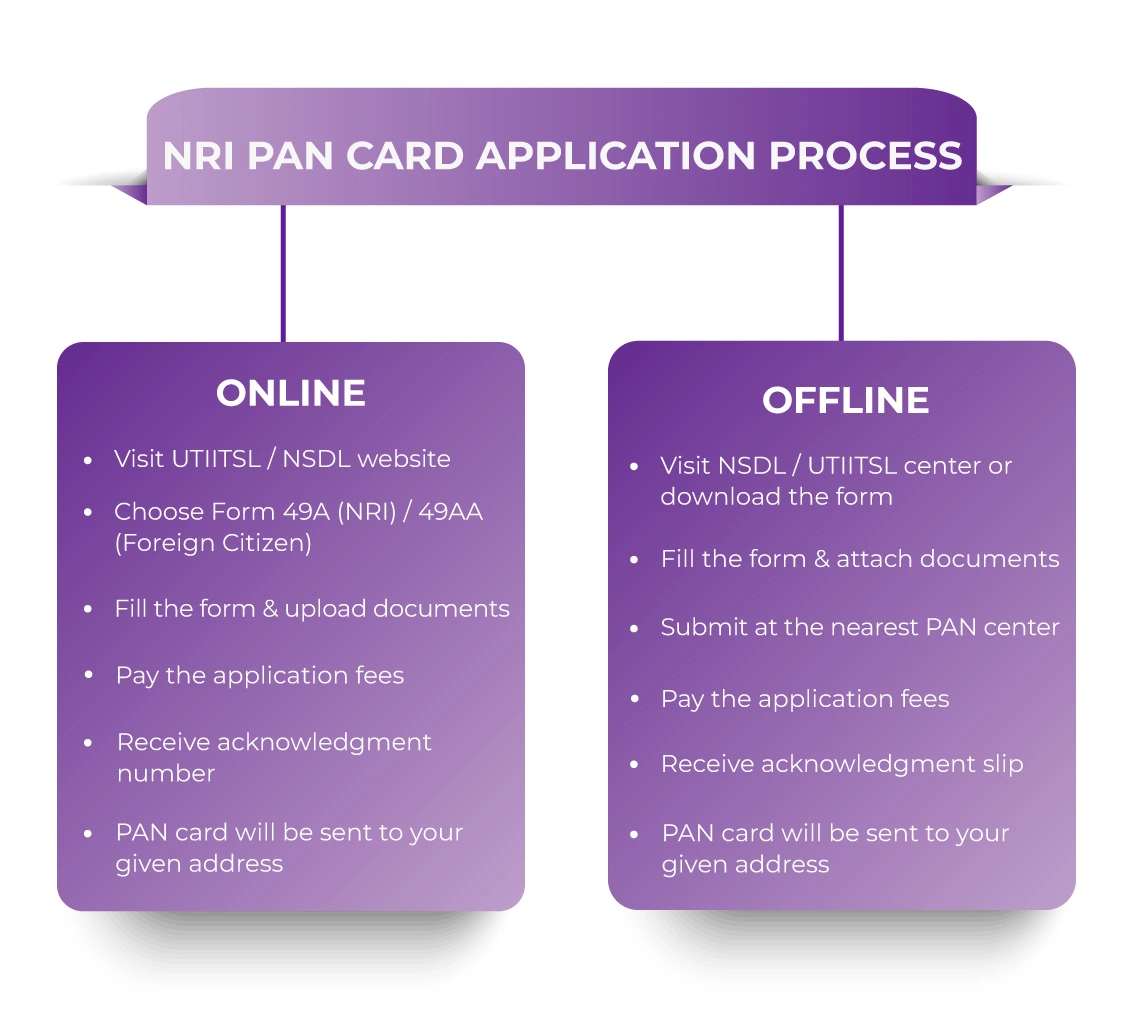

1. Visit the UTIITSL or Protean (NSDL) website.

2. Select

“PAN Card for Indian Citizen/NRI – Form 49A” (for NRIs)

“PAN Card for Foreign Citizen – Form 49AA” (for foreign nationals)

3. Enter your name, DOB, address, email, and contact number.

4. Select the applicant category and status as 'Individual' and then 'Non-Resident Indian'.

5. Choose "Individual" → "Non-Resident Indian".

6. Upload required documents.

7. Pay the applicable fee via credit card, UPI, or net banking.

8. An acknowledgment number will be generated - keep it for tracking.

9. Print the acknowledgment form.

10. Paste two passport-size photos and sign.

11. Send the acknowledgment with attested documents to the UTIITSL or Protean office within 15 days of applying.

1. Download the PAN application form for NRI 49A or 49AA from either the Income Tax website or the Protean website.

2. Complete the application form with all the required details.

3. Attach your photograph and sign the PAN application form.

4. Now submit both the application form and all the documents to your nearest PAN center.

5. Pay the fees for the PAN card application. The PAN card fees depend on whether the application is for a physical PAN card or an e-PAN

6. After paying the fees, you will receive your PAN acknowledgment number.

After the NRI has paid the fees and submitted the documents, it will take approximately 15 to 20 days to complete all the necessary steps successfully. The PAN Card will be delivered to the address mentioned in the application.

No, it isn't mandatory to file for a PAN Card unless you plan to conduct any financial transactions in India. As an NRI, if you wish to engage in economic activities that involve filing your taxes, such as buying a property, operating bank accounts, investing in the Indian stock market, or more, you need to file a PAN Card mandatorily.

We at Savetaxs have expertise in helping NRIs manage their financial planning and taxes in India. Our team of CAs brings more than 30 years of experience in handling NRI PAN Card issues.

We can help you with every PAN-related service, like

A PAN Card is more than just an ID in India; as mentioned earlier, it's your VIP access to the Indian financial and investment market. We at Savetaxs offer 24/7 assistance across all time zones, so don't let the distance hold you back from filing your NRI PAN Card online.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

Yes, with Savetax, an NRI can apply for a PAN card from the USA.

Yes, to open an NRI account in india, you need to have a PAN card.

Yes, you can sell a property in India without a PAN card, but it comes with hurdles like high TDS deduction, tax refund challenges, compliance issues for the buyer, and more.

The fees of a physical PAN card when delivered to a foreign address are rs. 994, whereas delivery within india is Rs. 107 (approximately).