WhatsApp Community

- Whatsapp CommunityWhatsapp Community

Connect with us in just a click!

- Chat WhatsappChat Whatsapp

Fast replies, simple and direct!

NRI Repatriation is an integral part of NRI financial management and planning. In simple terms, repatriation refers to the transfer of funds from an Indian bank account to a bank account in a foreign country, as per FEMA and RBI guidelines. NRI repatriation specifically refers to the transfer of funds from your NRI account in India to your bank account in your country of residence.

If you are an NRI living abroad for work, business, or education, this blog is all you need. As an NRI living abroad, you need to maintain NRI bank accounts in India to manage fund transfers from India to abroad. This process refers to the repatriation of funds, and this blog guide will break down every aspect of it.

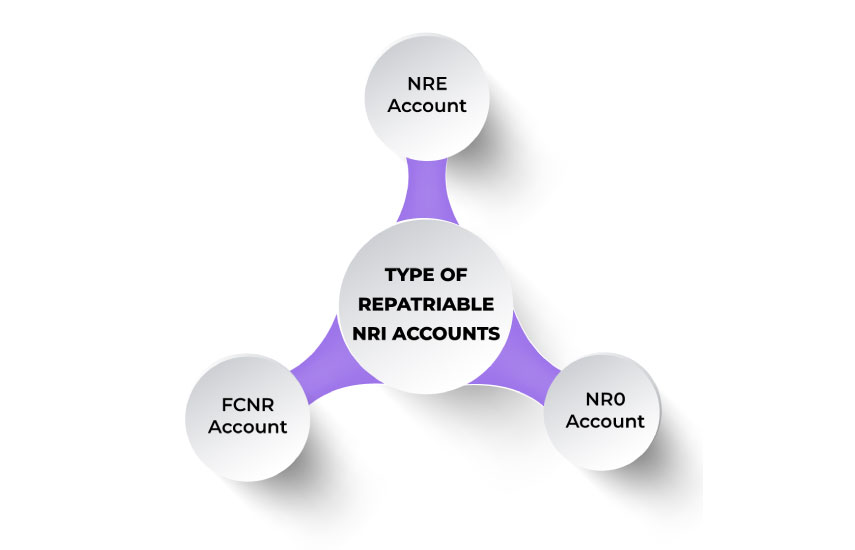

NRI repatriation refers to the transfer of funds from India to a foreign country where the individual resides. To repatriate money from India, you need to maintain NRO (Non-Resident Ordinary) and NRE (Non-Resident External) accounts. You may also have an FCNR (Foreign Currency Non-Resident) account.

As mentioned earlier, as an NRI, you need at least one NRI account to repatriate funds from India to your country of residence. Here's a closer look at what each account means and how it operates:

An NRO account is intended for NRIs who earn income in India from dividends, rental income, pensions, or other sources. The repatriation of funds from an NRO account must be done in accordance with the regulations set by the RBI, which permit an NRI to repatriate up to USD 1 million in a financial year after paying all applicable taxes.

Remember that the interest earned on the NRO account is taxable in India. Therefore, NRIs must consider all tax implications, settle their tax obligations, and then repatriate the funds.

NRIs use an NRE account to deposit their foreign income in India. Unlike an NRO account, NRIs can easily repatriate funds from an NRE account, including interest earned and principal, without any tax implications.

An FCNR account allows NRIs to keep their earnings or savings in a foreign currency. This account safeguards your savings against exchange rate risks as your deposits are in currencies such as USD, EUR, etc. Like an NRE account, you can fully repatriate both the principal and interest from this account without facing any tax implications or set limits.

As an NRI, you can repatriate the income earned through the following means:

As per regulations set by FEMA and RBI, NRIs must be prepared with the required documents to repatriate funds and ensure a seamless process.

NRIs can repatriate funds from any NRI account; however, each account is subject to specific rules and limitations.

| Type Of Income | Repatriation Limit |

| Salary, Investments, Interest, Profits from any proprietorship or business held under the NRE account | No Limit |

| Movable assets balance, sales from assets acquired in India through the legacy, inheritance, or settlement | 1 million USD per financial year |

| Income from immovable assets, like revenue from the sale of the residential property you bought in India, as per FEMA. | 1 million USD per financial year |

You can repatriate funds from the NRO account only after all due taxes on the income have been paid. The limit is USD 1 million per financial year on revenue from the sale of any immovable or movable asset in India. Income through rent, inheritances, and property sales will be taxed first, and then they will be eligible to repatriate.

You have the complete liberty to transfer money from your FCNR account, as it has no repatriation limits, because the deposits made under this account are in a foreign currency source.

FEMA refers to the Foreign Exchange Management Act, India's modern law governing the foreign exchange market. NRIs must be aware of the FEMA regulations before repatriation from India.

Nowadays, NRIs seek investment options in India that can be easily repatriated. Here is a list of such investment options:

Equity Investment: Through the Portfolio Investment Scheme (PIS), non-resident Indians (NRIs) can conveniently invest in NSE and BSE stocks. Investments made under this scheme can be easily repatriated.

Mutual Funds: Various mutual funds cater to the needs of an NRI. However, there are now NRI-specific mutual funds, or "NRI mutual Funds", that offer full repatriation of the invested amount and the gains made. Such funds invest in various asset classes, including debt, equities, or a combination of both.

Government Securities: Indian government treasury bills and bonds are another great investment option for non-resident Indians (NRIs). The investments made here offer great returns with low to no risk, allowing NRIs to easily repatriate the full principal amount, as well as the interest earned upon maturity.

Real Estate: Excluding the farmhouses, plantations, and agricultural land, a non-resident Indian can invest in both residential and commercial property in India. However, you cannot repatriate the entire property; however, the rental income earned from such properties can be easily repatriated after the applicable taxes are paid. Apart from this, the sale proceeds are also repatriated after the taxes are duly settled.

Other options to explore include public sector undertaking bonds, the national pension system, and bonds or units issued by infrastructure debt funds.

Repatriation of funds is subject to tax implications, rules, and regulations set by the RBI and FEMA (Foreign Exchange Management Act), making the entire process overwhelming. One needs a solid understanding of Indian taxation laws and FEMA compliance to ensure no penalties are incurred during the process and that all activities remain within regulatory requirements.

For a seamless process, an NRI can hire a tax expert who can provide end-to-end assistance, from repatriating funds to ensuring every step complies with tax laws and FEMA regulations. This is when Savetaxs comes to the NRI's rescue. We are a team of expert Chartered Accountants (CA) with over 30 years of experience in NRI taxation and repatriation of funds abroad.

We can assist you through every step of repatriation, including filing Form 15CA and CB, providing remittance support, offering expert guidance, and more. With more than a decade of experience, our experts ensure that everything is done exactly as required by FEMA rules and RBI (Reserve Bank of India) regulations, so that nothing is done otherwise and the funds are repatriated securely and efficiently.

Yes, NRIs can take money out of India, and this process is called repatriation of funds. During this process, an NRI can transfer funds from their Indian bank account to a foreign bank account.

No, there are no restrictions on making outward remittances from an NRE account.

To repatriate money from an NRE account to the usa, you need to access your net banking account along with your IPIN and Customer ID. Once you have accessed it, go to the transaction tab and select 'repatriation of funds'.

Now, choose the transaction type as 'repatriation of funds from NRE account', select the beneficiary, and then proceed with the transaction to complete the process.

As per the 120-day rule, a non-resident Indian or person of Indian origin earning over 1.5 million INR (approximately USD 17,213.6) will be considered an RNOR if they have stayed in India for more than 120 days in a tax year or have stayed for more than 365 days in the past four years.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.