The ITR-3 (Income Tax Returns) is designed for individuals, NRIs, and Hindu Undivided Families (HUFs) with income from the head, receiving profit or gains from business and profession, and who are required to maintain the comprehensive books of accounts. Additionally, individuals getting their earnings from salaried employment and other additional sources, like freelancing or part-time business activities, can also use to ITR-3 to file their income tax returns, till the time they have a business income. The Income Tax Department of India (IT) has prescribed ITR-3 for different types of taxpayers. This blog will walk you through the significance of the ITR-3 form. We will discuss what ITR-3 is, who can and cannot file ITR-3, and how an NRI can file an ITR-3.

Key Takeaways

- ITR-3 is an income tax return form used by NRIs and HUFs receiving income from specific sources.

- The deadline for filing ITR-3 has been extended from 31st July 2025 to 15th September 2025 for accounts that don't need audits.

- The due date for accounts that need an audit is the 31st of October.

- The ITR-3 form has now been added with Section 44BBC to simplify compliance.

What is the ITR-3 Form for NRIs?

ITR-3 is an Income Tax Return form used in India for individuals, NRIs, and Hindu Undivided Families (HUFs) who have income from the following sources:

- Income from capital gains

- Income from salary or pension

- Income from house property

- Income from business or profession

- Income from other sources

You can also call it a master form because this is the one form where an individual or HUF can report all their possible incomes. However, the taxpayer needs to either have a proprietorship or a business as one of their source of income to be eligible to file the ITR-3.

The ITR-3 is a more thorough form, allowing the taxpayer to add more detailed information about their income and deductions across different sources. The form has several sections where the individual needs to fill out the relevant information, like personal details, taxes paid, deductions, details of income from various sources, verification, and calculation of total income.

Who Is Eligible to File the ITR-3 Form as an NRI?

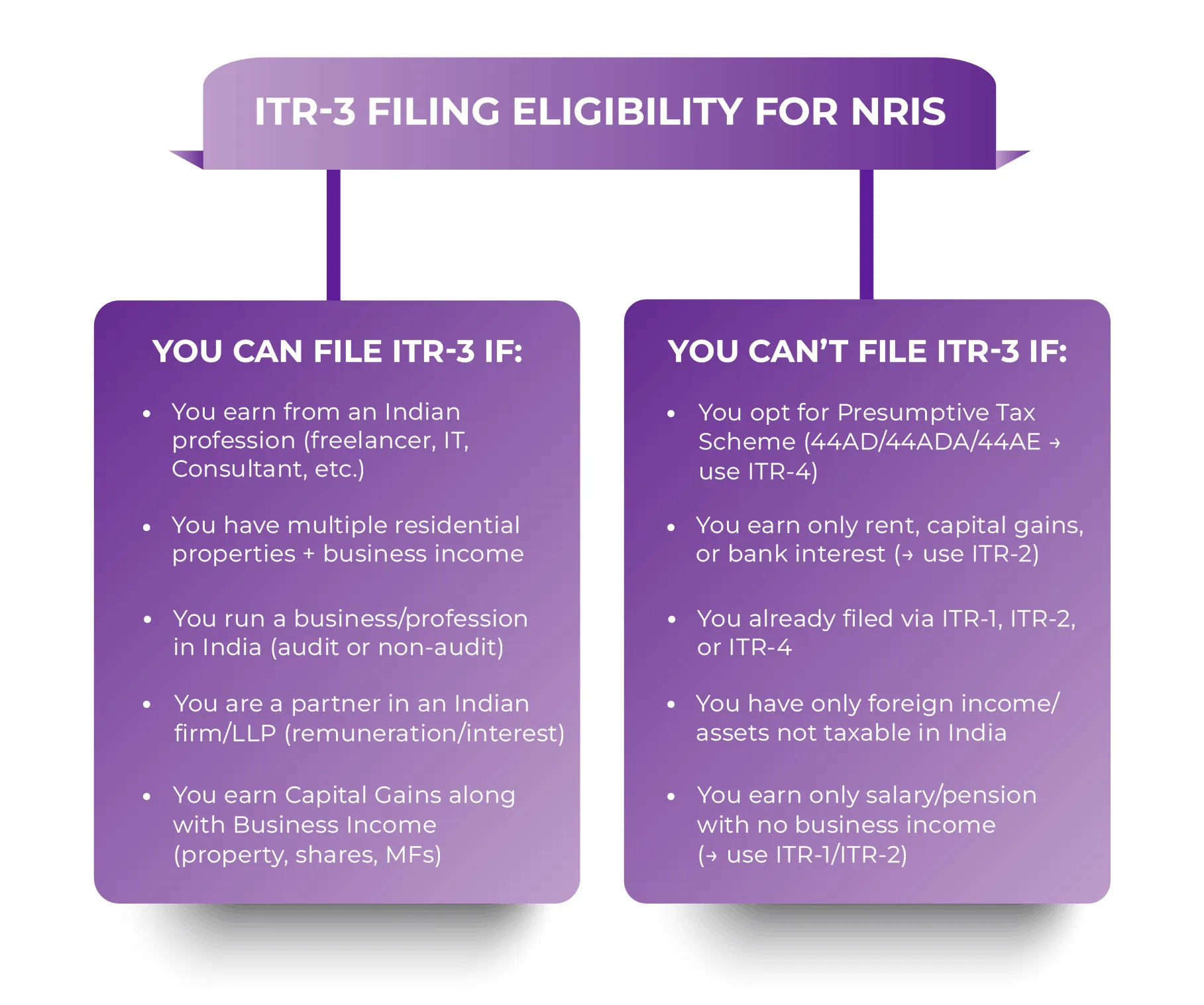

Not everyone can file ITR-3. Individuals who fall in the following categories will be eligible to file ITR-3 as an NRI:

- NRIs who receive income from an Indian profession like freelancer/, consultant, IT, advisory design, content, etc.

- An NRI who holds multiple Indian residential properties along with business income.

- Individuals who are carrying on a business or a profession in India, regardless of whether it is a tax audit or a non-audit case.

- An NRI who is a partner in an Indian partnership firm/LLP and receives interest or remuneration from the firm.

- NRIs who are earning Capital Gains on an Indian asset, along with business income, can include a house property, shares, or mutual funds.

Who is Not Eligible to File ITR-3?

- NRIs whose only income is from foreign assets or foreign income, which is not taxable in India, are not eligible to file ITR-3.

- ITR-3 is strictly for individuals, HUFs, NRIs, partnership firms, companies, LLPs, etc. Any other form of organisation must not file ITR-3 as they have different forms for filing their tax, such as ITR-5 or ITR-6.

- An NRI, individual, or HUF who is not receiving any income through the means of business, profession, or partnership firm cannot file the ITR-3 form. Like only rental, capital gains, bank interest, etc.

- A taxpayer who has already done their tax filing under ITR-1, ITR-2, or ITR-4 cannot use ITR-3.

- An individual, HUF, or NRI who is not receiving any income from a business or profession must use ITR-2, regardless of whether they have rental income or capital gains.

- An individual who is choosing the presumptive taxation scheme under Section 44AD, 44ADA, or 44AE must not file ITR-3; instead, they should file ITR-4.

- A person whose income is from salaries or pensions and who does not have any business or professional income must not file ITR through ITR-3. They should use ITR-1 or ITR-2.

What is the Due Date for Filing the ITR-3 Form?

The due date to file ITR-3 for the financial year (FY) 2024-2025 (AY 2025-2026) has been extended from 31st July 2025 to 15th September 2025 for accounts that fall under non-audit cases. While the due date for accounts that require an audit is 31st October.

What are the Main Changes in the ITR-3 Form for AY 2025-2026?

The following are some of the major changes in the ITR-3 form that have been made for the assessment year 2025-2026:

Introduction of Section 44BBBC: Presumptive Taxation for Cruise Business

- The ITR-3 form has now been added with Section 44BBC, which is a newly introduced presumptive taxation provision under the Budget 2024 that applies to non-resident cruise business operators. This section considers 20% of gross receipts from passenger carriage as taxable income for non-resident cruise operators.

- Adding this reference in the ITR-3 form simplified compliance by clarifying the reporting obligations for businesses operating in the cruise sector and ensuring that they understand the specific tax rules that apply to their operations and follow them more effectively as per the new taxation structure.

Capital Loss on Share Buybacks After 1st October, 2024

- According to the new provisions, from 1st October 2024, capital losses incurred on share buybacks will be allowed if the corresponding dividend income is reported under the "Income from Other Sources" section.

- Taxpayers must make sure that the reporting of dividend income is done correctly to claim such losses under the capital gains.

- This clarification adds transparency to the treatment of buyback-related transactions.

Capital Gain Split: Before and After 23rd of July, 2024

- Capital gains will now be split based on the amendments introduced by the Finance Act 2024; capital gains must now be split based on whether they arise before or after July 23rd, 2024.

- Taxpayers now need to categorise their capital gains accordingly and calculate taxes under the applicable provisions.

- This change aims to simplify the reporting of capital gains by clarifying the timeframes affected by the amendments of the Finance Act, leading to a more straightforward tax treatment, with compliance with the updated tax laws.

What are the Steps to File ITR-3 Online?

An individual, NRI, or HUF can file ITR-3 online by following the steps mentioned below:

Step 1: Log in to the e-filing portal

Log in to the Income Tax India e-filing portal using your PAN number and password.

Step 2: Go to the Filing Section

Go to the e-file menu and click on Income Tax Return> File Income Tax Return.

Step 3: Choose the assessment year

Select the period for which you are filing the return. Such as AY (Assessment Year) 2025-2026 for FY (Financial Year) 2024-2025.

Step 4: Fill out the required details and upload the documents

Select the form ITR-3 and fill out all the required details one by one, starting from personal details, then income, and then deductions. Once you have filled in the details correctly, upload the required supporting documents.

Step 5: Verify and Submit the Form

Cross-verify all the information that you have filled in and make sure that everything is accurate and there are no errors. After that, submit the form. Verify using any of the following options: Aadhaar, OTP, EVC, or DSC, as it is a vital requirement.

What are the Documents Required to File ITR-3?

To file your ITR-3 (Income tax returns), you need the following documents:

- Indian Bank Account Details: Preferably, NRE/NRO account details are required. To provide refunds and the availability of financial details.

- Passport: To validate the residential status of an NRI, if required.

- PAN Card: It is important to identify the taxpayer and to file taxes in India.

- Books of Accounts: For an NRI who receives income from an Indian business or profession.

- Investment Details: To claim the deductions, including mutual funds, stocks, or property income in India.

- Foreign Assets/Income Details: Required if disclosure is required under the Indian tax laws, and if you were a resident in any financial year.

- Form 16 (if applicable): Received from the employer if you have income from Indian employment or contracts.

- Aadhaar (if applicable): An NRI doesn't necessarily need an Aadhaar card, but if they have one, they need to link it with their PAN.

Get trusted guidance for NRI tax filing, planning, and cross-border strategies with ease.

What is the Structure of the ITR-3 Form for AY 2024-2025 and AY 2025-2026?

The ITR-3 comprises the following parts and schedules:

Part A

- Part A-GEN: General details and nature of the business.

- Part A-BS: Balance Sheet as of 31st March, 2021 for the proprietary business or profession.

- Part A-P&L: Profit and Loss: Profit and loss for the financial year 2020-2021.

- Part Trading Account: Trading account for the financial year 2020-2021.

- Part A-Manufacturing Account: Manufacturing account for the financial year 2020-2021.

- Part A-QD: Quantitative Details: It is optional if not subject to audit under Section 44AB.

- Part A-OI: Other Information: It is also optional if not subject to audit under Section 44Ab.

Schedules

- Schedule BP: Calculation of income from business or profession.

- Schedule S: Computation of income from salaries.

- Schedule AL: Assets and liabilities at the end of the year (applicable if the total income exceeds Rs. 50 lakhs).

- Schedule SI: Income statement, which is chargeable to tax at special rates.

- Schedule PTI: Details of pass-through income from either a business trust or investment funds according to Section 115UA, 115UB.

- Schedule FA: Statement of foreign assets and income from sources outside India.

- Schedule HP: Calculation of income under the head of income from house property.

- Schedule BP: Computation of income from business or profession.

- Schedule-CG: Calculation of income from capital gains.

- Schedule 112A: Details of capital gains where section 112A is applicable.

- Schedule 115AD (1) (b) (iii) Proviso: Capital gains details for non-residents where section 112A is applicable.

- Schedule OS: Calculation of income from other sources.

- Schedule-CYLA: Income statement after set-off of current year's losses.

- Schedule CYLA-BFLA: Statement of income after set-off of current year's losses and unabsorbed losses brought forward from past years.

- Schedule CFL: Statement of losses to be carried forward to future years.

- Schedule-DPM: Calculation of depreciation on plant and machinery under the Income Tax Act.

- Schedule DOA: Computation of depreciation on other assets under the Income Tax Act.

- Schedule DEP: Summary of depreciation on all the assets under the Income Tax Act.

- Schedule DCG: Calculation of deemed capital gains on the sale of depreciable assets.

- Schedule FSI: Details of income from outside India, as well as tax relief.

- Schedule TR: Statement of tax relief claimed under Section 90, Section 90A, or Section 91.

What are the Business Codes for ITR Forms?

These codes will be applicable if the individual or NRI has a business, profession, or income-generating activity in India under ITR-3:

| Category | Business/Profession/Service Description | Code |

|---|---|---|

| Real Estate and Investment Related (if applicable to business) | Commercial banks, savings banks, and discount houses | 13001 |

| Housing finance activities | 13005 | |

| Credit cards | 13007 | |

| Mutual funds | 13008 | |

| Life insurance | 13011 | |

| Pension funding | 13012 | |

| Non-life insurance | 13013 | |

| Administration of financial markets | 13014 | |

| Stock brokers, sub-brokers, and related activities | 13015 | |

| Financial Intermediation Services | Finance advisers, mortgage advisers, and brokers | 13016 |

| Foreign exchange services | 13017 | |

| Other financial intermediation services n.e.c. | 13018 | |

| Investment activities | 13010 | |

| Computer and Related Services | Software development | 14001 |

| Other software consultancy | 14002 | |

| Data processing | 14003 | |

| Other IT-enabled services | 14005 | |

| BPO services | 14006 | |

| Cyber cafe | 14007 | |

| Maintenance and repair of office, accounting, and computing machinery | 14008 | |

| Computer training and educational institutes | 14009 | |

| Professions (Freelance or Consulting) | Legal profession | 16001 |

| Accounting, book-keeping, and auditing profession | 16002 | |

| Tax consultancy | 16003 | |

| Architectural profession | 16004 | |

| Engineering and technical consultancy | 16005 | |

| Advertising | 16006 | |

| Fashion designing | 16007 | |

| Interior decoration | 16008 | |

| Market research and public opinion polling | 16012 | |

| Business and management consultancy activities | 16013 | |

| Labour recruitment and provision of personnel | 16014 | |

| Investigation and security services | 16015 | |

| Building-cleaning and industrial cleaning | 16016 | |

| Packaging activities | 16017 | |

| Medical profession | 160191_1 | |

| Film artist | 16020 | |

| Other professional services n.e.c. | 16019 | |

| Other Services | Hair dressing and other beauty treatments | 21001 |

| Event management | 21008_01 | |

| Other services n.e.c. | 21008 |

Suggested Categories For NRIs Filing ITR-3

When NRIs select the nature of business or profession code while filing ITR-3, these are the most commonly used categories:

- 14001: Software development

- 16002: Accounting, bookkeeping, and auditing profession

- 13010: Investment activities

- 13014: Administration of financial markets

- 13016: Financial advisers, mortgage advisers, and brokers

- 16013: Business and management consultancy activities

What are the Key Changes Made in the ITR-3 Form for AY 2023-2024 and AY 2024-2025?

Below changes have been added in the ITR-3 form of the FY 2022-2023 (AY 2023-2024) and are applicable for FY 2023-2024 (AY 2024-2025) as well:

- As an additional disclosure measure, foreign institutional investors (FI/FPI) are required to provide their SEBI registration number.

- The turnover and income from intraday trading should be reported under the newly introduced section, which is "Trading Account."

- A new Schedule VDA has been incorporated to report your income separately from crypto and other VDAs. In case you treat the income earned from VDAs as capital gains, then you will have to provide a quarterly breakup under the capital gains schedule. As per the amendments of the ITR-3, every VDA transaction is required to be reported along with the sale and purchase dates.

To Conclude

Having a good understanding of who must file an ITR-3, what kind of information it needs, and the latest updates for the current tax season is vital to ensure tax compliance and a smooth and informed tax filing experience. Whether you are a freelancer, small business owner, or professional having private practices, learning about the dos and don'ts of ITR-3 can ease the process of tax filing. In this blog, we have covered everything that will help you enhance your tax returns and understand the requirements for Income Tax for NRIs. From learning about the applicable sections of ITR-3 for an NRI to the process of filing one online, we have discussed everything. However, if you are still worried or confused about the application process, contact the experts at Savetaxs.

Our experts have more than a decade of experience, and they will make sure that all your tax-related issues get resolved, as they have all the required knowledge and expertise. They are working around the clock to help you avoid any stress. Therefore, choosing Savetaxs will help you get the best guidance and assistance from the top experts in this industry.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- Income Tax Notice: Check and Authenticate Online

- NRI Capital Gains and Their Taxability in India

- What Is Form 16: A Comprehensive Guide

- ITR 2 for NRIS: All You Need to Know for FY 2024-25

- What are the 5 Heads of Income Tax?

- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- Advance Tax Planning For NRIs (Non-Resident Indians)

- Form ITR-V: How to Download Your ITR-V from the Income Tax Portal?

- What is ITR-U (Updated Income Tax Return) for NRIs?

- Penalty for Late Filing of Income Tax Return for NRIs

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

Frequently Asked Questions (FAQs)

Are you not sure if ITR-3 applies to you? Our FAQs explain it in detail for NRIs.

The ITR-3 form is now available for all taxpayers. The Income Tax Department has already released the utility for ITR-2 and ITR-3 on the 11th of July, 2025.

If you don't file ITR-3 within the due date for AY (Assessment Year) 2025-2026, you might attract a penalty. The penalty can be up to Rs. 1,000 for individuals who have an income of nearly Rs. 5,00,000 and a penalty of Rs. 5,000 for individuals who have an income of more than Rs. 5,00,000. You can file a belated return by the 31st of December for not filing the return within the due date. However, this will attract interest on the due amount of tax at the rate of 1% every month.

Yes, you can file ITR-3 without the help of a CA. However, it is advised to seek help from a professional while filing returns if you don't have a good understanding of income tax, to avoid making mistakes while filing the return. If you file your return yourself without being aware of the IT rules, then some benefits might remain unclaimed. Instead, the experts at Savetaxs can deal with these issues, and they have all the required knowledge and expertise.

Currently, there are seven types of ITR notified by the department, each catering to a specific type of taxpayer, i.e., ITR-1, ITR-2, ITR-3, ITR-4, ITR-5, ITR-6, and ITR-7.

A salaried person must file ITR-3 if they also have business or professional income, such as freelancing, consulting, or income from a partnership. They can file ITR-3 by following the steps below: 1 . Report salary under Income from salary, 2. Report the income from business or professional under the Profits and Gains of Business or Profession section, 3 . Claim business and deductions as per eligibility, 4 . File the ITR-3 online via the official portal of Income Tax, or utilise an online platform specified for tax filing, 5. E-verify your return using Aadhaar OTP, net banking, or simply by sending ITR-V.

It completely depends on the requirements. ITR-3 is for taxpayers who are required to maintain books of accounts, while ITR-4 is for small taxpayers who are opting for the presumptive taxation under sections like 44AD, 44ADA, or 44AE.