- Why Was PAN 2.0 Introduced?

- Key Features of PAN Card 2.0

- Why Do NRIs Need A PAN?

- Documents Required for NRI PAN Application

- Are NRIs Eligible for PAN 2.0?

- PAN Card 2.0 QR Code: What It Contains

- Features of QR Code

- PAN vs PAN Card 2.0: What’s the Difference?

- How NRIs Can Apply for PAN Card 2.0?

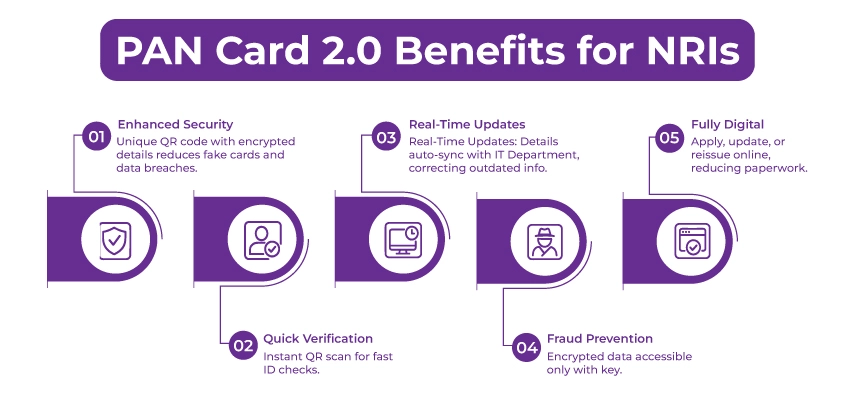

- Benefits of PAN Card 2.0 for NRIs

- Get NRI PAN Card 2.0 with Savetaxs

PAN Card 2.0 is an initiative by the Government of India to simplify and secure the process of using and obtaining a PAN card. The Permanent Account Number (PAN) is a crucial document for businesses and individuals to comply with income tax laws and track financial transactions in India. The launch of the PAN 2.0 project takes this a step further, as it is an upgraded version of the PAN Card that now features a QR code. This modernization and innovative approach by the government creates a paperless, online ecosystem in India for all taxpayers.

This guide provides comprehensive information about the new PAN Card 2.0 for NRIs, including its features, benefits, eligibility criteria, pricing details, application process, and more.

Why Was PAN 2.0 Introduced?

The Cabinet Committee on Economic Affairs (CCEA) granted permission on November 25, 2024, for the PAN 2.0 Project, which the Income Tax Department of India initiated. The total budget allocated for the project is ₹1,435 crore. The primary objective of this project is to re-engineer taxpayer registration services by leveraging technology to enhance TAN and PAN services, ultimately providing taxpayers with a seamless, improved digital experience.

The PAN 2.0 project is a significant upgrade to the existing Permanent Account Number (PAN) framework, integrating both core and non-core PAN and TAN services. Along with this, to align with the government's Digital India vision, PAN validation will also become a unified, paperless platform.

Key Features of PAN Card 2.0

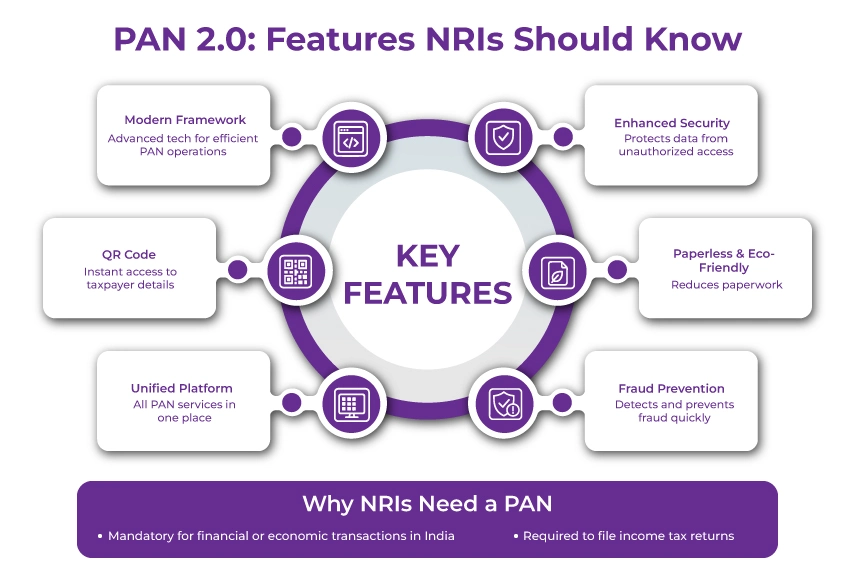

Some of the key features of the Permanent Account Number (PAN) Card 2.0 are listed below:

- The primary feature of PAN 2.0 is its enhanced and modernized framework, integrating advanced technology to improve the efficiency of PAN operations.

- PAN 2.0 will feature an integrated QR code that, upon scanning, provides quick access to the taxpayer's details.

- A single, unified platform will now combine all PAN-related services, enabling users to manage their accounts easily.

- Cybersecurity measures have been strengthened to protect taxpayers' data from unauthorized access and breaches.

- PAN 2.0 supports a paperless ecosystem, contributing to environmental sustainability by reducing paper usage.

- Advanced technology enables faster detection and shutdown of fraudulent activities.

Why Do NRIs Need A PAN?

NRIs are required to obtain a Permanent Account Number (PAN) card if they are engaged in any financial or economic transactions in India where a PAN card is mandatory. Additionally, if they need to file an income tax return in India, they must have a PAN card.

Documents Required for NRI PAN Application

NRIs must gather all the documents listed below to apply for a PAN.

- Passport Copy

- Address Proof: Utility Bills, a copy of a bank statement from the resident's country of origin is required. Alternatively, a copy of their NRE bank account statements, showing at least two transactions within the last six months, can be provided. This copy has to be attested by the Indian Consulate, the bank manager, or the High Commission.

- Proof of DOB: School leaving certificate, Birth Certificate, Passport.

- In cases where NRIs lack an Indian address, they can provide their country of residence address, their office address, or their residential address.

- Two recent passport-size photographs

- If you are an Indian citizen, you must fill out Form 49A; a foreign national can apply for Form 49AA.

- Proof of identity: Aadhar Card, Passport, Driving Licence, etc.

Note: that all documents outside India must be attested by either the Indian consulate or embassy or apostilled by the competent authority (as per the Hague Convention).

Are NRIs Eligible for PAN 2.0?

Yes, NRIs are eligible to apply for PAN 2.0, but they must already be existing PAN holders to be eligible for the new PAN Card 2.0.

PAN made simple for NRIs. Start in minutes.

PAN Card 2.0 QR Code: What It Contains

The modernized PAN Card 2.0 features a QR code that stores the PAN holder's information in digital format. When scanned, it retrieves updated data from the Government of India's database, ensuring the information's legitimacy and accuracy. This helps verify both the PAN holder's details and the card's authenticity.

The data hidden in the QR code is encrypted and contains the PAN holder's full name, PAN number, date of birth, Aadhaar number, and other relevant details. This quick scanning speeds up and simplifies the verification process. Apart from this, when the PAN card is integrated with Aadhaar, the QR Code also enhances KYC verification by reducing manual checks, as everything is now handled by technology.

Features of QR Code

Not just the PAN Card 2.0, but the QR code also comes with various features, including:

1. Elevated Security Measures

You can only scan the QR code on the PAN card through authorized software, which keeps your data safe and reduces the chances of using the information for an illegitimate purpose. Not only this, but the unique QR code also prevents the creation of fake or duplicate PAN Cards.

2. Encrypted Data Storage

All the data of PAN Holder, including PAN number, name, date of birth, Aadhaar card number, and more, is encrypted. This helps to minimize the fraudulent activities.

3. Instant e-PAN Verification

PAN 2.0 features Aadhaar authentication, enabling the instant generation of the e-PAN. This reduces the lengthy processing time for e-PAN generation to a more manageable level.

4. Global Accessibility for NRIs

OCI cardholders and NRIs can now get their e-PA online anywhere in the world. This makes the compliance and financial processes easier, regardless of the location.

PAN vs PAN Card 2.0: What’s the Difference?

The traditional PAN card is a physical document issued by the Income Tax Department of India to businesses and entities to ensure compliance with Indian income tax laws. PAN 2.0 is the upgraded version of the traditional PAN card, which the Income Tax Department of India also governs. Below is a detailed comparison of the two.

| Feature | PAN Card 2.0 | Traditional PAN Card |

|---|---|---|

| Material of the Card | PVC Card, which is durable, similar to that of a debit card or an Aadhaar card. | Laminated paper card |

| QR Code | A dynamic QR Code provides real-time details of the PAN holder. | Missing or has a static QR code that contains details about when the card was issued. |

| Display of Information | Essential details like DOB, name, and father's name. | Display of detailed information, including the address. |

| Service Portals | One unified portal for all PAN or TAN-related services. | Multlle portals lie Protean, UTIITSL, etc. |

| Application Process | Online and paperless | Partially online, with some steps being manual |

| Security | Top-notch cybersecurity protocols. | Basic security measures. |

| Verification Process | Done instantly through QR | Time-consuming. |

| Prevention of Duplicate PAN | Cutting-edge technical logic to prevent duplication of PAN. | Constrained mechanism to identify duplicate PANs |

| Impact on the environment | Eco-friendly has reduced paper usage through its digital platform. | High environmental impact, as the processes use paper. |

Get personalized help with your PAN, Tax, or Compliance queries.

How NRIs Can Apply for PAN Card 2.0?

If you have a current PAN card, you're automatically eligible for PAN 2.0. However, if not, you must first meet the standard requirements for a PAN card.

Check Your Issuing Authority

Before proceeding, determine whether your existing PAN was issued by NSDL (Protean) or UTIITSL.

To find out, check the back of your PAN card and then follow the instructions below:

PAN Card 2.0 Apply Online via NSDL

If your issuer is NSDL:

Step 1: Visit the official NSDL PAN request page.

Step 2: Enter the required information and tick the checkboxes to confirm accuracy.

Step 3: Submit all entered details

Step 4: Choose the OTP delivery method (SMS or email) to validate your details.

Step 5: Agree to the terms and conditions and proceed with payment.

Step 6: Complete the payment using a debit/credit card or net banking. Your e-PAN will be emailed within 30 minutes. Once received, you can download your PAN Card 2.0.

PAN Card 2.0 Apply Online via UTIITSL

If your issuer is UTIITSL:

Step 1: Visit the UTIITSL e-PAN portal.

Step 2: Enter all the asked details, including your PAN number, date of birth, and captcha code.

Step 3: Confirm your email address and update it if it has already been registered.

Step 4: As an NRI, if you are applying for your e-PAN within 30 days of the issuance of your PAN card, you are not required to pay the fees. However, if you use it outside this timeframe, you will be required to cover the costs.

Step 5: Once the fees are paid, you will receive the e-PAN at your email address once the income tax authorities have processed it. Once you get the mail, you can finish your PAN Card 2.0 download.

Fees for NRI PAN Card Application

The application fee for an NRI PAN card is approximately Rs 994, provided the communication address is outside India for delivery of the physical card.

Benefits of PAN Card 2.0 for NRIs

NRI PAN Card 2.0 comes with several benefits, including:

Security: New PAN Card 2.0 features an integrated QR code, providing an additional layer of protection. This QR code contains the holder's encrypted information, including name, date of birth, and PAN number. Since this information can only be accessed through valid and authorized software, the risk of a data breach decreases. Additionally, because the QR code is unique to each individual, it also minimizes the risk of fake PAN cards.

Streamline Verification: As the QR code can be instantly scanned, it provides quick identification verification of the cardholder. This benefits both parties: the organization conducting the checks and the cardholder.

Real-Time Information: New PAN Card 2.0 is all about cutting-edge technology, and hence, with its use, the cardholder's details are synchronized with the latest requirements and formatting of the Income Tax Department of India. And this does not stop here. Any outdated or inconsistent information will be automatically corrected and updated during the replacement process.

No More Frauds: Without the key decryption tool, it is impossible to access the encrypted information. This eliminates cases of information replication or counterfeiting.

100% Digital: One of the significant objectives of PAN Card 2.0 is to digitalize the process of updating, reissuing, or applying for a PAN card. This helps to reduce the paperwork and makes the application process faster.

Get NRI PAN Card 2.0 with Savetaxs

PAN Card 2.0 initiative signifies the steps the Indian government is taking to simplify and secure India's income tax ecosystem, featuring advanced features such as a paperless system, enhanced security, and more. PAN Card 2.0 is in the game merely to elevate the experience of the taxpayers. The Digital India Vision is now spreading abroad as NRIs can easily access the PAN card 2.0 with Savetaxs.

Savetax has been helping NRIs obtain their traditional PAN cards for more than a decade now, and the satisfied clientele base of Savetax speaks for itself. Our experts bring over 30 years of experience; hence, with Savetax, you are in for the best guidance and assistance from the industry's top experts.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- PAN vs TAN: Key Difference You Should Know

- PAN Card Surrender For NRIs and Indian Residents

- What is the Importance of Aadhaar and PAN Card for NRIs?

- PAN Card Form 49A: How to Fill Pan Card Form 49A and 49AA?

- How to Apply for a Lost or Damaged PAN Card?

- Why NRI Need A PAN Card Even If They Don't Pay Tax In India?

- PAN Card Correction/Update Online: How to Change Name, Address, DOB and Mobile Number in Pan Card?

- Aadhaar Card For NRIs In India

- Duplicate PAN Card Application Process For NRIs and Indian Citizens

- How To Update The NRI Status On PAN Card

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767696432.webp)