Form 16 is a tax certificate issued under Section 203 of the Income Tax Act, 1961. It is one of the most essential documents required for individuals in India who receive a salary to file their Income Tax Returns (ITR). Form 16 consists of information on the tax deducted by the employer. It can also be considered as evidence of all the deducted TDS that has been submitted to the Income Tax Department.

If you are a non-resident Indian (NRI) who earns a salary in India, then you also need to fill out Form 16. This form serves as an essential document for all salaried individuals when filing their ITR. This form is proof that you have fulfilled your tax liability in India. Want to know more about this? Then, you are at the right destination. This blog will help you understand Form 16, its format, and how individuals in India use it. So, let's start reading.

Key Takeaways

- Form 16 is a mandatory TDS certificate issued by employers under Section 203 of the Income Tax Act.

- The form contains your salary breakup, deductions, and all other tax-related information related to your salary.

- It comprises Part A with employer-employee details and a quarterly summary of TDS. Also, part B contains a detailed salary breakup and deductions.

- Employers can download Form 16 through the TRACES portal. Furthermore, they must issue the form to their employees on or before the 15th of June.

- The FY 2024-2025 introduced an increased standard deduction of INR 75,000 and a detailed breakdown of other eligible deductions as well.

- Although it is an essential tax document for ITR filing, an NRI can file their ITR even without Form 16.

What Is Form 16?

As mentioned above, Form 16 is a certificate issued to salaried employees by their employers. It consists of a detailed summary of the deducted and deposited TDS to the income tax officials. It is a vital document issued under the Income Tax Act, 1961, by the tax authorities.

Form 16 is used as a TDS certificate, which showcases the employee's earned salary and the TDS deducted. On 15 June of each assessment year, the employer issues Form 16, which concludes the income received in the financial year. In case an employer delays or fails to issue this certificate on the specified date, they are liable to pay a penalty fee of INR 100 per day until they submit the form. Additionally, during the accounting year, if you changed your job, you have to gather Form 16 from each company you worked for.

Furthermore, employers must issue this form to their employees on or before June 15 of the financial year for which they file the ITR. For instance, for the financial year 2024-25 (accounting year 2025-26), Form 16 should be provided till 15 June 2025.

This was all about Form 16. Moving ahead, let's take a look at the different parts of Form 16.

Components of Form 16

Form 16 consists of two distinct parts: Part A and Part B. The two parts of the form are associated with the Tax Deducted at Source (TDS). However, both of them are used for different purposes. Moving further, let's know about them in detail:

Part A of Form 16

Part A of Form 16 is a certificate for TDS and is issued to individuals along with Form 16. Part A of the form consists of information about the deducted and deposited TDS quarterly, along with the TAN and PAN information of the employer. To download the certificate, employers can use the TRACES portal.

Additionally, before using it, the employer should authenticate the contents of the certificate. It is important to know that, in case you change your job in one accounting year, you will get a separate Part A of Form 16 from each employer till the time you work for them. Some of the components of Part A of Form 16 are as follows:

- Name and address of the employer

- PAN number of the employee

- PAN and TAN numbers of the employer

- Quarterly summary of the total payments of salary for the relevant financial year

- Summary of quarterly deducted and deposited tax as mentioned by the employer

Part B of Form 16

This part of the Form 16 is an annexure to Part A. The Employer prepares this certificate for the employee. It consists of the detailed structure of the salary and deductions made in it under Chapter VI-A. It provides a clearer picture of your earned income, including the employee's salary, allowances, and deductions under Section 80C and 80D, as well as the employee's claimed deductions and taxable income. Some of the components of Part B of Form 16 include:

- Detailed breakup of salary

- Under Section 10, a detailed breakup of the exempted allowances

- TDS deducted by the employer

- Under Chapter VI-A of the IT Act, the following are the allowed deductions for employees:

- Under section 80C, deduction of paid Life Insurance Premium, contribution to PPF, etc.

- Under section 80CCC, contribution to pension funds

- Under section 80CCD(1), the contribution of the employee to the pension scheme

- Under section 80CCD(1B), self-contribution of the taxpayer to a specific pension fund

- Under section 80CCD(2), contribution of the employer to the pension scheme

- Under section 80E, health insurance premiums

- Donations come under Section 80G

- Under section 80E, paid interest on a loan taken for higher studies

- Under section 80TTA, interest earned on a savings account

- Under section 89, relief for charged tax calculated, education, surcharge, and health cess

This pertains to the components of Form 16. Moving further, let's explore the differences between the various types of Form 16.

Difference Between Form 16, Form 16A , Form 16B and Form 16C

Here is the difference between Form 16, Form 16A, Form 16B, and Form 16C:

| Basis | Form 16 | Form 16A | Form 16B | Form 16C |

|---|---|---|---|---|

| Description | Under Form 16, a TDS certificate is issued as evidence of the tax deducted from the employee's salary income. | Under Form 16A, a TDS certificate is issued for income other than salary, such as commission, rent receipts, insurance commissions, or interest income. | Under Form 16B, a TDS certificate is issued for the purchase of property under section 194-IA of the IT Act. | Under Form 16C, a TDS certificate is issued by the HUF or individual tenants for the TDS deducted on rent under Section 194-IB. |

| Who Issues It | Form 16 is issued by the employer of the company where a person works. | The financial institution issues Form 16A. | The purchaser of the property issues Form 16B. | Form 16C is issued by the tenant (HUF or individual). |

| Covered Income | Form 16 covered salary income. | Form 16A covered income other than salary. | Form 16B covers the sale of immovable property, building, or land. | Form 16C covers rental income. |

| Frequency | Annually issued | Quarterly issued | Every time the transaction takes place | Annually issued |

| Threshold Limit | When the basic income exemption limit is exceeded. | Under the respective section, the specific income exceeds the threshold TDS limit. | When the property sale value is or the stamp duty value is more than 50 Lakhs. | When the monthly rent is more than INR 50,0000. |

| Purpose | Evidence that TDS has been deducted at source from the salary of the employee and deposited into the government. Vital for filing ITR. | Issued when TDS is deducted on income other than salary, such as insurance commission, interest on FDs, or rent receipts. | Evidence of TDS deducted on property transactions. Here, as proof of deducted tax, the buyer provides the Form 16 to the seller. | This certificate is issued by the tenant to the landlord for the deducted tax under Section 194-IB for high-value rent payments. |

| Rates | The TDS is deducted according to the slab rates. | The TDS rates are mentioned under the respective sections. | 1% TDS on the paid amount or stamp duty value, whichever is more. | 5% of the total paid rent to the landlord in an accounting year or tenancy period. |

This is how Form 16, Form 16A, Form 16B, and Form 16C differ from each other and are used for various purposes. Moving further, let's know if you are eligible to fill out Form 16 or not.

What Are the Eligibility Criteria for Form 16?

According to the guidelines issued by the Indian Finance Ministry, if the income of the employee is taxable, the employer has the right to deduct TDS. Hence, every individual whose salary is taxable is eligible for Form 16. If the employee's income does not exceed the basic tax limit, they are not required to complete a TDS form. Therefore, in this scenario, the company has no right to provide Form 16 to an employee. However, in today's times, many companies issue this certificate to employees in recognition of their good work. It consists of a consolidated image of individual earnings and is also used for other purposes.

So, in short, if your income exceeds the basic tax limit, then you are eligible for Form 16. It was all about the eligibility criteria for getting the form. Moving ahead, let's know why Form 16 is required.

Why Is Form 16 Required?

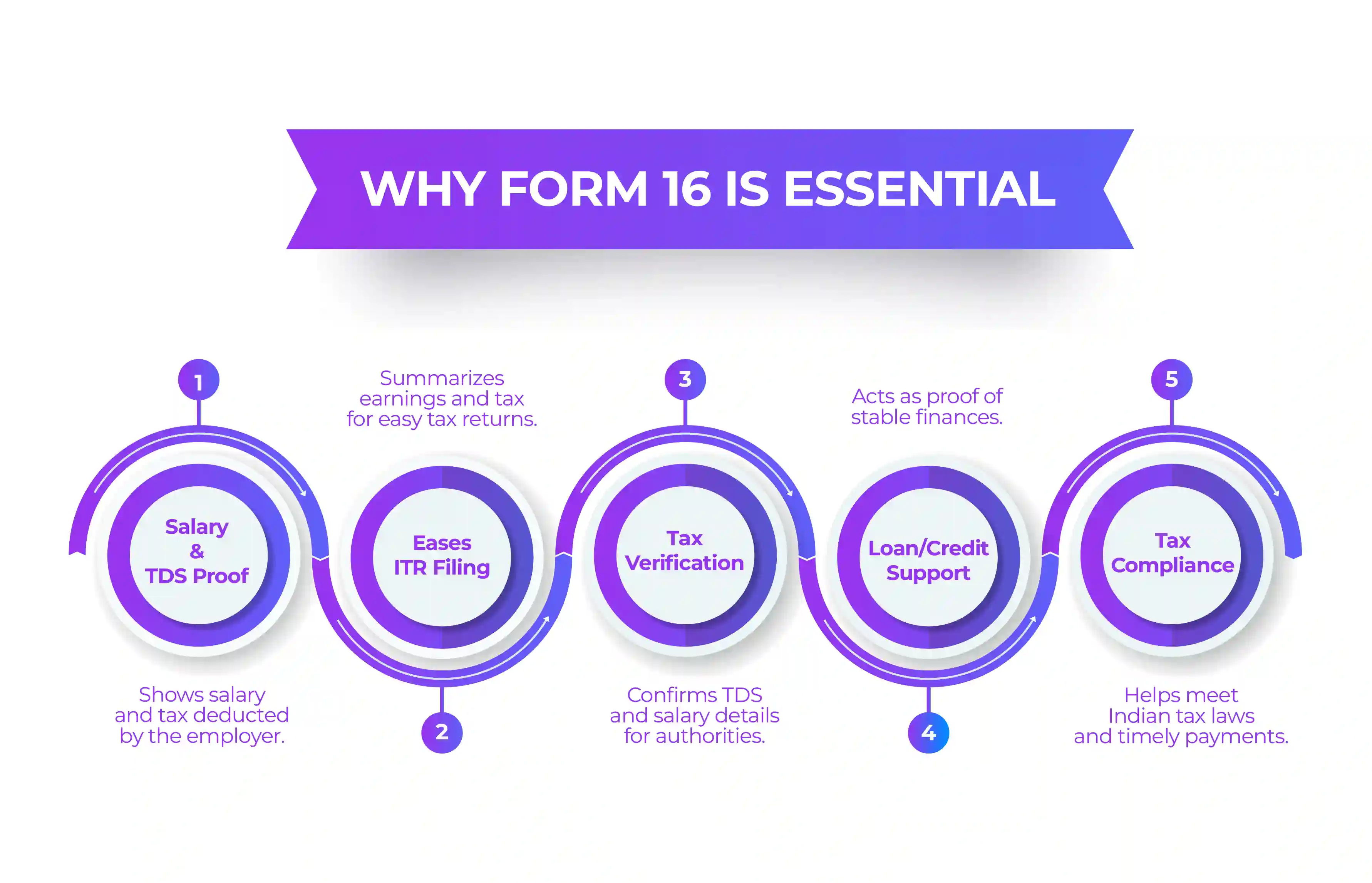

As Form 16 serves multiple purposes, it is a crucial document for salaried individuals in India. Some of the reasons why it is vital to have Form 16 are as follows:

- Proof of Paid Income Tax: As we all know, an employer provides Form 16 to the employee. The certificate shows that during the financial year, the salary paid and the TDS deducted were as follows. It is evident that on behalf of the employee, the employer has paid the tax to the government on the earned income.

- Income Tax Return (ITR) Filing: Form 16 eases the process of filing an ITR. It provides a summary of the earnings and the tax deducted from them. It simplifies the calculation of taxable income and allows for the application of applicable tax deductions.

- Verification by Tax Authorities: If the income tax department has any discrepancies or queries regarding the ITR, Form 16 serves as an official document that contains all the vital details of TDS and salary.

- Documentation for Financial Purposes: You can use Form 16 as proof of having stable finances when applying for credit cards, loans, or any other financial services.

- Compliance with Tax Laws: It assists employers and employees in ensuring compliance with Indian tax laws and regulations, as it facilitates timely and accurate income tax payments.

This is because, for the reasons mentioned above, you need Form 16. Apart from this, you can also use this form as proof of finances when applying for a visa. Moving ahead, let's know how to download this form.

Accurate, reliable, and professional NRI tax services in India. With end-to-end support for filing, compliance, and planning, we make sure your taxes are always in safe and expert hands.

Start Your FilingHow to Download Form 16?

You can download Form 16 using the TRACES portal. The TDS Reconciliation Analysis and Correction Enabling System (TRACES) is an online portal of the Income Tax Department in India. Using this platform, you can download Form 16 Part A and B. To download the form from the portal, here are the following steps that you need to follow:

Step 1: To download the form, first, visit the official TRACES website.

Step 2: Use your PAN number and password to log in to the portal if you already have an account on the website. However, if you do not, you will need to create an account on the site first.

Step 3: Once you log in to the portal, click on the 'Downloads' tab and then select 'Form 16.'

Step 4: Now, choose the form type and the accounting year for which you need the form.

Step 5: Check the mentioned PAN Card Number and other stated details.

Step 6: Mention the TDS receipt number and choose the TDS date.

Step 7: On the site, mention the total tax deducted and collected.

Step 8: Click on the submit option to complete the form download process.

This is how you can download Form 16 using the TRACES website. Moving ahead, let's know the perks of digital Form 16.

Benefits of Digital Form 16

Do you know that, using the TRACES portal, you can digitally auto-generate Form 16 online? Also, it offers several benefits. Want to know what they are? Read the section below and get your answers.

- By being directly generated, the digital Form 16 certifies error-free and consistent data from the TRACES portal of the Income Tax Department.

- The automatic extraction of the data from the Digital Form 16 eases the ITR filing process. In addition, it also saves time and minimises mistakes.

- To ensure the confidentiality of financial information, the digital form is securely stored on the site.

- Structured digital data provides a quicker tax return and refund disbursal process.

- Apart from this, the digital format reduces the requirement for physical forms. It also supports environmental sustainability by reducing paper usage.

- You can digitally upload and consolidate multiple Form 16s, easing tax filing for those who have changed jobs during an accounting year.

These are the perks that an individual can get from a digital Form 16. Furthermore, let's know the key changes that take place in the form for FY 2024-25 (AY 2025-26).

Key Changes in Form 16 for FY 2024-25 (AY 2025-26)

For the financial year (FY) 2024-25, employees will receive their Form 16 by June 15, 2025. Additionally, for the accounting year (AY) 2025-26, all key changes made in the 2024 budget will be reflected in Form 16. In Form 16 for FY 2024-25, the following are the key changes for salaried employees:

- Dedication increased in the NPS contribution of the employee

- Under the New Tax Regime, a higher standard deduction of INR 75,000

- Showcasing TDS on the other income received by the employee

These are the key changes that have been made to Form 16. Moving ahead, let's know the details mentioned in the form.

Form 16 Details when Filing Your Return

In the Form 16, along with your salary, the following information will be mentioned when filing your ITR for FY 2024-25 (AY 2025-26):

- Under Section 10, exempt allowances

- Under section 16, break-up deductions

- Salary taxable

- Income generated (or admissible loss) from house property mentioned by an employee and offered TDS

- Due refund or tax payable

- Income from other sources provided for TDS

- Break-up deductions made under Section 80C

- The aggregate of Section 80C deductions (deductible and gross amount)

Apart from all this information mentioned in the form, you can also find the details of your employer who files your Form 16, such as:

- TAN number of the employer

- PAN number of the employer

- Deducted TDS by the employer

- Name and address of employer

- Your PAN number

- Current assessment year

This is the information mentioned in Form 16, along with the TDS deducted. Moving ahead, let's review the key points to consider when checking Form 16 to avoid any mistakes or errors.

Points to be Noted while Checking Form 16

You should consider the following points while checking Form 16:

- Once you receive the form, ensure that all the information mentioned in it is correct.

- While reviewing the details, ensure that you verify the income amount, deducted TDS, and other relevant information.

- If any of the details are incorrect, please immediately communicate with the finance department/ HR/ Payroll of the organization and have them corrected.

- The employer of your organization will correct the error by filing a revised TDS return and crediting the amount against the correct PAN number. Once it is processed, you will get an updated Form 16.

Final Thoughts

To file an income tax return (ITR) in India, Form 16 is one of the essential documents for salaried people. This guide focuses on the form itself, its components, benefits, and more. I hope that after reading this blog, you will have gathered all the necessary information. If you need more details or assistance with filing, feel free to connect with Savetax.

We have professionals on our team who can assist you in resolving your queries and filing your ITR correctly before the due date. So, why hustle when you have the option to ask for help? Contact us and have your ITR filed on time with minimal effort.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- Income Tax Notice: Check and Authenticate Online

- Understanding TDS Certificate and How To Download It Online

- A Guide on the Types of TDS (Tax Deducted at Source) in India

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 195 of Income Tax Act - TDS Applicability for NRI

- What are the NRI Tax Slab and Rates for FY 2024-2025 For NRIs?

- ITR 2 for NRIS: All You Need to Know for FY 2024-25

- Section 197 Certificate or Lower Deduction Certificate for NRIs and Indians?

- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- What is ITR 3 and How Can an NRI File It Online?

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

Frequently Asked Questions (FAQs)

Wondering what Form 60 is and when to use it? Get all your doubts cleared with these must-know FAQs.

No, Form 16 is not mandatory for filing ITR. So, in case you do not have Form 16 by your side, you can still file for ITR using your salary slips, Form 26AS, or Annual Information Statement (AIS) and access TDS and income details.

No, self-employed individuals cannot get Form 16. This form is specifically for salaried individuals. Self-employed individuals and freelancers, instead of Form 16, receive income certificates.

If NRIs are salaried individuals in India, and their income is more than the basic tax exemption, then yes, they need Form 16 to file ITR. In the absence of Form 16, they can use their salary slip, AIS, or Form 26AS to file ITR.

Like the resident Indian, NRIs also get their Form 16 for the companies they work for in India. In case the salary of an NRI is not more than the basic exemption tax limit, no TDS will be deducted, and they will not receive the form.

Yes, the format of Form 16 remains the same for NRIs and Indian residents. It is only relevant to them if they are working in an Indian company and their salary is more than the basic exemption tax limit.

Yes, NRIs can file ITR without Form 16 if they are not employed in an Indian company. In case they are earning income from India from other sources, such as rent, interest, or capital gains, then they need to fill out Form 16A before filing ITR.

NRIs use Form 16 for ITR filing as evidence showcasing the details of the income and deducted TDS. Also, claiming a tax refund, if any, is credited to their bank account held in India.

No, NRIs cannot download Form 16 themselves. However, they can ask for a copy of the form from their employer or the Income Tax Department. NRIs and employees cannot use the TRACES portal as they do not have the details of the TDS receipt and the total deducted tax.