In India, the taxability of an individual is determined by his/her residential status under Section 6 of the Income Tax Act. Also, it is worth noting that as per the income tax rules, the residential status differs for types of people such as a corporation, an individual, a company, and so on. The Income Tax Department needs to know the residential status of a tax-paying company or individual in India. Additionally, it becomes more important during tax filing. It is one of the factors on which the tax liability of a person is decided. Want to know more about it? This blog will walk you through the factors that help in determining the residential status of a person in India, including the days spent and previous residency history in the country. So, let's begin reading by understanding the meaning of the residential status.

Key Takeaways

- The tax liability of a person is decided based on their residential status.

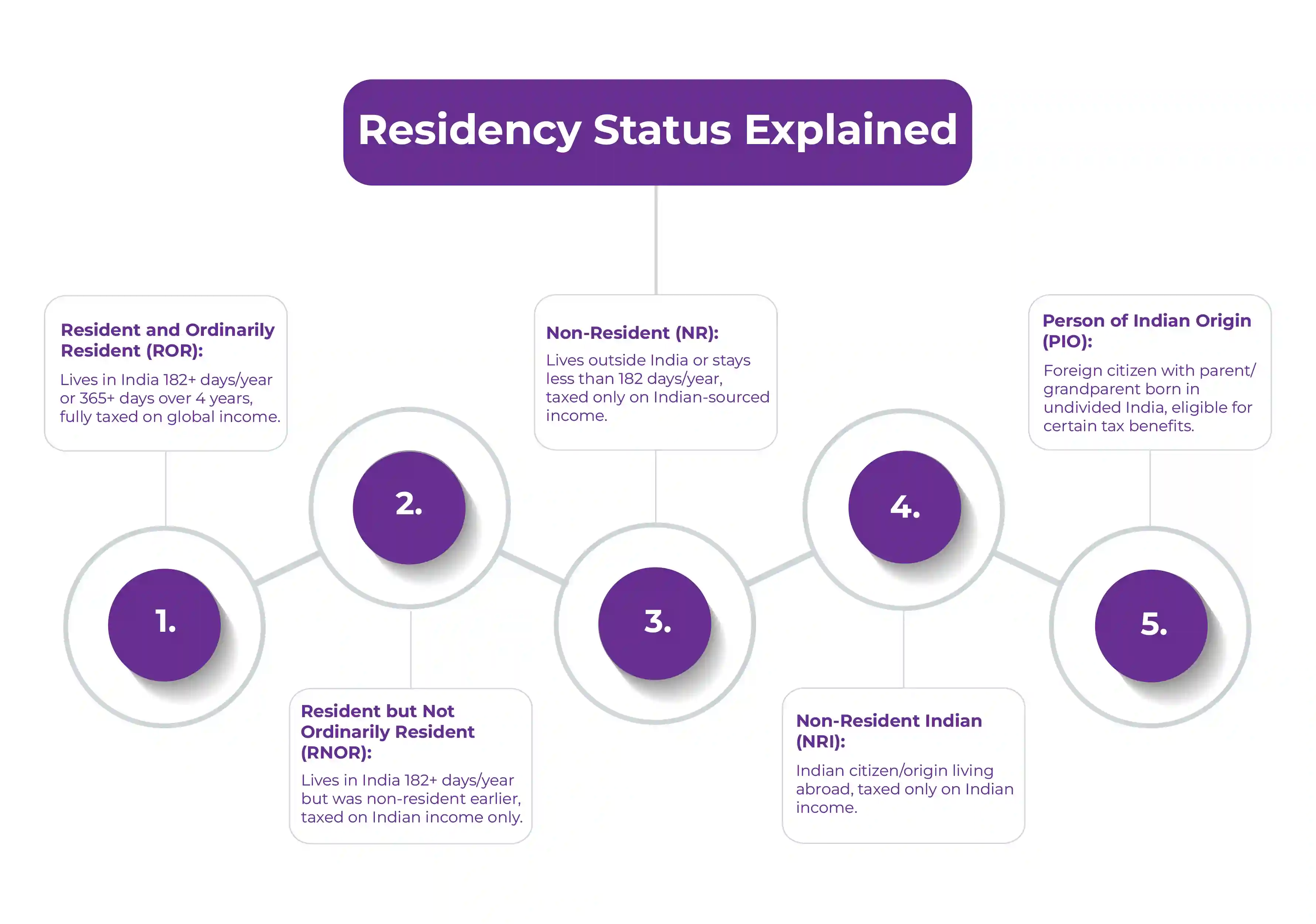

- The Income Tax Act defines three statuses - Resident and Ordinarily Resident (ROR), Resident but not Ordinarily Resident (RNOR), and Non-Resident (NR).

- An individual will be considered a deemed Indian resident if they are an Indian citizen and have an income of more than INR 15 lakhs.

- A person can be a resident of one or more countries, regardless of how many domiciles they have.

Meaning and Importance of Residential Status

In India, the taxability of an individual depends on his/her residential status for any specific financial year. Here, the term 'residential status' is coined under the Income Tax rules in India, and one should not get confused with the citizenship of a person in India. It is only used for tax purposes. As per this, even if a person is an Indian citizen, he/she might be considered as a non-resident, and a foreign citizen might be stated as resident in the country during a specific accounting year.

Moreover, in India, for different types of individuals, such as a firm, a person, a company, etc., the residential status is determined differently. Additionally, to know the tax liability of a person, it know the residential status.

*Note: As per the amendment from the financial year 2020-21, a person who is a citizen of India with income exceeding INR 15 Lakhs or more from Indian sources is considered deemed resident in the country is he/she is not liable to pay tax in any other nation due to domicile, residence or other similar reason.

This was all about the meaning and importance of residential status in India to determine tax liability. Moving further, let's know how to determine the residential status in the country.

How to Determine Residential Status?

For income tax purposes, to determine the residential status in India, the Income Tax Act defines three statuses. These are as follows:

- Resident and ordinarily resident (ROR)

- Resident but not ordinarily resident (RNOR)

- Non-Resident (NR)

For the above-mentioned categories, the tax liability differs. So, before we get into the taxability, let's first know how a taxpayer in India becomes a resident, an NR, or an RNOR.

Resident and Ordinarily Resident (ROR)

In India, a taxpayer would qualify as an Indian resident if he/she fulfill any of the following conditions:

- Live in India for 182 or more days in the previous year

- Stay in India for a total of 365 days or more in the last four financial years or 60 or more days in the current financial year

If any person fulfill any of these conditions, under the income tax laws become an Indian resident. Moving ahead, let's know the exceptions to residential status.

Exceptions to Residential Status

These are the following exceptions to residential status:

- Suppose an Indian citizen is a crew member of the Indian ship or, for employment purposes, leaves the country during the financial year. In that case, he/she will be considered an Indian resident if he/she stays in India for 182 or more days.

- Citizens of India or persons of Indian origin (PIO) who live outside India, visit the country during the financial year, and have a total income of more than INR 15 lakhs, other than the earnings from foreign sources during the previous accounting year, will be stated as Indian residents if:

- During the previous year, if he/she lived in the country for 182 or more days

- If he/she stayed in India for 365 days or more during the last four years. Additionally, lived in the country for a minimum of 120 days in the last year.

As stated in the above amendment, an individual will be treated as a 'deemed Indian resident' if he/she is an Indian citizen and has income more than INR 15 lakh and nil tax liability in other nations.

These are some of the exceptional cases under resident status. Moving ahead, let's know about a resident not ordinarily resident (RNOR).

Resident Not Ordinarily Resident

A person who has a close connection with India is considered an ordinarily resident. It can be classified by factors like place of birth, nationality, or permanent residence. However, according to the Income Tax Act 1961, a person is known as an ordinary resident if he/she fulfills any of the following conditions:

- They have lived in India for 730 or more days in the seven years before the current financial year.

- Before the current financial year, if they have stayed in India for a minimum of two years of the 10 preceding financial years.

These are the situations in which a person will be stated as RNOR. Additionally, if a PIO or an Indian citizen has a total income of more than INR 15 lakh, excluding their foreign income, and if they stayed in the country for 120 days or more, but less than 182 days during that financial year, then the person will be considered as RNOR. Furthermore, deemed residents are states as RNOR and pay tax in India as per this status. This clause applies to people who are citizens of India but are not considered residents in any other country.

This was all about RNOR. Moving further, let's know who are non-residents in India.

Non-Resident

A person will be classified as a non-resident in India if he or she fulfills any of the following conditions:

- If they live in India for less than 182 days in a financial year.

- If in a financial year, they did not stay in India for more than 60 days.

- If in a fiscal year, they live in India for more than 60 days, but for the last four financial years have not stayed in the country for 365 or more days.

If a person fulfills any of the above conditions, he or she will be considered a non-resident in India (NR). Well, this is how the residential status of an individual is determined in India as per tax laws. However, to get this status, an individual needs to follow a proper criteria. Want to know what it is? Read the next section and get your answers.

Instantly determine if you qualify as Resident, RNOR, or NRI under Indian Income Tax rules.

Points to Remember

These are the following points that you need to consider while determining your residential status in India:

- Living in India also includes living in the territorial waters of the country, i.e., from the coastline of India to the 12 nautical miles into the sea.

- The stay period in India needs to be active or continuous.

- While determining the number of days you stayed in India for knowing your residential status, both the departure and arrival date is also considered.

- The residence of a person has nothing to do with his/her place of birth, citizenship, or domicile for income tax purposes. Hence, a person can be a resident of one or more countries, even though he/she have only one domicile.

While estimating the residential status of a person for tax purposes in India, the above-stated points are considered. Moving further, let's talk about the important terms that you have generally heard during the payment of income tax.

Important Terms to Understand

Before moving ahead, let's know the key factors included in Section 6 of the Income Tax Act, 1961. One should know these terminologies:

- Non-Resident Indian (NRI): It is an individual who is an Indian citizen or of Indian origin but does not live in the country.

- Person of Indian Origin (PIO): A foreign citizen will be considered of Indian origin if he/she or either his/her parent or grandparents were born in undivided India.

- Income from Foreign Sources: It is applicable to the income earned outside India. It does not include the income sourced from a profession set or a business operated in India, which is not deemed to arise or accumulate in the country.

These are some of the terms that are vital for you to understand while paying tax in India. Moving ahead, let's know how tax is charged in India according to the residential status of a person.

Taxability

As mentioned above, in India, you pay tax according to your residential status in the country. It helps in determining how you need to file the income tax returns (ITR) and what tax obligations you have. In short, the tax filing requirements and liabilities are directly affected by whether a person or entity is considered a resident or NRI. Confused? Have a look at the table and clear all your doubts about it.

| Resident and Ordinarily Resident (ROR) | A resident needs to pay tax in India on his/her total income. It includes money earned in India as well as obtained outside the country. |

|---|---|

| Non-Resident (NR) and Resident but Not Ordinarily Resident (RNOR) | The tax burden of NR and RNOR is limited to the income they earned or received in India. They do not need to pay tax on the income they earned outside India. Also, in case of double taxation on the same income, they can opt for the Double Taxation Avoidance Agreement (DTAA) that India has signed with other countries to provide tax relief to individuals and avoid paying tax twice on the same income. |

This is how, according to the residential status in India, a person pays tax in the country. Moving ahead, let's know the residential status of the different entities.

Residential Status of HUF

Let's know the residential status of HUF as per different categories:

- Resident HUF: If the management and control of HUF is completely or predominantly in India, and the decisions are taken by the members in the country, then it is considered a resident HUF.

- Resident and Ordinarily Resident: If the Karta (manager) of HUF fulfils any of the below-mentioned conditions, it is classified as ROR:

- The Karta have stayed in India for a minimum of 2 years out of the last 10 years

- The Karta have lived in India for 730 or more days in the last seven years

- Resident but Not Ordinarily Resident: If the Karta does not fulfil any of the above conditions, then the HUF is stated as RNOR.

*Note: Only persons and HUFs can be classified as resident not ordinarily resident in the country. All other entities can be stated as either resident or non-resident in India.

This was all about the residential status of HUF. Moving ahead, let's know the residential status of a company.

Residential Status of a Company

In the following conditions, a company will be considered a resident in India:

- If it is an Indian organization or a company

- If the place of effective management of the company in previous years was located in India

*Note: Here, the place of effective management (POEM) means the location where the decisions of the business related to management and commercial are taken, such as policy decisions and strategic planning.

This was all about the residential status of a company. Moving further, let's know how the residential status of businesses and other entities in India is determined.

Residential Status for Businesses and Other Entities

Here is how residential status for businesses and other entities is classified in India for tax purposes:

- Resident: If the management and control of the business and other entities are primarily taken from India, then these entities are stated as residents.

- Non-Resident: If the management and control of the businesses and other entities are primarily taken from outside India, then these entities are stated as non-resident.

This was all about how the residential entities of businesses and other entities are determined in India for tax purposes. Furthermore, let's know the residential status for firms, LLPs, AOPs, and more in India.

Residential Status for LLPs, Firms, BOIs, AOPs, Local Authorities and Artificial Juridical Persons

If the management and control of a firm, LLP, BOIs, AOPS, local authorities, and artificial juridical persons are partly or completely located within India during the relevant financial year, then these are said to be resident in India, and if not, these are considered non-resident.

Final Thoughts

This was all about how the residential status under Section 6 of the Income Tax Act is determined in India of a person or any entity. It is vital to know the residential status in India, as according to this, you need to pay tax in the country and fulfil your tax liability. If you are still confused about your residential status and need help in determining your residential status in India, or want to know about NRI taxation, contact Savetaxs. We have a team of tax experts who can solve any queries related to tax and help you with filing your ITR before the due date without any issues. So, why struggle when you have the option to take assistance? Connect with us and let us guide and assist you with your tax liability in India.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- NRI Repatriation Guide 2026: How to Legally Send Money Abroad from India

- New NRI Taxation and Residency Rules Under the Income Tax Act

- What are the NRI Tax Slab and Rates for FY 2024-2025 For NRIs?

- What is a Tax Residency Certificate (TRC) and How to Get It?

- Old vs New Tax Regime: Which is Better for NRIs

- Section 115H Of Income Tax Act: Benefits & Provisions

- Advance Tax Planning For NRIs (Non-Resident Indians)

- NRI Capital Gains and Their Taxability in India

- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- Section 9 Of The Income Tax Act

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Frequently Asked Questions (FAQs)

Need help with tax residency rules? Our FAQs cover residential status, exceptions, and implications under Indian Income Tax law.

Under Section 6 of the Income Tax Act, a person is an NRI if he/she has not stayed in India for 182 or more days during the fiscal year or if he or she lived in India for less than 365 days during the four years before the current financial year and less than 60 days in the current financial year.

According to the Income Tax Act, to become an Indian resident, a person needs to be physically present in the country for 182 or more days during the fiscal year. It is the minimum days that a person needs to stay in India to become a resident there.

Yes, RNOR is different from NRI. RNOR is a contraction for the resident but not ordinary resident, and applies to individuals of Indian origin opting to return to India after living overseas for several years. NRIs who have lived 9 out of 10 years outside India before the current financial year can be stated as RNOR.

Yes, in the course of one year, the residential status of a person can change in India, if he/she stays outside the country for more than 182 days. In India, the tax liability of a person is determined according to the number of days he/she stayed in the country.

If you stayed in India for 182 or more days during a financial year, yes, it can affect your NRI status. However, if you stay in the country for a limited time during your every visit, it will not impact your NRI status. For instance, staying in the country for 100 days during a fiscal year.

RNOR status is provided to those individuals who have been non-resident in India in 9 out of 10 financial years before the current year, or people who have stayed in the country for 729 or fewer days during the previous 7 years before the current fiscal year. Considering this, an RNOR can enjoy their RNOR status for up to 3 financial years post their return to the country. Additionally, their tax liability is in line with NRIs.

The residential status matters to NRIs because it provides them with certain tax exemptions, specifically on foreign income, for a limited time after coming back to India. Additionally, it also allows them to claim several tax benefits.

Under the new tax regime, the 60-day rule does not apply to NRIs, Indian citizens working overseas, or crew members. Additionally, the 120-day rule is applicable to NRIs who have high income, i.e., INR 1.5 million in India.

NRIs should check their residency status after every visit to India. To do so, they need to calculate the number of days you stayed in the country. In India, the fiscal year begins from 1 April to 31 March in the following year. To consider yourself as an NRI, you need to stay in India for less than 182 days in an accounting year.