Talking about an NRI PAN card and a normal card is talking about the same thing with different aspects. The normal PAN card is for resident Indians who live within the country. For them, the normal PAN card is like a passport for managing finances that they can use for everything, whether it is for buying a mobile plan to paying taxes in the country. Now talking about the other aspect, i.e., NRI PAN card used by Indians living overseas. They might be running a business or working abroad, but still, they need to link with the financial system of India, especially if they have income in the country. So, when we talk about the difference between NRI PAN card & normal PAN card, we are discussing the same thing but with a different aspect. Confused? Not to worry, as here all your queries get solved. Read this guide and know the clear difference between NRI PAN card & normal PAN card.

Key Takeaways

- The NRI PAN card is for Indian citizens staying overseas. It streamlines their connection to India's financial system, specifically for tax purposes.

- The normal PAN card is for Indian residents and is important for managing domestic financial activities and tax obligations.

- Both PAN card types have the same format and validity. Both cards remain valid for a lifetime without the need for renewal.

- An NRI can apply online or through authorized services abroad. While Indian residents can apply through the official Income Tax Department channels.

- Both an NRI and a normal PAN card are essential for legal compliance regarding taxes and financial transactions.

- NRI PAN cards are used for property transactions, such as opening NRE/NRO accounts or making investments in India.

NRI PAN Card

An NRI PAN card is a tax identity issued to individuals who are not living in India but are citizens of the country. It is for the non-resident Indians who, for several reasons such as education, good job opportunities, or residence, are spread across the world. Additionally, PIOs (People of Indian Origin), OCI (Overseas Citizen of India), foreign nationals, and international companies not registered in India can also apply for an NRI PAN card. Apart from the status difference, in terms of validity and structure, the PAN (Permanent Account Number) remains the same, like the normal PAN card in India.

It is issued to NRIs who want to conduct financial transactions and take part in investment activities in India. This involves managing bank accounts in India, purchasing property, investing in mutual funds and the stock market, or doing any transaction that needs a tax account number in India. Despite the physical absence, a PAN card helps the NRIs to remain in the financial and taxation loop in India. Apart from this, this card is considered a valid ID proof in India and helps NRIs comply with the country's tax rules. While the format and design of the NRI PAN Card are the same as a normal PAN card, it is linked to the non-resident status of the cardholder for specific uses.

Normal PAN Card

A normal PAN card is issued to Indian residents living within the country. A PAN card is a personal identification number that secures the tax-related activities and financial transactions of Indian residents on a traceable, single thread. This includes banking transactions, salary, buying assets and property, or any activity that includes monetary transactions that are taxable under Indian law. Through normal PAN cards, the Indian government tracks the financial activities of Indian residents and makes sure they fulfill their tax liability.

NRI PAN V/s Normal PAN: Key Differences

Based on different factors, here is a quick comparison between NRI PAN Card and Normal PAN Card:

| Criteria | NRI PAN Card | Normal PAN Card |

|---|---|---|

| Eligibility Criteria | NRI PAN card is designed for people who are Indian citizens living outside India for business, jobs, and other purposes, and for foreign nationals and international companies. | A normal PAN is obtained by Indian citizens who live within the country. |

| Application Process | NRIs can apply for a PAN card either online or by using the services of authorized companies overseas. | Indian residents can apply for the PAN card directly using the official Income Tax Department website or going in person to a designated center. |

| Residential Status | An NRI PAN card is issued to individuals living outside India. | A normal PAN card is issued to Indian residents living within the country. |

| Taxation Rules | NRIs come under different tax regulations, such as the Double Taxation Agreement (DTAA) and the Foreign Account Tax Compliance Act (FATCA), which determine their tax liabilities based on the resident country and income earned in India. | Indian residents are subject to standard tax regulations. |

| Types of Transactions | NRI PAN cards are generally useful for specific transactions, including buying property, opening bank accounts, making investments, and doing financial transactions in India. | Normal PAN cards are generally used for several financial activities in India, for instance, taking a bank loan, opening a bank account, and more. |

| Repartition of Funds | NRI PAN cards facilitate compliance with India's tax laws for NRIs during the repatriation of funds. | Not used for funds repartition. |

| Validity | NRI PAN cards are valid for a lifetime and do not require reissuance or renewal. | Comes with lifetime validity and does not need renewal or reissuance. |

| Documents Required | ID, address, and date of birth proof, passport, abroad address proof, and proof of NRI status. | Require ID, address, and date of birth proof. |

| Tax Benefits | Under specific circumstances, NRIs can avail of several tax benefits, such as exemption on certain incomes. | Offer standard tax benefits to Indian residents. |

| Bank Account Operations | Using an NRI PAN card, NRIs can open NRE (Non-resident External) and NRO (Non-resident Ordinary) accounts in India. | It can be used to open standard bank accounts in India. |

Advantages of Having a PAN Card

Here are the following benefits of having a PAN card by your side:

- Tax Management: A PAN card is used as a unique identifier for tracking financial records and tax filings.

- Simplified Transactions: It is one of the vital documents for investing in the stock market, conducting property deals, and engaging in mutual fund transactions.

- Identity Verification: A PAN card is globally recognized as a reliable identity proof across several services.

Why is an NRI PAN Card Important?

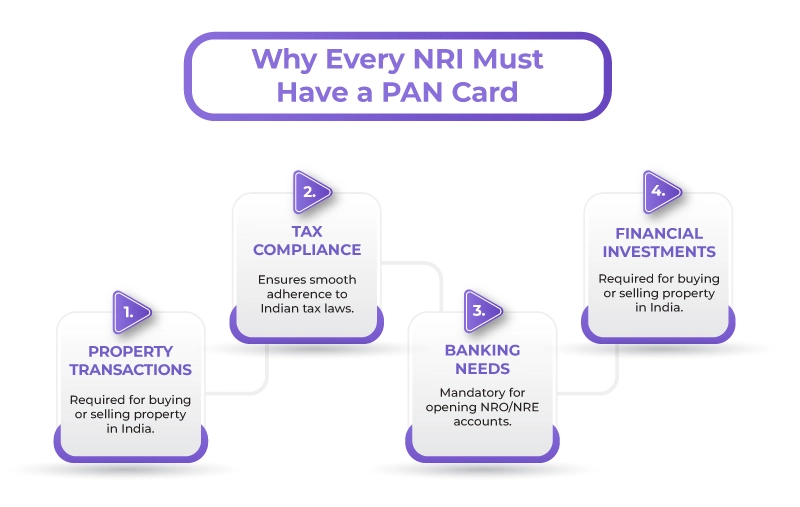

Apart from the benefits mentioned above, there are several more perks that an NRI PAN card offers to NRIs. These are as follows:

- Property Management: It is vital for an NRI to have a PAN card by their side to purchase or sell a property in India. It is one of the vital documents required for a smooth and legal transaction of property.

- Compliance with Tax Laws: An NRI PAN card helps NRIs to comply with the tax regulations of India concerning their income from the country. It is essential for NRIs as it helps them in maintaining their legal standing and tax implications with the financial institutions of India.

- Ease in Banking Operations: To open an NRO account and an NRE Account in Indian banks, NRIs need a PAN card. It is one of the vital documents required while opening a bank account in India. To manage income in India and overseas, opening these accounts is important for NRIs.

- Facilitation of Financial Investments: With a PAN card by their side, NRIs can easily invest in mutual funds, Indian stock markets, and other financial instruments. These investments further help in offering better returns to NRIs compared to other markets.

NRI PAN v/s Normal PAN: Application Process

The application process for both NRIs and Indian residents is straightforward, designed to be apply for the card from anywhere in the world. Moving further, let's know the application process for NRIs.

PAN Card Application Process for NRIs

As an NRI, to apply for a PAN card, you need to follow the steps mentioned:

- To apply for a PAN card, visit the official TIN-NSDL website.

- Fill out Form 49A with the correct information and upload all the requested documents.

- Additionally, attach digital copies of address proof, identification proof, DOB proof, and a recent passport-size photograph.

- Cross-check all the mentioned information and the attached documents before paying the PAN card fee.

- Once you make the payment, you will receive an acknowledgment receipt. It also helps you track the status of your PAN application.

PAN Card Application Process for Indian Residents

There are two ways in which Indian residents can apply for a PAN card in India, i.e., online and offline. Moving ahead, let's know about them in detail.

Online Application Process

- Visit the official NSDL website to apply for a PAN card in India.

- As part of the verification process, please mention your Aadhaar card number.

- Carefully complete the online PAN application form and upload the required documents.

- Once you have cross-checked all the details using any of the available online payment options, pay the PAN card fee.

- After payment confirmation, you will receive a 15-digit acknowledgment number. Further through it, you can easily track your application status.

Offline Application Process

- To apply offline for the application process, Indian residents must first download the application form from the NSDL website.

- Then, need to fill the form with correct information and attach the requested documents.

- After that, along with the demand draft or cheque, dispatch the filled form and attach the documents to the specified PAN service center. You can find a list of nearby PAN card centres online, as mentioned on the official website.

- Within 15-20 days of submitting your application, you will receive your PAN card.

Apply, update, or correct your NRI PAN card with ease.

What Are the Documents Required for NRI PAN and Normal PAN Card?

Having a PAN card by your side in India requires submitting several documents to establish your address, identity, and age for an easy application process. Although the documents remain the same for both Indian residents and NRIs but some of them differ. Moving further, let's know the documents that both parties need to submit.

Documents Required for Normal PAN Card

Here is the list of documents required when applying for a normal PAN card:

- Identity Proof: Any of the mentioned documents

- Passport copy

- Voter ID card copy

- Aadhaar card copy

- Driving license copy

- Pensioner card copy

- Address Proof: Any of the stated documents

- Driving license copy

- Passport copy (if address is mentioned)

- Domicile certificate granted by the government

- Recent utility bill (landline, electricity, gas, and more)

- Bank account statement or bank passbook

- Date of Birth Proof: Any of the following documents

- Copy of birth certificate

- Copy of passport

- Matriculation certificate copy

- Photographs: Two recent passport-size colored photographs

Note: Ensure that your name and date of birth are consistent across all submitted documents. For Indian residents, Aadhaar is mandatory to be linked with PAN, unless exempted under special provisions.

Documents Required for NRI PAN Card

To acquire an NRI PAN card, linking to the financial system of India, NRIs need to submit the following documents:

- ID Proof: Copy of Passport

- Overseas Address Proof: Any of the mentioned documents

- NRE bank account statement in India

- Overseas driving license

- Bank accountant statement copy in the current resident country

- An ID card issued by the government indicating the residence or nationality status

- Copy of residence permit in the residence country, attested by the Indian Consulate/Embassy/ High Commission

- Proof of NRI Status: PIO or OCI card, if applicable

- Photographs: Two recent passport-size colored photographs

Note: All NRI documents must be self-attested and, in many cases, also attested by the Indian Embassy/Consulate or a notary public in the resident's country.

| Document Type | Normal PAN Card (Indian Residents) | NRI PAN Card (Non-Resident Indians) |

|---|---|---|

| ID Proof | Any one of: • Aadhaar Card • Voter ID • Passport • Driving License • Pensioner Card |

• Passport (mandatory) |

| Address Proof | Any one of: • Driving License • Passport (with address) • Domicile Certificate • Utility Bill (electricity, gas, landline, etc.) • Bank Statement or Passbook |

Any one of: • NRE Bank Statement (India) • Overseas Driving License • Foreign Bank Statement (current residence country) • Residence/Nationality card (issued by local govt.) • Residence Permit (attested by the Indian Embassy/Consulate) |

| Date of Birth Proof | Any one of: • Birth Certificate • Passport • 10th/Matriculation Certificate |

Any one of: • Birth Certificate • Passport |

| Proof of NRI Status | ❌ Not Required | ✔️ Required: • PIO or OCI Card • Visa or Residence Permit (if not PIO/OCI) |

| Photograph | Two recent passport-size color photographs | Two recent passport-size color photographs |

| Document Attestation | Self-attested copies | Self-attested + Embassy/Notary attested (as required) |

Final Thoughts

Whether you are an NRI looking to invest in your home country or an Indian resident managing finances in India, having a correct PAN card simplifies your legal tax obligations and financial transactions within the country. To provide you with a clear idea, the above guide outlines the key difference between an NRI PAN card & normal PAN card, and how they simplify things for an individual. In support of your journey, Savetaxs helps you with correctly filing your ITR in India and solves any tax-related queries. If you have any questions about your tax liability or are facing issues with filing your ITR, please connect with us. We have a team of professionals who can assist you and guide you through the entire process smoothly on your behalf.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- PAN Card 2.0: Features, Process, Benefits and More

- PAN Card Correction/Update Online: How to Change Name, Address, DOB and Mobile Number in Pan Card?

- Form 10F: Purpose, Applicability, Requirements, How to Download and Fill Form 10F Online

- PAN Card for NRIs - Comprehensive Guide

- Income Tax Notice: Check and Authenticate Online

- Duplicate PAN Card Application Process For NRIs and Indian Citizens

- PAN Card Form 49A: How to Fill Pan Card Form 49A and 49AA?

- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- ITR 2 for NRIS: All You Need to Know for FY 2024-25

- PAN Card Surrender For NRIs and Indian Residents

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

Frequently Asked Questions (FAQs)

Have Questions About NRI vs. Normal PAN Cards? Get Clear Answers to Help You Choose the Right One.

No, the PAN card does not show NRI status on it. It only shows PAN number, name, date of birth, father's name, photograph, and signature of the individual.

For an NRI PAN card, the government charges a fee of INR 1011. It includes PAN application fee and dispatch charges, i.e., Rs. 857 and 18% GST to people with an address outside India. Additionally, a PAN card delivered to an Indian address costs Rs 107, including GST.

To convert your normal PAN card to an NRI PAN card, visit the official TIN NSDL website. Using your credentials, log in to the website. Once you log in to the portal, go to the edit profile option from the dashboard, click on the edit option, and update your resident status as 'non-resident.' It is how you can simply change your status on the PAN card.

According to the Indian Aadhaar Card Act, an NRI doesn't need to obtain an Aadhaar card unless they live in India for 182 days or more in 1 year. However, if the NRIs already have the card, then linking with their PAN card is a must, and not linking can result in an inoperative PAN.

Yes, an NRI is eligible to apply for a PAN card if he/she are involved in financial activities in India. Whether they are earning rental income, investing in stock markets or mutual funds, or opening an NRO savings account and NRE account, having a PAN card eases the financial transactions and tax compliance in India.

According to the new rules of the PAN card, the existing cardholders need to link their Aadhaar to their PAN card by 31 December 2025; failing to do so will result in card deactivation and penalties. Additionally, from 1 July 2025, the Indian government has made it compulsory for individuals applying for a new PAN card to provide their Aadhaar card number and get it verified.