Taxation in India is important to the nation's economy. Taxes are a way to improve the services and products that consumers use. Taxes are charged on various services and products that Indian citizens use in different ways. The taxation system of India is progressive, meaning the tax rates will increase with higher levels of income.

Income tax, service tax, property tax, tax deducted at source, etc., are some of the terms that most of the Indian people are familiar with. On the other hand, for NRIs, the only tax aspect they need to consider is Income Tax. The income tax slab rates in India define the rates that are applicable for different incomes. It may differ depending on the type of taxpayer, residential status, and age.

The applicable income tax slabs and rates might change every financial year, depending on the announcements made by the government. There are two tax regimes: the new tax regime and the old tax regime. In this blog, we will cover the income tax slabs that are applicable for the current financial year. Before that, let's understand a little more about what the income tax slab is.

Key Takeaways

- The income tax rates in India vary based on the income levels. The slabs may change every year based on the government's budget announcements.

- Common taxes in India include income tax, service tax, and property tax. For NRIs, the main concern is income tax.

- Taxpayers can choose between the old and new tax regimes. Both regimes offer different benefits in terms of rate and deduction availability.

- The old tax regime allows several deductions and exemptions. On the other hand, the new regime offers a simpler compliance mechanism with fewer deductions.

- The new regime provides slabs starting from NIL for income up to Rs. 4 lakhs.

- The tax rebate limit under the new regime has been raised to Rs 12 lakhs.

- Taxpayers have the option to switch between the old and new regimes every year during tax return filing.

What is the Income Tax Slab?

The Income Tax Slab was introduced to promote a fair taxation system across the country. In India, taxpayers are required to pay income tax depending on the income tax slab that matches their income levels. These income tax slabs feature various income ranges, each associated with different income tax rates. Tax obligations also increase alongside the increase in income. Taxpayers must complete their Income Tax Return (ITR) filing by the specified deadline based on these income tax slabs. Changes to the income tax slabs are announced during the budget. The old tax regime divided the slab into three categories based on an individual's age, while the new regime eliminates such classifications.

The Indian direct tax structure is also divided into the old and new regimes. The taxpayer has the option to choose one that provides more benefits while filing the ITR.

Income Tax Slab Under New Regime for FY 2025-2026 (AY 2026-2027)

The following table shows the revised income tax slab rates according to Budget 2025 under the new regime:

| Income (In lakhs) | Tax Rate |

|---|---|

| Rs. 0 to Rs. 4 lakhs | NIL |

| Rs. 4 to Rs. 8 lakhs | 5% |

| Rs. 6 to Rs. 12 lakhs | 10% |

| Rs 12 to Rs 16 lakhs | 15% |

| Rs 16 to Rs 20 lakhs | 20% |

| Rs 20 to Rs 24 lakhs | 25% |

| Above Rs. 24 lakhs | 30% |

Point to Note: The increased slab rates only apply under the new regime and will be put into action for ITR filing for FY 2025-2026 (AY 26-27)

Increased Tax Rebate Limits In Budget 2025

According to the 2025 Budget, the income tax rebate limit has been changed and increased to INR 12 lakhs. In the budget 2024, this limit was increased from Rs. 5 lakhs to Rs. 7 lakhs under the new tax regime:

| Tax Rebate Limit Under Old Tax Regime for FY 2024-2025 | Tax Rebate Limit in New Tax Regime for FY 2024-2025 | Tax Rebate Limit in New Tax Regime for FY 2025-2026 |

|---|---|---|

| INR 5 lakhs | INR 7 lakhs | INR 12 lakhs |

Note: You are also allowed to claim a deduction of INR 75,000 over and above the limit of INR 12 lakhs. This way, the total tax-free income will become Rs. 12.75 lakhs.

Income Tax Slab FY 2024-2025 (AY-2025-2026)

New Regime (FY 2024-2025)

| Range of Income (INR) | Applicable Tax Rates |

|---|---|

| Up to 3,00,000 | NIL |

| 3,00,000 - 7,00,000 | 5% |

| 7,00,000 -10,00,000 | 10% |

| 10,00,000 - 12,00,000 | 15% |

| 12,00,000 -15,00,000 | 20% |

| Above 15,00,000 | 30% |

Old Regime (FY 2024-2025)

| Range of Income (INR) | Applicable Tax Rates |

|---|---|

| Up to 2,50,000 | NIL |

| 2,50,000 -5,00,000 | 5% |

| 5,00,000 -10,00,000 | 20% |

| Above 10,00,000 | 30% |

Differentiating Between the Tax Rates of the Old Tax Regime and the New Tax Regime

| Old Tax Regime (FY 2022-2023, FY 2023-2024, and FY 2024-2025) | New Tax Regime | |||||

|---|---|---|---|---|---|---|

| Income Slabs | Age <60 years & NRIs | Age of 60 to 80 years | Age above 80 years | FY2022-2023 | FY2023-2024 | FY2024-2025 |

| Up to Rs. 2,50,000 | NIL | NIL | NIL | NIL | NIL | NIL |

| Rs. 2,50,001-Rs. 3,00,000 | 5% | NIL | NIL | 5% | NIL | NIL |

| Rs. 3,00,001 -Rs. 5,00,000 | 5% | 5% | NIL | 5% | 5% | 5% |

| Rs. 5,00,001 - 6,00,000 | 20% | 20% | 20% | 10% | 5% | 5% |

| Rs. 6,00,6001 -Rs. 7,00,000 | 20% | 20% | 20% | 10% | 10% | 5% |

| Rs. 7,00,001 -Rs. 7,50,000 | 20% | 20% | 20% | 10% | 10% | 10% |

| Rs. 7,50,001 -Rs, 9,00,000 | 20% | 20% | 20% | 15% | 10% | 10% |

| Rs. 9,00,001 -Rs. 10,00,000 | 20% | 20% | 20% | 15% | 15% | 10% |

| Rs. 10,00,001 -Rs. 12,00,000 | 30% | 30% | 30% | 20% | 15% | 15% |

| Rs. 12,00,0001 -Rs. 12,50,000 | 30% | 30% | 30% | 20% | 20% | 20% |

| Rs. 12,50,0001 -Rs. 15,00,000 | 30% | 30% | 30% | 25% | 20% | 20% |

| Rs. 15,00,1000 and above | 30% | 30% | 30% | 30% | 30% | 30% |

Note: According to Budget 2025, the rebate under section 87A has been increased to INR 60,000, which means income up to Rs. 12 lakh will be tax-exempt. However, this rebate is only applicable under the new regime and will be effective for ITR filing for the FY 2025-2026 (AY 2026-2027).

Comparison Between Old Tax Regime vs New Tax Regime

The Indian direct tax system is divided into the old regime and the new regime, with each offering various exemptions and advantages:

New Tax Regime

The new regime provides lower tax rates for higher income brackets compared to the old tax regime, and it allows taxpayers to reduce their tax liabilities under specific conditions, although choosing this regime is optional. If you opt for the new tax regime to calculate your taxes, you will miss out on most deductions and exemptions that are available under the Income Tax Act of 1961.

Nonetheless, with the Budget 2023, 2025, and 2025, the government has introduced a few changes, aimed at enhancing the appeal of the new tax regime:

| Tax Slab for FY 2023-2024 | Tax Rate | Tax Slab for FY 2024-2025 | Applicable Tx Rate |

|---|---|---|---|

| Up to Rs. 3,00,00 | NIL | Up to Rs. 3,00,000 | NIL |

| Rs. 3,00,000 -Rs. 6,00,000 | 5% | Rs. 3,00,000 -Rs. 7,00,000 | 5% |

| Rs. 6,00,000 -Rs. 9,00,000 | 10% | Rs. 7,00,000 -Rs. 10,00,000 | 10% |

| Rs. 9,00,000 -Rs. 12,00,000 | 15% | Rs. 10,00,000 -Rs. 12,00,000 | 15% |

| Rs. 12,00,000 -Rs. 15,00,000 | 20% | Rs. 12,00,000 -Rs. 15,00,000 | 20% |

| Above Rs. 15,00,000 | 30% | Above 15,00,000 | 30% |

Old Tax Regime

Regarding the old tax regime, it refers to the income tax calculation system and slabs that were in place before the new tax regime. It is often referred to as the existing tax regime. Under the old tax regime, individuals could claim numerous tax deductions and exemptions, allowing them to lower their taxable income. This regime offers over 70 deductions and exemptions, including provisions under section 80C, HRA, LTA, among others. There have been no changes to the slab rates in the old tax regime.

| Income Range (Rs.) | Applicable Tax Rate |

|---|---|

| Up to Rs. 2,50,000 | NIL |

| 2,50,000 -5,00,000 | 5% |

| 5,00,000 -10,00,000 | 20% |

| Above 10,00,000 | 30% |

Point to Note: Under the old tax regime, the basic exemption limit for an individual aged above 60 years and below 80 years is Rs. 3,00,000. Under the new tax regime, the basic exemption limit for individuals aged above 80 years is Rs. 5,00,000.

Features of the New Tax Regime

- Lower Tax Rates

The new tax regime offers lower tax rates in various slabs:

| New Regime Slabs (FY 2024-2025) | New Regime Slabs (FY 2025-2026) | ||

|---|---|---|---|

| 0 to 3 lakhs | NIL | 0 to 4 lakhs | NIL |

| 3 to 7 lakhs | 5% | 4 to 8 lakhs | 5% |

| 7 to 10 lakhs | 10% | 8 to 12 lakhs | 10% |

| 10 to 12 lakhs | 15% | 12 to 16 lakhs | 15% |

| 12 to 15 lakhs | 20% | 16 to 20 lakhs | 20% |

| Above 15 lakhs | 30% | 20 to 24 lakhs | 25% |

| Above 24 lakhs | 30% | ||

- Easier Compliance:

- There is no need to manage comprehensive documentation for exemptions or deductions.

- Increased Take-Home Pay:

- It can benefit those people who don't have any major tax-saving investments

- No Deductions or Exemptions:

- Only the standard deduction of Rs. 75,000 is permitted, which came into effect from Budget 2024.

- Numerous deductions and exemptions are not available, including 80C, HRA, and LTA.

- Ideal for Specific Taxpayers:

- The new tax regime is suitable for those individuals who have fewer or no investments and deductions.

Get trusted guidance for NRI tax filing, planning, and cross-border strategies with ease.

Features of the Old Tax Regime

- Higher Tax Rates:

- In the old tax regime, NRI tax slabs had higher rates for numerous ranges of income.

- Exemptions and Deductions:

- Exemptions were available for allowances, such as transport allowance and food coupons.

- It permits several deductions like:

- Standard deduction: Rs. 50,000 for salaried individuals.

- Section 80D: Medical insurance premium

- Section 80C: Rs. 1.5 lakhs for investments, such as ELSS, PPF, etc.

- Leave Travel Allowance (LTA) and House Rent Allowance (HRA)

- Suitable for Specific Taxpayers:

- In contrast to the new tax regime, the old tax regime is ideal for those who have high eligible deductions and exemptions.

How to Choose Between the Old and New Regime?

Consider the following points to make a choice between the old and new regimes:

- Taxpayers can choose a regime that is more beneficial to them.

- The old regime is ideal for those individuals who have significant investments/deductions

- The new regime is suitable for those having minimal tax-saving options.

Income Tax Slab Rates for FY 2024-2025 (AY 2025-2026) Depending on Residential Status

Income tax rate for residents and HUF (Hindu Undivided Families)

| Old Regime | |||

|---|---|---|---|

| Slabs (INR) | Idividuals aged <60 years | Resident Senior Citizens ( ≥ but <80 years) | Resident Super Senior Citizens (80 years and above) |

| Up to 2,50,00 | NIL | NIL | NIL |

| 2,50,001 to 3,00,000 |

5% |

NIL | NIL |

| 3,00,001 to 5,00,000 | 5% | 5% | NIL |

| 5,00,001 to 10,00,000 | 20% | 20% | 20% |

| Above 10,00,000 | 30% | 30% | 30% |

| New Regime (FY 2024-2025) | |

|---|---|

| Total Income (Rs. ) | Tax Rate (AY 2025-2026) |

| Up to 3,00,000 | NIL |

| 3,00,001 to 7,00,000 | 5% |

| 7,00,001 to 10,00,000 | 10% |

| 10,00,001 to 12,00,000 | 15% |

| 12,00,001 to 15,00,000 | 20% |

| 15,00,001 and above | 30% |

Income Tax Rate for Non-resident Individual

| Existing Tax Regime | New Tax Regime | ||

|---|---|---|---|

| Level of Income (Rs.) | Tax Rate | Level of Income (Rs.) | Tax Rate |

| 0 to 2,50,000 | NIL | 0 to 3,00,000 | NIL |

| 2,50,001 to 5,00,000 | 5% | 3,00,001 to 7,00,000 | 5% |

| 5,00,001 to 10,00,000 | Rs. 12,500 +20% of the amount exceeding Rs. 5,00,000 | 7,00,001 to 10,00,000 | Rs. 20,000 + 10% of the amount exceeding Rs. 7,00,000 |

| 10,00,001 and above | Rs. 1,12,500 + 30% of the amount exceeding Rs. 10,00,000 | 10,00,001 to 12,00,000 | Rs. 50,000 +15% of the amount exceeding Rs. 10,00,000 |

| 12,00,001 to 15,00,000 | Rs. 80,000 +20% of the amount exceeding Rs. 12,00,000 | ||

| 15,00,001 and above | Rs. 1,40,000 +30% of the amount exceeding Rs. 15,00,000. | ||

Note: In the case of the resident, a surcharge and cess also apply.

Tax Slabs for Domestic Companies

| Condition | Income Tax Rate (excluding surcharge and cess) |

|---|---|

| Total Turnover or Gross Receipts During the Previous Year 2020-2021 does not exceed Rs. 400 crores | 25% |

| If selected, Section 115BA | 25% |

| If you opt for Section 115BAA | 22% |

| If selected, Section 115BAB | 15% |

| Any other domestic company | 30% |

Note:

- A company that has opted for special rate taxation under section 115BAA and 115BAB does not have to pay MAT (Minimum Alternate Tax).

- MAT shall be paid at 9%, including applicable cess and surcharge, if the company is a unit of an international financial services center and receives its income only in convertible foreign exchange.

- A company must be subject to pay MAT at 15% of the book profit, as well as the applicable surcharge and health and education cess. In this, the normal tax liability of the company shall be less than 15% of the book profit.

- Companies that opt for a special rate of taxation under section 115BAA or 15BAB will not benefit from specific deductions, such as section 801A, 801AB, 801AC, 801B, etc., except for deductions under section 80JJAA and 80M.

Applicable Income Tax Rate for a Foreign Company

AY (Assessment Year) 2024-2025

| Nature of Income | Applicable Tax Rate |

|---|---|

| Royalty received from the government or an Indian concern in the implementation of an agreement with the Indian concern after 31st March, 1961. However, before 1st April, 1976, or fees for providing technical services in fulfillment of an agreement made after 29th February 1964. However, before 1st April, 1976, and where such agreement has, in either case, been approved by the Central Government | 50% |

| Any other type of income | 40% |

AY (Assessment Year) 2025-2026

| Nature of Income | Applicable Tax Rate |

|---|---|

| Royalty received from the government or an Indian concern in fulfillment of an agreement started with the Indian concern after the 1st of March, 1961, but before the 1st of April, 1976, or fees for providing technical services in pursuance of an agreement made after the 29th of February, 1964 but before 1st of April, 1976 and where such agreement has, in either case, been approved by the Central government. | 50% |

| Any other type of income | 35% |

Additionally:

(a) Surcharge: The income tax will be increased by a surcharge of 2% on the tax amount for total income that exceeds one crore rupees but does not exceed ten crore rupees. For income exceeding ten crore rupees, the surcharge is raised to 5%. However, this surcharge comes with a provision for marginal relief, which is as follows:

(i) For income above one crore rupees but up to ten crore rupees, the combined total of income tax and surcharge cannot exceed the tax amount payable on one crore rupees by more than the income that exceeds one crore rupees.

(ii) For total income over ten crore rupees, the total payable income tax and surcharge amount must not exceed the tax amount computed on ten crore rupees by more than the income over that limit.

(b) Health and Education Cess: In addition to the income tax and applicable surcharge, a health and education cess of four percent will be applied to the total of the income tax and surcharge.

Minimum Alternate Tax (MAT)

A foreign company must pay the Minimum Alternate Tax (MAT) if the tax is determined on its total income as per the normal provisions of the law, and is less than 15% of its "book profit". In this case, "book profit" becomes the basis for tax calculation, which is set at a rate of 15%. However, the MAT provisions do not apply to foreign companies that don't have a permanent establishment (PE) in India or choose to follow the presumptive taxation schemes outlined in Section 44B, Section 44BB, or any other sections specified in a certain regulation.

What are the Applicable Exemptions and Deductions for an NRI?

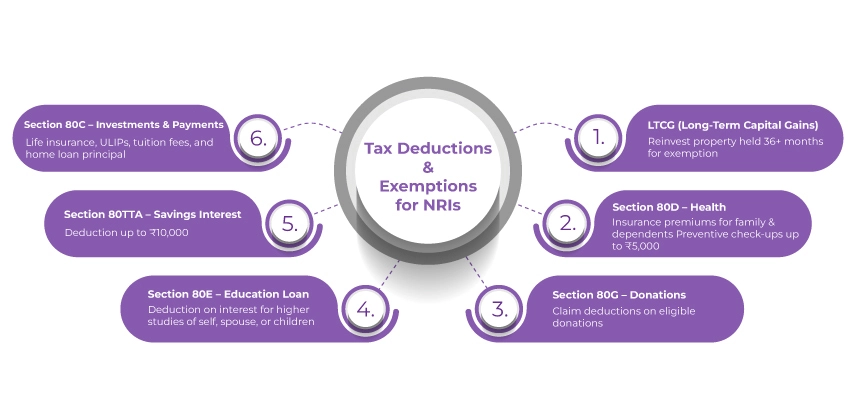

NRIs' income is mostly liable to a heavy TDS (Tax Deducted At Source), which often results in NRIs paying more tax than their actual liability. Hence, understanding the applicable deductions that can be availed as Non-resident Indians (NRIs) is vital. The deductions that an NRI can claim as per NRI taxation rules are as follows:

- LTCG (Long-term capital gains)

- LTCG from a property held for 36 months or more can be invested in other property, and the transaction amount will be exempted.

- Section 80D

- Health insurance premiums for the immediate family and dependents.

- Preventive health check-ups for up to a maximum of Rs. 5000.

- Section 80G

- Donations according to Section 80G.

- Section 80E

- Interest deduction paid on an education loan for higher studies of self, spouse, children, or a dependent student, subject to the earlier of a period of around 8 years or till the interest is paid.

- Section 80TTA

- A maximum of Rs. 10,000 on interest from a savings bank account.

- Section 80C

- Investment in ULIPs

- Tuition fee payment

- Payment of life insurance premiums

- Deduction from house property income

- Principal payment on the loan for the purchase of a residential property

What are the Surcharge Rates for an NRI?

- The Surcharge rate is 15% of the income tax that is payable on the total income that is more than Rs. 1 crore but up to Rs. 2 crore.

- 25% of income tax payable, if total income exceeds Rs. 2 crore but up to Rs. 5 crore.

- Surcharge rate is 37% of the income tax payable on total income exceeding Rs. 5 crore.

- 10% of income tax if the total income exceeds Rs. 50 lakhs, but not Rs. 1 crore.

- The surcharge is conditional on marginal relief and will be applicable to the income of an NRI also. ;

Note: Under the new tax regime, the maximum surcharge must be 25%.

Additional Points

- Compare your tax liability carefully under both regimes before choosing one. You can make use of a tax calculator online to get more help.

- You can change between the new and old regimes annually at the time of filing your tax returns.

- When making a decision, consider your future income growth and investment plans.

Conclusion

The Old vs New Tax Regime provides you with clarity on all the calculations and a detailed comparison on how much your taxability will be according to both old and new regimes, so that it becomes easier for you to choose the one that is suitable for you. If you are confused about which tax regime is ideal for you or if you find filing an ITR complex, then you can seek assistance from the experts at Savetaxs.

Our expert team of CAs at Savetaxs will help you to file your ITR easily. They bring an experience of over 30 years and can help you complete your income tax return filing easily, and that too without leaving the comfort of your home.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- Complete Guide for Double Tax Avoidance Agreement (DTAA) for NRIs

- Old vs New Tax Regime: Which is Better for NRIs

- Section 115H Of Income Tax Act: Benefits & Provisions

- Your Complete Guide for Section 80D of the Income Tax Act

- NRI Repatriation Guide 2026: How to Legally Send Money Abroad from India

- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- New NRI Taxation and Residency Rules Under the Income Tax Act

- Section 80C of Income Tax Act - 80C Deduction List

- Residential Status Under Section 6 of the Income Tax Act

- Section 80GG: Claim Tax Deductions on Rent Paid for Indian and NRIs?

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

Frequently Asked Questions (FAQs)

Common Questions on NRI Income Tax Slabs Answered

The new tax regime is the default tax regime.

Choosing the income tax slab is completely your personal choice. However, if you have high deductions, then choose the old regime or otherwise, select the new regime with lower tax rates.

Yes, you can change the applicable income tax regime every year if you have no business income. If you have a business income, then you change it only once.

The TDS for an NRI is as follows:

- Rent/Dividend: 20-30%

- NRO Interest: 30%

- Property Sale: 20% (LTCG) or slab (STCG)

- Equity STCG: 15%. LTCG: 10% above Rs. 1 lakh.

Under the old regime, income of up to Rs. 2.5 lakhs is tax-free for NRIs.

The tax on NRI funds depends on the type of income. Like, the interest earned on an NRE or FCNR account is free from taxes. On the other hand, interest on an NRO account, rental income, and capital gains are subject to taxes.