As a business owner in the United States, having a comprehensive understanding of federal, state, and local taxes is crucial. Knowing when and how to file taxes is essential to ensure the overall legitimacy and success of the business.

In this guide, we will break down every aspect that you must know about business entity tax filing in the United States.

Key Takeaway

- An Employer Identification Number (EIN) is required for most businesses with employees, trusts, partnerships, and for specific retirement plans.

- Single-member LLCs and sole proprietor shall file Schedule C to report their business income and the self-employment tax.

- Businesses must understand their legal structure correctly and then file the appropriate local, state, and federal taxes accordingly.

What is an Employer Identification Number (EIN)?

An Employer Identification Number is a federal tax ID number for your business. Most businesses are mandated to have an EIN to file their taxes. As per the regulatory framework set by the IRS, you must apply for the EIN if any of the following items are suitable for your business.

- The business has employees.

- The business is either a corporation or a partnership.

- The business has a Keogh (also known as the tax-deferred pension) plan.

- The business withheld the taxes on the income of a non-resident alien.

- The business files tax returns for tobacco, alcohol, employment, excise, and firearms.

- The business is involved in various sectors, including real estate, trusts, investments, farms, cooperatives, and plan administration, among others.

If you need an EIN, you can apply for it on the Internal Revenue Service (IRS) website.

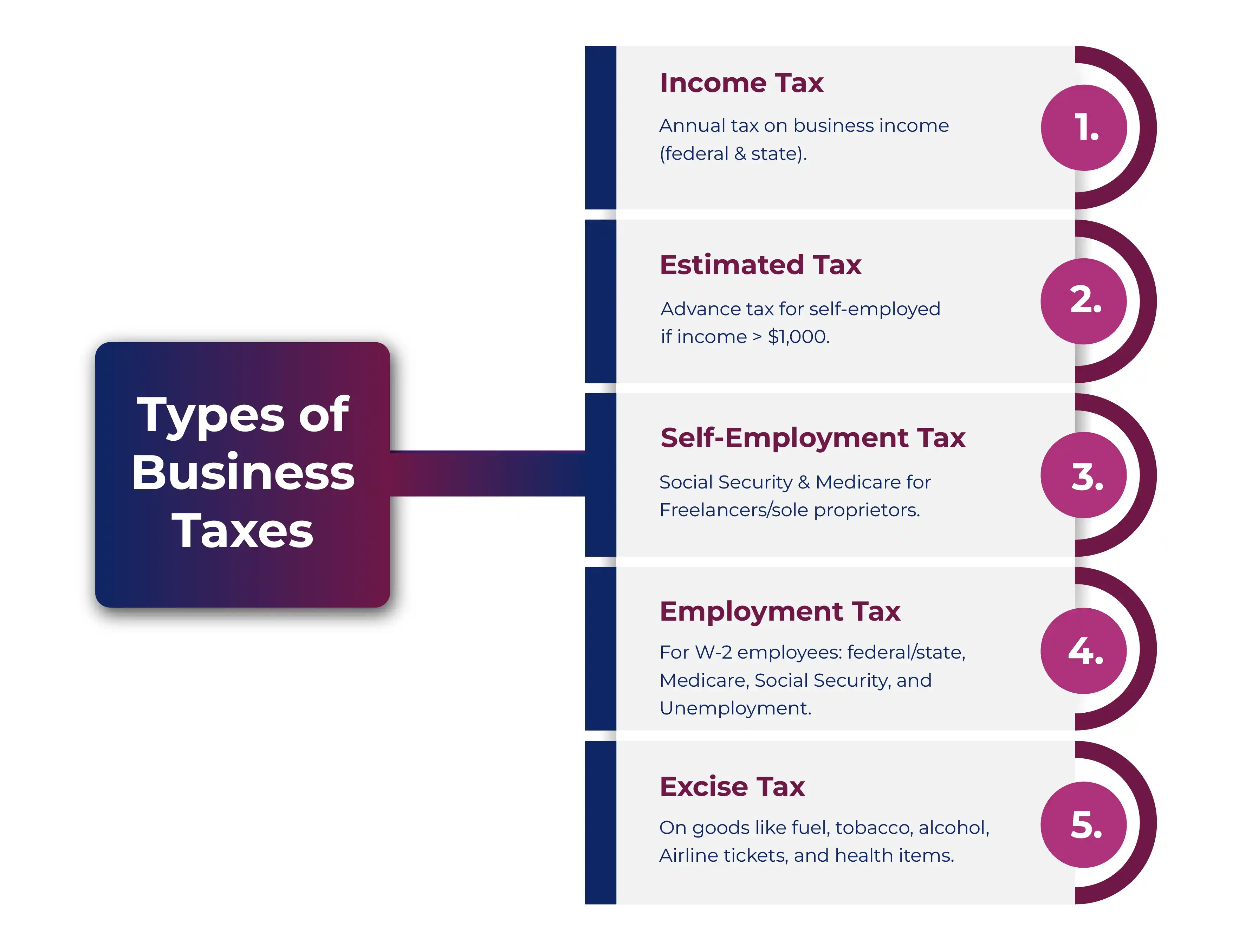

What are the Types of Business Taxes?

The type of business tax a business is required to pay depends entirely on two factors: the type of business the taxpayer owns and the state in which the business is established.

According to the IRS, the following are the different types of business taxes.

Income Taxes

Apart from partnerships, all business entities are required to file tax returns reporting the income received by the business throughout the entire year. Almost every state in the US imposes corporate income tax or business income tax; however, the tax laws might vary from state to state.

Therefore, when an individual prepares for business taxes for the relevant year, they must understand the required income tax at both the local and state levels.

Estimated Taxes

Self-employed individuals, S corporation shareholders, partners, and freelancers must make a tax payment if they expect to have $1,000 or more in taxable income by the time they file their return.

It is crucial to get your tax prediction or estimation right, as the taxpayer may receive a penalty for underpaying taxes.

Self-Employment Taxes

The SE tax, or the self-employment tax, is a social security and Medicare tax that contributes to your coverage under the Social Security system.

The coverage that Social Security provides includes multiple benefits related to disability, survivors, Medicare, retirement, and more. Contractors who work independently, as well as self-employed Sole proprietors, must file Schedule SE, which is attached to Form 1040 or Form 1040-SR, to compute and pay their taxes.

Employment Taxes

If the business has W-2 employees, then you should file and pay the specific federal taxes, which include Medicare taxes, Social Security taxes, federal income tax withholdings, and the federal unemployment tax.

Additionally, every state needs specific state employment taxes, such as workers' compensation insurance and unemployment insurance. Ensure that you gather all the required information from your state's taxation department.

Excise Taxes

The business entity must ensure that excise taxes are paid on the purchase of a specific good, such as gasoline. However, this tax is generally included in the price paid for the goods.

Many different types of businesses pay excise taxes, but fuel is a significant component of this tax. In addition to the fuel, excise taxes are also collected on airline tickets, tobacco products, health-related goods and services, alcoholic beverages, and other items.

Filing The Tax Form

As a business owner, you must have an understanding of the business entity taxes you need to file or are required to pay. Familiarizing yourself with the correct schedules and forms is essential; however, many taxation firms or software provide you with the proper and accurate forms. Nevertheless, it is always best to be prepared on your own so you can fill them out accurately and quickly.

In cases where you are not sure, it is advisable to consult a certified professional tax expert or a certified public accountant (CPA).

In the case where you run your business as a single-member limited liability company or a sole proprietor, then you must file Schedule C (Form 1040) to report the annual profit or loss of the business.

You may also need to submit a Schedule SE or the self-employment tax form, along with Schedule C. Schedule C is a specific business tax form that is only two pages long. To complete this form, you must list all the expenses that you claim and then subtract the expenses from your earnings, and the resulting figure will be your net profit or loss.

If your business is either a corporation or you treat it as an LLC, you must file a separate corporate tax return, such as Form 1120 or Form 1120-S for S corporations.

Form 1120 is similar to Schedule C, as you similarly calculate your business income. However, this form is somewhat complicated because it requires a lot of details, and it is filed separately from the personal income tax return.

Below is a List of Such Common Taxation Forms That a Business is Required to File, Depending on the Type of Business You Own:

Annual Return of Income (Partnerships)

Income Tax

- 1040, US Individual Income Tax Return

- Schedule C (Form 1040), Profit or Loss From Business

- Schedule E ( Form 1040), Supplemental Income and Loss (partnerships)

- 1120, US Corporation Income Tax Return (C Corporations)

- 1120-S, US Income Tax Return for an S corporation

- Schedule K-1 (Form 1120-S) (S corporations)

Estimated Tax

Employment Tax

- 941, Employer's Quarterly Federal Tax Return

- 943, Employee's Annual Federal Tax Return for Agricultural Employees.

- 944, Employer's ANNUAL Federal Tax Return

Social Security, Medicare taxes, and income tax withholding

- W-2, Wage and Tax statements (to employee)

- W-3, Transmittal of Wage and Tax Statements (to the Social Security Administration)

Federal Unemployment (FUTA) Tax

There is a list of all the business tax forms. Either consult a business tax expert or visit the IRS's tax forms and instructions page for clear instructions on which and how to file.

File your Business Taxes With a Business Tax Expert In the USA

Juggling between the never-ending tax forms, analyzing which one to file, investing time in preparing account books, computing, and planning taxes can be overwhelming and confusing if you lack the basic knowledge of US taxation. And one wrong move, and boom, the IRS chases you with hefty penalties and back taxes.

However, it is generally advisable to seek the help of a professional business expert who can handle everything for you, right from analyzing your account books to which IRS form you must file. And such a tax expert is Savetaxs.

Savetaxs is a leading tax firm that helps US citizens and NRIs file their taxes online. Whether it's your business entity tax filing or personal taxes, we help you with both, ensuring that your deductions and exemptions are maximized.

We have been serving U.S. citizens for over a decade with tax services, and our satisfied client base of thousands of taxpayers, like you, is a testament to the quality of service we offer.

Savetaxs serves its clients 24/7 across all time zones; connect with us today and file your business entity taxes in the USA.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Frequently Asked Questions

Clear and Concise Answers to the Most Frequently Asked Questions for Better Understanding and Guidance

Most businesses, such as partnerships, corporations, and those with employees, need an EIN to file taxes. However, in the case of sole proprietors without employees, they can use their social security number instead.

The Internal Revenue Service (IRS) recognizes various categories such as income taxes, estimated taxes, self-employment taxes, excise taxes, and employment taxes. The business structures determine which one to apply.

C-corporation file form 1120 (US Corporation Income Tax Return). This form reports losses, deductions, gains, and tax credits and calculates the tax liability of the entity at the corporate tax rate.

An S-Corporation files Form 1120-S, which passes deductions, tax credits, and income to the shareholders of the corporation. The business entity does not directly pay income tax; instead, the shareholders report their income on their personal tax returns.

Partnerships file their U.S. taxes through Form 1065 (U.S. Return of Partnership Income). Although the partnership itself does not pay federal income taxes, it does provide a Schedule K-1 to each of its partners, who then use it to report their share of income on their personal tax return.

Trusts and estates use this form to report the income that the trustees or estate has generated. Beneficiaries report their share of income received.

Yes, self-employed individuals, businesses, freelancers, or businesses that owe $ 1,000 or more in taxes are required to make quarterly payments. To do so, Form 1040-ES is used for individuals, and Form 1120-W is used for corporations.

Self-employment tax covers social security contributions and the Medicare contributions for self-employed individuals. It is calculated based on net earnings and is different from income taxes.

Employers must file Form 941 quarterly for federal income tax withholding, Medicare, and Social Security. Furthermore, they are required to file Form 940 annually for Federal Unemployment Tax (FUTA).

The excise taxes apply to specific goods, services, or even activities. Form 720 reports federal excise taxes, including those on fuels and environmental taxes. Whereas Form 2290 reports the heavy highway vehicle use tax.

The ERS was a temporary thing while COVID-19 hit. The ERC allows employers to claim a refundable credit for keeping employees on the payroll. However, with the end of the COVID-19 pandemic, the organization has also ceased operations, but businesses can still file an amended return to claim the retroactive credits.

Yes, the IRS charges a penalty for filing delays.