When we talk about US taxation, the first thought that comes to our mind is of federal tax. However, the state tax is also important to consider. It is a tax imposed by the state government on its residents and businesses. Through these taxes, the government gets revenue, which it further uses in funding public programs and services within the states. State taxes offer local services like transportation, public education, state-level healthcare programs, and public safety. Additionally, these taxes vary due to unique economic conditions and revenue needs of each state in the U.S.

Want to know more about state tax in detail and how to file it? Then this guide is for it. It consists of all the information about these taxes. So, let's start reading.

Key Takeaways

- State income taxes ensure that individuals and business taxpayers in the US fulfill their tax obligations under state-specific income, sales, and payroll tax laws.

- Depending on the state in the US, requirements vary, such as some states do not charge income tax, while others impose additional surcharges and tax filing rules.

- Non-resident individuals in the US still owe state tax if they earn income (business, salary, or rental) from that state.

- Businesses need to register, collect, and pay state sales/ use tax when crossing the economic nexus threshold.

- Staying compliant with the state taxes helps in avoiding paying interest, penalties, and audits, and offers state-level tax credits and benefits.

What Are State Taxes?

As mentioned above, state taxes are the payments that every individual state government in the US mandatory collect from residents and businesses to generate money for funding public operations and services within the states. The tax rules and tax rates vary from state to state. In simple words, the tax amount you pay can be different depending on the state you live in or work in. Additionally, unlike federal taxes that fund national programs, these taxes stay local and impact directly to the community.

Among small business owners, paying state income tax is vital, and it creates triple responsibilities for them. Confused? The small business owners need to pay their own taxes, pay the amount from the paychecks of employees, and collect sales tax from customers on every purchase. If any of these go wrong, they are liable to pay interest, penalties, and face unhappy employees.

This was all about state taxes. Moving ahead, let's know how these taxes are calculated.

How State Taxes in the US Work?

As stated above, every state has its own system to collect taxes, and they all work differently. To keep it easy to understand, some states imposed taxes with a flat rate on everyone. However, other states have complicated tax brackets depending on the earnings. At present, 27 states in the US and the District of Columbia impose graduated rate income taxes. In these, as per the states, the number of tax brackets varies. There is a collection piece also that shows how the states actually get money in their hands.

It is how state taxes in the US work. Now, let's know how they are calculated.

How State Taxes Are Collected in the US?

There are three different ways in which state taxes in the US are collected. These are as follows:

- Withhold income tax from paychecks

- Sales tax from customers

- Own property tax

This is how state taxes are collected in the US. In case you are a business owner, you are probably juggling all three taxes. Moving ahead, let's know the different types of state taxes.

Types of US State Taxes

The state tax imposed on you in the United States depends on several factors. It includes your business structure, where your business is set up, and business activities. To provide you with an idea, here are some typically imposed state taxes that individuals and businesses encounter.

State Income Tax

Like its name, state income taxes are taxes that are imposed on the income of businesses and individuals. In terms of business, these taxes are what the business owners withhold from the paychecks of employees. Additionally, these taxes are also called personal income taxes for individuals as they are imposed on their wages, salary, and other income types.

The general formula to calculate it is, i.e., state income tax = (income taxable * tax rate) - tax credits.

However, in every state, the "taxable income" has a different meaning. Some adjust their federal taxable income while others calculate it from the start. Furthermore, for business owners, this means correctly withholding for different employees tracking different tax rates, and keeping yourself updated with the annual tax rates.

Let's know about the states that do not impose taxes on income on individuals in the US.

States Without Income Tax

There are eight states in the U.S. that do not levy individual income taxes. These are as follows:

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

Also, on 1 January 2025, one state became a part of these states, i.e., New Hampshire. This state only imposed taxes on interest and dividend incomes, and by 2027, these taxes will be phased out in this state.

Furthermore, to compensate for the loss from not imposing the income tax, the above-mentioned eight states had made alternative sources to collect revenue. These are as follows:

- Alaska imposed high taxes on the extraction of natural resources like natural gas and oil.

- Florida collects taxes from revenue from tourism.

- Nevada generates revenue by imposing taxes on gaming.

- Texas, instead of imposing a traditional corporate income tax, levies a "margin tax" on businesses.

From the above information, you should understand that the absence of state income tax does not reduce your tax liability. These states compensate for the absence of income tax by imposing higher tax rates on other taxes. For example, Washington has a 9.38% tax rate, which is the highest combined local and state tax rate in the country.

States With the Highest Income Taxes

Out of the 50 states in the USA, 42 states and Washington, D.C., on individuals impose the highest income taxes. These are the states that have the highest rates of state income tax:

- California: 1% to 12.30%

- Hawai: 1.4% to 11%

- New Jersey: 1.4% to 10.75%

- Maine: 5.8% to 7.15%

- Idaho: 5.80%

State Business Tax

A state business tax is a common tax imposed by the state government on businesses to give them the right to operate within its borders. It applies to all businesses, no matter how much profit they earn. Additionally, the state business tax may be calculated as per the gross net income or a percentage of total receipts. Depending on your state's rules, you might pay taxes annually even if your business has not earned a profit that year. For instance, the Business and Occupation (B&O) tax of Washington or the Commercial Activity Tax (CAT) of Ohio.

State Franchise Tax

Like its name states, it is not what you suppose to consider. A state franchise tax is not a tax businesses pay on food chains or clothing; it is a tax on the privilege your business gets from being incorporated or registered in a state. These taxes are generally paid by companies, LLCs, corporations, and other entities. State franchise taxes are charged according to the capital stock, net worth, or a flat fee for the business. Also, like the business tax, you are liable to pay the franchise tax annually, whether your business has earned a profit in a particular year or not. For instance, states like California, Delaware, and Texas imposed franchise taxes on businesses.

State Sales & Use Tax

Sales tax is a consumption tax that is levied on the sale of several services and products. These are indirectly paid by customers on their purchases. It is a percentage added by the business owner to its sales and then sent to the state. The rates of state sales tax vary, with some states not charging the tax while others have 7% tax rate. These taxes are collected by businesses during the sale and transferred to the state.

Use tax, while on the other side, ensures that the state still gets the tax on online purchases or out-of-state sales. For instance, if you purchase a product online without paying sales tax, you are liable to pay the use tax to your state. To stay compliant with the taxation rules, it is vital for businesses to regularly file their sales tax returns and register themselves for sales tax permits.

Moving further, let's know the states in the US that do not charge sales tax.

States Without Sales Tax

Currently, there are five states in the US that do not charge sales tax. These are as follows:

- Alaska

- Delaware

- Montana

- New Hampshire

- Oregon

The absence of sales taxes in these states helps consumers save on their large purchases. For example, an individual from any of these states purchases a vehicle of $50,000 compared to other states where sales tax is charged, saving between $2500 and $5000.

States With Highest Sales Tax

These are some of the states in the US that charge the highest sales taxes:

- Tennessee: 9.55%

- California: 7.25%

- Indiana: 7%

- Mississippi: 7%

- Rhode Island: 7%

State Property Tax

Property tax is imposed whether you lease or own property. This tax is levied by the local officials where your property is situated. According to the property value, the local assessors send you the bill. These state taxes help in funding local services such as schools, road maintenance, emergency services, fire, and the police department. After payroll, it is often considered the biggest tax bill for individuals with limited tax reduction options.

Moving further, let's know about the states with lower property taxes.

States With the Lowest Property Taxes

Here is the list of states that have the lowest property taxes in the US.

- Hawai: 0.28%

- Alabama: 0.41%

- Colorado: 0.51%

- Louisiana: 0.55%

- Wyoming: 0.58%

States with the Highest Property Taxes

These are the following states in the US have the highest property tax rates:

- New Jersey: 2.47%

- Illinois: 2.27%

- New Hampshire: 2.18%

- Connecticut: 2.14%

- Vermont: 1.90%

Here, the varying rates of property tax showcase the differences in how the state governments in the USA fund their public services. For this approach, New Hampshire is a good example, as while avoiding general income and sales taxes, the state depends on property taxes.

These are some of the different types of state taxes in the US. Moving ahead, let's know the total tax burden of each state.

States Ranked by Total Tax Burden

As mentioned above, based on income, sales/use, property, business, and franchise taxes, each state in the USA has a different tax burden. The effective local tax rate denotes all the local and state taxes paid by the taxpayers, including excise tax, income tax, sales/use tax, and more. Furthermore, the table below consists of the 50 US states arranged from the highest to the lowest tax rate.

| Rank | Name of the State | Tax Rate | Rank | Name of the State | Tax Rate |

|---|---|---|---|---|---|

| 1. | New York | 15.9% | 2. | Connecticut | 15.4% |

| 3. | Hawaii | 14.4% | 4. | Vermont | 13.6% |

| 5. | California | 13.5% | 6. | New Jersey | 13.2% |

| 7. | Illinois | 12.9% | 8. | Virginia | 12.5% |

| 9. | Delaware | 12.4% | 10. | Maine | 12.4% |

| 11. | Minnesota | 12.1% | 12. | Utah | 12.1% |

| 13. | Massachusetts | 11.5% | 14. | Nebraska | 11.5% |

| 15. | Rhode Island | 11.4% | 16. | Maryland | 11.3% |

| 17. | Lowa | 11.2% | 18. | Kansas | 11.2% |

| 19. | Wisconsin | 10.9% | 20. | Oregon | 10.8% |

| 21. | Idaho | 10.7% | 22. | Washington | 10.7% |

| 23. | Pennsylvania | 10.6% | 24. | Montana | 10.5% |

| 25. | Arkansas | 10.2% | 26. | New Mexico | 10.2% |

| 27. | Ohio | 10% | 28. | North Carolina | 9.9% |

| 29. | Alabama | 9.8% | 30. | Mississippi | 9.8% |

| 31. | West Virginia | 9.8% | 32. | Colorado | 9.7% |

| 33. | Kentucky | 9.6% | 34. | Nevada | 9.6% |

| 35. | New Hampshire | 9.6% | 36. | Arizona | 9.5% |

| 37. | Indiana | 9.3% | 38. | Missouri | 9.3% |

| 39. | Florida | 9.1% | 40. | Louisiana | 9.1% |

| 41. | Oklahoma | 9% | 42. | Georgia | 8.9% |

| 43. | South Carolina | 8.9% | 44. | North Dakota | 8.8% |

| 45. | Michigan | 8.6% | 46. | Texas | 8.6% |

| 47. | South Dakota | 8.4% | 48. | Tennessee | 7.6% |

| 49. | Wyoming | 7.5% | 50. | Alaska |

4.6% |

These are the US states ranked by the highest state taxes. Moving ahead, let's know how to determine the state income tax in the US.

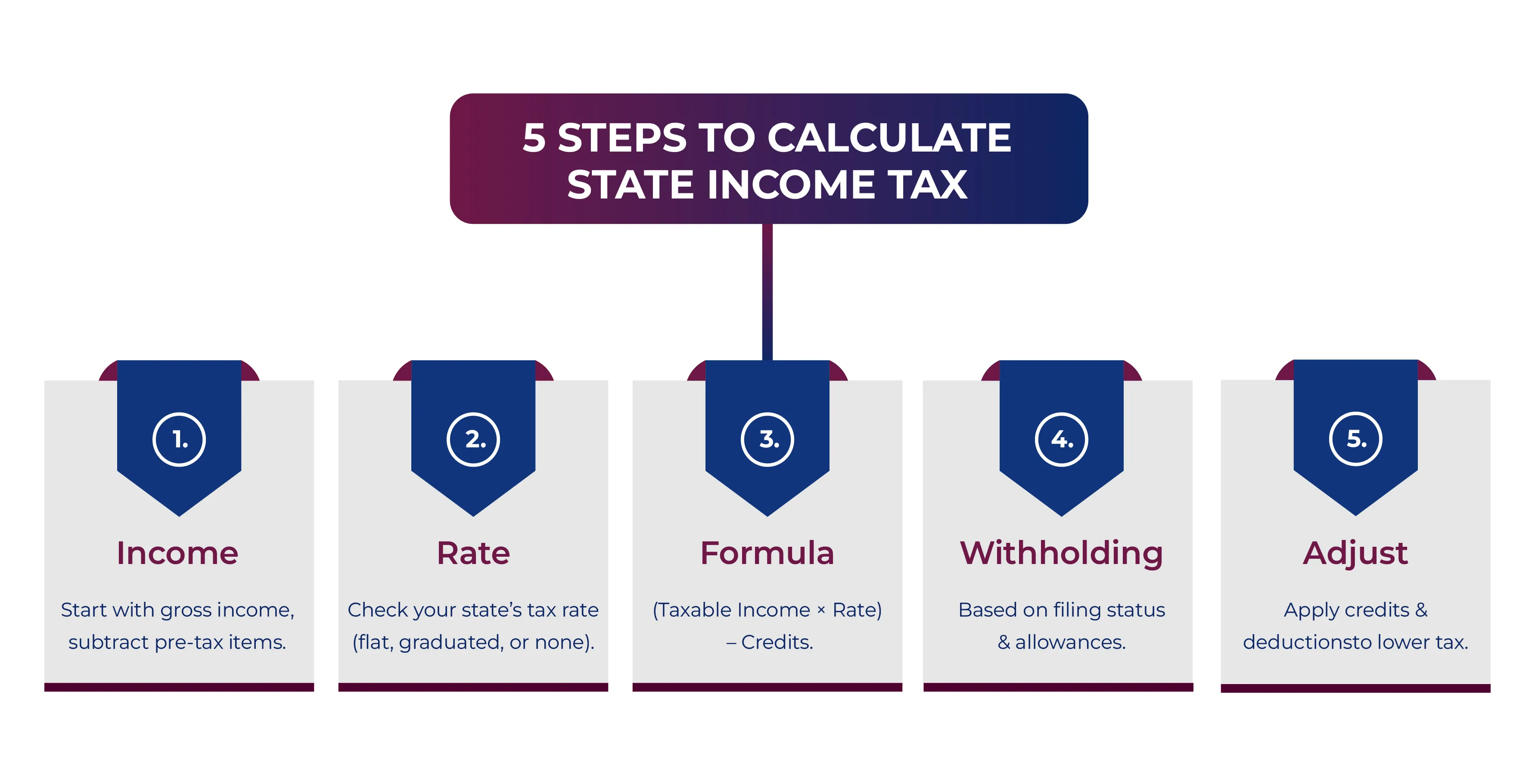

How to Calculate State Income Tax?

Many people consider calculating state income tax as their biggest nightmare, as they think it is a complex process. Although it is quite difficult to calculate but you can ease it by following these five steps. These are as follows:

Step 1: Know Your Taxable Income

To calculate your state income tax, the first thing you need to determine is your gross income. It includes your every income, such as your wages, bonuses, overtime, tips, and commissions. After that, deduct pre-tax items like retirement contributions, FSA contributions, and health insurance premiums. Once you do all these calculations, you get your taxable income.

However, as mentioned, every state in the US has different taxation rules. For instance, some states start with federal taxable income and do adjustments to it, while others use their own tax rules to calculate the value from scratch. For instance, Pennsylvania merely provides any tax deductions, while in California, some specific federal deductions are added back. So, before determining your taxable income, it is advisable to check your specific state tax rules.

Step 2: Find the Tax Rate of Your State

State taxes in the US fall into three camps. These are flat rates, a graduate rate, or no tax at all. At present, 14 states in the US have single tax rate structures. In this, every individual pays the same tax on the same percentage. However, many of the states in the US follow graduated tax brackets, where the tax is charged according to the income of the individual.

Furthermore, states like Nevada, Texas, Florida, and six other states do not impose state income tax. For clarification of the tax rates, it is advisable to check the website of the state revenue department. The officials for the following year, each December, generally provide new holdings tables.

Step 3: Use the Individual Income Tax Formula

To calculate the state tax, use the following formula:

State income tax = (Taxable income * Tax rate) - Tax credits

For flat state tax rates, the calculation is simple multiplication. For instance, Mr. A is an individual whose annual income is $50,000. The flat state tax rate is 5%. Calculate the annual and biweekly paychecks (26 paychecks yearly) of Mr. A. Using the formula, the annual income tax paid by Mr. A is $2500 (50,000 * 5%), and his biweekly paychecks are $96.15 per week ($2500 / 26).

Furthermore, graduates' tax rates need more calculation since for each bracket you have to do the calculation and then add them up. Additionally, you can also find tax tables in most US states that ease the calculation for you.

Step 4: Account for Withholdings

Based on your tax filing status, tax allowances, and any additional amounts they want to add on, your state W-4 employees form shows you how much to withhold. You get the withholding tables that are already categorized in standard exemptions and deductions from the states.

Find your filing status as an employee in the table, locate your income range, and you will know the withholding amount paid per period. Know that here, withholding is only an estimated amount to provide you with an idea of whether you are liable to pay more tax or will receive a refund.

Step 5: Adjust for Credits and Deductions

Through tax credits, you can reduce your tax liability or receive earned income credits, education credits, or child care credits. However, some can reduce their paycheck withholding, while others can apply only to their annual returns.

Additionally, do not forget special circumstances like local taxes in some cities, reciprocity agreements between two states, or employees working in different states. Each of them adds another layer to your state calculations.

This is how you, using the above-mentioned steps you can calculate your state income tax. Moving further, let's read about the things to consider in multi-state taxes.

Multi-State Tax Considerations

Traveling sales reps, remote employees working in other states, while their home state is different, and cross-border workers create several tax challenges. If you calculate them wrong and you face penalties in multiple states. To help you out, here is what you can consider while calculating multi-state taxes in the US.

Tax Rules for Remote Employees

Working remotely means working for a company whose headquarters is in a different state from where you work. This creates an issue in where and how you pay state taxes. However, as a remote worker, you are liable to pay state tax on your income to your home state, where you live. It does not include the states where state tax is not paid. Regardless of the location of your employer, it is true.

Additionally, if your employer withholds your income for state taxes, you are eligible to claim the tax credit for the paid amount to your non-resident state so that your same income is not taxed twice.

Working Across State Lines

Employees who work across state borders, through location, have their income tracked. For this, the states either use income methods (income earned per state) or day count (percentage of days in each state). Some states calculate the taxation days from the first day, while others start counting after 14-30 days. In this scenario, for tax purposes, every mile matters.

Tax Credits Between States

Tax credits generally help in avoiding double taxation. However, you don't always receive money for money. For instance, if an employee works in a state where 5% tax is charged but lives in a state where 2% tax is charged. In this scenario, from the home state, the employee will get the full amount paid. Now reverse these tax rates. They owe the 3% difference. This is why employees working in states with low tax rates but living in a state with high tax rates get high tax bills.

These are the multi-state tax considerations. However, to avoid it, several factors are also designed that help the taxpayers in reducing their tax burden.

Final Thoughts

This was all about state taxes in the US and how it is determined. Like the federal taxes, these taxes are also vital as they help each state in generating revenue and funding public services. Having an understanding of state taxes helps you in fulfilling your tax liability and avoiding paying unnecessary penalties.

Furthermore, if you need more information about state tax or are facing issues in calculating your payroll checks. Connect with Savetaxs and let our experts help you with this. Our team has years of experience in US taxation, and they can help you with matters related to the IRS or US taxation.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

Frequently Asked Questions

Clear and Concise Answers to the Most Frequently Asked Questions for Better Understanding and Guidance

The state-level takes are of different types. It includes state income tax, franchise tax, business tax, and sales/ use taxes. Additionally, depending on the state, the state taxes and their rates may vary.

No, not all states have income tax. As of 2025, nine states, like Washington, Texas, Florida, etc., for now do not have any state tax. Other than these states, the rest have income tax, and their residents and some non-residents are liable to file tax on their state income.

While both state business taxes and income tax are paid to the government, the primary difference between them is the types of earnings on which they apply and who pays them. A state business tax includes gross receipts or franchise taxes that target the business entities. On the other hand, the state tax is imposed on the earnings of an individual.

A franchise tax is a state tax imposed on certain businesses and for-profit corporations to be chartered or operated in the state. This tax is the right to exist as a legal entity and operate within a specific jurisdiction. The franchise tax is charged on profit, not on a flat fee or net worth. It is also known as a privilege tax.

Yes, in most states you need to pay sales tax on your online purchase. Sales tax is imposed on goods or services bought in the state. Additionally, the use tax is imposed when you buy out-of-state or online without sales tax but use the product in your home state.

No, if you pay federal tax, you do not need to file state taxes. Filing a state tax depends on your earned income, where you live, or where you do business. Most residents who have income more than the threshold limit need to file the state and federal taxes separately.

If you worked in another state but do not live there, then in this scenario, on your earned income from that state, you need to file a non-resident state tax return. Additionally, some states may also have reciprocal tax agreements with each other, so residents there only file tax in their home state.

As of 2025, states without state income tax include South Dakota, Alaska, Nevada, Texas, New Hampshire, Florida, Washington, Wyoming, and Tennessee. In this, New Hampshire is a new member as of 1 January 2025; the state imposed taxes on only unearned income, such as dividends and interest.

No, the stated deadlines and the federal deadlines are not always the same. However, usually, federal and some state returns are filed at the same time. Also, date extensions match the federal deadlines, but in many states, it is applied separately.

Yes, if you miss filing your IRS, the states penalize you. On you, the state will impose failure-to-file and failure-to-pay penalties, interest on not paid taxes, and in some cases, they can also suspend your licenses and garnish wages.

Likely, yes, if your company operates in different states, you may need to file in each one. Businesses often do so when they have nexus (significant activity or presence), which generates income, franchise, business, or sales tax obligations.

Well, relocating is not a solution to avoid all taxes. You still need to pay local and federal taxes and potentially taxes from your previous location. While relocation to a country or a state may lower or no income tax can decrease your tax liabilities, but other increases in other taxes, such as excise, sales, or property taxes, can compensate for it.