A 401(k) is a US employer-sponsored retirement savings plan. The plan enables employees to contribute a portion of their pre-tax income, thereby reducing their overall taxable income.

The savings or the contributions made in this plan grow on a tax-deferred basis, meaning you will not have to pay taxes on the investment earnings. However, when you retire, you are required to pay the usual income tax on the money you withdraw from the account.

There are two primary types of 401(k) retirement accounts: traditional and Roth. The funds in a 401 (k) account are locked in till the age of 59 and a half.

In this blog, we will provide you with a general understanding of how to manage your 401(k) after returning to India, as well as the tax implications of 401(k) plans.

Key Takeaways

- A 401(k) plan is a type of employee-sponsored retirement plan. In this plan, employees contribute a percentage of their pre-tax income.

- There are two types of 401 (k): traditional and Roth, and the major difference between the two is how they are taxed.

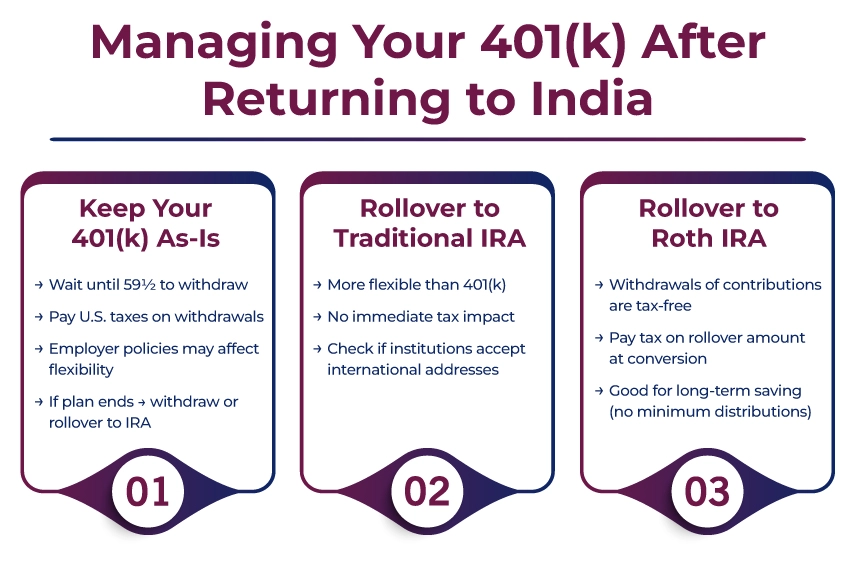

- The options for managing a 401(k) after returning to India include leaving the 401(k) plan as is, rolling it over to a traditional IRA, or rolling it over to a Roth IRA.

Options for Managing 401 (k) After Returning to India.

Let's come straight to the point and talk about how you can manage your 401 (k) after retiring to India.

1. Let your 401 (k) Plan Be As It Is

NRIs returning to India often keep their 401(k) accounts or their US retirement funds untouched until they reach the age of 59 and a half. Upon attaining this age, you can withdraw the funds and pay US taxes on them.

Considerations:

- The flexibility of your 401(k) plan will depend on the employer's policy.

- If the employer terminates the plan, you will either withdraw the funds or toss them into an IRA, which stands for Individual Retirement Account.

2. 401(K) Rollover To IRA

A traditional Individual Retirement Account (IRA) is more flexible compared to a 401(k). Turning over your funds from a 401 (k) retirement plan to a Traditional IRA has no tax implications immediately.

Considerations:

- Some financial institutions do not allow the opening of a traditional IRA account with an international address. So check before you plan the move.

- Please ensure that you have reviewed all the specific policies before rolling over your 401(k) retirement account to a Traditional IRA.

3. 401 (k) Rollover To Roth IRA

In Roth IRA accounts, withdrawals up to the amount contributed are completely tax-free. This is because the contributions made to the Roth IRAs are with post-tax dollars. This alternative is excellent if you wish to be in a higher tax bracket later in life.

Considerations:

- At the time of conversion, you are required to pay the tax on the amount being rolled over from a 401(k) account to a Roth IRA.

- Roth IRAs are suitable for long-term saving, as they do not require minimum distributions.

Tax Implications on 401 (k) Withdrawals

There are certain tax implications associated with 401(k) withdrawals. Let's understand each of them.

Lump Sum Withdrawal

As a 401 (k) account holder, if you wish to withdraw your 401 (k) savings as a lump sum, then this is what you must know.

- US Tax Implications: The Internal Revenue Service taxes any income sourced from the US, including your 401(k) withdrawals.

- Indian Tax Implications: As an Indian resident, the income you earn globally is taxable in India. With respect to NRI taxation norms, taxation also depends on your current residential status. Meaning whether you are categorized as a Resident but not ordinary Resident (RNOR) or resident and ordinarily Resident (ROR).

This does lead to double taxation, but under the 401(k) tax, the India-US Double Taxation Avoidance Agreement, certain reliefs are available.

Monthly Pension Withdrawal

In cases where you have opted for monthly withdrawals, you must be aware of these 401 (k) withdrawal tax implications.

- Tax in India: As per Article 20 of the Double Taxation Avoidance Agreement (DTAA), tax is levied only in the country of residence of the individuals. Now that you are returning to India, the withdrawals will be taxed only in India.

- Avoid US Withholding Tax: Please ensure that the actual documentation is submitted to the Internal Revenue Service (IRS) to avoid withholding tax.

Here are some key points to consider before making a decision.

- The Cash Flow Needs: Please consider your cash flow needs, which refer to whether you need to access the funds immediately or prefer to leave them invested.

- Tax Brackets: You must also consider your current and future tax brackets in both countries, namely India and the US.

- Investment Goals: Your ability to take risks and your long-term financial objectives must also be taken into consideration.

- Documentation: Please ensure that the taxes are accurately filed and documented in both countries. This will help you claim any applicable credits.

How Savetaxs Will Help NRIs in Managing 401(k) After Returning to India.

Managing your 401(k) as an NRI after returning to India involves making critical decisions, considering tax implications, and carefully evaluating your financial goals. To ensure everything goes smoothly, it is essential to have an independent financial consultant to help you navigate these complexities while maximizing your returns.

We at Savetaxs have been providing end-to-end services and consultancy for NRIs returning to India or those who have already returned. From managing your DTAA to overseeing your 401(k) and other key assets, our experts ensure everything proceeds smoothly.

By now, we have helped thousands of NRIs who are moving back or have moved back to India, and our satisfied clientele base speaks for the kind of services we offer. Savetaxs serves its clients 24/7 across all time zones, so connect with us today and get a tailored plan to meet your financial needs.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Navneet brings in more than 12 years of experience as a US Tax and ITIN Expert. Additionally, he has expertise in accounting, finance, taxation, financial analysis, budgeting, and risk management.

Frequently Asked Questions

Clear and Concise Answers to the Most Frequently Asked Questions for Better Understanding and Guidance

Upon Returning to India, You Can Leave Your 401(K) Account Untouched, Transfer It to an IRA or Roth IRA, or Withdraw the Funds. Ensure That Each Option Has a Different Tax Implication in India and the United States.

Yes, You Can Withdraw Your 401(K), but It Will Be Taxed at the Time of Withdrawal. Additionally, if You Are a Resident of India, the Withdrawal Will Also Be Taxed in the United States Under the US-India Double Taxation Avoidance Agreement Treaty.

The 401(K) Withdrawals Are Taxed Similarly to the U.S. income. However, Please Note That Any Early Withdrawal Before the Age of 59 and a Half Will Attract a 10% Penalty. Additionally, if You Are Living in India, the Withdrawals Can Also Be Taxed in India, and the Relief Can Be Claimed Under the DTAA Treaty of India Nd the US.

Yes, NRIs Can Roll Over, but Some U.S. financial Institutions Do Not Allow Opening an IRA with an International Address. You Must Check the Policies Before Initiating a Rollover.

Ultimately, Your Long-term Financial Goals Depend on What Your Long-term Financial Goals Are. You Can Leave Your 401 (K) in the U.S. Roll It Over to a Traditional or Roth IRA, or Even Withdraw It. The Best Option Ultimately Depends on Your Final Goal. To Make a Tax-efficient Choice, We Recommend Consulting a Tax Professional.