WhatsApp Community

- Whatsapp CommunityWhatsapp Community

Connect with us in just a click!

- Chat WhatsappChat Whatsapp

Fast replies, simple and direct!

An ITIN is an Individual Taxpayer Identification Number issued by the IRS to individuals who do not have an SSN. It is a nine-digit unique tax processing number allocated to people who are required to pay taxes in the United States.

The format of the ITIN is XXX-XX-XXXX, and they can be easily identified because an ITIN always starts with the number 9.

In this guide, we will discuss everything that you need to know about ITIN as an immigrant, including what ITIN is used for, ITIN eligibility criteria, how to get one, required documents, mistakes to avoid while filing for ITIN, facts about it, and more.

ITIN stands for Individual Taxpayer Identification Number. This number is a nine-digit, unique tax processing number issued by the Internal Revenue Service Department.

The IRS assigns this number to taxpayers and their dependents who are either immigrants or not qualified to obtain a U.S. Social Security number (SSN) from the Social Security Administration (SSA).

The Individual Taxpayer Identification Number is used by the Internal Revenue Service (IRS) for federal tax reporting purposes only. However, the IRS issues the ITIN for federal tax purposes, but it can also be accepted for other purposes, such as opening an interest-bearing bank account as an immigrant or getting a mortgage.

Regardless of your immigration status, if you are a resident alien, nonresident alien, foreign alien status, or their dependent or spouse, you can apply for an ITIN.

If you are not a U.S. citizen, your tax status may be either that of a resident alien or a nonresident alien.

Nonresident Alien: An individual's status is that of a nonresident alien when they do not meet any of the criteria, which include the green card or substantial presence test.

Resident Alien: If an individual is present in the United States for more than 183 days, or if they are a lawful permanent resident of the US.

Dependents and spouses are only eligible for an ITIN if they can be claimed for an allowable tax benefit (such as a spouse filing a joint return, head of household, or premium tax credit) or if they file their own tax return.

An individual might need an ITIN number if they are:

The entities listed below do not require an Individual Taxpayer Identification Number (ITIN).

These are the documents you'd need to apply for your ITIN.

Form W-7: Individuals are required to complete Form W-7, which is an IRS application for an individual tax identification number.

Next, individuals are required to prove their identity and foreign nationality status by providing the original documents or certified copies thereof. Ensure that the notarized copies of documents are not acceptable.

A passport is the standard document that provides both foreign individuals and tourists with identity and, along with tit he application, might need to submit any other documents with it.

However, if the passport is not submitted as proof of identity or foreign nationality, in that case, the IRS will only accept a combination of two or more documents from the list of 13 documents listed below as proof of foreign nationality status and identity.

There are two ways to apply for an ITIN number.

You can mail your ITIN package, which includes the completed form and the required documents, to any of the addresses below.

When applying in person, individuals can have their supporting documentation authenticated and returned immediately.

Lastly, when the Internal Revenue Service 9IRS) approves the application, the ITIN is sent to the concerned applicant via mail.

Note that if a person has an ITIN and he/she does not include it while filing a U.S. tax return for three consecutive years, it will automatically expire.

Once the ITIN number has been applied for, allow approximately seven weeks for the IRS to notify you about your ITIN application status.

During tax season, which typically runs from January to April, the IRS may take up to nine to eleven weeks to notify you of the application status.

If the individual has submitted any original documents or certified copies with their ITIN application, they should be returned to them within approximately 14 weeks from the date you mailed them.

If the information and documents are not provided within the given time frame, you can contact the IRS.

800-829-1040

7:00 AM to 7:00 PM Local Time

267-941-1000 (not toll-free)

Hard-to-hear or deaf callers

TTY/TDD 800-829-4059.

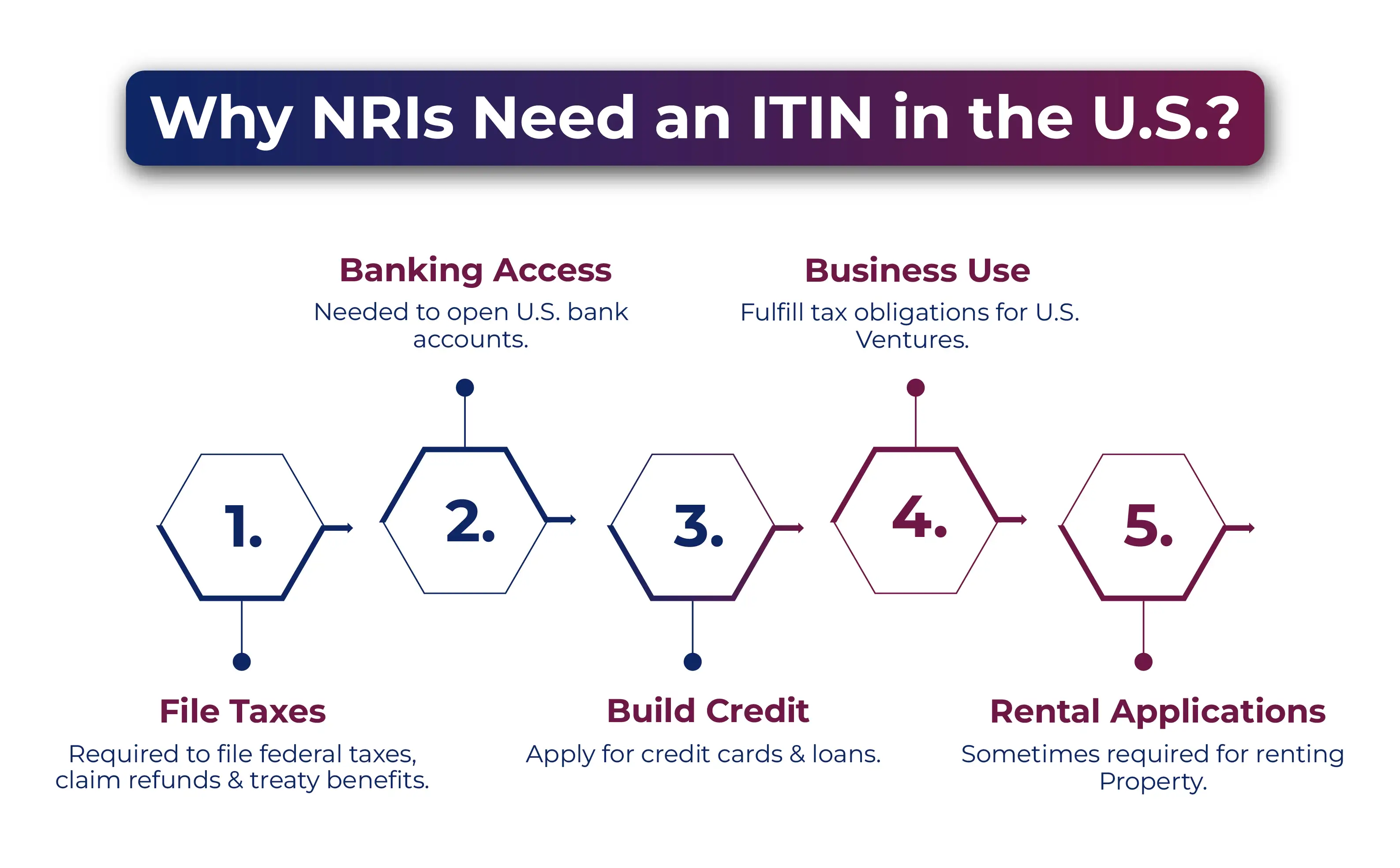

Indian residents living in the United States might need an ITIN for several reasons.

Compliance with Federal Taxes: To file federal taxes, claim refunds, or avail any tax treaty benefit, an NRI needs an ITIN number.

To Access Banking: For an NRI to open a bank account in the United States, an individual tax identification number is mandatory.

To Build Credit: For NRIs to apply for a credit card and a loan in the United States, an ITIN is required.

Business Operation: For NRIs to fulfill their tax obligations for business and entrepreneurial ventures in the USA, an ITIN number is needed.

Rental Application: ITIN number for NRIs might also be required in the case of rental applications.

There are several mistakes that applicants make while applying for an ITIN, and such errors result in rejection of their application.

Incorrect or Incomplete Form: Please double-check all the information you fill in the Form because inaccurate or incomplete data might result in the rejection of the ITIN.

Not Providing all Documents: If you are not providing all the documents asked to prove your foreign status and identity, then the application could either be put on hold or rejected.

Avoid Sending Original Documents: The IRS asks the applicant to submit the original documents or certified copies of those documents. It is advisable to send certified copies, as sending the original documents might result in them being damaged or lost. Hence, to avoid any mishap, it is advisable to send certified copies.

The different types of taxpayer identification numbers in the USA are:

Applying for an ITIN number in the USA as an immigrant can be a complicated and burdensome process. However, if you comply with the IRS requirements, you might not be able to avoid the mistakes. But for individuals who are lacking such information, you definitely need a US taxation expert to file for your Individual Taxpayer Identification Number (ITIN).

Savetaxs, an emerging name in the tax industry, has been helping people obtain their tax identification number (TIN) for years now. We have been helping immigrants, U.S. residents, citizens, and non-resident aliens obtain the appropriate tax identification number they need through a smooth, hassle-free, and quick process.

We at Savetaxs ensure all the documents you provide are right, and we double-check every information that has been filled in the form before applying.

Our experts are available to you 24/7 across all time zones, so connect with us today and let's get your ITIN as quickly as possible.

Speak to our experts and get personalized solutions for your NRI tax needs

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

Yes, spouses or dependents must renew their ITINs as the expiration date arrives.

Yes, you can send the certified copies of your documents to the IRS.

ITIN is legally and solely used for taxation purposes.

In such a case, you must notify the IRS so they can update your information.

The ITIN processing can take anywhere from seven to ten weeks.