The foreign earned income exclusion, or FEIE, is one of the most valuable tax benefits offered to U.S. citizens and resident aliens who reside and work abroad. The foreign earned income exclusion (FEIE) can help expats reduce a significant amount from their U.S. tax liability. The FEIE permits qualifying individuals to exclude foreign-earned income of up to $130,000 for the 2025 tax year.

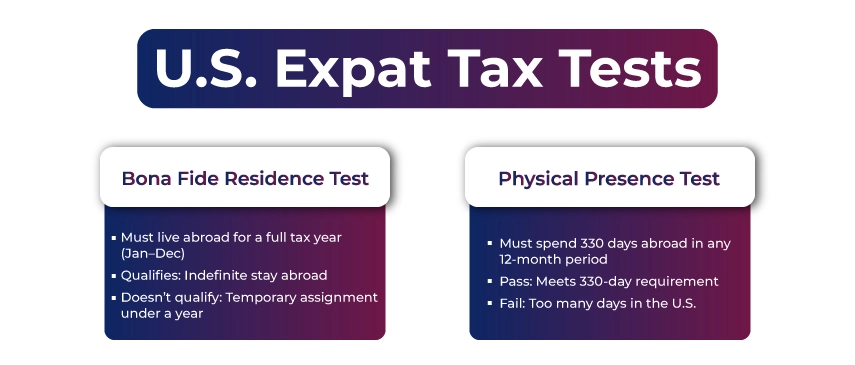

To be eligible for the foreign earned income tax exclusion, you must fulfill either the bona fide residence test or the physical presence test, and also have a tax home in a foreign country.

An expatriate must file Form 2555 with their U.S. tax return to claim the FEIE, which is used to compute the amount of exclusion and provide details regarding foreign residence and income sources. In this guide, we will walk you through the details regarding FEIE, how to claim it, common mistakes, and much more.

The citizens of the U.S. are taxed on their worldwide income, even if they reside abroad. The FEIE tax benefits help an expat to prevent double taxation. If you are a qualified individual, you can exclude a significant amount of your foreign income from your U.S. return.

The maximum limit of exclusion for the tax year 2025 is $130,000 (filed in 2026), up from $126,500 for the tax year 2024 (filed in 2025). For instance, if you earn $150,000 in 2025 while residing abroad and qualify for the FEIE, you will be taxed only on $20,000.

The Form 2555 is an IRS tax form that an individual can use to claim the foreign earned income exclusion. It permits the qualifying U.S. expats to exclude up to a certain limit of foreign-earned income from U.S. taxable income, which will be adjusted every year for inflation.

Additionally, Form 2555 also allows for the foreign housing exclusion that permits a taxpayer to deduct specific housing expenses while staying in a foreign country. If you meet the eligibility criteria, filing Form 2555 can significantly reduce your U.S. tax burden.

To qualify for the Foreign Earned Income Exclusion (FEIE), you must fulfill the following requirements:

| Bona Fide Residence Test | Physical Presence Test |

|---|---|

| You are a citizen of the US or a resident alien | You are a U.S. citizen or a resident alien |

| Your tax home is in a foreign country | Your tax home is in a foreign country |

| You are a bona fide resident of a foreign country for a continuous period that includes an entire tax year. | You are physically present in a foreign country for at least 330 full days during any 12 months. |

| Ideal for: Digital nomads, short-term assignments, or if you are new to staying abroad. | Ideal for: Permanent expats who have truly made another country home. |

The foreign earned income exclusion applies particularly to income earned via active work done in a foreign country. The following income types qualify for the FEIE:

However, not all income qualifies for the FEIE; it doesn't apply to passive or unearned income sources. Here is what doesn't qualify:

Note: The only income earned while being physically present in a foreign country will qualify. Also, under the foreign-earned income exclusion, you cannot exclude income acquired during visits to the US or in international waters.

For the tax year 2025, you can exclude up to $130,000 from your foreign-earned income. If both you and your spouse work abroad and fulfill either the Bona Fide Residence or Physical Presence Tests, each of you can exclude up to $126,000.

The FEIE amount increases every year due to inflation. The limit of exclusion for recent years is as follows:

| Tax Year | Filed in | Maximum Exclusion |

|---|---|---|

| 2025 | 2026 | $130,000 |

| 2024 | 2025 | $126,500 |

| 2023 | 2024 | $120,000 |

| 2022 | 2023 | $112,000 |

| 2021 | 2022 | $108,700 |

If you have moved overseas mid-year, you will have to distribute your exclusion by using this formula:

Formula: (FEIE Limit) * (Qualifying Days Abroad + Days in Year) = Your Maximum Exclusion

Example: Mr. X moved to Korea on the 1st of May, 2024, so the qualifying days left in the year are 245. Now, if we calculate this:

$126,500* (245/365) = $84,897 (maximum exclusion limit for 2024)

The Bona Fide Residence test applies to those U.S. citizens and resident aliens who are bona fide residents of a foreign country for a continuous period that includes a whole tax year (January 1 - December 31). An individual's bona fide residence is determined based on certain facts and situations. Some main factors that are considered are as follows:

To qualify under the bona fide residence test, you must demonstrate your residency in a foreign country for a continuous period that includes an entire tax year, which is from the 1st of January to the 31st of December.

Your purpose plays a major role; you may qualify if you stay abroad for an indefinite period of time. However, you won't qualify if your stay is for an accurately defined, temporary assignment, specifically one year or less. Let's understand this with two examples:

Situation: Eric is a US citizen who moved to Japan for an open-ended position with his company on the 15th of January, 2024. He decided to stay there for an indefinite period and return to the US only for a period of 30 days throughout the year for a vacation or urgent work.

Here, Eric will qualify for the FEIE under the Bona Fide Residence Test, as his move was indefinite, and he resided abroad for the entire 2024 tax year.

Situation: Sam moved to London on the 1st of March, 2024, for a 2-year work assignment. However, his employer ended the project early without any notice, and he had to come back to the U.S. permanently on January 25th, 2025.

In this scenario, although Sam stayed abroad for almost 11 months, his foreign residence did not last for an entire tax year, so he doesn't qualify under the Bona Fide Residence test. However, he might be eligible to claim a prorated FEIE by passing the physical presence test, based on his actual days abroad.

The physical presence test comprises no requirement related to an individual's residency. It applies only based on the duration of your physical presence in a foreign country during a 12-month period. If you stay in a foreign country for 330 days in any consecutive 12 months, you will qualify under this test. The period of 330 days doesn't need to be a full calendar year or continuous.

Consider these things when counting the 330 days:

Situation 1: From the 1st of July 2022 till the 30th of June 2023, Sarah is present in France for 345 days, during which she also visited the U.S. twice for a 10-day trip. So, here she passed the physical presence test for the year 2022-2023 because she fulfilled the requirement for staying in a foreign country for 330 days during 12 months.

Situation 2: George worked in the U.S. from the 1st of January 2023, till the 31st of December, 2024. However, during this duration, he visited the U.S. multiple times for 20-day trips in March, May, July, and November, which is a total of 80 days. Since he was in the U.S. for more than 35 days, he did not pass the physical presence test.

You might face some common issues when claiming the foreign earned income exclusion. The following is a list of the common pitfalls that you might face and ways to avoid them:

To claim the Foreign Earned Income Exclusion (FEIE), you need to file IRS Form 2555 with your annual US federal income tax return (Form 1040). Form 2555 comprises comprehensive questions regarding your foreign-earned income, housing, and travel.

Savetaxs Tip: In case your foreign income was solely wages reported on W-2, and the FEIE is your only option for deduction or exception, you can file Form 2555-EZ instead.

Follow the steps mentioned below to file Form 2555:

US citizens abroad are granted an automatic extension of 2 months until June 15th to file their taxes. However, any overdue tax must be paid by the 15th of April to avoid interest and penalties. Furthermore, you can request an additional extension untill the 15th of October by filing IRS Form 4868 in case you need some more time.

Note: Utilizing Form 4868 will extend the deadline for filing, not the deadline for payment.

There are several other tax benefits offered to expats, of which the FEIE is just one of them, which helps to reduce your US expat taxes. Below are some other benefits to consider:

If you earn any income abroad, filing Form 2555 can considerably help you in excluding foreign-earned income and reducing your overall U.S. tax liability. However, the decision of choosing between FEIE and any other tax benefit depends completely on your tax situation, income level, and foreign tax obligations.

At Savetaxs, our team of experts can provide professional tax advice and can guide you throughout filing Form 2555 to ensure that your foreign-earned income is excluded accurately. Our team actively works 24*7 across all time zones so you can contact us anytime and ensure that you are making the most out of your expat tax benefits.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Some disadvantages of claiming the FEIE are as follows:

Some examples of foreign income include:

Generally, all of these must be reported to the IRS.

When you are asked about the foreign earned income exclusion, for example, on FAFSA or tax forms, you must mention whether you claimed the FEIE on your U.S. tax return by filing IRS Form 2555. If you excluded part of your income, report it honestly, even if it was not taxed in the U.S.

The IRS receives information through:

Yes, U.S citizens and green card holders are taxed on their worldwide income, regardless of where they reside. If you earn income abroad, you are required to report it on your U.S. tax return. However, tools like Foreign Tax Credit (Form 1116) or the Foreign Earned Income Exclusion (Form 2555) can help in avoiding double taxation.