As an American staying abroad, it's no wonder that you might have a financial account in a foreign bank outside of the US, whether savings, a pension, or an investment. However, do you know that only having financial assets in a foreign account might trigger specific reporting requirements? One of the main reporting requirements is called FBAR.

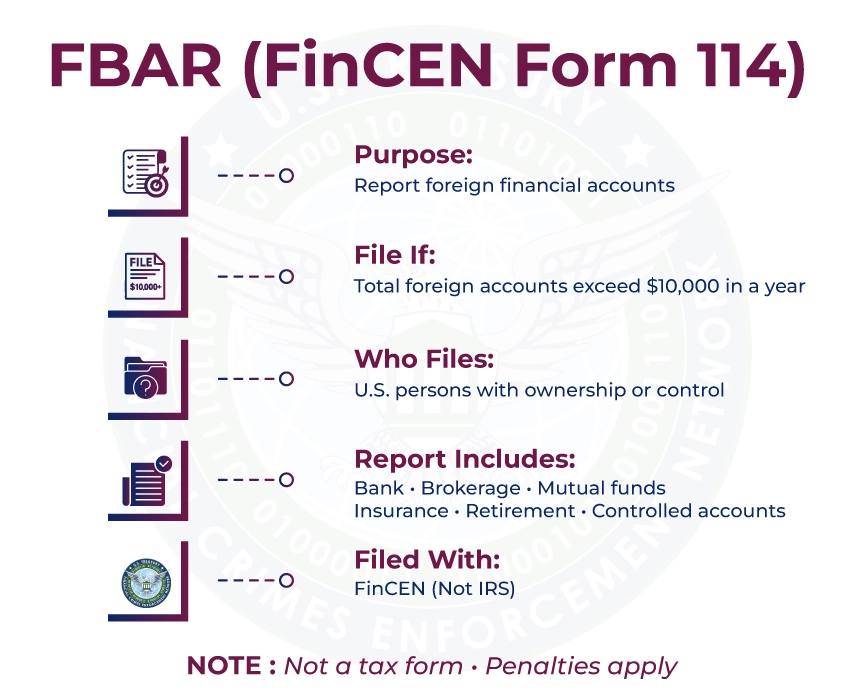

FBAR stands for the Report of Foreign Bank and Financial Accounts. It is a crucial filing requirement for US persons, including specific NRIs. You must file an FBAR if your foreign financial accounts exceed the limit of $10,000 during one calendar year.

In this guide, we will walk you through what an FABR is, its requirements, FBAR filing deadlines, FBAR penalties, and much more.

The FBAR (Report of Foreign Bank and Financial Accounts) is an annual reporting requirement, apart from your regular tax return. It helps the US government to detect tax evasion and money laundering that involves foreign bank accounts. You must file an FBAR to report certain foreign financial accounts that hold a combined amount of $10,000 or more at any point during the calendar year. It includes the following:

Instead of filing with the IRS, you need to submit an FBAR to FinCEN, the U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN). It is not a tax form, and its filing doesn't depend on the rate of tax. However, the income that you earn from a foreign bank account will be taxed in the country where the account is held. Additionally, if you fail to meet this requirement, you may face heavy FBAR penalties, so it's ideal to stay updated about any information.

Moreover, many expat tax filers will just report their foreign bank account balance, but remember that you may also need to report:

You are required to file an FBAR (Report of Foreign Bank and Financial Accounts) if all the following conditions apply:

An account at a financial institution outside the US is called a foreign financial account. Additionally, the threshold of $10,000 applies to the overall combined account instead of each account individually. Financial interest includes direct ownership or indirect interests, like bank accounts held by an entity under your control or trusts in which you are a beneficiary.

Signature authority means you can have control over the account assets by having direct communication with the institution. For example, managing your parents' bank account or having a signature authority on an employer's bank account.

Point to Note: Even if you are not the owner of the account, you may still have to file an FBAR if you have control over direct transactions, access funds, or decide on behalf of the account holder.

You don't have to file an FBAR for the calendar year if:

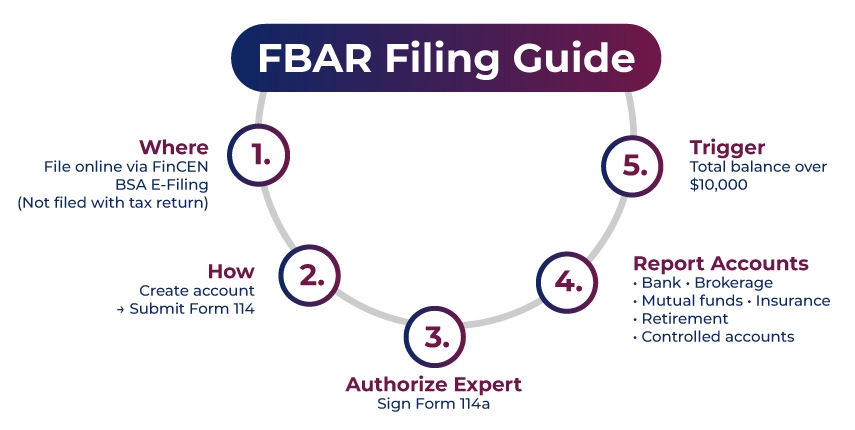

You can file the FBAR yourself electronically through the FinCEN's BSA E-Filing System. The FBAR is not filed with your Federal Tax Return. If you wish to paper-file your FBAR, call FinCEN's Resource Center and request an e-filing exemption. If your request is approved, they will send you the paper FBAR to fill out and mail to the IRS at the address mentioned in the form.

Moreover, if you want to hire a tax professional to file your FBAR on your behalf, you can do the same by authorizing them. To authorize them, you need to sign FinCEN Report 114a. You must keep this form in your records and make it available in case FinCEN or the IRS requests it.

You can file the FBAR online through the BSA E-Filing System. Follow the steps mentioned below:

If the combined value of all your foreign bank accounts exceeded $10,000 at any point in the year, you must report it. The reportable accounts include:

If you share an account with your spouse, they have the option to authorize you to file on their behalf by signing FinCEN Form 114a. If your spouse holds a separate foreign bank account, they need to file their own FBAR. Additionally, if you file separately, the joint account must be mentioned on both FBARs.

You have to maintain records for every account that is reported on the FBAR, such as:

You may also keep bank statements or copies of filed FBARs that contain these details. Generally, the records must be kept for five years from the due date of the FBAR (Report of Foreign Bank and Financial Accounts).

The FBAR is an annual report, meaning it must be filed by April 15 following the calendar year reported. In case you miss this date, there is no need to request an extension, as you will be granted an automatic extension to the 15th of October.

In case you miss the due date again because of a natural disaster, the government may further extend your FBAR annual due date. However, you must check the relevant FBAR relief notices to get the complete information.

Not filing the FBAR might put you in serious situations, and you might end up facing serious consequences. If it's a non-wilful violation, caused by either carelessness or misunderstanding, then you might face a penalty of up to $10,000 per violation, inflation-adjusted (currently $12,921).

In case of wilful violations caused due to irresponsibility and done intentionally, they can bring more strict penalties, which is either the greater of $100,000 or 50% of the account's balance during the violation.

Some wilful violations may also result in criminal charges under some severe conditions, with fines leading up to $250,000 and/or up to five years of imprisonment.

Firstly, don't take stress. There are millions of Americans who have their FBAR forms due even after the specified date. However, there is no need to worry, as the IRS has created two amnesty programs to assist you. Both programs allow the expats to adhere to the US laws without paying any hefty penalties. Let's now understand in brief:

It is specifically designed for those taxpayers who were not aware that they had to file both income taxes as well as FBAR. You will qualify for this if:

This program is for catching up on FBARs. You should use this procedure if you are someone who stays updated on tax returns, have not maintained records of your financial assets, and the IRS has not contacted you regarding this issue yet.

The US government has another place where you may be asked to declare foreign financial assets. Don't get confused, it is Form 8938, created by the Foreign Account Tax Compliance Act (FATCA) during the 2008 financial crisis. However, these filing requirements also aim to avoid tax evasion, so what's the difference between FBAR vs Form 8939?

If we see it from your perspective, it's just one more form that requires some different information and holds a higher filing threshold. However, if we see it from the government's point of view, FATCA is much easier to enforce as compared to FBAR. It requires the foreign financial institution to report information directly to the IRS regarding US citizens.

Although both FBAR and FATCA involve reporting of foreign bank accounts, they have different purposes and requirements. Consider the table mentioned below to understand the main differences between FBAR vs. FATCA:

| Category | FBAR (FinCEN Form 114) | FATCA (Form 8938) |

|---|---|---|

| Who Should File? | U.S. persons who have foreign bank accounts with an excess $10,000 | Specified individuals/entities holding foreign assets more than the specified thresholds. |

| Filing Thresholds | Total of $10,000 | May differ from $50,000 - $600,000 based on the status |

| Reportable Assets | Foreign bank and financial accounts | Foreign financial assets, including bank accounts, investments, and securities |

| Deadline | 15th of April (with an automatic extension until 15th of October) | With the annual tax return (Form 1040) |

| Penalties | Up to $10,000 | Up to $10,000, increasing for ongoing non-compliance |

| Criminal Liability | Yes, for wilful violations | Yes, for tax evasion or fraud |

| US Territories | Applicable | Excludes, such as Puerto Rico, Guam. |

Who is required to report their foreign accounts? There's a lot of confusion amongst people regarding this question, and a lot of people are there who assume they are free for one reason or another. However, staying in confusion and believing in these myths will put you in some serious consequences, and you will end up paying hefty penalties. Here are some misconceptions about the FBAR that people often believe in:

We know that filing an FBAR and fulfilling the Foreign Bank Account Report (FBAR) requirements can be complex, particularly when you manage multiple foreign accounts or deal with complicated financial situations. Worry not, at Savetaxs, we understand the challenges that an expat goes through during tax filing, and that is why we are here to assist you at every step.

We have a complete team of experts who carry more than 30 years of experience and knowledge, specializing in US taxation, FBAR filings, and much more. They will ensure that you complete everything accurately and submit the form on time, saving you from facing hefty penalties. Don't wait any further, contact our experts right away and get peace of mind and the best quality assistance that you deserve.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr Vikram brings in more than ten years of experience in US Taxation. He is also an EA mentor and instructor. The expertise of Mr. Agrawal includes accounting, bookkeeping, Tax preparation, small business tax, personal tax planning, income tax, financial advisory services, and retirement planning.

For the tax year 2025, the limit of exclusion is $130,000 per qualifying individual. It means that if you earn less than the prescribed amount abroad, you may not owe any tax on that income in the USA.

A United States person who has a financial interest in or signature authority over foreign financial accounts is required to submit an FBAR if the combined value of the foreign financial accounts exceeds $10,000 at any time during the calendar year.

If you have never filed an FBAR, but you should have, then you must file it as early as possible. The US Department of the Treasury has introduced voluntary disclosure programs that permit taxpayers to disclose their foreign financial accounts and file an FBAR without facing any criminal prosecution.

Yes, you will have to file an FBAR every year if you have a financial interest in or a signature authority over foreign financial accounts with a combined value exceeding $10,000 at any point during the tax year.

Once you are done filing your FBAR through FinCEN's BSA E-Filing System, you will receive an electronic confirmation. You may also check the status of your submission on the E-filing website of BSA or contact FinCEN's support for further verification.