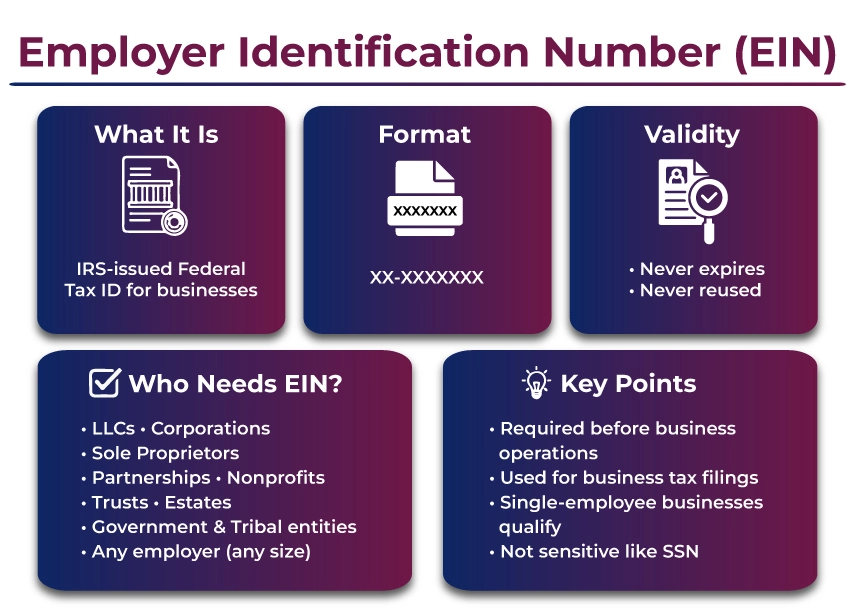

An Employer Identification Number (EIN) is a unique nine-digit tax ID number assigned to a business entity by the IRS. The EIN allows the Internal Revenue Service (IRS) to identify the business for tax reporting purposes.

In this guide, we will explore the concept of an Employer Identification Number (EIN), including who is required to have one, how to obtain it, and additional information.

Key Takeaways

- An Employer Identification Number (EIN) is a unique identifying number assigned by the Internal Revenue Service to a business entity.

- Through an EIN, the IRS can easily identify businesses for taxation purposes.

- All businesses that meet a specific requirement must obtain an Employer Identification Number (EIN) before operating.

- Applying for an IRS is free of cost, and one can apply for it through the official IRS website.

- Apart from the tax purposes, an EIN also allows the business to open a bank account and then apply for tax credits.

What is an Employer Identification Number (EIN)?

An Employer Identification Number is a unique identification number that helps the IRS identify businesses in the US for taxation purposes. This works in the same way as the Social Security Numbers (SSNs) are used to identify individuals in the United States for taxation purposes.

Another name for the EIN is Federal Tax Identification Number.

As mentioned above, it is a non-digit number that is formatted as XX-XXXXXXX. With the help of this number, the IRS department identifies the business entities that are required to file various business tax returns.

EIN never expires, and the same number is never issued or reissued to another business, even if the employer having the number goes out of business. Ensure that businesses satisfy the requirements and apply for EIN before they begin operating their business activities.

Type Of Business Entity That Needs An EIN

Below is a list of types of businesses and other entities that are required to have an EIN before commencing their business operations.

- Limited Liability Companies (LLCs).

- Sole Proprietorships

- Non-Profit Organizations (NPO)

- Government Agencies

- Corporations

- Personal Service Corporations

- S corporations

- Partnerships

- Churches and organizations controlled by churches

- Plan administrators.

- Military entities

- Government entity

- Farmers Cooperatives

- Indian tribal governments and enterprises

- Real Estate Mortgage Investment Conduit (REMIC)

- Trusts

- Estates

The Internal Revenue Service is not biased against companies of a specific size. This means that even if you have only one employee, you are as eligible as a multinational company for an Employer Identification Number (EIN).

A Fast Fact: Unlike the Social Security Number, an EIN is not considered a sensitive piece of information and is freely circulated by businesses online.

What is the Criteria for Having an EIN?

A business entity needs an EIN if it meets any of the following criteria.

- Has employees.

- The business entity operates either as a corporation or a partnership.

- The business files elements, alcohol, tobacco, firearms, and excise tax returns.

- The business withholds taxes on income other than wages paid to a nonresident alien.

- The business has a Keogh Plan.

- The business deals in an operon farmer's cooperative or a real estate mortgage investment conduit.

- You operate as an IRA, which is an Individual Retirement Account, or any other retirement Plan.

- You are involved with a Trust, except for those that are grantor-owned and non-recognizable.

Even if an EIN is not mandatory for you, as a business owner, you must apply for one. Doing so helps you open a bank account, as well as obtain licenses and more.

How To Get Employer Identification Number?

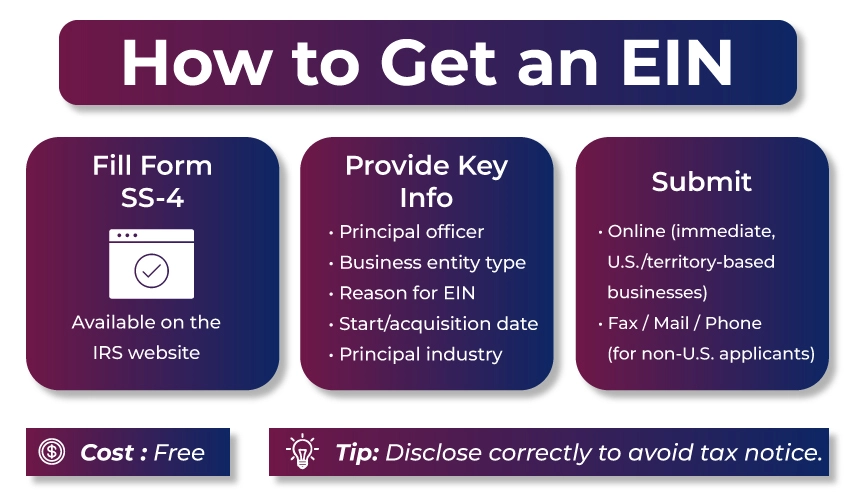

The process of getting an EIN is fairly easy, costs nothing, and can be done easily over the phone. For individuals who are not residing in the USA but will conduct business operations here, you can also obtain an EIN through fax, mail, or online.

To do so, applicants are required to fill out Form SS-4: Application for Employer Identification Number. The form is available on the IRS official website.

When filling out the form, the individual is required to provide the following information, including the name of the company's principal officer, grantor, general partner, trustor, or owner, along with their personal identification number and other relevant details.

The Other Relevant Details are:

- The type of business entity

- The reason for applying for an EIN is to comply with IRS and withholding requirements, to fulfill tax obligations, and to comply with IRS and withholding requirements.

- The start or acquisition date.

- The principal industry of business.

Note that to obtain an EIN online, the business must be located either in the US or one of its territories. After validating the information given online, the employer identification number is assigned immediately.

Benefits of an Employer Identification Number?

One of the many benefits of having an EIN is that it allows you to operate your business in the US legally. With an EIN, you can:

- Hire and pay your employees

- Open a bank account, obtain a tax credit, and invest surplus cash.

- Maintain corporate shield.

- File business taxes and register state taxes.

Another benefit of an EIN line is that it allows you to separate your personal finances from your business finances. This is essential for people who are self-employed, such as subcontractors.

How to Close Your EIN?

Once an EIN is assigned to you, it is forever associated with your business, and the IRS never officially cancels it.

Now, suppose you also have an employer identification number and have stated that you no longer need it or have decided to close your business. In that case, you can ask the IRS to deactivate the EIN-associated business account.

The EIN will always remain, but the IRS will suspend the business account associated with it.

EIN vs TIN (Taxpayer Identification Number)

Taxpayer identification number is an umbrella term used to describe any other type of identification number. TIN serves as a generic descriptor for various taxation numbers used on tax forms.

- SSN

- EIN

- ITIN (Individual Taxpayer Identification Number)

- ATIN (Taxpayer Identification Number for Pending United States Adoptions)

- PTIN (Prepare Taxpayer Identification Number)

For individuals, their tax identification number is typically their Social Security number. For corporations, trusts, estates, and partnerships, the Employer Identification Number (EIN) is their TIN.

What to do When an EIN is lost or Misplaced?

To find the missing EIN, you can try these steps:

- Look for the EIN on the notice the IRS issued when you applied for the employer identification number (EIN).

- Contact the bank that holds your business account.

- Check the EIN with the agencies where you have applied for the local or state licenses.

- Look for the EIN on the past business tax returns.

If everything fails, contact the IRS Business & Specialty Tax Line at 1-800-829-4933. And yes, please keep all identifying information on hand before speaking to the officials here.

What Is The Processing Time For an EIN?

If the EIN is applied online, it will be issued immediately. However, it usually takes around seven days to get an employer identification number when applying by fax. And if it is used by mail, the processing time can also take four to six weeks.

Let Experts File Your EIN Hassle-Free

By far, we have understood that EIN is an employer identification number, which is unique and has nine digits, and must be assigned by a business entity to the IRS. EIN is crucial for businesses to report taxes and for their related financial matters.

However, suppose you are running a business in the USA. In that case, you need an expert business tax professional to help you file your EIN accurately so it gets assigned to you immediately with no hassles. That is where Savetaxs come in. We help U.S. business owners and individuals obtain their U.S. tax identification numbers, such as EIN, SSN, and ITIN.

We have been serving NRIs and US residents for over a decade, and our expertise is unparalleled. Savetaxs serves its clients 24/7 across all time zones, so connect with us today and get your EIN issued immediately.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

Frequently Asked Questions

Clear and Concise Answers to the Most Frequently Asked Questions for Better Understanding and Guidance

EIN stands for Employer Identification Number, also known as Federal Employer Identification Number (FEIN) or Federal Tax Identification Number (FTIN). EIN is a unique nine-digit number formatted as XX-XXXXXXX, which is assigned by the Internal Revenue Service (IRS) to businesses to identify them for tax purposes.

EIN works for businesses exactly like how SSN works for individuals. It helps businesses in filing business tax returns, setting up payroll, opening a business bank account, and applying for licenses as well as loans.

Organizations and businesses that need an EIN are:

- Employers that have employees.

- Corporations, LLCs, and partnerships.

- Nonpoetry, estates and trusts.

- Entities paying for excise or taxes.

- Businesses that are withholding tax on payments made to non-resident aliens.

Yes, but only if they have no employees and are not associated with retirement plans, such as Keogh.

You can get an EIN either by fax, mail, or online.

Yes, they are permanent and never expire.

Yes, they can be. However, the EIN remains only as long as the business account associated with the number is active and not deactivated or cancelled.

TIN is an umbrella term for numbers used to identify a taxpayer, such as SSN, EIN, or ITIN.