For U.S. citizens residing abroad, IRS Form 1116 can be beneficial to avoid double taxation on income that you earn in a foreign country. It allows you to claim the Foreign Tax Credit (FTC) and reduces your tax liability in the US by the amount of foreign income taxes you have paid. Filing Form 1116 will help you ensure that you are not being taxed twice in two different nations.

It means once by the U.S. and again by the foreign country from where you acquired the income. You may have to take actions based on the foreign income type that you have earned and the amount of foreign tax you have paid to claim the credit.

Keep reading our guide to learn more about Form 1116 and determine whether you are eligible to claim this tax credit.

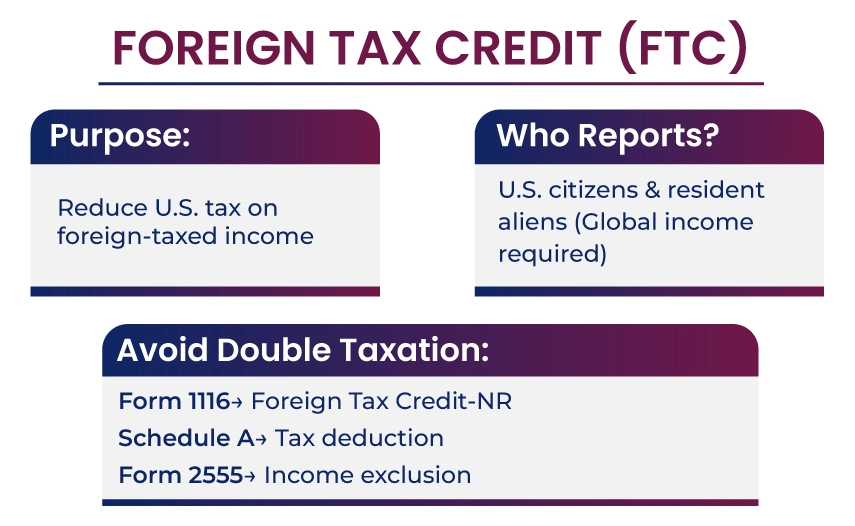

The foreign tax credit is a U.S. tax credit designed to offset income tax paid abroad. Resident aliens and U.S. citizens can claim the credit if they pay income taxes enforced by a foreign country or a U.S. possession. Claiming the credit can help you lower your U.S. tax liability as well as ensure that you are not being taxed twice on the same income.

The IRS wants U.S. citizens and U.S. resident aliens to report and pay taxes on their worldwide income. It includes both those who hold a U.S. green card and those who fulfill the significant presence test. However, the taxpayers must be aware of some implications that are involved.

The IRS offers several options to Americans staying abroad to help them avoid double taxation, which are as follows:

Claiming the FTC will help you lower your U.S. tax liability significantly in most situations.

Not all the taxes you pay to a foreign government can be claimed as a credit against the U.S. federal income tax. The taxes paid in another country will qualify for the FTC when you:

Apart From These, Some Taxes do not Qualify to be Included in the FTC:

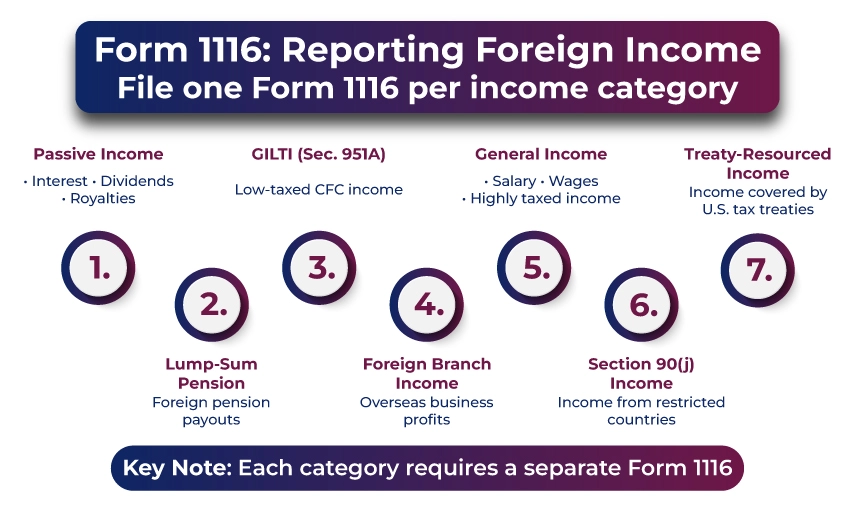

If you have only a single foreign income type, you are required to fill out only Form 1116. Additionally, all those filing Form 1116 must choose how they view their income, which can be either on an accrual basis or a cash basis.

Remember, you need to convert every amount to U.S. dollars that you report on Form 1116, unless otherwise stated. You must use the conversion rate that is in effect on the day you paid your foreign taxes or the date they were withheld. In case you select the accrual method, you can use the average exchange rate in effect during that specific tax year.

If you read the instructions for Form 1116, you can understand each line item, and it also includes worksheets. The form has four sections, using which you provide detailed information:

In case your credit is more than your U.S. tax obligation, utilize the extra amount to reduce your taxes in the future. Moreover, remember that if a foreign tax redetermination (recalculation to your benefit) takes place, you need to file a Form 1040-X to inform the IRS about the changes. Failing to notify could lead to fines.

Tip to Remember:

Claiming the Foreign Tax Credit can be very beneficial for you to reduce your U.S. tax obligation by deducting the taxes you have paid in another country from the amount you are liable to pay to the IRS. Furthermore, if your credit surpasses your U.S. tax obligation, you have the option to carry forward the leftover amount to future tax years, resulting in further tax savings.

Once you classify your foreign income according to the category, you need to complete an individual form for each of the seven income types that you may have:

There might be situations that might permit you to claim the FTC without filing Form 1116 if the concerned income satisfies the qualifying definition. Let's understand this with an example:

The tax credit can either be refundable or non-refundable. A refundable tax credit provides a refund if the tax credit is more than your tax bill. For example, if you apply for a $5,300 refundable tax credit to a $5,000 tax bill, you will get a refund of $300.

A non-refundable tax credit will not provide a refund, as it only lowers the tax you are responsible for paying to zero. If the $5,300 tax credit were non-refundable, you would owe nothing to the government. However, you will also lose the leftover amount of $400 after the credit is applied.

Many tax credits, including the foreign tax credit, are non-refundable.

Although both tax credits and tax deductions help you save money, there is a difference between the two.

Tax credits reduce the tax that you need to pay dollar-for-dollar; on the other hand, tax deductions will reduce the amount of taxable income. A $1,000 tax credit will reduce your tax bill by $1,000. On the contrary, a $1,000 tax deduction will lower your taxable income. If you are in the 25% tax bracket, a $1,000 tax deduction will save you nearly $250 on your tax bill.

The foreign tax credit and the foreign earned income exclusion are the two ways that help you avoid double taxation on the income that you earn while staying abroad. The main difference between the two is the income to which each applies. The foreign tax credit is applicable to both earned and unearned income, such as dividends and interest. On the contrary, the foreign earned income exclusion only applies to earned income.

The foreign tax credit is a U.S. tax break that balances income tax paid to other countries. The tax must be enforced on you by a foreign country or U.S. possession, and you must have paid the tax to be eligible to claim the FTC. Generally, taxes on income, wages, dividends, interest, and royalties qualify for the foreign tax credit.

It is generally advisable to contact a professional who can handle everything for you so that you don't miss out on an important step or face penalties. When we talk about experts, Savetaxs tops the list.

We at Savetaxs have a team of professionals and experts who have been assisting US citizens and NRIs to fulfill their U.S. tax obligations confidently. Our team has been serving U.S. citizens with tax services for over a decade now. The experts work around the clock across all time zones so that you can contact them anytime you need and get the highest quality service possible.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr Navneet brings in more than 12 years of experience as a US Tax and ITIN Expert. Additionally, he has expertise in accounting, finance, taxation, financial analysis, budgeting, and risk management.

Form 1116 is required if you paid over $300 ($600 for married filing jointly) in foreign taxes or have multiple sources of foreign income. For smaller amounts, you can claim without using Form 1116.

No, the foreign tax credit is non-refundable. It only lowers your U.S. tax due. Any unused credit can be carried back 1 year or carried forward up to 10 years.

You can claim the Foreign Tax Credit by filing Form 1116 along with your U.S. tax return (Form 1040). After that, you need to report the foreign income, taxes paid, and attach proof to lower your U.S. tax liability.

If you don't claim the FTC, you may end up paying taxes twice, once in the foreign country and again in the United States.

U.S. citizens, resident aliens, and, in some situations, dual-status taxpayers who have paid or accrued foreign income taxes on foreign-sourced income.