As a non-resident Indian (NRI), your NRO account generally includes earnings, savings, or inherited income in India. If you plan on repatriating the funds of your NRO account to NRE or a foreign account, then first you need to fill out Form 15CA and 15CB. Filling out these forms is essential to make a payment overseas. Through these forms, the Indian government can easily track foreign transactions and certify proper tax compliance. Want to know more about it? Well, then you are at the right place. This guide will help you better understand these forms and their role in Income tax. So, let's start reading.

What Is Form 15CA?

If an Indian resident makes any type of remittance to a non-Indian resident (NRI), foreign resident, or a foreign company, he/she need to file the Form 15CA with the Income Tax Department. According to the Income Tax Act of 1961, the payer needs to mention the information and details. As mentioned above, Form 15CA helps the Income Tax Department to track foreign payments and liable tax liabilities. Additionally, it also helps the NRIs under the DTAA agreement to claim tax deductions in India. Apart from this, Form 15CA is submitted online on the e-filing portal of the Income Tax Department.

This is all about Form 15CA and why it is necessary to be filled out by Indian residents. Moving further, let's know about the Form 15CB.

What Is Form 15CB?

Form 15CB is a certificate that is issued by a Chartered Accountant (CA). It verifies that the tax deducted at source (TDS) from the payment made to an NRI, foreign resident, or foreign company is as per the Double Taxation Avoidance Agreement (DTAA) and the Income Tax Act. The certificate consists of the payment details made to an NRI, the DTAA provisions, the TDS rate, and compliance with section 195 of the IT Act. Before making any remittance to an NRI, it is vital to fill out the Form 15CB.

This is all about Form 15CB and who issues it. Moving ahead, let's know the applicability of filling out these forms.

What is the Applicability of Form 15CA and 15CB?

Under the Income Tax Act, 1961, you need to file Form 15CA and 15CB when making payments to an NRI, foreign national, or a foreign company. The form selection depends on the type and remittance amount. To provide you with an idea, here is the applicability of the forms mentioned below:

Situations Where Form 15CA is Required

These are the following situations where you need to fill out the Form 15CA:

- When making a payment to a non-resident or a foreign company, you need to fill out the Form 15CA, irrespective of whether it is taxable or not.

- The payer can be an Indian resident, NRI, foreign resident, domestic, or foreign company.

- According to the provision of Section 5 of the IT Act, 1961, when the income arises, accrues, is received, or is going to arise, accrue, or be received in India, it should be stated in this form.

Situations Where Form 15CA is Not Required

These are the following situations where Form 15CA is not required:

- You do not need to fill out this form when the payment is made per the provisions mentioned in the Rule 37BB list of payments.

- According to Section 5 of the Foreign Exchange Management Act (FEMA), 1999, a person does not need to fill out Form 15CA while making payment to a foreign individual or firm if it does not need the approval of the RBI.

Circumstances Where You Need Form 15CB

Here is the list of the following circumstances where you need to fill out the Form 15CB:

- Form 15CB is required when the payment is made to a non-resident, NRI, or a foreign company that is taxable.

- To make the payment, this form is necessary to be filed by a CA.

- When the remittance amount is more than INR 5,00,000.

- When the assessing officer does not give any order.

Circumstances Where You Do Not Need Form 15CB

Here is the list of the following circumstances where you do not need to fill out the Form 15CB:

- There are no requirements to fill out the Form 15CB if the remittance amount is not taxable in India.

- If the receiver's residence country considers the income taxable, and the remittance is made in that country.

- If Part A of Form 15CA is not filled out, then you do not need to provide Form 15CB.

- When an individual does not make the payment for buying a foreign asset or a tour operator in a foreign country. Additionally, if the remittance amount is not more than the stated limit of the RBI.

- When a person makes the payment to pursue higher studies overseas.

- Under sections u/s197 or u/s 195(2)/(3), this form is not needed when you obtain a certificate from the AO.

Payments Where Form 15CA and 15CB Are Not Required

Here is the list of payments along with the purpose code as per the RBI, which does not require Form 15CA and 15CB:

| Purpose Code as per RBI | Nature of Payment |

|---|---|

| S0001 | Investment overseas by Indians in equity capital (shares) |

| S0002 | Investment overseas by Indians in debt securities |

| S0003 | Investment overseas by Indians in wholly owned subsidiaries and branches |

| S0004 | Investment overseas by Indians in associates and subsidiaries |

| S0005 | Investment overseas by Indians in real estate |

| S0011 | Loans extended to foreign citizens |

| S0202 | Payment for the operating expenses of Indian shipping companies functioning overseas |

| S0208 | Operating expenses of Indian Airlines functioning overseas |

| S0212 | Booking of passages overseas- Airlines companies |

| S0301 | Payment for business travel |

| S0302 | Travel under basic travel quota (BTQ) |

| S0303 | Travel for pilgrimage |

| S0304 | Travel for medical treatment |

| S0305 | Travel for higher studies (including hostel expenses, fees, and more) |

| S0401 | Postal Services |

| S0501 | Construction projects of Indian companies overseas, including imports of goods at the project site |

| S0602 | Freight insurance- associated with the export and import of goods |

| S1011 | Remittance for maintaining offices overseas |

| S1201 | Maintenance of Indian consultants/embassies overseas |

| S1202 | Payment by foreign consultants/embassies in India |

| S1301 | Payment by non-residents, NRIs, towards savings and family maintenance |

| S1302 | Payment towards donations and personal gifts |

| S1303 | Payments towards donations to charitable and religious institutions overseas |

| S1304 | Payment towards donations and grants to other charitable and government institutions established by the government |

| S1305 | Donations or contributions made by the government to overseas institutions |

| S1306 | Payment towards a refund or payment of taxes |

| S1501 | Rebates or refunds, or a reduction in the invoice amount on account of exports |

| S1503 | Remittance by residents for overseas bidding |

This was all about where you need to fill out Form 15CA and 15CB, and where it is not required. Moving further, let's know about the different parts of the Form 15CA.

What Are the Components of Form 15CA?

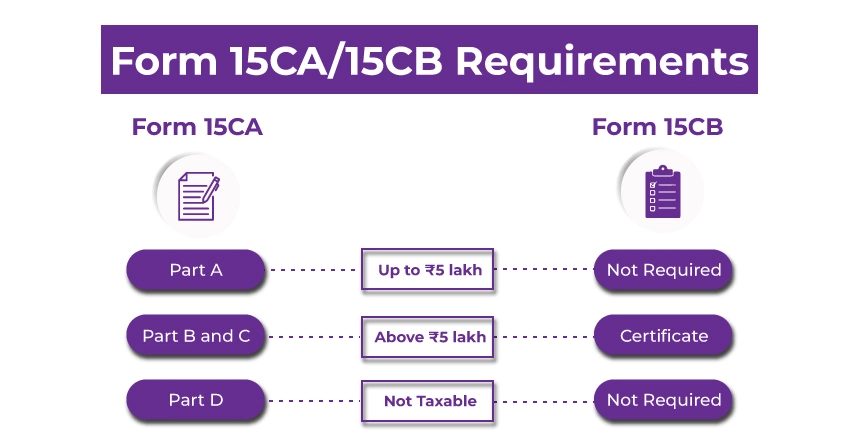

Form 15CA is divided into four different sections. Based on the remittance structure, each part of Form 15CA needs to be filled out and properly submitted. Furthermore, the four parts of this form are as follows:

- Part A: If the remittance amount is taxable and its total does not exceed INR 5,00,000, then you need to fill out Part A of Form 15CA. This part of the form needs to be filled out, whether the remittance is taxable or not in India.

- Part B: If the amount is more than INR 5,00,000 and under Section 197/195(2)/196(3) of the IT ACT, the assessing officer issued a certificate, then this part needs to be filled out in the form.

- Part C: If the remittance amount is more than INR 5,00,000 and the remittance is taxable under the IT Act. In addition, the CA provided Form 15CB.

- Part D: Under a specific exemption, in case the remittance is covered, you need to fill out Part D of the form.

These are the different components that Form 15CA consists of. Moving ahead, let's know the mandatory information that you need while filling out Form 15CA and 15CB.

Mandatory Information Required to File a Form 15CA and 15CB

When filling out Form 15CA and 15CB, here is the mandatory information that you need by your side:

- Details of Remitter (Sender)

- Name of the sender

- Address of the sender

- PAN Card of the sender

- Principal place of business of the sender

- Phone number and e-mail address of the sender

- Status of the sender (individual/company/other)

- Details of Remittee (Receiver)

- Name and status of the receiver

- Address of the receiver

- Country of the receiver (nation in which the payment is made)

- Principal place of business of the receiver

- Details of the Remittance (Payment)

- Name of the country where the payment is made

- The currency in which the payment is made

- Payment amount in Indian currency

- Proposed date of payment

- Nature of payment as per agreement (invoice copy from the client)

- Bank Details of the Sender

- Bank name of the sender

- Branch name of the bank

- BSR code of the bank

- Other Details

- Father's name of the signing person

- Designation of the signing person

- Documents Required from the Receiver

- Form 10F filed by the authorised person of the receiver

- A certificate stating that the receiver does not have any permanent address in India

- Tax residence certificate from the remittance receiver (tax registration of the country where the remittee is resident)

These are the mandatory information that you generally require while filling out Form 15CA and 15CB. Moving further, let's know how you fill out these forms online.

How to File Form 15CA and 15CB Online?

Follow the steps below to file Form 15CA and 15CB online:

Form 15CA

Using the e-filing portal of Income Tax, you can fill out Form 15CA online. Additionally, the form is verified either by using an electronic verification code (EVC) or a digital signature. Follow the steps below to fill out Form 15CA online:

Step 1: Log in to the official website of the Income Tax.

Step 2: Before filling out the Form 15CA, you need to add your CA. To do so, follow the mentioned steps:

- Select the tab, "Authorised Partners." Then, from the drop-down menu, click on the "My Chartered Accountant (CA)" option.

- You will be directed to the "My Chartered Accountant(s)" page. Here, click on the option 'Add CA.'

- Now you need to mention the 'Membership number of the CA.'

- Then, click on 'Add', and give your confirmation.

- Once you follow this process, you will receive a message displaying that your request for adding CA has been successfully submitted, now it is pending for getting the acceptance of your CA.

Step 3: Process to fill out Form 15CA online:

- Using your credentials, log in to your account from the E-filing portal. Then, go to "E-file"> "Income tax Forms"> "File Income Tax Forms"

- To do so, go to the 'File Income Tax Forms' page. Here, click on the 'Others' option (Not relevant income source) and select Form 15CA. You can also use the search box to find the Form 15CA.

- From the "instructions Page", click on the "let's get started" option.

- On the Information for remittance to non-resident page, choose "mode of submission" and the assessment year.

- Now, from the Form 15CA, you need to choose Parts A, B, and C of the form. Here is what information you need to mention as per your selected form part:

- Part A

- If the remittance is below INR 5,00,000 during an accounting year, then you need to choose this part.

- You need to mention the information of the sender, receiver, and payment details. Additionally, there is no need to submit Form 15CB. Once you fill out the form, send it for verification.

- Part B

- This is applicable when, under Section 195(2), 195(3), or 197, you get approval from the assessing officer (AO).

- Like Part A, here also, you need to mention the details associated with the sender, receiver, and payment. The only difference in these two parts is that here you mention the details of the AO. Apart from this, you do not need to submit Form 15CB.

- Part C

- When your remittance is more than INR 5,00,000 during an accounting year, then you need to file Form 15CA and also require to submit Form 15CB.

- In this part of the form, you need to mention the information about the CA and attach the requested documents. These are additional details from the remitter and remittance that you need to fill in Part C.

- Once you fill in all the requested details, you need to click on the "Assign to CA" option.

- Click on 'Yes' to give your confirmation. On your device, you will receive a message stating 'successfully assigned to the CA.'

- Now, from the dashboard, click on the 'Pending Actions' option.

- Once you click on that option, you will see the Form 15CB uploaded by your CA. Now you can either accept or reject your Form 15CA that you filled out online.

- In case you accept the form, you will move to the 'e-verify' page. Using EVC or DSC, once you e-verified your form, you will receive a message stating "successfully submitted."

- Part D

- This section of the form is only applicable when the remittance is not taxable under the Income Tax Act.

- In Part D of the Form 15CA, you need to mention the details of the sender, such as his/her name, PAN number, contact, and address details, and more. Also, in this section, verification of the individuals submitting the form is needed. Once you fill out all the requested information, click on 'save.'

- Followed by this, you also need to mention the information of the payment receiver and the payment details.

- Part A

- According to your situation, once you fill out the correct part of the Form 15CA, you need to verify the mentioned details and click on the 'Preview' option.

- After checking all the mentioned details, using a digital signature certificate (DSC), you need to e-verify your form.

- When all the things are done, you will receive a success message with an acknowledgement number and Transaction ID. You need to keep both things securely. Apart from this, you will also receive the confirmation message on your registered mobile number and email ID.

Form 15CB

To fill out Form 15CB online, follow the steps below:

- Before filling out Form 15CB, you need to first complete the 'Add CA' requisite.

- Now, under the authorised partners tab, choose my CA, and then the "Add CA" option.

- In this, you need to mention the membership number of the CA.

- After that, you have to assign your Form 15CB.

- Since you have now successfully added the CA, the remaining process will be completed by the CA.

- The user account of the CA should be registered on the website as a CA and not as a general account.

- Now, under the e-file tab, choose the Income Tax Forms> File Income Tax Forms. Then, choose the Form 15CB and click on the File Now option. Here, you will see three options, i.e., online, offline/bulk mode upload, and manual options to submit the form.

- The manual option is only for filing, and helps in the digitisation of the forms that were manually filed between 7 June and 15 August 2021.

- In the offline/ bulk upload option, the file is operated from the offline utility.

- The online option allows you to fill in the details and submit the form online.

- Once you choose the form submit option and complete the further process, move towards the e-Verify option. Here, upload the Digital Signature Certificate (DSC) of the CA and file the forms.

- Now you have to upload your Form 15CB, and it should be successfully submitted by the CA, using the E-file Tab. You can view and download the form online using the e-file tab. To do so, log in to the website and see the form under the "worklist" tab by choosing the "For Your Information" button.

This is how, by following the above-mentioned steps, you can fill out Form 15CA and 15CB online. Moving ahead, let's know how you can apply for the forms offline.

How to File Form 15CA and 15CB Offline/ Bulk Mode?

Follow the below-mentioned steps to file Form 15CA and 15CB offline/ bulk mode:

Form 15CA: Part A and B (Taxpayer)

Here is how you can fill in Part A and Part B of the Form 15CA:

- Using your credentials, log in to the e-Filing portal of income tax and go to "e-File"> "Income Tax Forms"> "File Form 15CA."

- Mention the Basic Details: You will find the PAN/ TAN number autofilled. You need to fill out the assessment year, submission mode, and filing type. Options like online, manual, and offline/ bulk mode are available there. Choose the one as per your convenience.

- According to the Press Release, the manual mode is only applicable for the forms that were manually filled from 7 June 2021 to 15 August 2021.

- In offline/ bulk upload, download the form using the offline utility facility.

- If you are choosing the online option to submit the form, fill in the required details online. After that, move towards e-verification. Upload the Digital Signature Certificate (DSC) of the authorized person and fill out the forms.

- Download the Form 15CA Using Offline Utility: You can get the Form 15CA from the Income Tax Website under the download section.

- After downloading the form, make separate XML files for remittee, remitter, and CA (only required for Part C). Once you do this, zip all the XML files. To complete part C, import the Form 15CB in XML sent by your CA, which you downloaded from the view e-filed forms.

- Now, upload the zipped files and submit them. After submission, you will receive a token number.

- To check your submission status, visit "e-File"> "View Form 15CA offline/ Bulk." Here you can know whether your file has been submitted successfully or failed.

- In case the submission fails, the reason for it will be mentioned on the screen. Here, you need to re-upload the correct XML file with fixed data/ validations.

Form 15CB

Here is how you can fill out Form 15CB using offline/ bulk mode:

- Appointing a CA: To start the process, the first thing you need to do is appoint a CA. To do so, follow the mentioned steps:

- Using your credentials, log in to the e-filing portal and under the "Authorised Partners" go to "My Chartered Account (s)."

- To add, your CA gives the membership number and assigns him/her Form 15CB.

- Form CB: Part A and B: These parts of the form need to be filled out by CA.

- To download the filed form by the CA, log in to the e-filing portal and choose the "e-file"> "File Form 15CB."

- Fill in the general details like your user ID, PAN number, "offline/bulk submission and accounting year.

- To download the form, you have two options: either download the form using the offline utility or from the Income Tax Forms page, get it under the "download" section.

- Create separate XML files for the sender, receiver, and CA and zip them.

- Upload the zipped files on the site and use your DSC to submit them. Once you do all this, you will receive a token number.

- To know your file submission status, visit the "e-File" > "View Form 15CB offline/ bulk." Here you will be able to see whether your files are successfully submitted or failed.

- In case your file submission fails, you have the option of resubmission with fixed data/validations. You can also download the PDF of your successful file submissions and an export stating the status, acknowledgement number (ARN), and XML filename for your failed files.

This is how you can fill both the Form 15CA and CB offline/ bulk mode.

Final Thoughts

This was all about the Form 15CA and 15CB. Hope after reading this blog, all your queries get solved. The Indian government has made filling out Form 15CA mandatory whenever NRIs or an Indian resident repatriates their funds overseas to NRE or a foreign bank account. Additionally, Form 15CB submission depends on the Form 15CA type you are filling out. Furthermore, if you have any tax-related queries or need assistance with ITR filing or the e-filing of Form 15CA and 15CB? Connect with Savetaxs, our experts will not only help you file your ITR and filing Form 15CA and 15CB but also assist you in maximising your tax savings in India.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- Section 17(1)- Definition of Salary Under the Income Tax Act

- Section 194I - TDS on Rent

- How to Fill Form 10E - Tax Relief On Salary Arrears Under Section 89(1)

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- Tax Guide for Working from India for a US Company After Expire of H-1B Visa

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766559165.png)