The Foreign Account Tax Compliance Act (FATCA) is an essential piece of legislation for US taxpayers, designed by the US law to curb tax evasion by Americans having money and investments abroad. It requires the reporting of certain foreign financial assets by filing Form 8938 if the assets exceed the specified thresholds. FATCA was introduced as a measure to ensure transparency in foreign-held assets.

Filing Form 8938 is the main compliance responsibility under FATCA; hence, if you are a US citizen or a green card holder, you must determine whether you are obliged to file, which assets you need to report, and the consequences of not adhering to this regulation. In this guide, we will walk you through the FATCA reporting thresholds, what accounts you need to report, and everything you need to know to stay in compliance with the tax laws.

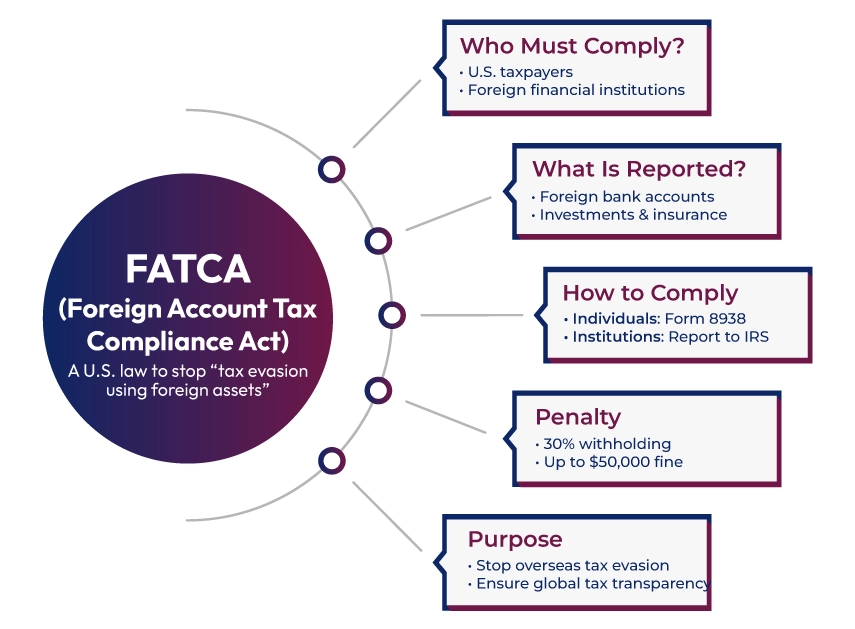

Short form for Foreign Account Tax Compliance, FATCA is a tax compliance act that is designed to oppose tax evasion by US taxpayers having their financial assets outside the United States. It includes citizens, green card holders, as well as certain resident aliens. Approved in 2010, FATCA requires foreign financial institutions and specific US taxpayers to report certain foreign financial assets to the Internal Revenue Service (IRS).

The FATCA Act particularly concentrates on foreign-held financial assets and safeguarding abroad accounts from being used for tax evasion. This US law designed act requires both individual taxpayers and foreign financial institutions (FFIs) to report certain foreign financial accounts, including bank accounts, mutual funds, life insurance policies, and annuity contracts.

If you hold a foreign financial account or assets that surpass the thresholds, you need to file Form 8938 every year to adhere to the FATCA requirements. Financial institutions all over the world are affected by FATCA, including credit unions, investment firms, and foreign entities involved in holding financial assets, unless they qualify for an exemption.

Here are some key features to consider regarding the Foreign Account Tax Compliance Act (FATCA):

Understanding and identifying which assets will fall under the scope of FATCA is one of the difficulties that arises before you even get to valuation. The IRS (Internal Revenue Service) has defined specified foreign financial assets as foreign financial accounts and non-account assets held for the purpose of investment, instead of assets used in a trade or business.

Specified Foreign Financial Assets Includes:

Now, before you consider whether you have reached the reporting thresholds, you must check the fair market value of individual assets. The IRS advises:

You are required to report all your specified foreign financial assets, including accounts, stocks, partnership interests, and foreign-issued life insurance, on Form 8938. This obligation is when the combined value goes beyond the limit of $50,000 for single filers, with thresholds differing depending on the filing and residency status.

The obligations of the FATCA act apply to the following:

Under citizenship-based taxation, US persons are liable to taxation on their worldwide income, regardless of the matter if they don't stay in the United States. The U.S tax obligations apply no matter what your residency status is.

Financial institutions and non-financial foreign entities (NFFEs) are also obliged to comply with the FATCA regulations. They must disclose either their U.S ownership or face withholding on some payments acquired from U.S sources.

Moving forward, let's understand the FATCA requirements by the type of taxpayer:

If you reside in the United States, it is essential to report your foreign assets on Form 8938 if their combined value surpasses the following:

For couples who are married and filing jointly, the threshold limit increases to:

If you are someone staying outside the US, the thresholds you need to report are different. You are required to fulfill the IRS's presence abroad tests and have your tax home in a foreign country to be eligible to qualify for these higher thresholds:

You should file Form 8938 if you hold foreign financial assets that are valued over:

For a married couple filing together, the thresholds may rise to:

The reporting requirements of FATCA are comprehensive and complex, which makes it difficult for foreign banks that serve US taxpayers. For example, the Belgian authorities stated that transferring the financial data of a US account holder to the IRS violates the privacy of EU laws. Therefore, some of the banks in Belgium have restricted services for the citizens of the US.

Note: You can keep an account with a US bank that provides international services or contact the IRS list of financial institutions that adhere to the FATCA requirements.

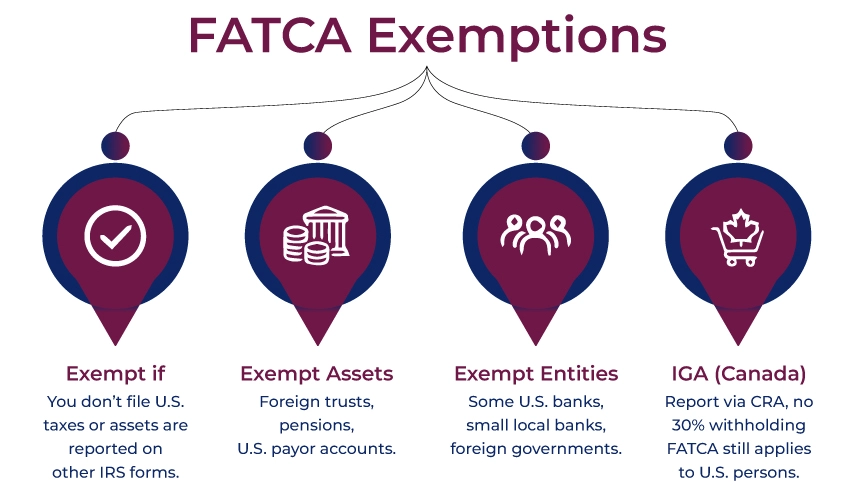

Some individuals and financial assets are exempt from the FATCA reporting requirements. You will automatically be exempt from filing Form 8938 if you are exempt from filing a US income tax return. Moreover, if you have reported your interest in a foreign entity or any other IRS forms, you don't have to replicate that information on Form 8938.

Such as Form 3520 (related to foreign trusts) or Form 8621 (for passive foreign investment companies). Instead of that, you can utilize the previously filed form on Form 8938 as a reference.

Under FATCA, you don't need to report the following:

If you qualify for an exemption, you may have to include specific FATCA exemption codes on your tax forms to mention the reason for the exemption. Indicating these codes will help the IRS process your return correctly without asking for any needless check-ins.

Some financial institutions may be exempt from the obligations of FATCA reporting. It includes some US financial institutions, local banks with limited US clients, and foreign governments under specific agreements.

The exemptions under FATCA are limited and may depend on certain criteria. To determine and ensure your eligibility for any FATCA exemption, you can contact a tax professional who has good knowledge of the tax laws for expatriates.

On February 5, 2014, the Canadian Government signed an intergovernmental agreement (IGA) with the U.S under the Canada-U.S. Tax Convention. It summarizes how the Canadian financial institutions adhere to the FATCA.

FATCA and FBAR (Foreign Bank Account Report) are two different reporting requirements for US taxpayers having foreign financial assets. Here are some of the main differences between FATCA vs. FBAR:

| Context | Foreign Account Tax Compliance Act (FATCA) | Report of Foreign Bank and Financial Accounts (FBAR) |

|---|---|---|

| Aim | The main purpose of FATCA is to capture a wide picture of U.S. taxpayers' foreign assets. | Required for individuals having a foreign bank account balance that exceeds $10,000 at any point in the tax year. |

| Filing Forms | FATCA uses Form 8938 with your tax return | FBAR can be filed online through FinCEN Form 114. |

| Reporting Thresholds | Its threshold may vary depending on an individual's residency and filing status. | FBAR has a threshold limit of $10,000 |

| Assets Covered | FATCA covers a wide variety of financial assets. | FBAR focuses only on foreign bank accounts. |

A taxpayer might have to file both Form 8938 and Report of Foreign Bank and Financial Accounts (FBAR) if they hold foreign bank accounts or foreign financial assets that surpass the threshold limit for FATCA reporting and the FBAR limit.

For example, you must report foreign accounts on the FBAR, and other specified foreign assets held over the FATCA threshold on Form 8938.

The IRS enforces strict penalties for those who don't comply with the requirements:

The FATCA enforcement mechanism is supported by a global network of tax authorities in partner countries, ensuring adherence through automatic exchange of information. If you can prove that you failed to file due to a reasonable cause and it wasn't an intentional neglect, you may be able to avoid penalties.

Suppose you underreport income, which is linked to an undisclosed foreign financial asset, the dividend acquired from foreign shares that are not reported on Form 8938 on your tax return. In such a case, the penalty can be up to 40% of that underpaid tax.

Additionally, the penalty may rise to 75% in case of any fraud.

The IRS has simplified filing procedures for those who missed the reporting requirements unintentionally but wish to adhere by choice. These procedure helps you to cover late or amended tax returns and FBAR filings. As Form 8938 is attached to your tax return, you must include it when you file under the streamlined program to manage FATCA reporting.

Whether you are a green card holder, a non-U.S. resident, or a dual citizen, understanding everything about FATCA reporting can be daunting. If you are not sure of your status, whether you need to file, or if you are eligible to claim any exemption, contact Savetaxs as we are here to help.

We have a team full of experts to assist and guide you so that you can meet your U.S. tax obligations with confidence. Our team has been working for decades now and can help you complete the process, stay compliant, and avoid any hefty penalties. Don't wait any further, contact us right away.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr Navneet brings in more than 12 years of experience as a US Tax and ITIN Expert. Additionally, he has expertise in accounting, finance, taxation, financial analysis, budgeting, and risk management.

If you don't report under FATCA, you may face some serious penalties. You may result in a 30% FATCA withholding tax. Individuals may even face fines of up to $50,000 and extended statutes of limitations for IRS audits.

You will automatically be exempt from reporting under FATCA if you are exempt from filing a US income tax return for the year. Exemptions can also include financial accounts maintained by a US payer, such as a foreign branch of a US financial institution, and specific interests in a foreign trust, estates, or a government-sponsored social insurance.

Yes, FATCA is mandatory for US taxpayers who hold foreign financial assets beyond the specified threshold, which may vary depending on residential, marital, and filing status. FFIs (Foreign Financial Institutions) and overseas bank holding US taxpayer assets must also adhere to FATCA.

You should report your foreign financial assets on Form 8938 and attach it to your annual income tax return. Generally, it is due on the 15th of April; however, expats may be granted an extension under specific situations.

Under FATCA, a US person can be a citizen, a resident, or a non-resident alien who fulfills specific criteria. It includes US corporations, partnerships, or trusts. Understanding your US or non-US status can be daunting, and if you are not sure about your status, it is ideal to consult with a tax professional.