Indian citizens working abroad and contributing to foreign pension accounts often face potential double taxation upon returning to India. India taxes income on a progressive basis and follows the accrual method of taxation, which means residents may be taxed on income earned in foreign retirement accounts even if the money is not withdrawn. This creates a financial burden for individuals who plan to use their retirement income in the future.

Taxpayers were also facing challenges in claiming the Foreign Tax Credit (FTC) due to a mismatch in the year of taxation between India (accrual basis) and foreign countries (receipt basis). Additionally, claiming the Double Tax Avoidance Agreement (DTAA) benefit became difficult in these cases.

To address this situation, the Finance Act 2021 introduced a new provision, Section 89A, in the Income Tax Act, 1961, to provide relief to individuals receiving income from foreign retirement benefit accounts. This section applies to Indian residents who previously worked overseas and have accumulated retirement funds such as 401(k) s, IRAs, RRSPs, or SIPPs.

What is Section 89A of the Income Tax Act?

Introduced in 2021, Section 89A provides tax relief to Indian residents on income from specified foreign retirement accounts. The main aim of Section 89A is to address double taxation for NRIs who later become residents of India.

Since India taxes income on an accrual basis, even unwithdrawn income (interest, dividends, capital gains, etc.) in foreign retirement accounts becomes taxable in India once the individual becomes a resident.

Illustration

For example, an individual worked in the USA for nearly 20 years and was an NRI until FY 2021–22. He contributed to a US retirement account during this period. In FY 2022–23, he returned to India and became a resident.

- Until FY 2021–22, the income accrued in his US retirement account was not taxable in India (because he was an NRI).

- In FY 2022–23, once he became a resident, the accruals (interest, dividends, capital gains) became taxable in India.

- However, the USA taxes these accounts on a receipt (withdrawal) basis, causing a year-mismatch.

- Since no tax was paid in the USA for FY 2021–22, he cannot claim FTC in India.

Section 89A solves this by allowing receipt-based taxation for such foreign accounts. This provision is adequate from 1 April 2021 and applies from Assessment Year (AY) 2022–23 onwards.

Notified Countries Under Section 89A

The Central Board of Direct Taxes (CBDT) has notified the following countries for Section 89A:

- Canada

- United Kingdom

- United States of America

CBDT has also introduced Rule 21AAA and Form 10-EE to claim relief for income from foreign retirement accounts.

Accrual Basis vs Receipt Basis

- Receipt Basis: Income is taxed in the year it is actually received or withdrawn.

- Accrual Basis: Income is taxed when it accrues, even if not received.

Section 89A allows residents to be taxed on a receipt basis for income from specified foreign retirement accounts.

How Does Section 89A Work?

One significant benefit of Section 89A of the ITA is that the income from specified foreign retirement accounts is subject to taxation in India only when it's taxed in the foreign country after withdrawal. It avoids the burden of double taxation that might occur under the traditional accrual-based system. Here is how Section 89A of the ITA works:

1. Specified Accounts & Notified Countries

A specified account is an employer-sponsored or government-sponsored foreign retirement account, such as:

- 401(k), IRA (USA)

- RRSP (Canada)

- SIPP (UK)

Only accounts maintained in notified countries qualify under Section 89A.

2. Tax Deferment

Once the taxpayer opts for Section 89A:

- Income inside such accounts is not taxed annually in India.

- It is taxed only in the year of withdrawal — aligning with foreign tax rules and preventing double taxation.

Rule 21AAA & Form 10-EE

According to Rule 21AAA, any income that occurs in the overseas retirement benefits account during a financial year will be included in your total income for that year in India. However, the tax section on such income is deferred under Section 89A. The actual tax liability will shift to the year in which the income is taxed on withdrawal or redemption in the notified country. Such income is ultimately taxed in the nation where the retirement account is maintained.

The taxable income shall exclude the following:

- Tax-exempt income due to a Double Tax Avoidance Agreement (DTAA) between India and a foreign country is not taxed.

- Income that has already been taxed under the Income Tax Act (ITA) in the previous year is not taxed again.

- Income that was not taxable in India during the year it was received because of your residency status. It means either Non-Resident (NR) or Resident, but not Ordinarily Resident (RNOR).

Claiming Relief Through Form 10-EE

To claim relief, the taxpayer must file Form 10-EE on the Income Tax e-filing portal before filing the ITR for the relevant year.

Once opted, the choice is irrevocable, except where the income:

- Was never taxed in India, and

- Will be taxed in the foreign country on withdrawal.

If the taxpayer becomes an NRI again, the Section 89A benefit becomes inapplicable for that year.

Reporting in ITR

The updated ITR forms now include:

- Schedule S (salary)

- Schedule OS (other sources)

Taxpayers can claim relief under Section 89A and defer taxation until withdrawal. They do not need to classify accrued income as salary, capital gains, interest, etc., for annual taxation.

Steps to File Form 10-EE

If you have a retirement account in either the UK, the USA, or Canada, with your residential status being resident or ordinarily resident, and you receive income in the form of interest, dividends, and capital gains, which is collected in your retirement fund account. You want to postpone the taxation till the time of money withdrawal:

Step 1: Log in to the Income Tax e-filing portal.

Step 2: Go to e-File → Income Tax Forms → File Income Tax Forms.

Step 3: Select Form 10EE.

Step 4: Select the appropriate Assessment Year.

Step 5: Enter the required basic details about the specified account.

Step 6: Download the CSV template.

Step 7: Fill in details such as:

-

Account number

-

Name of the notified country

-

Retirement fund name

-

Opening year of the account

-

Previous year's balance

-

Tax rules in that country

-

Nature of income (dividend, interest, salary, etc.)

Step 8: Upload the account statement and submit the form.

Who Can Claim Benefits Under Section 89A?

Section 89A is added to provide benefits to a specific group of taxpayers:

- Specified Account: This refers to a retirement benefits account maintained in a notified country for the purposes of Section 89A, as determined by the Indian government. Currently, the US, the UK, and Canada are notified.

- Specified Person: A resident of India who opened a retirement account while residing outside India. It means that the individual was an NRI during that period.

What Are Some Examples of Qualified Foreign Retirement Accounts?

If you fulfill the criteria mentioned above and if you have maintained savings from your retirement income in a notified country in any of the following account types, then you can claim benefits from Section 89A:

- SIP (Self-invested Personal Pension): A personal pension plan in the United Kingdom

- RRSP (Registered Retirement Savings Plan): A retirement savings plan registered by the government in Canada.

- IRA (Individual Retirement Account): A personal retirement savings account plan in the US.

- 401 (k): Available in the US, an employer-sponsored defined-contribution retirement account.

Conclusion

The Indian tax regulations for retirement benefits accounts offer a more favourable opportunity to save and grow funds for retirement. With several tax exemptions and provisions, such as Section 89A, that defer taxation on foreign retirement accounts until funds are withdrawn, it is crucial to plan carefully.

Seeking assistance from professionals who are experts in cross-border taxation can help you easily understand these complexities. At Savetaxs, we have been helping people with issues of such complexity for several years now. Our experts have over 30 years of experience and can therefore offer the best guidance and assistance for every tax-related problem.

Note: This blog is for informational purposes only. The views expressed in this blog are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

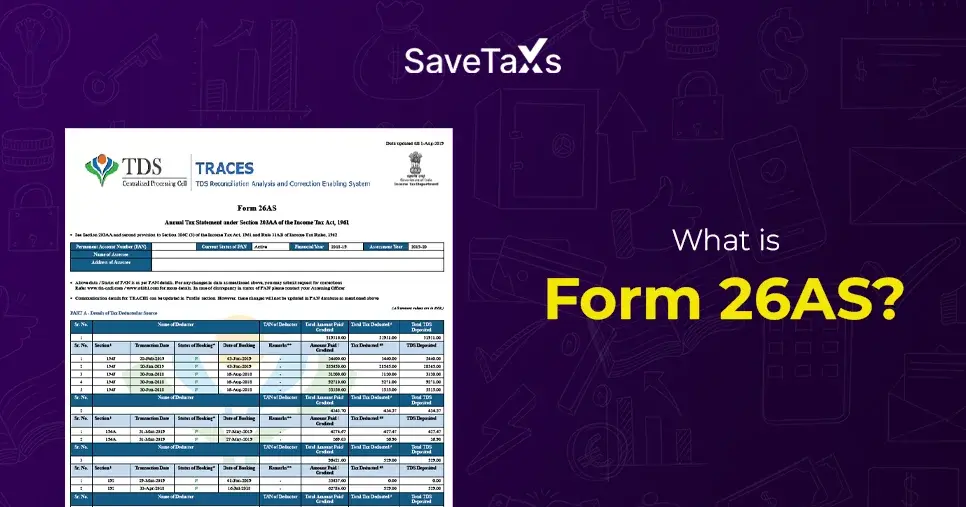

_1768304909.webp)

_1756467732.webp)

_1767696432.webp)

_1756729655.webp)