- What is DTAA Between India and the USA?

- How is Residential Status Determined for DTAA Between India and the USA?

- Taxes Covered in DTAA Between India and the USA

- What Are the Different Types of Income Taxed Under the DTAA Between India and the USA?

- Tax Relief Mechanisms: Exemption vs. Tax Credit

- Claiming DTAA Benefits: A Step-by-Step Guide

- Final Thoughts

Navigating the complexities of international taxation can be difficult for Non-Resident Indians (NRIs). It often becomes more difficult when they have to manage the earned income from multiple countries.

Fortunately, the Double Taxation Avoidance Agreement (DTAA) between India and the USA helps in this. Under this agreement, NRIs are relieved of paying tax twice on the same income.

Here is a comprehensive blog on DTAA between Indian and the USA with complete instructions. So, read on and gather all the information.

- The DTAA between India and the USA helps individuals avoid paying tax twice on the same income.

- There are two ways by which you can claim DTAA relief: the foreign tax credit and the exemption method.

- To claim the DTAA benefits, it is vital to have a TRC and Form 10F by your side.

- A TRC certificate is issued by the residency country where the NRI resides.

What is DTAA Between India and the USA?

The Double Taxation Avoidance Agreement (DTAA) signed between India and the USA helps individuals and entities from paying taxes twice on the same income earned in both nations. Through the agreement, NRIs are not completely exempt from paying taxes. However, their tax liability gets minimized, and it promotes fair tax practices.

For instance, if a person works in the US and gets paid there, he/she is liable to pay federal tax to the US government. However, being an Indian resident, his/her income is also taxable in India. Under the DTAA between the US and India, the taxpayer receives relief through a tax credit or an income exemption.

This was all about the DTAA between India and the US. Moving ahead, let's discuss how a person's residential status is determined for the DTAA agreement.

How is Residential Status Determined for DTAA Between India and the USA?

If a person is a resident in both India and the USA, his/her residential status will be determined as follows:

| Situation | Considered to be a Resident of the Country in Which |

|---|---|

| In both countries, have a permanent home | Closer personal and economic relations |

| There is no permanent home in either state | Habitual abode is present |

| Both countries have a habitual abode | He is a national |

| National of both states or neither of them | Through mutual agreement, the residential status of the individual should be determined by the competent authority. |

This is how a person's residential status is determined under the DTAA between India and the USA. Moving further, let's know on what taxes the DTAA agreement applies in the US and India.

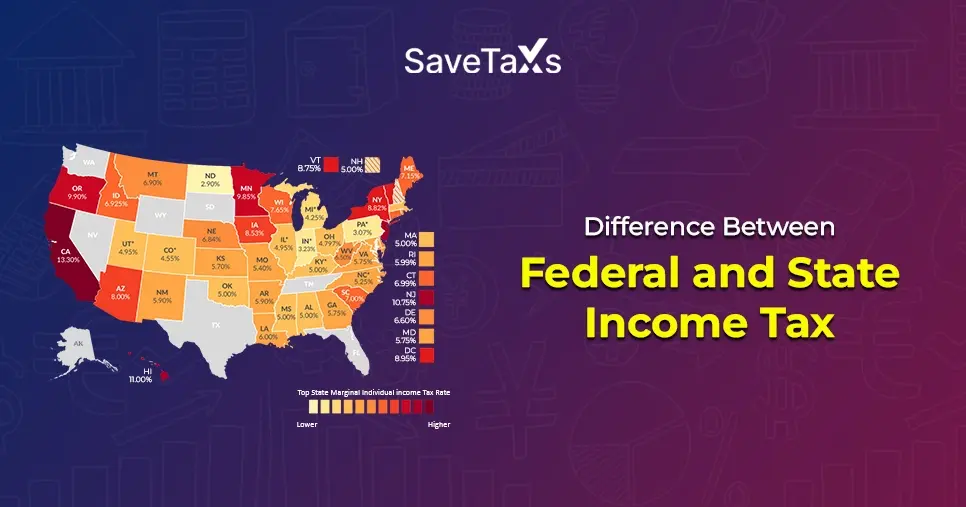

Taxes Covered in DTAA Between India and the USA

The DTAA between India and the USA covers the following taxes:

- United States: Under the Internal Revenue Code (IRC), DTAA applies to federal income tax. However, it does not include all other taxes. It includes personal holding company tax, accumulated earnings tax, excise tax on insurance premiums, and social security taxes. For NRIs, in income tax, these are relevant considerations.

- India: The DTAA agreement covers income tax, including surcharges. However, it excludes taxes like surtax.

These are the taxes covered in the DTAA between India and the USA. Also, default taxes and penalties are not covered under the DTAA agreement. Moving ahead, now let's know the different types of income taxed in this agreement between India and the USA.

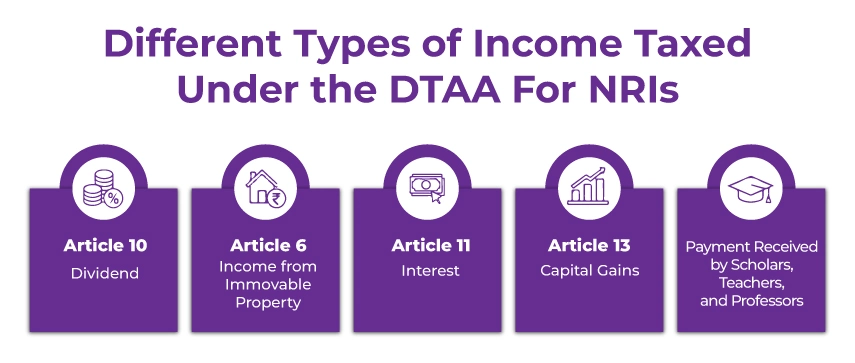

What Are the Different Types of Income Taxed Under the DTAA Between India and the USA?

The different types of income taxed under the DTAA between India and the USA are as follows:

Article 10 - Dividend

If a resident company pays a dividend to a resident of another country, the earnings from it will be taxable in the receiving country. Confused? Let's understand with an example.

For instance, suppose an individual in India receives a dividend amount from a US company. In this scenario, his dividend is taxable income in India.

Further, in some cases, it can also be taxable in the paying country if the individual lives in the receiving country. However, if this happens, the tax on the dividend should not be more than:

- 15% of the total amount if a company received the dividend, which has a minimum of 10% of the shares of another company.

- 25% of the total amount in any other cases.

Article 6 - Income from Immovable Property

From an immovable property, if a resident has income, then tax will be payable in the country where the property is located. Under this, the following types of income are covered:

- Income from forestry or agriculture

- From the immovable property, income is earned by an enterprise

- Income from letting out immovable property

- Income generated from an immovable property used for personal services

Article 11 - Interest

Similar to dividend income, if income from interest arising in a country is paid to a resident of another country, it is taxable in that other state. Considering this, it is also taxable in the country where it arises. In case the individual is a resident of the interest-receiving country, then the tax on the interest cannot be more than:

- 10% of the total amount, if the interest is paid on a loan from a financial institution or bank.

- In other cases, a 15% tax is imposed on the total amount.

Article 13 - Capital Gains

Under the DTAA between India and the USA, capital gains are taxed under the domestic laws of each country. In this, air transport and shipping companies are an exception. So, in simple terms, capital gains are taxed under the laws of both countries.

For instance, a US resident sells a property in India. Here, the capital gain generated from it will be taxable in India as per Indian tax laws.

Payment Received by Scholars, Teachers, and Professors

The income of a research scholar, teacher, or professor will be exempt from paying tax if for working purpose they move to the US from India. However, this can only be done if they fulfill the two conditions:

- If an individual resides in a foreign country for up to 2 years

- Before shifting, they were residents in the previous country

However, this tax exemption will only be available in case of the public interest and not for the benefit of some private authorities.

So, these are the different types of income that are taxed under the DTAA agreement between India and the USA. Moving further, let's know about the tax relief mechanisms under the DTAA.

Tax Relief Mechanisms: Exemption vs. Tax Credit

There are two primary ways by which NRIs can claim tax relief. These are as follows:

- Foreign Tax Credit (FTC): Under this, the resident country allows you to claim a tax credit on the taxes you have already paid in the source country. If you are an Indian resident, by filing the Form 67, you can claim an FTC.

- Exemption Method: Through this method, certain types of income are exempt from taxation in one country. It depends on the DTAA clauses between the two countries.

This was all about the tax relief mechanisms, i.e., foreign tax credit and the exemption method. Moving ahead, let's know the steps to claim the DTAA benefits.

Claiming DTAA Benefits: A Step-by-Step Guide

Here is how you can claim DTAA benefits:

Understand Eligibility

Before claiming DTAA benefits, determine whether you qualify. The DTAA between India and the US generally applies to residents of either country who earn income in the other country.

Opt for the Correct Form

Depending on your tax status, to claim the DTAA benefits, you need to fill out the correct tax form:

- US Residents: If you are a US resident, fill out form W-8BEN (for individuals) or W-8BEN-E (for entities) to ensure your US residency.

- Indian Residents: Indian residents need to fill out Form 10F to certify their Indian residency.

Get a Tax Residency Certificate (TRC)

A tax residency certificate (TRC) is a crucial document for claiming benefits under a DTAA. This document is issued by the tax officials of the nation in which the NRI resides. For example, if you are an NRI living in the US, the Internal Revenue Service (IRS) will provide you with the TRC. In addition, you need to provide proof of your identity and address.

Include DTAA Claim in Your Tax Return

When filing your income tax return, state your eligibility for the DTAA benefits. Additionally, as per the DTAA rates, mention the income that qualifies for the DTAA. To support your claim, attach TRC and other required papers.

Calculate Taxes As Per DTAA

Based on the applicable tax rates and exemptions stated in the DTAA, calculate your taxes. Additionally, stay up-to-date with the tax requirements and regulations in both countries when claiming the DTAA benefits.

This is how, by following the steps as mentioned above, you can claim the DTAA benefits.

Final Thoughts

Lastly, the DTAA between India and the USA significantly reduces the tax burden of individuals. It helps them pay tax twice on the same income. Here, the above blog was all about it and how you can claim the DTAA benefits.

Further, if you are still uncertain about the process, consider connecting with Savetaxs. We have a team of professionals who have a proper understanding of the international tax laws and the DTAA between the USA and India. They will solve all your queries and help you claim the DTAA benefits.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756816946.webp)

_1766559165.png)

_1766396437.webp)