An NRI (Non-Resident Indian) is required to file Form 10F online to claim the benefits under the DTAA (Double Taxation Avoidance Agreement) treaty. It is a self-declaration document that must be submitted to avoid paying taxes twice on the same income. It becomes mandatory when the taxpayer's TRC (Tax Residency Certificate) misses out on specific details.

In the absence of Form 10F, payments earned in India would be taxed at full domestic rates instead of the reduced rate available under DTAAs.

In this guide, we will explain who needs to file Form 10F, how to file it correctly, the purpose of Form 10F, and much more.

- Form 10F plays an important role in enabling NRIs to claim tax benefits under the DTAA agreement and lower their taxability on income acquired in India.

- The tax form is valid for one financial year only, meaning NRIs must file a new Form 10F every year.

- Failing to submit this form may result in NRIs facing higher tax rates or incurring penalties for non-compliance.

- Filing Form 10F is mandatory for all non-residents now, regardless of whether they have a PAN or not.

What is Form 10F?

Form 10F is a self-declaration tax form used by non-resident taxpayers to claim benefits under the DTAA (Double Taxation Avoidance Agreement). India has signed a DTAA tax treaty with several nations to prevent double taxation. To claim these benefits, non-residents need to submit a TRC (Tax Residency Certificate) issued by their home country.

However, if the TRC lacks specific crucial details, you need to submit Form 10F to provide the information required by the Indian tax authorities. It applies to NRIs who receive income in India but are residents of another country.

The form provides essential information such as the taxpayer's status, nationality, tax identification number (TIN), and residency period, as mandated by Rule 21AB of the Income Tax Rules.

Correctly completing and submitting Form 10F can help you avoid excess deduction of tax at source and ensure compliance with Indian tax regulations. This tax form is valid for one financial year only, meaning you must submit it annually to continue receiving the tax benefits it offers.

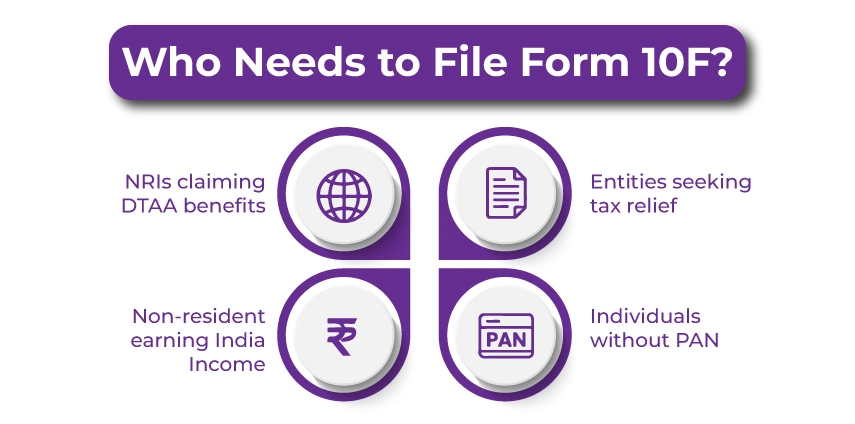

Who Needs to File Form 10F?

Here is a list of people or entities who need to file Form 10F:

- Any foreign company operating in India, even without a permanent establishment.

- NRIs working in India, including freelancers/consultants or those earning income from Indian investments.

- Other entities (trusts, partnerships, associations) receiving income from India.

The applicability of Form 10F is mainly determined by the nature of income, the existence of a DTAA, and the specific provisions of that DTAA.

Changes in PAN Requirement

Earlier, non-resident taxpayers without a PAN (Permanent Account Number) were allowed to file Form 10F manually. However, an important change was enacted in October 2023. Now, filing Form 10F online is mandatory for all non-residents, regardless of whether they have a PAN.

What are the Purposes and Benefits of Form 10F for NRIs?

Here is the purpose and the benefits of filing Form 10F for non-resident taxpayers in India:

- Lower TDS Rates: Claim lower tax rates on income like dividends, interest, and royalties.

- Claiming Tax Treaty Benefits: The main purpose of Form 10F is to claim the benefits of the DTAA tax treaty. Claiming these benefits can be significant, often helping obtain reduced tax rates or even an exemption from withholding tax on income earned in India.

- Establishing Tax Residency: The form also serves as proof of your tax residency status with the Indian tax authorities. The TRC you submit with Form 10F is vital evidence in this situation. Understanding your residency helps determine your taxability in India and ensures you are not taxed on your global income.

What are the Documents Required to File Form 10F Online?

The following documents are required when completing Form 10F electronically:

- Tax Residence Certificate

- Permanent Account Number (PAN) card

- Proof of nationality (if you are an individual)

- Proof of residence in your country of residence

- Proof of registration or incorporation (for other entities)

- Taxpayer status details, like individual, trust, firm, company, etc.

- The duration of your residential status as specified in the TRC (Tax Residence Certificate)

- The tax identification number (TIN) or any other unique tax identification number in your country of residence

- A digital signature certificate to authenticate the information mentioned in Form 10F

Note: Ensure all documents are self-attested and uploaded as PDFs within the file size limits prescribed on the Income Tax portal.

How to File Form 10F Online for NRIs?

To help non-residents complete the electronic filing process for Form 10F, here is a step-by-step guide:

- Step 1: Visit the E-Filing Web Portal: Navigate to the Income Tax e-filing web portal online to start the registration process. After that, click on the "Register" button located at the upper-right-hand corner of the webpage to register yourself.

- Step 2: Select the Registration Category: Select the "Others" option. Now, in the drop-down menu, select "Non-residents not holding and not required to have PAN" from the given list of choices.

- Step 3: Enter the Taxpayer Information: Provide the necessary details, such as your full name, incorporation/ birth date, tax identification number, and country of residence.

- Step 4: Furnish the Key Persons' Details: Fill in the relevant information related to the key person. It can include their full name, date of birth, tax identification number, and designation.

- Step 5: Contact Information: Furnish the contact details of the key person and add a secondary email and contact details. You will receive a one-time password (OTP) on your primary mobile number and email ID.

- Step 6: Postal Address: Fill in the details related to the company's postal address.

- Step 7: OTP Confirmation: Enter the OTP received on your registered email and mobile number to verify your identity.

- Step 8: Attach the Documents: Upload all necessary documents, including your Tax Residency Certificate and other proofs.

- Step 9: Submission of the Form: After completing all the steps accurately, review and submit the form.

Common Challenges Faced By NRIs When Filing Form 10F

It might seem easy to file Form 10F; however, NRIs may end up making mistakes that can lead to the denial of claiming DTAA benefits. Here are some of the common mistakes that an NRI can make and must avoid to save time and tax complications:

- Insufficient Documentation:

Ensure you submit all the necessary documents along with your Form 10F. You must attach your tax residency certificate when submitting the form online. In some cases, you may also need to submit a “No PE (Permanent Establishment)” certificate or declaration. - Wrong Personal Information:

Your name and other details must exactly match those on your tax residency certificate. Additionally, your PAN must be valid and accurate before filing Form 10F online. - Navigation Issues with the Portal:

The e-filing portal is primarily designed for Indian residents. Hence, NRIs who are unfamiliar with it may find it challenging to navigate or upload documents correctly. - Not Fulfilling the DTAA Requirements:

Make sure you meet all the conditions mentioned in the relevant DTAA to claim its benefits. - Filing Late:

Although there is no official due date for filing Form 10F, you need to submit it before filing your ITR (Income Tax Return). If not, you might receive notices that demand higher tax payments under Section 143 (1) (a).

Tips for Avoiding These Mistakes

- Check your eligibility under the relevant DTAA (Double Taxation Avoidance Agreement).

- Make sure that your PAN is registered and linked to your digital signature.

- Before starting the filing process, gather and organize all required documents.

- Cross-check all your personal details against your official documents.

- Complete Form 10F accurately before submitting your tax return.

To Conclude

Form 10F is a crucial document required by NRIs to avail benefits under the DTAA. It helps submit all missing details in the TRC. Staying informed about Form 10F ensures that you can claim all eligible benefits and stay compliant with Indian tax regulations.

Furthermore, if you need more assistance with filing Form 10F, connect with the experts at Savetaxs. Our team of experts with over 30 years of combined experience can help you navigate and complete Form 10F. We ensure that you are not faced with any hassle or stress caused during the process. So, contact us anytime as our team is working 24*7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decisions based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Speak to our experts and get personalized solutions for your NRI tax needs

View Plan- A Comprehensive Guide on the DTAA between India and the USA?

- Difference between NRI PAN Card & Normal PAN Card

- NRI Capital Gains and Their Taxability in India

- NRI Income Tax in India (2025): Rules, Slabs, Capital Gains & ITR Forms

- What is a Tax Residency Certificate (TRC) and How to Get It?

- Complete Guide for Double Tax Avoidance Agreement (DTAA) for NRIs

- PAN Card for NRIs - Comprehensive Guide

- Form 67 & Claim Of Foreign Tax Credit For NRIs

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- TDS on Sale of Property by NRIs in India

- NRE & NRO Accounts - Meaning, Comparison, Benefits, Taxation

- TDS Certificate Form 16A For NRIs: TDS on Indian Income

- Section 54F of Income Tax Act - Exemption on Purchase of Residential Property

- Form 61A Income Tax: Applicability, Due Date & How to File SFT Online

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

Frequently Asked Questions (FAQs)

Explore common questions about Form 10F for NRIs repatriating funds or seeking tax relief under DTAA.

Form 10F is a self-declaration document filed by NRI taxpayers who wish to avail the benefits of a DTAA (Double Tax Avoidance Agreement). It allows them to avoid paying taxes twice on the same income.

Form 10F is used by an NRI who wishes to claim the benefits of India's tax treaties with other countries (DTAA) and also to avail a reduced rate of TDS on the income they earn in India.

Yes, an NRI taxpayer who doesn't have a tax residency certificate (TRC) from their home country, as well as a PAN card, needs to file Form 10F online on the official portal of income tax e-filing. However, a PAN card is not a mandatory requirement to file Form 10F.

An individual needs to submit Form 10F if:

- They wish to claim the benefits of the DTAA provision on their income.

- You are an NRI taxpayer who is earning income in India.

- Your TRC doesn't include specific details that were required by the DTAA.

The difference between Form 10F and TRC is as follows:

- TRC:

- Purpose: A tax residency certificate proves that you are a resident of a country for tax purposes.

- Issuance: It is issued by the tax authorities of your home country. It includes details like your name, address, tax identification number, and residency period.

- Form 10F:

- Purpose: It provides extra information to claim the DTAA benefits on the income that is earned in India. It fills in any gaps that aren't covered by the TRC.

- Issuance: It is a self-declaration that is made by an individual. It contains details such as the nature of the income, claimed DTAA article, and any other details that are missing from the TRC.

No, to sign Form 10F digitally, an NRI has to obtain a DSC (Digital Signature Certificate) in India.

If you don't file Form 10F, then you will not be eligible to claim taxation relief benefits under the DTAA provision.

Form 10F is required when the TRC doesn't have all the necessary information according to the DTAA. The NRI taxpayer has to provide all the following additional details in Form 10F: