- What Is TCS on Foreign Remittance in India?

- Exemptions Under TCS

- TCS on Foreign Remittance Limit Increased from INR 7 Lakh: Stated in Budget 2025

- Proposed Changes on TCS on Foreign Remittance in Budget 2025

- How to Pay TCS for on Foreign Remittance?

- How to Transfer Money from India to the USA Without Paying Any Taxes?

- How to Check for TCS Deducted?

- How to Claim TCS Refund on Foreign Remittance?

- How to Avoid TCS on Foreign Remittance?

- Final Thoughts

In recent years, the government of India to ensure tax compliance and curb tax evasion has implemented several tax measures, specifically for foreign remittances. In this, one of the popular measures is Tax Collected at Source (TCS) on foreign remittance. TCS is a type of tax imposed by the government on specific transactions, such as sending money overseas. This step taken by the Indian government impacts the businesses and individuals involved in global transactions. Additionally, it is vital to know the TCS on foreign remittance with the increase of investments and mobility globally. Having an understanding of it will assist you in smoothly handling the international legal and financial aspects. Want to know more about TCS on foreign remittance? Then you are on the right destination. In this blog, you will get the complete information on TCS in detail, why it is collected, and the rates of it. Apart from this, the changes introduced by the government on the TCS in the 2025 Budget. So, let's start reading.

What Is TCS on Foreign Remittance in India?

TCS on foreign remittance is a tax mechanism that the Indian government introduced to certify tax regulations on the money being transferred overseas. Confused? Let's simply understand this. When a person sends a certain amount of money to a foreign country, he or she on that money needs to pay a certain percentage of that amount as TCS. It is deposited with the Income Tax Department of India and shown in your Form 26AS. It is collected by an authorized person, such as a financial institution or bank, from the sender during the transaction. You can see the transaction of the TCS file for the income tax return (ITR) for that fiscal year. Additionally, TCS is only applicable to Indian residents, non-resident Indians (NRIs) with an NRE account who are transferring funds or sending money to their permanent overseas residence, and do not need to pay TCS.

This was all about TCS on foreign remittance in India. Moving ahead, let's know the exemptions under it.

Exemptions Under TCS

Well, not on all the amount you send overseas, you need to pay TCS. There are exemptions made by the Income Tax Department of India on certain money. For instance, under Section 80E, for pursuing higher education, if a person sends money for the loan repayment taken from any financial institution, then on that money, he/she does not need to pay TCS. To provide you with a clear picture of this, the table below shows the TCS rate and the threshold limit under the Liberalised Remittance Scheme (LRS) of the RBI for different foreign remittances. From 2025 onwards, these TCS rates on foreign remittances are effective.

| Types of Remittance | New TCS Rate (Effective from 1 April 2025) |

|---|---|

| LRS for an education loan taken from any financial institution | 0 |

| LRS for education loan is not taken from a specific financial institution/ self-funded | 5% TCS on any amount more than INR 10,00,000 |

| LRS for medical treatment | 5% TCS pm any amount more than INR 10,00,000 |

| Purchase of overseas tour program |

|

| LRS for other purposes | TCS on any amount more than INR 10,00,000 |

Confused? Not to worry, let's understand the calculation of TCS on foreign remittances with an example. Suppose you want to invest INR 14,00,000 in a foreign asset, and for this purpose, you take the help of a money transfer agency. In your scenario, the amount is more than the fixed limit, i.e., INR 10,00,000, so on your investment amount, you need to pay 20% TCS. So, when transferring money, the agency will collect Rs. 80000 (20% of INR 4,00,000). Here, the TCS will be charged on the money more than INR 10,00,000, not on the whole amount. With this, to complete your investment, you need to pay INR 14,80,000 to the agency.

These are the exemptions provided by the Indian government under TCS. Moving further, let's know the increased limit of income under TCS on foreign remittances.

TCS on Foreign Remittance Limit Increased from INR 7 Lakh: Stated in Budget 2025

In Budget 2023, the Indian government increased the TCS on foreign remittances from 5% to 20% As a result, the government faced criticism from people. Hence, in the 2025 budget, the government made some changes and addressed the concerns of the people. The changes are as follows:

- The increase in TCS limit from INR 7,00,000 to INR 10,00,000 per fiscal year. However, now the TCS rate will only be applicable if the money sent overseas is more than INR 10,00,000.

- On education-limited remittance, a person does not need to pay TCS. However, if the studies are self-funded or the loan is taken from a non-specified financial institution, an individual needs to pay 5% TCS on the amount more than INR 10,00,000.

- If the annual amount of medical remittances is more than INR 10,00,000, 5% TCS will be charged.

- For remittance amounts below INR 10,00,000 on overseas tour packages 5% TCS will be charged, and if it is more than that, the TCS rate will increase to 20%.

This was all about the increased amount of income and TCS on foreign remittances. Moving ahead, let's know the proposed changes made by the Indian Finance Minister in Budget 2025 on TCS on foreign remittance.

Proposed Changes on TCS on Foreign Remittance in Budget 2025

In the budget 2025, on TCS related to foreign remittances, certain changes have been introduced. The aim behind making these changes was to decrease the tax burden of individuals and businesses making international financial transactions and provide them with compliance. These changes come into effect from 1 April 2025. Moving further, let's know about them.

- Increased TCS Threshold: Under the Liberalised Remittance Scheme (LRS), the TCS exemption limit has increased by the government from INR 7,00,000 to INR 10,00,000 per fiscal year. It means that if the remittance amount sent overseas in a year is more than INR 10,00,000, then you need to pay TCS; if it is less than that, TCS on that amount is not chargeable.

- No TCS on Education Loans: One of the most essential changes made by the Indian government is removing TCS on money sent overseas for studies. However, as mentioned in Section 80E of the Income Tax Act of 1961, it is only applicable when the study loan is taken from a specific financial institution and not self-funded. So, students who have taken a loan from a recognized financial institution to study overseas do not need to pay TCS on the amount sent. In case the loan is taken from any financial institution not mentioned in Section 80E or studies are self-funded, then 5% TCS will be applicable on the amount more than INR 10,00,000.

- Other Changes: To increase goods and services, the Indian government has also removed the TCS threshold limit from the goods purchase if the transaction is below or up to INR 50,00,000. Additionally, non-filers need to pay higher TCS rates on the remittance amount.

This was all about the proposed changes made by the Finance Minister on TCS. Moving ahead, let's know how to pay TCS on foreign remittance.

How to Pay TCS for on Foreign Remittance?

Your service provider, i.e, bank or financial institution, kept the record of the payment you made outside India during a financial year. Once in that financial year, if the amount exceeds INR 10,00,000, during the money transfer, the services provider automatically deducts the TCS amount. The deduction happens automatically when the amount transfer is processed. It is shown in your transaction statement. Additionally, you have the opportunity when filing ITR, you can adjust this amount with your tax liability.

This is how you can pay TCS on foreign remittance. Moving forward, let's know how NRIs without paying TCS can transfer their money to the UK from India.

How to Transfer Money from India to the USA Without Paying Any Taxes?

Do you know that as a non-resident India (NRI), when transferring up to $1 million in the USA from India, you can avoid paying tax? According to Section 206C(1G) of the Income Tax Act, 1961, NRIs do not need to pay any TCS when transferring money from their NRO to NRE account. Through this, NRIs can send their income in India, like dividends, salary, rent, business profits, etc., using their NRO account. However, to make this transaction, you need to obtain approval from the RBI.

Additionally, it should be remembered that TCS is applicable to foreign payments made while overseas through a forex or a debit card. However, if you are using an international credit card for making these expenditures overseas, it will not count in TCS. In addition, under section 206C(1G), TCS would not be deducted on these amounts.

Furthermore, until further guidelines are issued, the Finance Ministry of India has postponed the TCS application on foreign expenses done using international credit cards. So, it is possible that soon TCS will also impose on international credit cards.

Well, for now, NRIs are exempt from paying TCS on foreign remittance, but in the future, they can be liable to pay this. Moving ahead, let's know the different ways by which you can check the deducted TDS.

How to Check for TCS Deducted?

During the fiscal year, to check the deducted TDS on your overseas transfer, you can check the following documents:

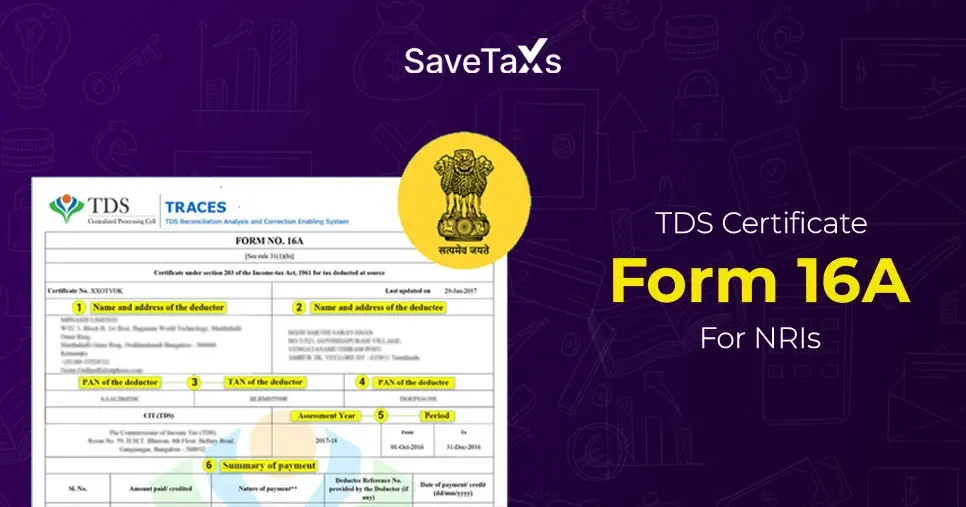

- Form 27D: This certificate is issued by the bank or financial institution by which you transfer your money overseas. The certificate serves as proof that from your foreign remittance, TCS has been collected and deposited with the tax officials. It consists of the following details:

- Your PAN card number

- Transferred amount

- Applied TCS rate

- Amount collected

Once the TCS has been collected, you will get this certificate in your email from your bank or financial institution, or you can also request it directly from them.

- Form 26AS: Form 26AS is a tax credit statement available on the e-filing portal of Income Tax. The form showcases the total TDS and TCS amount deducted against your PAN card for an accounting year. This form assists you in checking the deducted and deposited TCS by your bank to the tax officials.

- Annual Information Statement (AIS) and Tax Information Statement (TIS): You can find both statements on the e-filing portal of Income Tax. These provide you with a clear picture of the deducted TCS and taxable transactions.

This is how using the different forms and statements you can check whether your deducted TDS has been deposited in the financial year with the Income Tax Department or not. In reference to this, do you also know that when filing ITR, you can claim a TCS refund on your foreign remittance? Want to know how? Read the next section.

How to Claim TCS Refund on Foreign Remittance?

As mentioned above, the TCS deducted by your finance institution or bank is submitted to the Income Tax Department. When filing for your Income Tax Return (ITR), that amount is credited to it. In a fiscal year, if your overall tax liability is less than the deducted TDS, then when filing for ITR, you can claim a refund. Want to know how you can do this? Follow the steps below and get your answers.

Step by Step Guide

To claim a refund on your deducted TDS, follow the steps mentioned when filing ITR:

- When claiming for TDS refund, ensure you have Form 27D by your side. It consists of complete information on the deducted and deposited TDS.

- From the Income Tax e-filing portal, download Form 26AS and check whether the amount mentioned in Form 27D is mentioned correctly in Form 26AS.

- Now, file your ITR and mention the TDS amount in the given section.

- If applicable, the Income Tax Department will provide you with the refund.

This is how you can claim a refund on deposited TCS on foreign remittance when filing ITR. Do you know you can also avoid paying TCS on foreign remittances? Want to know how? Read the next section and get your answers.

How to Avoid TCS on Foreign Remittance?

One of the most effective ways to avoid paying TCS on foreign remittance is to certify that your total amount transferred in a fiscal year is not more than INR 10,00,000. Here are some points you can consider to do so:

- Schedule Your Remittance: When making the payment overseas, keep it less than INR 10,00,000 in a fiscal year. If your transferred amount exceeds the exemption limit, consider paying it next accounting year.

- Evaluate the Purpose of Transfer: Payments made for purposes like education and medical treatment, compared to other remittances, have lower TCS rates.

- Accurately File Your Returns: In case you paid TCS, if your tax liability is lower, you can claim for refund. To do so, when filing ITR, align Form 27D with Form 26AS.

- Consider an Education Loan: If you are a student going overseas for studies, use an education loan as it has 0% TCS on foreign remittance.

Using these ways, you can avoid paying TCS on foreign remittance.

Final Thoughts

Many people to buy property in foreign countries pay high-value remittances. However, on their ITR, these amounts are not shown, and because of this, the tax department of India cannot appropriately tax them. TCS on foreign remittance helps the tax department to keep a track record of payments made by people outside India in a financial year and ensure that they properly state this in their ITR. Here, the whole blog was about that and how NRIs get the benefit of not paying TCS on foreign remittance. With this, being an NRI, if you still have any confusion on this or want more information on it, connect with Savetaxs. The experts here have years of experience in the tax field and can guide you better on this. Also, can assist you in understanding your tax liability in India and filing ITR.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- Common ITR Filing Mistakes NRIs and Indian Residents Make

- A Comprehensive Guide to the Annual Information Statement

- Section 9 Of The Income Tax Act

- Old vs New Tax Regime: Which is Better for NRIs

- Section 80C of Income Tax Act - 80C Deduction List

- What is ITR-U (Updated Income Tax Return) for NRIs?

- Penalty for Late Filing of Income Tax Return for NRIs

- A Guide on the Types of TDS (Tax Deducted at Source) in India

- What is Section 54 and Section 54F for NRIs?

- Foreign Exchange Management Act, 1999 - FEMA

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766730933.webp)