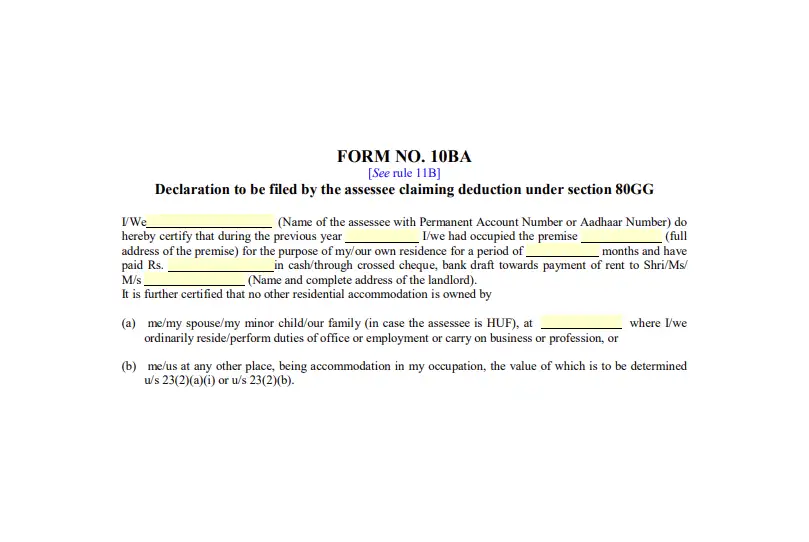

Do you know that, using Form 10BA, under section 80GG, you can claim house rent deduction? Both Indian residents and non-Indian residents (NRIs) are eligible to claim; however, they must meet certain conditions. It includes not receiving House Rent Allowances (HRA) from your employer. Through this, you can reduce your taxable income and overall tax liabilities. Want to know how you can do so and claim tax benefits using the Form 10BA of the Income Tax Act? Then you are on the right page. Read on the blog and get your answers.

What is Form 10BA?

Form 10BA under the Income Tax Act 1961 is a statement used by taxpayers, whether Indian residents or NRIs in India, to specify the rent paid and the tax deducted therefrom under section 80GG. It is for people who do not have a house or other property but want to claim tax deductions for paid rent on residential accommodations. This tax benefit is generally available for self-employed individuals and salaried employees who do not receive HRA from their employer.

This was all about Form 10BA of the Income Tax Act. Moving ahead, let's review the conditions for filing Form 10BA.

Form 10BA Applicability

As stated above, to file Form 10BA and claim the rental tax benefits under section 80GG, individuals must meet specific conditions. These conditions apply to both self-employed and salaried individuals who do not receive HRA. For both Indian residents and NRIs, the conditions for filing Form 10BA differ. Moving further, let's know about each of them.

For Indian Residents

Indian residents can fill out Form 10BA and claim rental tax benefits under section 80GG of the Income Tax Act, but they need to fulfill the following conditions:

- You do not have residential property where you stay or work. In addition, you do not have property in any other location that is self-occupied by you.

- You pay rent for living in your own house.

- Your employer is not providing your HRA.

- You are living in a rental house and have taxable income in India.

- If you are a spouse, a minor child, or a member of a Hindu Undivided Family (HUF), then you should not have any self-occupied residential property.

For Non-Indian Residents

Here are the following conditions that NRIs need to fulfill to fill out Form 10 BA and claim rental tax benefits under section 80GG of the Income Tax Act in India:

- They are living in a rental property in India and do not have a house there.

- Have taxable income in India, whether it is from salary or business.

- Whenever they visit India, they live in a rented property.

- Apart from these, they also meet the other conditions mentioned in section 80GG.

This was all about the conditions both Indian residents and NRIs need to fulfill to fill out Form 10BA of the Income Tax Act. However, it does not apply to the rent paid outside India or to passive income, such as rent, interest, received in India. Moving ahead, let's know why it is essential to fill out this form.

Is Form 10BA Mandatory?

Yes, it is mandatory to file Form 10BA to claim rent deduction under section 80GG of the Income Tax Act before filing the income tax return (ITR). Mentioned below is the list of reasons before filling ITR, why it is essential to fill Form 10BA:

- Under section 80GG of the Income Tax Act, it is mandatory to fill out Form 10BA to claim a rental tax deduction.

- This form serves as evidence to approve your rental tax deduction claims.

- Form 10BA works as a certifiable record of your rental payments.

- Filling out this form reduces your taxable income, helping you save on taxes, especially if a portion of your income goes toward rent.

- Serves as proof of tax compliance that is beneficial during loan approvals, visa applications, or background checks.

- During an income tax audit, Form 10BA, along with all essential documents, helps with tax deductions.

These are the key reasons why it is essential to file Form 10BA before filing ITR. Moving forward, please let us know the tax deduction limit applicable under this form.

Form 10BA Limit

Under section 80GG of the Income Tax Act, the Form 10BA limit for claiming tax benefit for paid rent in India is as follows:

- INR 5,000 per month or INR 60,000 annual

- Actual rent (-) 10% of total income

- 25% of the total income (excluding under section 111A short-term capital gains, under section 115A or 115D long-term capital gains, income, and tax deductions mentioned under sections 80C to 80U).

These are the tax deduction limits you can claim through Form 10BA for your paid rent in India. Among them, the lowest amount will be deducted. Moving ahead, now let's know the due date to fill out this form.

Form 10BA Due Date

Before submitting your income tax return, you must fill out Form 10BA of the Income Tax Act. The due date of both Form 10BA and ITR is the same. Confused, let's understand it with an example. For instance, for the fiscal year 2023-24, the due date to fill out Form 10BA is July 31, 2024. If your accounts need an audit, you must complete this form by September 30, 2024.

This was all about the due date of filing out Form 10BA. Moving forward, let's review the information needed to fill out this form.

Information Required to File Form 10BA

Here is the following information required to fill in the Form 10BA:

Personal Information of the Individual

-

- Your full name

- PAN card number

- Address

- Details of your business or employment

Details of Paid Rent, Name of landlord, PAN, and Address

-

- Monthly amount of rent

- Payment mode for rent

- Name and complete address of landlord

- PAN card number of landlord (if the rent amount is INR 1,00,000)

These are the details generally required when filing Form 10BA under the Income Tax Act. Moving on, let's see how you can fill out this form online.

How to file Form 10BA on the Income Tax Portal?

To fill out Form 10BA online, follow the steps mentioned below:

Step 1: Visit the official income tax site and, using your credentials, log in to the e-filing portal

Step 2: From the dashboard, click on 'e-file'> 'Income tax form'> 'file income tax form'.

Step 3: Scroll down to choose Form 10BA. Additionally, in the search box, you can also mention Form 10BA. To proceed further, click on the 'file now' option.

Step 4: For filing the return, choose the correct assessment year. For instance, if you are filing taxes for the earned income in the financial year 2024-25, then opt for the assessment year 2025-26.

Step 5: After checking all required documents for filing Form 10BA, click the 'Let's Get Started' option.

Step 6: Fill in the requested information. After that, click Preview, then Save.

Step 7: Once you review all the mentioned information, for e-verification, click on 'proceed.' You can do e-verification either through

- Digital Signature Certificate (DSC)

- Aadhaar Card OTP

- Electronic Verification Code (EVC)

Step 8: Enter the received OTP, then click 'continue'. You will file Form 10BA online.

Here are the steps to fill out Form 10BA online. For both Indian residents and NRIs, the procedure for filling out the form remains the same. Moving ahead, let's know how you can download your filled form from the site.

How to Download Form 10BA Online?

You cannot download the Form 10BA directly online; you can only fill it out. To download the form online using your credentials, log in to the Income Tax e-filing portal. Once you log in, go to the "e-file'> "Income Tax Form" > "File Income Tax Form." Under "person not dependent on any source of Income," search for Form 10BA and click on the "File Now" option.

Click on the "Download Form 10BA" to Download the Form

Final Thoughts

Whether it is an Indian resident or an NRI who pays tax in India, Form 10BA undoubtedly provides value, as it allows them to claim a tax deduction under section 80GG for rent paid in India. Through this, their taxable income gets reduced, and their overall tax liabilities are reduced. It is especially beneficial for individuals with lower incomes and who are self-employed. The above blog was all about Form 10BA of the Income Tax Act. Hope that after reading it, you gain a clear understanding. Furthermore, if you need more guidance on this or are facing any issues filing the ITR, contact Savetaxs. We have a team of experts with years of experience in the tax field who can better assist you.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- How to Claim TDS Refund for an NRI?

- A Comprehensive Guide on the DTAA between India and the USA?

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

- What is a Tax Residency Certificate (TRC) and How to Get It?

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- Section 195 of Income Tax Act - TDS Applicability for NRI

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- TDS Deduction on Rental Property Owned by NRI

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766559165.png)

_1767164087.webp)