- What is Section 80GGC?

- Who Can Avail 80GGC Deduction?

- Section 80GGC Deduction Limits

- Documents Required for Section 80GGC

- Difference Between Section 80GGB and Section 80GGC

- What are the Conditions Under Which an Individual Is Ineligible to Claim a Tax Deduction?

- Procedures to Avail Tax Deductions u/s 80GGC

- Save Tax with SaveTaxs: Expert NRI tax Consultancy Services.

Section 80GGC of the Income Tax Act allows individuals to claim a tax-saving deduction for donations to political parties in India. Under this section, the entire amount contributed as a donation can be claimed as a deduction, but the 80GGC deduction is allowed only under the old tax regime.

In this blog topic, we will understand all about Section 80GGC, including its eligibility, features, applicability, and more.

What is Section 80GGC?

Section 80GGC of the Income Tax Act is a tax-saving mechanism for all individuals who have made donations to active political parties or electoral trusts in India. The deduction under this section further encourages individuals to come forward and support their nation's political system.

However, the entire amount is eligible for the deduction only if it is not deposited in cash but through another medium. Additionally, the political parties must be registered under Section 29A of the Representation of the People Act, 1951. Suppose you, as a taxpayer, had made contributions to any political party that is not registered under the Registration of Persons Act section 29A. In that case, the deduction under section 80GGC is not eligible.

Who Can Avail 80GGC Deduction?

The eligible entities that can claim the section 80GGC deduction are:

- Individual taxpayers, be they non-resident Indians (NRIs) or Indian residents.

- Hindu Undivided Families

- Associations of Persons (AOP)

- Bodies of Individuals (BOI)

- Firms

- Artificial juridical persons that the government does not fund.

Section 80GGC Deduction Limits

There is a particular limitation set on the Section 80GGC exemption limit. Here is what they are:

- A taxpayer can claim 100% of their donation made to a registered political party or an electoral trust. Since section 80GGC of the Income Tax Act falls under Chapter VIA deduction, in such a case, the total deduction cannot exceed the total income of the individual donating.

- Donations or contributions made in cash are not eligible for the Section 80GGC tax benefits.

- The donation to an active political party must be made only through a legitimate banking portal, such as credit or debit cards, internet banking, demand drafts, cheques, or other means.

- Suppose a taxpayer is not able to provide all the required documents while claiming a deduction under section 80GGA. In that case, the designated authorities have the charge to deny the entire claim for the tax deduction.

Documents Required for Section 80GGC

For an individual claiming a deduction under section 80GGC, they must submit the documents mentioned below:

- A proof of donation receipt

- The receipt must have the following details: PAN, TAN, political party address, fund registration number, donor name, and the payment methods.

- The ITR form must be furnished and submitted within the given timeframe.

Difference Between Section 80GGB and Section 80GGC

Section 80GGB of the Income Tax Act means that any Indian company that is contributing to the political parties is eligible to claim a deduction for the amount that has been contributed.

Whereas Section 80GGC of the Income Tax Act means that any individual taxpayer, be it an Indian resident or a non Indian resident (NRI), can claim tax deduction for the amount contributed to a political party.

What are the Conditions Under Which an Individual Is Ineligible to Claim a Tax Deduction?

The following conditions apply under which an individual is unable to claim tax-saving benefits under section 80GGC of the Income Tax Act.

If an individual, be it an NRI or an Indian resident, has opted for a new tax regime.

If the contribution has been made in cash, then such a contribution is not eligible for a tax deduction under this section. However, if any donation is made by cheque, demand draft, or online payment, it qualifies for tax deductions under section 80GGC of the Income Tax Act.

For people who provide donations or gifts in forms other than monetary, such contributions do not qualify for claiming a deduction under section 80GGC of the Income Tax Act 1961.

In a nutshell, Section 80GGC aims to ensure that electoral funding is transparent and free from corrupt practices. The tax deductions for donations under this section enable individuals to support their nation's political system while reducing their tax liability.

Procedures to Avail Tax Deductions u/s 80GGC

The process for claiming a tax deduction under this section is relatively easy.

The taxpayer will generally file their ITR as they do, and while filing it, they will enter the amount of the contribution made under section 80GGC in the allotted space. As a salaried individual, you must give all relevant donation details to your designated employer so they can include them in Form 16.

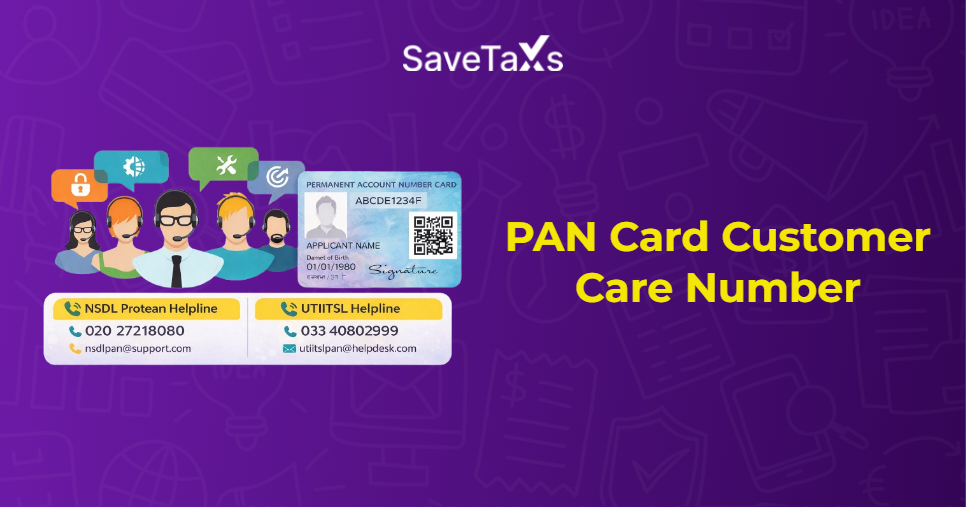

The political party must acknowledge the contribution or the donation. To claim the deduction, the taxpayer will also have to provide the PAN and TAN of the political party. Moreover, the taxpayer is eligible for the deduction if the employer issues a certificate stating that the deduction has been made from the taxpayer's bank account.

Save Tax with SaveTaxs: Expert NRI tax Consultancy Services.

NRIs, if you have donated or made many contributions to an active political party during a financial year, then do not forget to claim the deduction under Section 80GGC. However, please ensure that you have opted for the old tax regime and are following all the relevant regulations set by the Income Tax Department, because even a small error and you won't be able to claim the deduction.

However, Savetaxs helps you avoid these errors and guides you through a seamless ITR filing process, minimizing your tax liability. Our experts bring over 30 years of experience in NRI taxation, providing end-to-end tax solutions and tailored strategies for every client.

Connect with us today. We are available 24/7 across all time zones to ensure your tax journey is free from stress and hassles.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Section 80TTA of Income Tax Act – All about Claiming Deduction on Interest

- Section 80GG: Claim Tax Deductions on Rent Paid for Indian and NRIs?

- Section 80C of Income Tax Act - 80C Deduction List

- TDS Deduction on Rental Property Owned by NRI

- Section 80E of IT Act - Deduction for Education Loan Interest

- Section 89A - Tax Relief on Income from Foreign Retirement Funds

- Section 80EEA Tax Deduction on Home Loan Interest for Affordable Housing

- Income Tax Form 13 For NRIs - Lower or Non Deduction

- Section 80EEB of IT Act - Electric Vehicle Tax Deduction

- Your Complete Guide for Section 80D of the Income Tax Act

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1768221427.webp)

_1768633699.png)

_1768304909.webp)

_1754564786.webp)