Understanding the tax deduction at source (TDS) implications when purchasing a property in India from an NRI is essential. This is because these TDS rules can be complex, and failing to comply with them might result in legal complications and penalties.

If the seller is an NRI, the TDS is deducted under Section 195 of the Income Tax Act. This section has different rules from Section 194-IA (resident seller). In this guide, we will cover all the essential information about TDS on property purchases from NRIs.

Whether you are an NRI seller, an NRI buyer, or an Indian resident buying a property from an NRI seller, understanding the TDS regulations will help ensure that the entire property transaction process goes smoothly.

Key Takeaways

- The buyer is responsible for deducting and depositing the accurate TDS on the property purchase from an NRI.

- There is no minimum threshold for NRI property transactions; TDS must be deducted from every payment made to an NRI selling property in India.

- To deduct the TDS of an NRI seller, the buyer must obtain a Tax Deduction and Collection Account Number (TAN).

- TDS rates for NRIs on property sales in India are significantly higher than those for resident sellers.

- If an NRI seller fails to provide a lower deduction certificate, the buyer must deduct TDS on the entire sale amount, not just the capital gains.

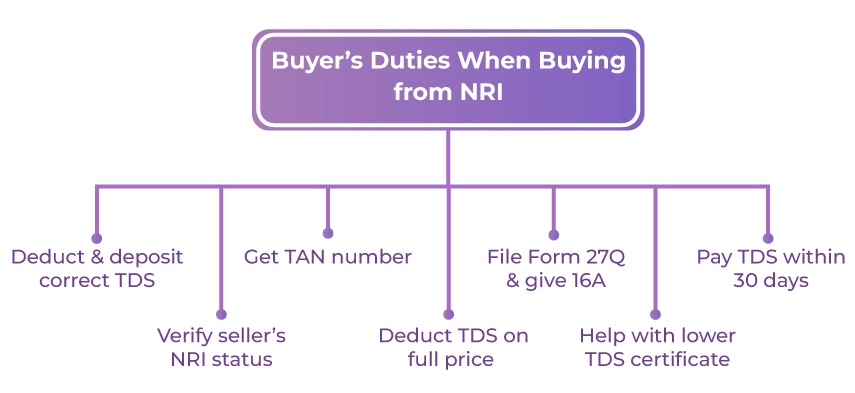

Responsibility of a Buyer Purchasing Property From an NRI

The buyer is responsible for deducting and depositing the correct TDS amount with the Income Tax Department. Along with this, the buyer must verify the seller’s residential status and ensure compliance with foreign exchange regulations.

Here are some important responsibilities for buyers purchasing property from an NRI:

1. Verifying the residential status of the seller:

Before buying, confirm whether the seller is a resident indian or a non-resident Indian (NRI). Doing so will help you apply the corrected TDS rate, as the TDS rates for both the resident seller and the non-resident are different.

2. Get a TAN Number:

A Tax Deduction and Collection Account Number (TAN) is mandatory for anyone deducting TDS under Section 195.

3. Deduct TDS on the full sale price:

Unlike resident transactions, where TDS is deducted only on capital gains, for NRI sellers, TDS is deducted on the entire sale consideration.

4. Form 27Q and Form 16A:

The buyer must file Form 27Q and issue Form 16A (TDS certificate) to the seller as proof of TDS deduction.

5. Lower Deduction Certificate:

Buyers may assist the NRI seller in obtaining a Lower Deduction Certificate (LDC). This helps reduce unnecessary TDS deductions.

6. Timely TDS Payment and Filing:

TDS must be deposited with the Government of India within 30 days from the end of the month of deduction. Delays may attract penalties.

How Can an NRI Seller Reduce the TDS Deduction?

NRIs face higher TDS rates compared to resident Indians. To avoid high deductions, NRIs can apply for a Lower TDS Certificate under Section 197 of the Income Tax Act.

This allows TDS to be deducted only on the capital gains, not on the entire sale value.

Without this certificate, the TDS for NRI property sale is usually deducted at 12.5% to 14.95%, leading to blocked funds and long refund cycles.

To apply for the LDC, an NRI must file Form 13 and submit:

- Sale agreement details

- Cost of acquisition documents

- Capital gain and capital gain tax computations

- Proof of reinvestments (if claiming exemptions under Sections 54, 54EC, etc.)

The processing time for an LDC is usually 4 to 6 weeks, so applying early is recommended.

Example: TDS on Property Purchase From an NRI

Below is an example showing the TDS calculation where an NRI sells a property in India for ₹3 crore, purchased earlier for ₹1 crore, resulting in a capital gain of ₹2 crore.

Example of tax rates for NRIs on property sale

| Particulars | Amount |

|---|---|

| Sale Price of Property | Rs 3,00,00,000 |

| Capital Gain | Rs 2,00,00,000 |

| LTCG Tax at 12.5% | Rs 25,00,000 |

| Surcharge (10%) | Rs 2,50,000 |

| Cess (4%) | Rs 1,00,000 |

| Total Tax Liability | Rs 29,00,000 |

| TDS Deducted at 14.95% | Rs 44,85,0000 |

| Excess TDS | Rs 15,85,000 |

| Refundable to NRI | Rs 15,85,000 |

In this case, the buyer deducts TDS of ₹44.85 lakh on the full sale price. Since the actual tax liability is ₹29 lakh, the NRI is eligible for a refund of ₹15.85 lakh through ITR filing or by obtaining a Lower TDS Certificate.

How to Repatriate Property Sale Funds (For NRIs)

To repatriate property sale proceeds outside India, these conditions must be met:

- The property must have been acquired under FEMA regulations.

- The proceeds were paid in foreign exchange received through banking channels or from funds held in NRE or FCNR accounts.

- For residential properties, the repatriation of sale proceeds is limited to 2 properties.

NRIs must complete:

- Form 15CA – submitted by the person remitting funds

- Form 15CB – certified by a Chartered Accountant

NRIs can repatriate up to USD 1 million per financial year outside India.

Penalties for Non-Compliance With TDS Rules

Non-compliance with TDS regulations can result in:

- Interest Charges:

1% per month for non-deduction and 1.5% per month for non-deposit - Late Filing Fees:

₹200 per day for delayed filing of Form 27Q (up to the TDS amount) - Penalty under Section 271C:

Equal to the amount of TDS not deducted. - Income Tax Scrutiny:

Non-compliance may trigger scrutiny and legal consequences.

The Bottom Line

Buying property from an NRI seller requires TDS compliance under Section 195 of the Income Tax Act to avoid penalties. Buyers must be aware of the NRI TDS rates, must have a TAN, and should comply with all NRI TDS filing requirements.

However, for expert-backed guidance on TDS on NRI property transactions, TDS planning, or the sale of property by an NRI in India, consult with Savetaxs. Our experts bring more than 30 years of hands-on experience specializing in NRI tax compliance and cross-border property-related matters.

So connect with Savetaxs today as we serve our clients with the best services 24/7 across all time zones.

*Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the content. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- TDS on Sale of Property by NRIs in India

- Everything You Need to Know About Form 15CA and 15CB of Income Tax

- A Guide for NRI Buying Agricultural Land in India

- What is House Rent Allowance: HRA Exemption, Tax Deduction, Rules & Regulations

- Section 54EC of Income Tax Act: Capital Gain Exemption

- Section 195 of Income Tax Act - TDS Applicability for NRI

- Section 194I - TDS on Rent

- TDS Deduction on Rental Property Owned by NRI

- How to Apply for TAN? - Acknowledgment & Payment Details

- NRI Selling Property in India

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756816946.webp)

_1767003468.png)

_1766129179.png)