-

Services

India

India

USA

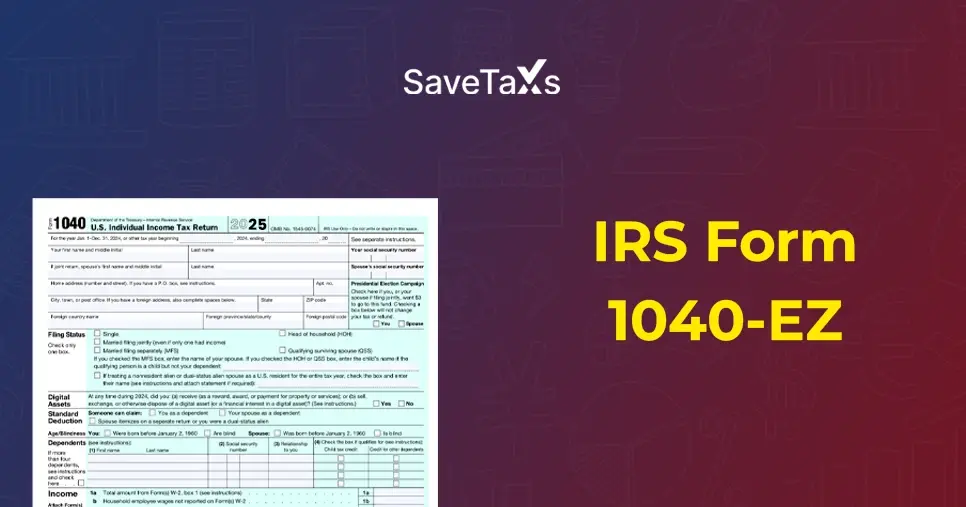

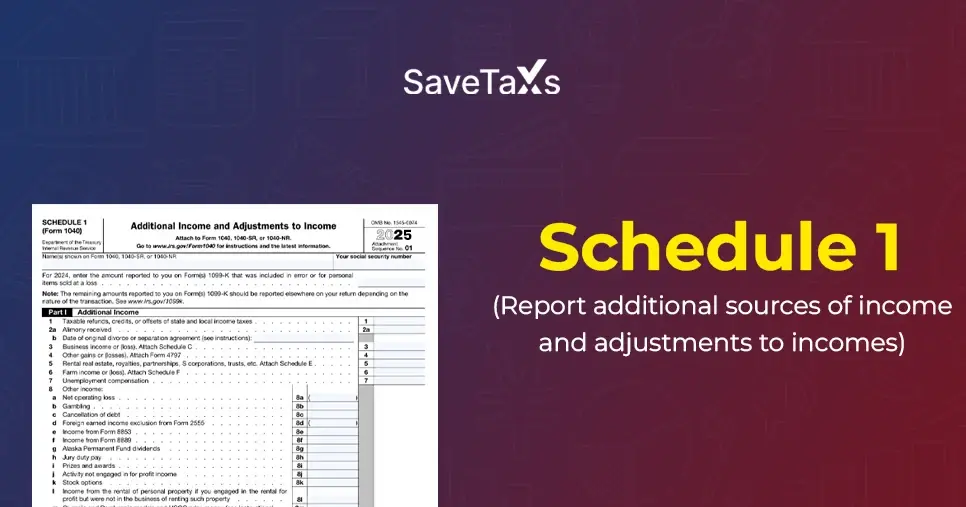

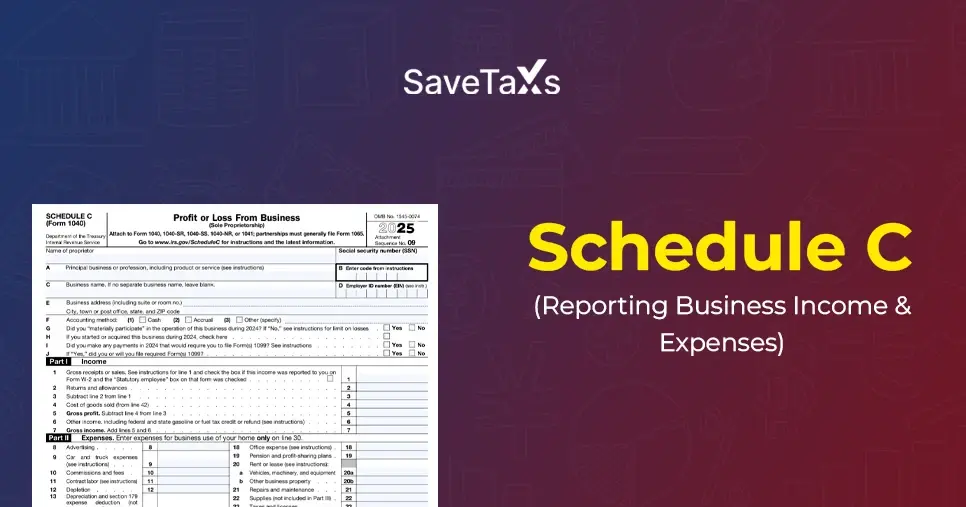

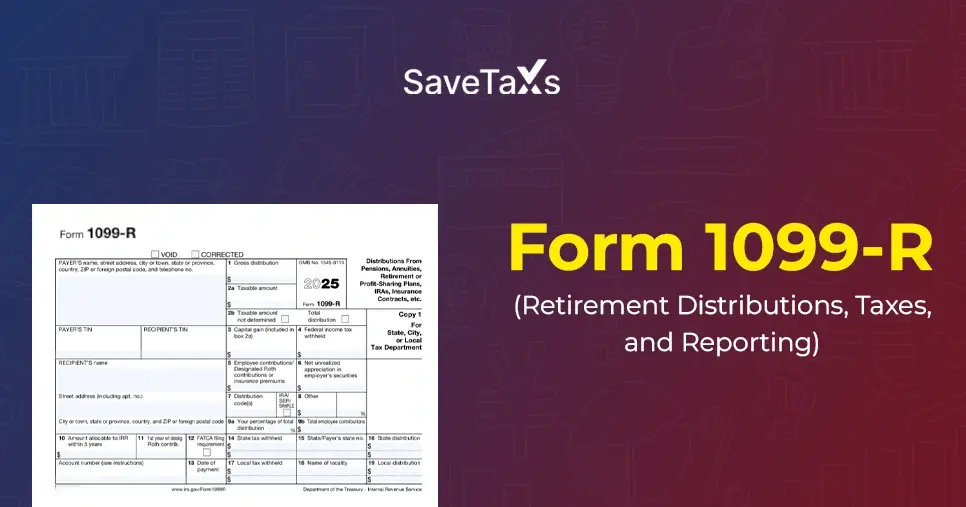

Tax Consultancy Services

USA

Tax Consultancy ServicesExpert CA support for tax filing, GST, and compliance with maximum savings.

USA–India Tax ConsultancySpecialized NRI support for cross-border tax, DTAA, and USA–India filings.

Tax ITR ConsultantRead More -

ResourcesTax Consultancy Services

Expert CA support for tax filing, GST, and compliance with maximum savings.

USA–India Tax ConsultancySpecialized NRI support for cross-border tax, DTAA, and USA–India filings.

Tax ITR ConsultantRead More - About Us

- Blogs

- Contact Us