Form 1040-X is used by individuals who need to correct an error made in their previously filed federal tax returns. Correcting your tax returns is known as amending, and doing so is important if you want to get the refunds you deserve. The Form 1040-X allows you to fix errors in the filing status of the taxpayer, the number of dependents, or omissions of deductions or credits.

Please ensure that this form is not used to correct simple mathematical errors made on the tax return, as the IRS itself corrects such mistakes during the processing of our return.

In this blog, we will tell you all about Form 1040-X, including its purpose and how you must file it.

- The IRS 1040-X Form is filed by taxpayers who wish to amend their previously filed annual tax return.

- Using 1040-X Form, you can amend your tax return if you filed using any of these forms: Form 1040, 1040-SR, 1040A, 1040EZ, 1040EZ-T, 1040NR, or 1040-EZ.

- To receive a refund, you must file Form 1040-X within three years of the original return's filing date. Now, if the tax was paid, the time frame is two years.

- For every tax year, a separate Form 1040-X will be filed.

- IRS permits you to e-file Form 1040-X if you e-file the corresponding federal tax return. If not, simply mail it in.

- Lastly, please include any supporting or unsubmitted documents along with the form.

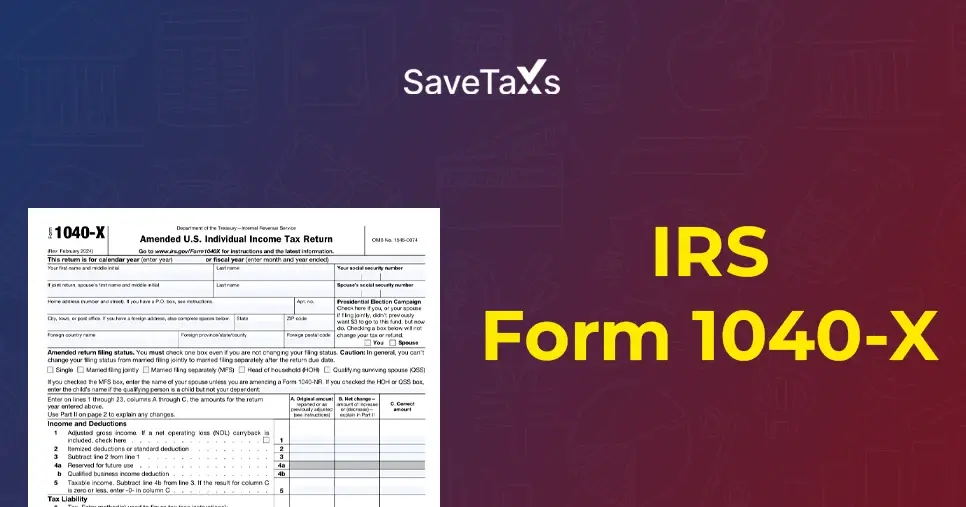

What is Form 1040-X?

Form 1040-X: Amended U.S. Individual Income Tax Return. This form is used by taxpayers who want to correct errors made in their previously filed federal income tax returns.

Common mistakes that you can correct with the help of this form include errors in the tax filing status of the taxpayer, numbers or dependents mentioned are wrong, or the omission of tax deductions or credits.

An NRA (Non-Resident Alien) can also use Form 1040-X, Amended U.S. Individual Income Tax Return, to rectify a mistake on their original Form 1040-NR. It is filed to make corrections to a previously filed return instead of replacing it entirely.

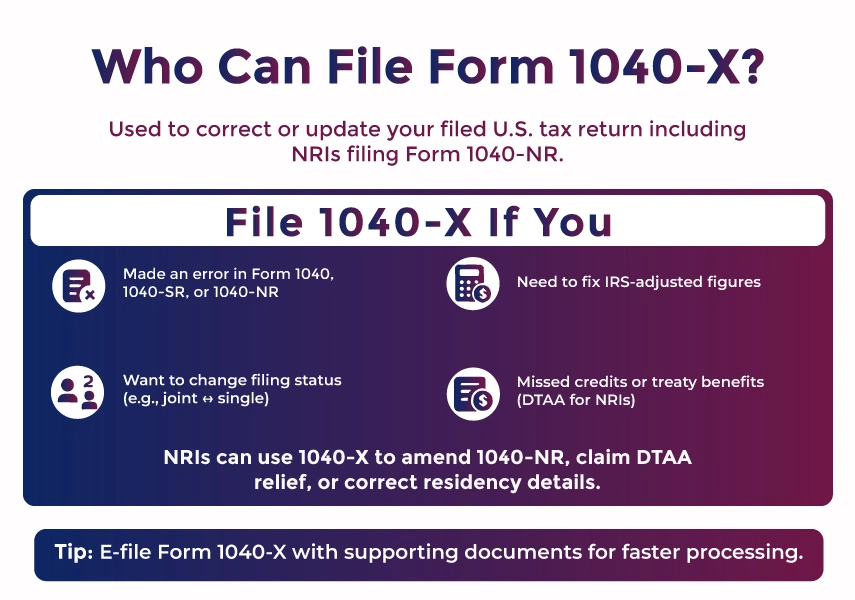

Who Can File Form 1040-X?

Tax form 1040-X is filed by anyone who has already filed a federal tax return and needs to amend or make changes for any of the following reasons.

To make amendments in Form 1040, Form 1040-SR, or 1040-NR. Most taxpayers use any one of these three tax forms to file their tax returns.

To make an election after the income tax return deadline. For example, a married taxpayer can elect to file jointly with their spouse or an individual as well.

To make changes in the amount that was adjusted previously by the Internal Revenue Service.

To make a carryback claim due to unused or loss credit.

Information You Cannot Miss

One important document that you cannot miss while preparing your Form 1040-X is a copy of the original tax return that you will be amending. On the amended tax return, Form 1040-X, you can transfer this information.

- Social security number (SSN).

- Your income tax filing status

- The Gross Income

Additionally, related to the changes or amendments that you will be making, you may need documentation to support them. If you have added schedules to your original tax return, you do not have to complete them again on your amended return, unless the correction causes the number on the schedules to change.

How To File Tax Form 1040-X?

The entire process of filing a Tax Form 1040-X is simple. The following steps outline the process.

Step 1: Collect all the relevant documents.

You must gather your original tax return copy, if available, and any new deductions that are added to your amended return.

For example, if you need to amend the income tax return, you must have a new or amended 1099 form or W-2 form.

If there is a case where you missed claiming a vital tax deduction or a tax credit, then you will need the documents to support the claim of the missed credit or deduction.

Step 2: Get Your Forms Right

For amending your return, you will need Form 1040-X. Additionally, you may need to complete additional forms that will be affected by the changes.

For example, you will need a copy of Schedule A if you are changing your itemized deductions.

If you are making any amendments related to revenues or expenses from businesses or trades, you will need Schedule SE and a Schedule C.

Schedule D may be required if you plan to adjust your capital losses or gains.

Step 3: Fill out Form 1040-X

This Amended US Individual Income Tax Return Form has three columns

Column A: Under this, you will enter the numbers that were reported in your previously filed tax return. To fill this column, you can use the copy of your original income tax return form that you gathered in step 1.

Column B: This column is used to show the net change. Meaning you will never have either the negative or the positive difference between the original and amended amount in column B.

Let us say, for example, that you forgot to claim a deduction worth $ 1,000. Then, in this column, you will enter "+$1000" in the appropriate line of the column.

Column C: This column of the form showcases the correct amount. Just add or subtract the amounts of Column A and Column B, and enter the final and amended amount here.

An Example

Here is a practical example to illustrate how Columns A, B, and C of the 1040-X Form work.

Let us say Mr. Aman filed their original tax return with the gross Income (AGI) of $70,000. He later realized that he had forgotten to report an additional $4,000 in income.

This is how he will fill the columns of Form 1040-X

Column A (The originally filed amount): $70,000

Column B (Net Change): +$4,000

Column C (Correct Amount ): $74,000

Step 4: Submit the amended Forms

The final step is to submit the amended forms. Now you can e-file the amended tax form as well, but this is only applicable if the originally filed tax return was also e-filed. If not, then print the complete Form 1040-X, attach all the necessary supporting documents, which can be as follows:

- Any amended 1099 or W-2 forms.

- Other schedules or forms that have been changed. For example, adding Schedule A if the taxpayer has updated its itemized deductions.

- You must also add any notices that you have received from the IRS that are associated with your amended return.

Now, you can either electronically file the return or mail all he documents and the forms to the address provided in the instructions.

Form 1040-X Deadline

The Internal Revenue Service has a limit on the amount of time that you have to file an amended income tax return. The deadline date for filing taxes for the majority of taxpayers is:

- Within three years from the date of the original tax filing deadline.

- Within two years of actually paying he tax for that particular year.

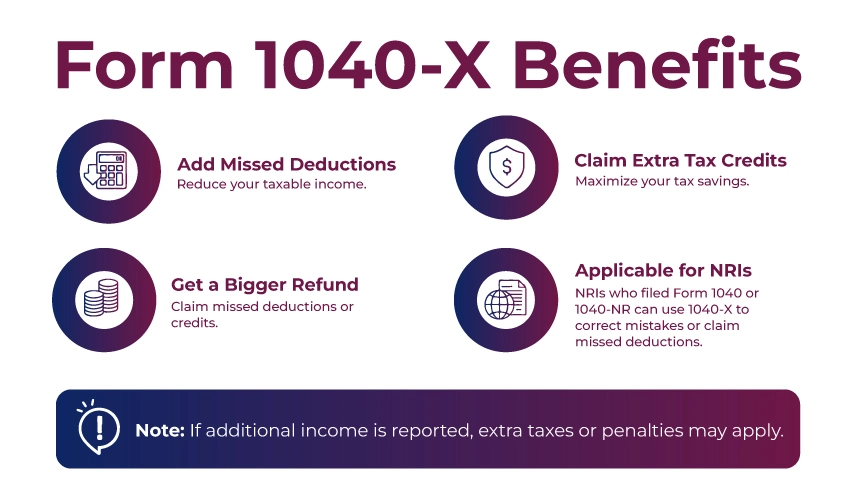

What are Form 1040-X Benefits?

The benefits of filing the 1040-X form are incredible for those who have missed a critical deduction, exemption, or tax credit on their previously filed return. Several advantages come with amending your tax return, such as.

- Getting a bigger and better refund.

- Claiming the additional tax credits.

- Taking additional deductions.

However, please ensure that you are also required to report any additional income that you might have not included in your original return. If this happens, your taxable income may increase, and you will have a balance owing. As a taxpayer, you will be responsible for paying the outstanding amount, any applicable penalties, and fees.

The Bottom Line

IRS Form 1040-X is used by those taxpayers who wish to amend their previously filed income tax return. The returns are amended to correct any errors or update previously provided information. When using this form, the taxpayer will provide all relevant details about the changes being made and explain those amendments.

However, when filing amended returns, you have to be very careful because this time, one small error and boom, you might attract a few penalties or fines. The IRS advises taxpayers to seek the help of a tax professional who has expertise in U.S. taxation. One such trusted expert in the US taxation industry is Savetaxs.

Savetaxs has by now helped thousands of US residents and citizens file their annual tax returns with complete accuracy and within the deadline. Exerts here brings a combined experience of thirty years to the table, hence with Savetaxs, complete precision is guaranteed.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- Form 1099-NEC: Purpose and Requirement

- What is Form 4868: IRS Tax Extension?

- What is Schedule 1: IRS Form 1040?

- What is IRS Tax Form 1120?

- What is an S corp - Overview, Taxes and How To File

- IRS Form 1099-INT: What It Is & Who Needs to File It?

- Understanding Form 1065 (Partnership Tax Return)

- What is Form 1040-NR

- All You Need to Know About a W-2 Form

- W-4 Form: What It Is and How to Fill It?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756816946.webp)

_1767003468.png)

_1754046271.webp)