The IRS Form 1040EZ was used by taxpayers with basic tax situations. This form was the most simplified and shortest version of IRS Form 1040. However, in 2018, this was discontinued by the US government. Considering this, Form 1040 was modified, and IRS Form 1040-SR was introduced.

Want to know more about this form? Well, then you are on the right page. Here, the complete blog is about this Form and why it is no longer used. Also, it consists of information about other types of 1040 Forms. So, read on and gather all the details about it.

- With basic tax situations, IRS Form 1040EZ was the most straightforward and simplified version of Form 1040.

- In the tax year 2018, this was discontinued. It was replaced by the modified version of Form 1040.

- Form 1040EZ was used by taxpayers with single or married filing jointly status, and had a simple tax return. Additionally, their taxable income was less than $100,000, with no more than $1500 interest income and zero dependents.

- IRS Form 1040 is used to report tax deductions, income, and credits to determine your tax bill. Also used to know whether you owe money or have a tax refund.

- Form 1040-SR is for taxpayers who are 65 or above. It includes the Standard Deduction table and a larger font printed on the form.

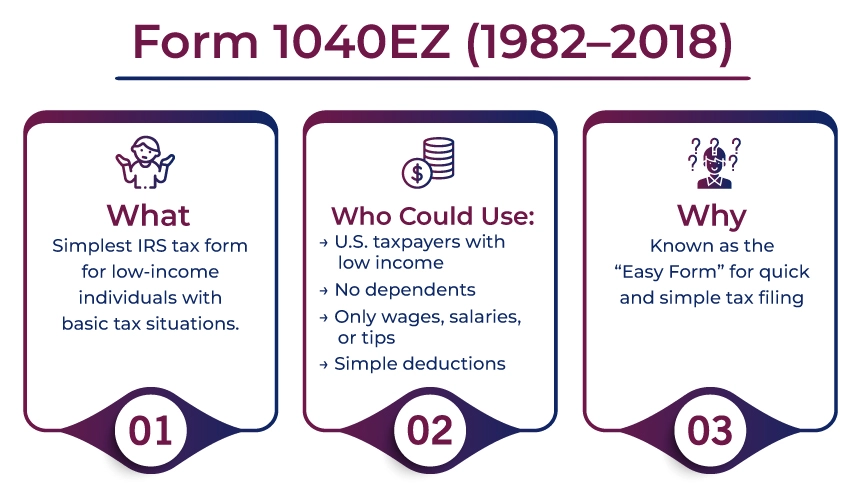

What Was Form 1040EZ?

To simplify the tax filing process, in the year 1982, the Internal Revenue Service (IRS) introduced Form 1040EZ. It was generally used by individuals who had lower incomes and simple tax situations. This form was also called the "easy form." It is because it was the easiest of the six sections federal tax returns of the time.

So, this was all about Form 1040. Moving ahead, let's know what the eligibility criteria were to fill out this form.

Eligibility for Form 1040EZ

To qualify for filling out the IRS Form 1040EZ, your taxable income should be less than $100,000. Additionally, on your taxable income, you should get less than $1500 interest income and have zero dependents. Further, there were other requirements to fill out this form. These were as follows:

- If married filing jointly, the age of both spouses should be under 65 at the end of the tax year.

- Taxpayers were not allowed to claim tax deductions for tuition fees, student loan interest, itemized deductions, or educator expenses.

- Tax credits for education, retirement savings, and health coverage were not allowed.

- In any Chapter 11 bankruptcy case, a taxpayer could not be a debtor that was filed after October 16, 2005.

- Not allowed to file the form if the taxpayer earned interest income or was a nominee in the interest income.

- The taxpayer does not get any advance payments of the premium tax credit provided for health coverage plans that were sold on the marketplace.

- Should not owe any household employee taxes on paid wages to household employees.

- The taxpayer was not allowed to get any advance earned income credit (EIC). Although they were allowed to claim it while filing Form 1040EZ.

These were some of the eligibility criteria that taxpayers needed to consider while filing Form 1040EZ. Moving further, let's know the limitations of this form.

What Were the Limitations of Form 1040EZ?

The key reason behind discontinuing the IRS Form 1040EZ was its limitations. The IRS chose the building block method, allowing taxpayers to easily add credits or allowances for which they qualify. Additionally, the form also had several other limitations. These were:

- This form was not available for those who have an income of less than a certain amount. Also, the eligible income types were limited.

- Anyone having income from sources other than wages, like tips, salaries, fellowship grants, or taxable scholarships, could not fill this form. This prevented any individual from using this form who gets foreign income or files taxes using a foreign address.

- Additionally, any taxpayer that have a dependent by their side was not allowed to fill out this form.

- Further, taxpayers using Form 1040EZ were not allowed to itemize their tax deductions. Also, they were not allowed to claim other tax deductions, such as individual retirement accounts (IRA) contributions.

These were some of the key limitations that resulted in discontinuing the Form 1040EZ. Moving ahead, now let's know about Form 1040.

What Is Form 1040?

IRS Form 1040 is one of the official documents used by taxpayers to file their annual federal income tax return. As mentioned above, this form has replaced the IRS Form 1040EZ since the 2018 tax year. This form consists of different sections where you can mention your tax deductions, credits, and income.

This further assists the form in determining the tax bill and whether any money is owed by you or have a tax refund. Also, depending on the income type you report and the tax deductions or credits you claim, you may need to fill out other forms.

This was all about Form 1040 and the information stated in it. Moving further, let's know the difference between the IRS Form 1040EZ and Form 1040.

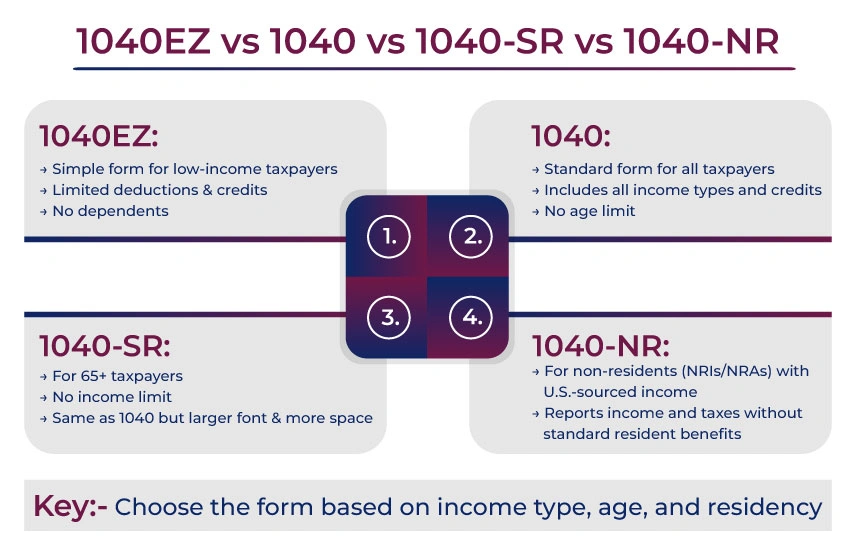

Form 1040EZ vs. Form 1040

Before the IRS 1040EZ was discontinued by the government, it allowed you to claim a handful of deductions and credits on your income tax return. For instance, while filing your tax return, you were also claiming the earned income tax credit (EITC) and standard deduction, you could fill out this form.

Further, in Form 1040, you can mention the information of dependents, while 1040EZ does not allow you to have one. Additionally, the IRS Form 1040 resembles Form 1040EZ to claim the following income:

- Tips

- Wages

- Salaries

- Unemployment compensation

- Taxable scholarships or grants

Moreover, compared to IRS Form 1040EZ, Form 1040 has more income categories. It includes items such as alimony and Social Security benefits, with the ability to claim more tax deductions.

So, these were the key differences between Form 1040EZ and Form 1040. Moving ahead, now let's know the difference between Forms 1040EZ, 1040, and 1040-SR.

Form 1040EZ vs. 1040 vs. 1040-SR

Forms 1040 and 1040-SR denote the IRS Form 1040EZ. This form was used to simplify the tax return process if you fulfill the specific conditions and have a simple tax situation.

Now, with Forms 1040 and 1040-SR, you have the options; for most taxpayers, the selection is still simple. The regular IRS Form 1040 includes more categories of income, credits, and deductions. Considering this, Form 1040-SR is only for taxpayers who are 65 or older.

If you fulfill the age criteria, then the IRS Form 1040-SR Tax Return for Senior Citizens is the same as Form 1040. However, this form has a larger font along with the Standard Deduction table printed on it. Also, the taxpayer gets more space to fill in the details in the Form 1040-SR if they fill it out by hand. Moreover, unlike Form 1040-EZ, Form 1040-SR has no income limit.

So, this is how Form 1040EZ is different from Forms 1040 and 1040-SR. Now, moving further, let's look at the different sections included in Form 1040EZ.

What Were the Different Sections Included on Form 1040EZ?

While Form 1040EZ is no longer used by taxpayers, let's have a look at the sections that were included in it. This will provide you with an overview and a better understanding of the form.

Personal Information

Like all IRS tax forms, the top of the Form 1040EZ needs you to mention your personal information. It includes:

- Your name

- Your complete residential address

- Social Security number

Sources of Income

The sources of income you can mention in the IRS Form 1040EZ include:

- Wages

- Unemployment compensation

- Salaries

- Tips

- Alaska permanent fund dividends

- Unemployment compensation

Tax, Payments, and Credits

In this section, you mention the tax payments that have already been made through the employer withholding or estimated tax payments. Considering this, from your paycheck, if you had federal income tax withheld, you will get a Form W-2 from your employer. This form consists of the information on the total amount withheld.

Additionally, in this section, you can also claim EITC if you qualify for it. However, these were the only tax credits that were available to claim in this form. Further, before calculating your taxable income, you were required to add up all your credits and payments. Also, to know your taxable income and owed tax, you could use the tax tables given in the instructions.

Calculating Due Amounts and Refunds

In case your total tax credits and payments were more than the tax on your income. In this scenario, for overpayment, you were eligible to get the refund. If you calculated a tax refund, you could mention your bank details and get it directly into your account. However, if you have underpaid taxes, then for the remaining balance, you are required to make the payment.

Singing Your Return

Without signatures, an income tax return is not valid. While it may seem essential, many taxpayers sometimes forget to sign their tax returns before sending them to the IRS. Considering this, in the last section, you need to surely sign the form. Further, if you are married and file taxes jointly, then your spouse also needs to sign the form. Also, if you file your tax return electronically, then you would sign it electronically.

So, these were the key sections in the Form 1040EZ that were required to be filled out by the taxpayers.

Final Thoughts

Lastly, the IRS Form 1040EZ was the tax form that taxpayers used previously to file their tax return. It was the most straightforward and simplified tax form. However, due to its limitations, like a specific income limit, fewer credits, and more, this form was discontinued in 2018. After that, with certain changes, Form 1040 was introduced to taxpayers along with Form 1040-SR. The above blog was all about Form 1040EZ and why it is no longer used. Hope that after reading it all, your queries about this form get solved.

Furthermore, if you still have some confusion or are facing issues in filing your tax returns, contact Savetaxs. We have a team of experts who can assist you in filing your tax return as per your situation. Also, we can provide you guidance in tax planning and other tax-related issues. So, connect with us today and solve all your tax-related doubts with ease.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- W-4 Form: What It Is and How to Fill It?

- Understanding Form 1065 (Partnership Tax Return)

- What Is The Difference Between a 1099 and a W-2 Tax Forms

- All You Need to Know About a W-2 Form

- What is Form 4868: IRS Tax Extension?

- Form 1099-NEC: Purpose and Requirement

- Everything to Know About the 1040-SR Form for Filing Seniors

- IRS Form 1099-INT: What It Is & Who Needs to File It?

- What is Form 1040-NR

- What is IRS Tax Form 1120?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767077669.webp)

_1763555884.webp)

_1767780160.webp)

_1768304909.webp)