The IRS Form 1099-R is used to report the distribution income received by the taxpayer from their retirement accounts. It includes profit-sharing plans, annuities, pensions, individual retirement accounts (IRAs), and more. This form helps the IRS track the income received by individuals from their retirement plans.

Are you also receiving money from your retirement account? It means that during the tax season, you will also get this form. But before that, it is vital to have basic information about it. Read on the blog. In this, we have covered all the details of Form 1099-R from what it is to who should file it.

Key Takeaways

- IRS Form 1099-R states the distributions from retirement plans, pensions, annuities, IRAs, and more.

- Any individual in the US who receives a distribution of $10 or more will surely get this form.

- Form 1099-R is given by the plan issuer.

- This form is also used to mention death or disability benefits that may be paid out to an estate beneficiary.

- Additionally, Form 1099-R also records loans and account rollovers.

What is Form 1099-R?

The IRS Form 1099-R is known as "Distributions from annuities, pensions, profit sharing plans, retirement, insurance contracts, or more. As mentioned at the start of the blog, this form is used to report the distribution of retirement benefits. It includes income received from annuities, pensions, or other retirement plans.

Furthermore, the IRS Form 1099-R is an informational return form. You used this form to report income on your federal income tax return. Additional variations of this form include:

- Form CSA 1099-R

- Form CSF 1099-R

- Form RRB 1099-R

Generally, most of the private and public pension plans that are not part of the Civil Service System use the Form 1099-R. Additionally, if you get a distribution of $10 or more from your retirement plan, then surely you will receive Form 1099-R.

This was all about Form 1099-R. Moving ahead, let's know about the different types of distributions included in this form.

Pension and Annuity Payments

Employer-based retirement benefits are generally an extension of compensation. The employer arranged this for the employee. On most of the retirement plan contributions, the income tax is deferred. It means that until the amount is withdrawn, the taxpayer does not pay tax on the contributed funds.

Usually, annuity distributions and pensions are for disabled employees and retired employees. Additionally, in some cases, it may also be received by the beneficiary of a deceased employee.

- Before distribution, if no after-tax contribution was made to the pension plan, the whole amount is included in taxable income.

- In case after-tax distribution is made to a pension or annuity, only the distribution portion is taxed.

Furthermore, against the pension plan, if you take a loan, and during the repayment of the loan, you pay interest. In this scenario, the loan will not be considered as a distribution in many cases. However, if you do not make the loan payments on time, Form 1099-R will be issued to you.

Rollovers

In terms of finance, rollovers mean transferring retirement funds from one plan to another without payment of taxes on the transferred money. The specific meaning of rollovers depends on the context it is used. However, it always includes an extension, transfer, or deferral of a financial position or product.

- Direct transfers are generally stated on Form 1099-R. Using the G or H distribution codes, they are mentioned in box 7.

- Indirect rollovers happen when the possession of the retirement funds is re-deposited by the owner into another qualified retirement account.

To avoid paying taxes on the funds and possible early distribution penalties, generally, funds should be rolled over within 60 days of distribution into a qualified account. Generally, within 12-month periods, you can only do one indirect rollover. Here, it does not matter how many types of IRA accounts you have.

Furthermore, funds that are distributed directly are taxed at 20% federal income tax withholding. This means that to make up for the 20%, taxpayers need to add additional funds. Additionally, send it to the IRS so that the amount of the rollover can be equal to the total distributed amount.

Also, when a rollover meets all the Internal Revenue Service guidelines, you do not need to pay tax on the distribution. However, you still need to report the amount on your income tax return and state it as a rollover.

Loans

Some companies permit employees to take a loan against their pension plans. Generally, the repayment of these loans is done with interest, and they are not counted as distributions. Considering this, Form 1099-R is issued when the repayment of the loan is not made on time.

When this happens, the amount that is not paid is stated as a distribution. Considering this, on Form 1099-R, it is mentioned on the distribution code L. These are deemed taxable income and face early distribution penalties.

Early Distributions

Many benefits before the taxpayer turns age 59 1/2, paid off, are considered as early distributions. On early distribution, an extra 10% federal tax is imposed. It is done to prevent the misuse of these retirement funds. Apart from this, a state penalty is also imposed by some states on early distributions.

Furthermore, the additional tax applies to the whole taxable distribution amount, unless there are any exceptions to it. Considering this, some common exceptions include:

- Death

- Disability

- IRS levy

- Medical expenses, more than 7.5% of AGI

Under the qualified domestic relations (divorce) order, if payments are made to another payee, an exception is applicable.

This was all about the income distributions included in this form. Moving ahead, let's know who can file Form 1099-R.

Who Can File IRS Form 1099-R?

As per the IRS guidelines, an entity that manages any of the below-stated accounts is responsible for filing out the Form 1099-R. This form applies to each distribution that is $10 or more.

- IRAs, both traditional or Roth

- Retirement plans or profit-sharing

- Charitable gift annuities

- Pensions, annuities, insurance contracts, or survivor income benefits plans.

- Under life insurance contracts, permanent and total disability payments

Furthermore, like most 1099 Forms, Form 1099-R should also be given to recipients by January 31 of the following tax year. Anyone who gets this form needs to mention the amount stated on the form in their tax return and pay taxes on it.

Moreover, if you receive this form, not all distributions you received from tax-deferred or retirement accounts are subject to tax. An example of it is a direct rollover you receive from a 401(k) plan to the IRS.

This was all about who needs to fill out Form 1099-R. Moving further, let's know what information is stated in this form.

Information Included on Form 1099-R

The IRS Form includes the following information. Here we have mentioned a few essential box numbers that often ask tax questions.

- Box 1: This box reports the total distribution amount from an annuity or retirement plan. Here, the amount mentioned is the total amount of dollars you received from your retirement plan. Depending on several factors, it can be taxable or not.

- Box 2: This box states the taxable distribution amount as mentioned by the payer. Therefore, the annuity or retirement plan has determined what amount should be included in the income. On the Form 1040, this amount should be mentioned on line 4b or 5b.

- Box 4: This box mentions the withheld amount that the payer takes from the distribution. This amount is vital to be considered by the receiver. It is because it states the tax amount that they have already paid on the distributed amount.

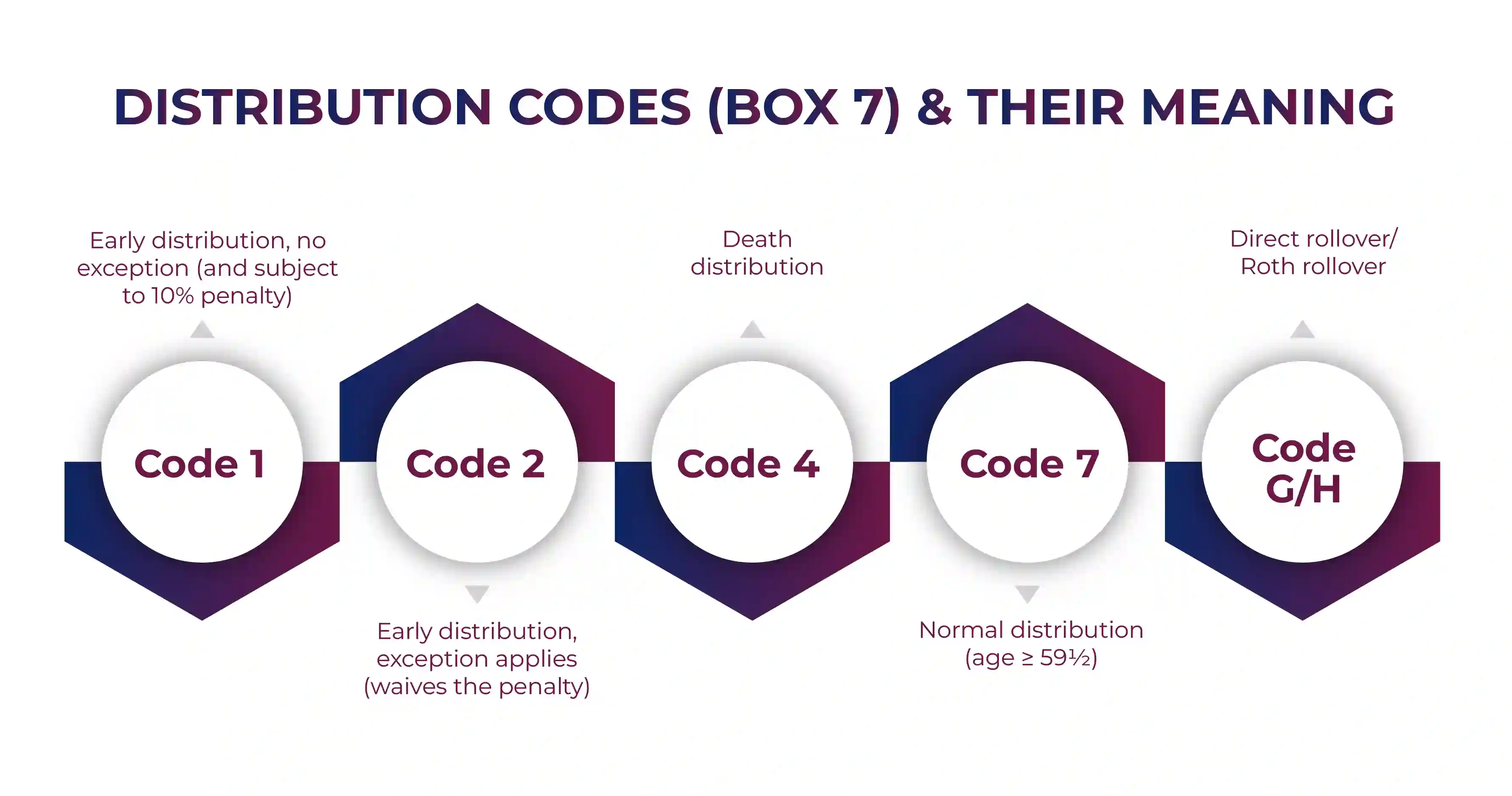

- Box 7: This box is a distribution code. It describes the distribution type that the taxpayer has taken from the payer. This code further helps in determining the tax liability of the distribution. If the payer knows that the distribution was a rollover or a loan, it will be described as a letter or a code number. On the back of the Form 1099-R, these codes are described.

- Box 9b: The box 9b states your investment earned for a life annuity in a 403(b) or a qualified plan. The amount you invested in the plan is already taxed. In the investment plan, it is your basis and is tax-free. Additionally, a portion of every distribution you get from this will provide you with a return basis. Furthermore, to know the taxable distribution amount as stated in the Form 1099-R, it is vital for you to know this number.

It was all about the boxes stated in the Form 1099-R that you generally need to consider. Moving further, let's know the other information stated in this form.

- Name and identifying information of the payer, along with the federal identification number.

- Name and identification number of the recipients.

- 1- Gross distribution

- 2a- Amount taxable- this will help you in knowing whether you have paid taxes on the 1099-R distribution amount..

- 2b- Taxable amount not estimated and total distribution

- 3- Capital gain

- 4- Federal income tax withheld

- 5- Designated ROTH contributions/ Employee contributions or insurance premiums

- 6- Net unrealized appreciation securities of the employer

- 7- Distribution code- it shows your distribution categories

- 8- Other

- 9a- Total percentage distribution

- 9b- Total contributions of the employee

- 10- Amount allowable to IRR within five years

- 11- 1st year of designated Roth contributions

- 12- FATCA filing requirement

- 13- Payment date

- 14- State tax withheld

- 15- State number of state/payer

- 16- State distribution

This is the information you will get in Form 1099-R. Moving ahead, let's know about the different types of distribution codes mentioned in this form.

1099- R Distribution Codes

As stated above, there is a code field mentioned in the Form 1099-R. It helps in identifying the distribution type. This is mentioned on Box 7 of the form. Further, let's know about these codes.

- Code 1: Early distribution with no known exception

- Code 2: Early distribution with applicable exception

- Code 3: Disability

- Code 4: Death

- Code 7: Normal distribution

- Code 8: Corrective taxable refunds in the current year

- Code G: Direct Rollover to a qualified plan, 403(b), government 457(b) or IRA

- Code L: Loan treated as a distribution

- Code M: Qualified Plan loan offset

Furthermore, based on the amount mentioned in Box 2a of the Form 1099-R, Code 4 is taxable.

Final Thoughts

The Form 1099-R is an essential tool. It helps in tracking the taxable retirement distribution. Additionally, also certifies that proper tax information is received by the IRS. Here, the complete blog was about this form. From what it is used for to who should file it, all the information is stated in this blog. Hope after reading it, you get all the understanding of this form.

Furthermore, if you still have some confusion related to this form, connect with Savetaxs. The experts in our team will solve all your doubts and provide you clear understanding of this form. They have expertise in US taxation, and if you want can also help you with your tax returns.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- What is IRS Form 1099-A?

- What Is The Difference Between a 1099 and a W-2 Tax Forms

- 1099 Form: Overview, Types, Uses, and Who Receives It.

- IRS Form 1099-Q: Payments from Qualified Education Programs

- What is IRS Form 1099-C: Cancellation of Debt

- Form 1099-NEC: Purpose and Requirement

- Understanding the Purpose of IRS Form 1099-MISC

- Form 1099-B: Proceeds from Broker Transactions

- IRS Form 1099-INT: What It Is & Who Needs to File It?

- What is a 1099-G Tax Form?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766492717.png)

_1760618042.webp)

_1767077669.webp)