Form 1099-C is used to report canceled or forgiven debts of $600 or more, and the IRS often considers those funds income. If you have received a 1099-C form. Don't worry, keep reading this blog to know when canceled debt is considered taxable income. Also, we will learn about the applicable exceptions, how to report them to the IRS, and much more.

Key Takeaways

- Form 1099-C reports canceled or forgiven debts of $600 or more. Some canceled debts are not taxable.

- As per the IRS, nearly any debt you owe that is cancelled, forgiven, or discharged becomes taxable income to you.

- The lenders need to submit the form to the IRS and provide a copy to the taxpayer/debtor.

- In most cases, if you get a Form 1099-C: Cancellation of Debt" from the lender that forgave the debt, you need to report the canceled debt amount on your tax return as taxable income.

- In case your debt was discharged in a Title 11 bankruptcy proceeding, such as a Chapter 7 or Chapter 13 case. Then, you are not liable to pay taxes on that debt.

- Similarly, you can avoid taxes on debts that you can prove to the IRS that you were insolvent at the time the debt was cancelled.

What is Cancelled Debt?

If your debt has become so vast that you are unable to pay it. Then, the only option you have to cope is to request a debt cancellation with your lender. However, the next major challenge might occur after this, which can be a hefty tax bill. In most cases, if you get a Form 1099-C from a lender, you must report the amount of cancelled debt on your tax return as taxable income. Nevertheless, certain exceptions are applicable.

How Does the IRS Classify Cancelled Debt?

It can be quite unfair that a debt you successfully canceled or negotiated backfires on you as taxable income. However, the IRS classifies the canceled debt as income. It is because you acquired a benefit without actually paying for it.

You are not liable to pay tax on the money you receive when you first borrow it. The reason behind this is that you are contractually obligated to repay the amount.

If such a contract gets cancelled without repaying the amount, the money is all in your hands. Now, because you basically obtained the money for free, your obligation to repay it gets cancelled, which usually makes it taxable income.

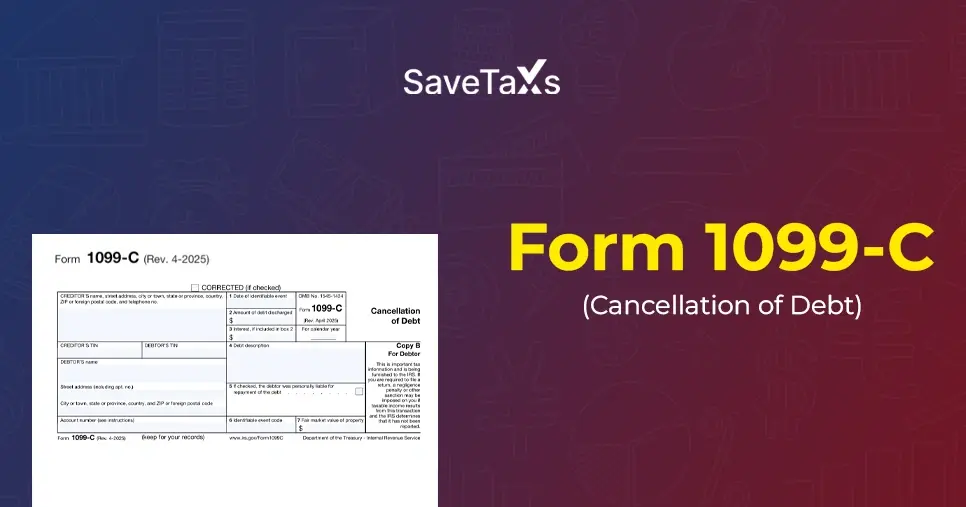

What is Form 1099-C?

As per the IRS, your debt obligation that is cancelled, forgiven, or discharged becomes taxable income to you. The lender who forgave the debt is responsible for sending you a Form 1099-C: "Cancellation of Debt". These are some common situations when you might receive a Form 1099-C:

- Foreclosure

- Repossession

- Abandonment of property

- Return of property to a lender

- Charge-off of a credit card balance

- Loan modification on your primary residence.

What is Included on Form 1099-C?

Form 1099-C covers a wide range of information related to the loan or debt. The left side of the form is allocated to finding out the lender and the debtor. The right side is separated into various boxes, all clearly labeled. The information filled in here includes (by box number):

- A description of the debt

- The amount of the debt

- The date when the debt was forgiven

- The amount of any interest mentioned in the debt

- Whether the debtor was personally responsible for the debt

- The fair market value of any property in the event of a foreclosure

- The reason behind the creditor submitting the form, such as a balance of $600 or more.

Ensure to enter the debt's account number in the bottom left corner of the form.

Which Debts Don't Require 1099-C?

The lenders must send copies of Form 1099-C to debtors by the 31st of January of the year after the repossession or foreclosure took place or the debt was canceled. You might not receive the Form 1099-C if the canceled debt is less than $600.

Nevertheless, you need to report the sum on your tax return, even if your debt was only $1. Since it is still one dollar you didn't have before the cancellation happened. Also, in case your canceled debt is not taxable, you might not get the form, as some debts aren't. A lot of debts get discharged because you file for bankruptcy, and such debt discharges are exempt from taxation.

Under the American Rescue Plan, student loans forgiven between the 1st of January, 2023, and 31st of December, 2025, are not liable for taxation and don't need a Form 1099-C. Furthermore, the Public Service Loan Forgiveness Program permits debt exemption for certain government employees working at non-profits.

**Tip: Using the Mortgage Forgiveness Debt Relief Act, you can exclude nearly $2 million in forgiven mortgage debt if you were married and filing jointly. Also, up to $1 million for other filing statuses for tax year 2007-2020. Furthermore, the Consolidated Appropriations Act of 2020 extended the exclusions of qualified mortgage debt up to $750,000 for tax years 2021-2025.

Mortgage Forgiveness Debt Relief Act

The Congress passed the Mortgage Forgiveness Debt Relief Act because of the significant decline of the real estate market that started in 2007. If you were married and filing jointly, you can exclude nearly $2 million in forgiven mortgage debt for calendar years 2007 through 2020. Also, up to $1 million for other filing statuses.

This is also applicable to debt that was discharged in 2021, if there was a written agreement entered into in 2020. Additionally, it also applies to mortgage debt forgiven via a mortgage restructuring or in connection with a foreclosure.

The Consolidated Appropriations Act (CAA) was enacted on the 27th of December, 2020. It was signed as a measure to offer relief to those who are affected by the COVID-19 pandemic. The CAA extends the cancelled qualified mortgage debt exclusion from income tax for years 2021 through 2025. However, the maximum limit of excluded forgiven debt is up to $750,000.

Bankruptcy and Insolvency

You can still avoid taxation on the forgiveness of a debt, even if you get a Form 1099-C from a lender. Also, you will not be liable to pay taxes on debt that was discharged in a Title 11 bankruptcy proceeding. Such as a Chapter 7 or Chapter 13 case.

If you can prove to the IRS that you were **insolvent at the time the debt was cancelled. Likewise, you can avoid taxes on that debt. Some other types of debt can also prevent taxation in the event of cancellation. This includes qualified farm indebtedness and qualified real property business indebtedness.

**Insolvent: It happens when your financial liabilities are more than your assets.

To Conclude

Understanding Form 1099-C is crucial for managing tax obligations related to canceled debt. Do not panic if you have received this form. Check the details thoroughly and determine whether the amount is taxable, and after that, take necessary actions to report or exclude the forgiven debt accurately.

When in doubt, consider seeking help from the experts at Savetaxs to ensure compliance and minimize potential tax liabilities. We have been helping thousands of individuals with taxation-related queries and issues. Our satisfied base of clients speaks about the quality of service we offer.

Savetaxs believes that you should not wait when in stress due to a tax-related issue, which is why we serve our clients 24*7 across all time zones. So, connect with us whenever you need assistance and enjoy the best-quality service without any hassle.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Want to read more? Explore Blogs