- What is Schedule C IRS Form (Form 1040)?

- Who Needs to File Schedule C Tax Form?

- What Does Sole Proprietorship Mean?

- Does an LLC Need to File a Schedule C?

- Is Schedule C Only Meant for Self-Employed?

- What Information is Included on a Schedule C?

- What Does Ordinary and Necessary Expense Mean?

- How Do You Fill Out Schedule C Form?

- What is Schedule C-EZ?

- Is Schedule C the Same as a W-2?

- Is Schedule C the Same as a 1099?

- Do I Need to Report My 1099-NEC Income on Schedule C?

- To Conclude

Schedule C form can be used by small business owners and self-employed individuals to report profits or losses acquired from a business. Additionally, sole proprietors also must file this form in the US when filing their annual tax returns. You can attach Schedule C to your regular 1040 form when filing your taxes.

If you are someone who recently became self-employed or started a new business. Then, keep reading further to learn more about Schedule C. In this blog, we will walk you through how to use Schedule C to report your business income, and much more.

- Schedule C is used by a sole proprietor or a single-member LLC to report income and expenses from their business.

- You might need to use Schedule C to report income and expenses for your trade or business if you are self-employed or receive 1099-NEC forms.

- The expenses have to be ordinary and mandatory for your business to qualify for a deduction on Schedule C.

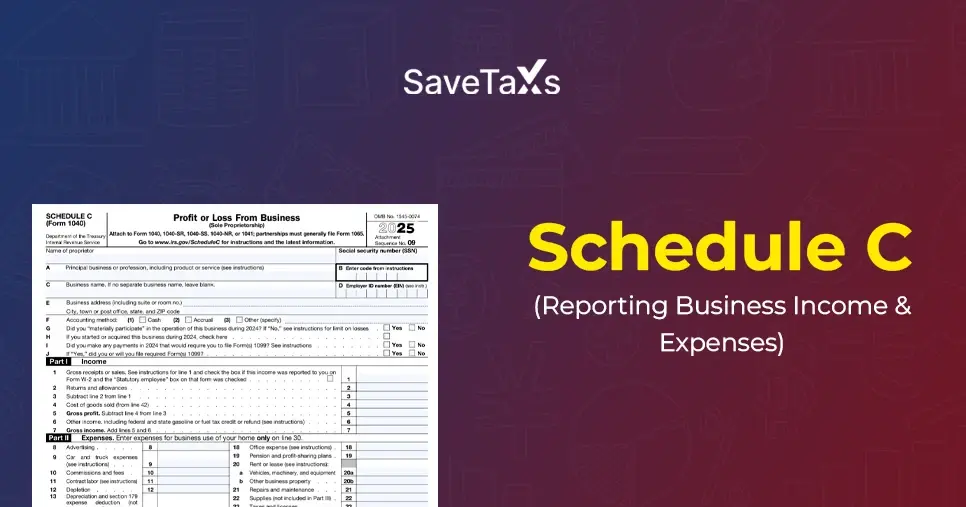

What is Schedule C IRS Form (Form 1040)?

IRS Form Schedule C, Profit or Loss from Business, is a tax form that you file with your Form 1040. Taxpayers use it to compute and report profits and losses from the business they operate or from the profession they work as a sole proprietor.

The resulting profit or loss is treated as "self-employment" income. If you fill out Schedule C, you generally need to fill out Schedule SE, "Self-Employment Tax". You can use this form to compute your Medicare tax and Social Security taxes depending on your self-employment income. After which, you will report the income on Form 1040, Schedule 2, Part II, other taxes.

Also, if you haven't completed the paperwork to become an **LLC (Limited Liability Company) or a corporation, then you are likely a sole proprietor and need to file a Schedule C along with your tax return. You also need to file Schedule C if you are the only member of the LLC.

Limited Liability Company (LLC): An LLC is a business structure type that protects its owners from being personally liable for repaying the company's debts or liabilities. It provides the flexibility of a small business and the tax advantages of a partnership.

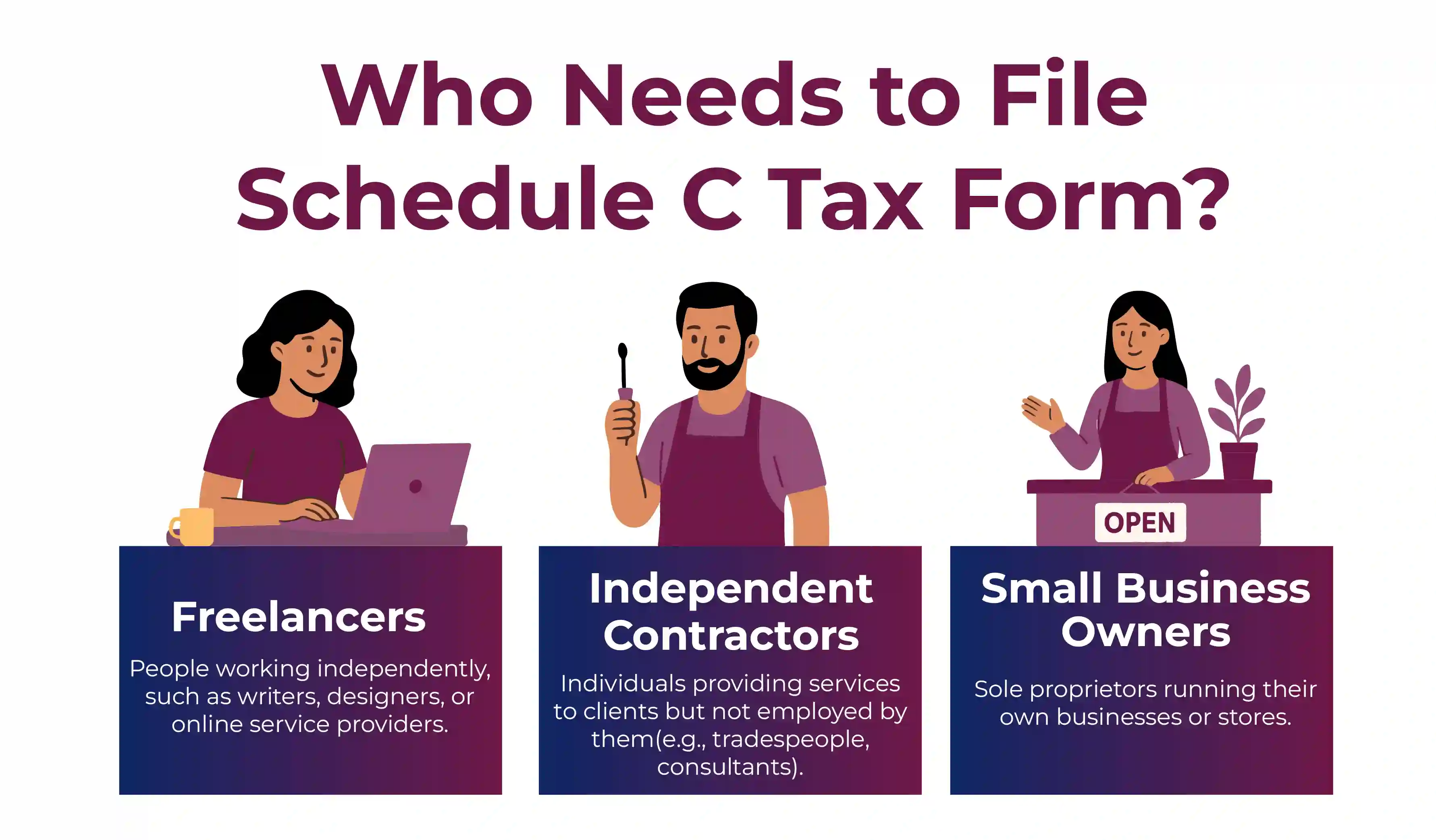

Who Needs to File Schedule C Tax Form?

You will have to file Schedule C if you are a self-proprietor or a single-member LLC, earning income through self-employment. As per the IRS, you don't need to make a sole proprietorship. It is because you will be considered one automatically if you regularly take part in an activity to make money.

Your business clients will send you 1099 forms if you are a self-employed person, like Form 1099-NEC. Such forms report the amount you have received from a business throughout the tax year.

You may also have to send 1099s to any vendor or contractor to whom you have paid through your business. Usually, these payments will be added to your Schedule C as expenses along with your other qualifying business expenses.

You don't need to use a Schedule C to report the business profit and loss of a C corporation or S corporation. You can navigate to the official website of the IRS and download all the versions of a Schedule C.

What Does Sole Proprietorship Mean?

A sole proprietorship is a business that is operated by a single person. Also, controls that are not set up as another legal business entity separate from yourself. It can include a corporation or partnership.

There is usually no legal separation between you and your business. It means that you own and operate the business all by yourself. Also, you are allowed to enjoy all the profits and are also responsible for all its losses and liabilities.

Freelancers, gig workers, independent contractors, and other small business owners handle and work as sole proprietors.

For example, suppose you cut your neighbor's grass using your grass cutter on weekends. You get paid $10 per yard for this work, so you are probably a sole proprietor. It means you need to report your business finances on Schedule C.

Does an LLC Need to File a Schedule C?

An individual can also operate their business as a single-member LLC. It is not required to be a business operating in an office with employees, but it can be. In such a case, you still need to fill out Schedule C.

There is no difference between you and the LLC for tax purposes if you operate a single-member LLC. Instead, the profits and losses generated by the LLC will go directly into your personal tax return. The IRS treats this as a "Disregarded Entity".

The key factor of both a sole proprietor and a single-member LLC is that you are the boss. No one is authorized to write you paychecks or withhold taxes from your pay.

Is Schedule C Only Meant for Self-Employed?

There are chances that you can be both self-employed and an employee of some other business. If you are an employee and your employer reports your pay on Form W-2. Then, you may also have to file a Schedule C as you have income that you receive outside of your W-2 job.

Generally, you don't need to include your W-2 income with your self-employment income on Schedule C. Additionally, if you are getting some side money without the intention of handling a business and making profits. Then, it might be considered as your hobby.

In such cases, you don't need to report your income and expenses on Schedule C. Instead, you report this income on Schedule 1, Part I, Additional Income, Line 8, " Other income".

When your activity is treated as a hobby, you must report all the income. However, you are not allowed to use any of your expenses as tax deductions.

What Information is Included on a Schedule C?

You need to provide some information related to your business or trade. Some of the items include:

- employer identification number (EIN)

- name and address of the business

- Detailed reporting of your income

- main product, service, or profession offered by your business

- If you have materially participated in the business

- accounting method used for your business (cash, accrual, or other)

- If you have started or acquired the business throughout the current year.

- The details about the vehicles used in your business (if applicable)

- Information about the cost of goods sold used in your business (if applicable)

- Itemized reporting of your business expenses. It includes items like advertising, insurance, legal, and professional services: rent or lease payments, repairs and maintenance expenses, utilities, wages, and more.

- any other expenses that are not easily categorized by the fields mentioned within the form.

**Note: The business expense must be both ordinary and necessary for your business to be included on Schedule C as a deduction against your income.

What Does Ordinary and Necessary Expense Mean?

The business expense must be both "ordinary" and "necessary" to qualify for a deduction. The IRS will consider an expense to be ordinary if it is common and accepted in your industry.

Also, an expense will be considered necessary if it is helpful and relevant to your trade or business. An expense doesn't have to be indispensable to be deemed necessary.

For example, when you work in an office setting, you might incur several expenses. Expenses like office furniture, supplies, software, and computer hardware are all ordinary and necessary expenses that you would anticipate spending.

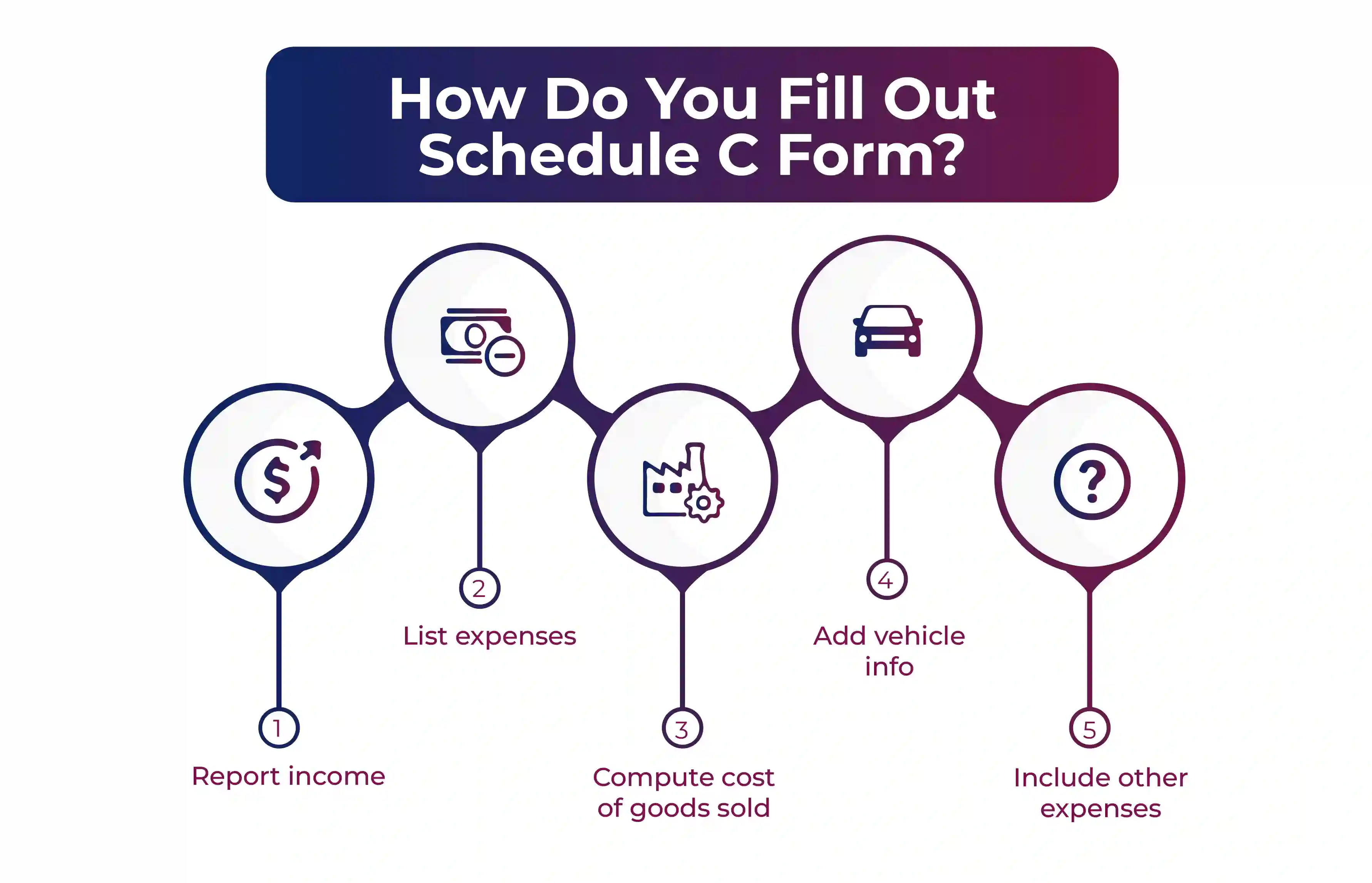

How Do You Fill Out Schedule C Form?

Schedule C contains five parts for reporting income as well as expenses. You may not have to fill out all of the items in each section based on the type of your business.

To complete your Schedule C, you need to gather some information regarding your business for the tax year. The information may include:

- receipts or lists of your business expenses

- your business's income for the tax year

- mileage records and expenses for the business use of your vehicle

- inventory information, including detailed costs (if applicable to your business).

Now, after collecting this information, you will move further with each section of the Schedule C. Fill out the following information in the relevant parts:

- Part I: Here, you mention all the income you acquired from your business. Also, compute your gross income.

- Part II: You add all your expenses and then deduct them from your gross income. This way, you will find out your net profit or net loss. You need to report the resulting figure on your income tax return.

- Part III: In this part, you compute your cost of the goods sold (if applicable).

- Part IV: It requires information about a vehicle that you have used in your business.

- Part V: Mention any other eligible expenses which is not listed in Part II.

What is Schedule C-EZ?

Numerous proprietors used a simpler version, which is called Schedule C-EZ. This form excluded several details in the full Schedule C. It only required your total business receipts and expenses. However, in case you claimed an expense for a vehicle, you still need to fill out a separate section.

If you operated a sole proprietorship, didn't report more than $5,000 in business expenses, reported a net profit, didn't hold business inventory throughout the year, had no employees, and didn't claim a deduction for a home office. Then, you could use Schedule C-EZ.

However, Schedule C-EZ is no longer available starting with the 2019 tax year. Now, only Schedule C is available.

Is Schedule C the Same as a W-2?

No, Schedule C is not the same as a W-2. Schedule C is used to report income you earn as a self-employed person. This can be either through a sole proprietorship or a single-member LLC. On the other hand, a W-2 is used to report the income you have earned while working as an employee of a business.

You may acquire W-2 income and still report separate income on Schedule C. For this, you typically need to work as a freelancer, independent contractor, side gig, or run your own small business. Although this side income must be acquired from the work you do regularly, with the expectation of receiving a profit.

Otherwise, the income will be treated as received from a hobby and would be mentioned on Schedule 1 rather than Schedule C.

Is Schedule C the Same as a 1099?

No, Schedule C is not the same as a 1099. A 1099 usually reports the money exchanged between a payor and a payee. A copy of a 1099 is typically sent to both the payee and the IRS. You may report this on Schedule C or other Schedules of Form 1040 based on the income type earned or 1099 received.

For example, if you are working as a freelance video editor, tutor, or rideshare driver and earning income. It means that you are not an employee for this work. So, this income would probably be reported to you using a Form 1099-NEC. Also, you might need to include this income on Schedule C of your tax return.

Now, if you earn income by renting out a property, you will use Schedule E to report this income. Additionally, Schedule F is used to report income received from farming.

Do I Need to Report My 1099-NEC Income on Schedule C?

In case you get a Form 1099-NEC reporting your income acquired as a contractor, freelancer, or other non-employee job. Then, you usually need to report this detail on Schedule C. You also need to include all your eligible business-related expenses regarding your trade or business.

To Conclude

Schedule C contains information regarding the profits and losses earned by you as a sole proprietor or single-member LLC. However, if you work as an employee and receive money reported on a W-2, you don't need to fill out a Schedule C for your tax return. Schedule C is a vital tax form that provides detailed reports of the business income and expenses.

After which, it is used to compute the individual's taxable income and self-employment tax. Understanding Schedule C and accurately filing it is important to ensure compliance with tax laws and avoid potential issues with the IRS.

Moreover, if you need further assistance with completing Schedule C, you should connect with the experts at Savetaxs. Our experts ensure to streamline the entire process for you with 100% accuracy and compliance. We are actively working 24*7 to serve our clients across the globe. So, contact us right away and enjoy the highest-quality service you deserve.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- What is Form 4868: IRS Tax Extension?

- What is Form 1040-NR

- What is an S corp - Overview, Taxes and How To File

- IRS Form 1099-R: What It Is Used For & Who Should File It?

- IRS Form 1099-INT: What It Is & Who Needs to File It?

- What is IRS Tax Form 1120?

- IRS Form 1099-Q: Payments from Qualified Education Programs

- What is IRS Form 1099-C: Cancellation of Debt

- What is IRS Form 1099-A?

- Understanding the Purpose of IRS Form 1099-MISC

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767170479.png)