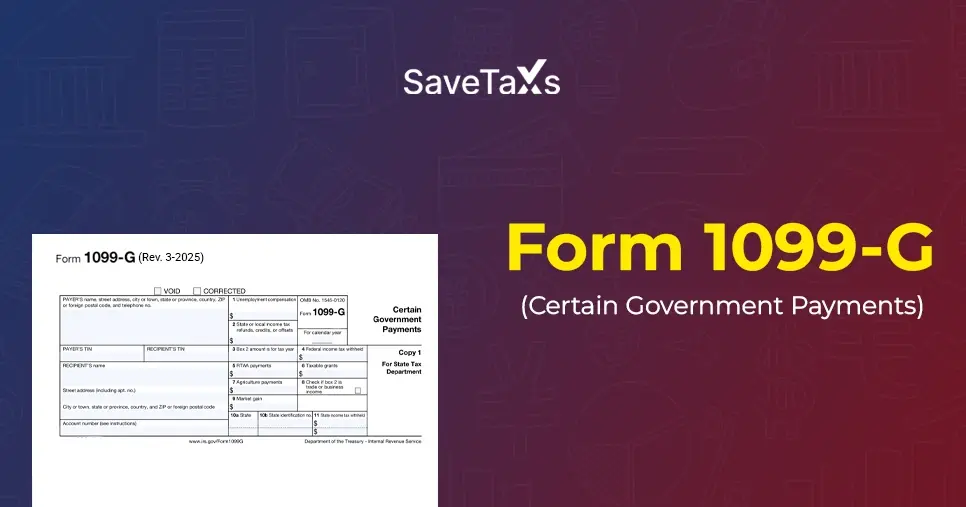

If you got certain payments from the government, you must know about an IRS form called the 1099-G tax form. Form 1099-G is issued by a government agency to report government payments. Such as unemployment compensation and state or local income tax refunds. This form informs you about funds that you have received and may need to report on your federal income tax return.

Keep reading this blog to learn more about what the 1099-G form is. We will walk you through the details included on this form and when you can expect to receive it. Also, we will share the details regarding how you need to report this income on your tax return.

Key Takeaways

- A government agency issues Form 1099-G to taxpayers to inform them about the funds they received. You may need to report these funds on your federal income tax return.

- Box 1 of the 1099-G form reports your overall unemployment compensation payments for the year. Generally, you need to report it as taxable income on Form 1040.

- Box 2 of Form 1099-G indicates the state or local income tax refunds, offsets, or credits you got. However, you need to report these amounts only if you took a federal deduction for paying those taxes in any previous year. Also, if that deduction actually lowered your federal taxes.

- All other boxes on the form may reflect the amount you got from other government agencies. Like, taxable grants or payments from the Agriculture Department.

Understanding the 1099-G Tax Form

Federal, state, and local governments send Form 1099-G to taxpayers for specific payments. If you also got a 1099-G Form this year from a government agency. Then, you must report some of the details from the form on your tax return. It is most commonly used for:

- Unemployment compensation

- State or local income tax refunds that you received that year.

Some other less-common government payments are also reported on Form 1099-G. It includes reemployment trade adjustment assistance (RTAA) payments, taxable government grants, agricultural payments, and market gains on some loans.

Tax Form-1099 G for Unemployment Compensation

If you claim unemployment income from the state government. Then, the unemployment benefits will be subject to taxation. Generally, you need to include any unemployment compensation from a state government in your federal taxable income.

- Box 1 of the 1099-G Form indicates your overall unemployment compensation payments for the relevant year.

- Schedule 1 of Form 1040 contains a separate line for unemployment compensation under the income section.

- Attaching 1099-G to your tax return is not mandatory.

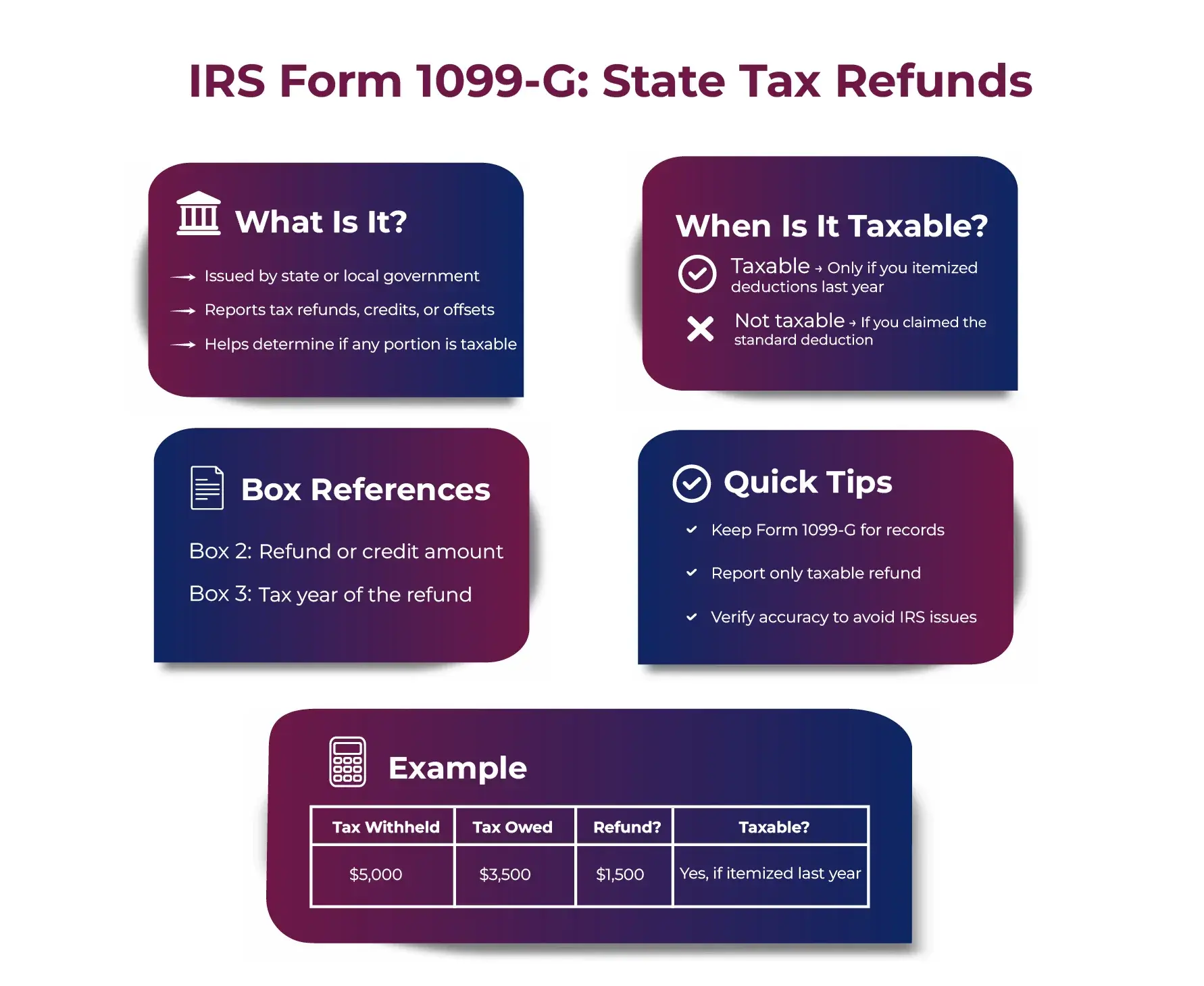

IRS Form 1099-G for State Tax Refunds

One common reason for receiving a Form 1099-G is due to an overpayment of state taxes. If the state issues a refund, offset, or credit of state or local income tax. In such a case, the amount will be reflected in Box 2 of your 1099-G form. However, you don't need to report this amount on your federal tax return or pay extra federal taxes.

The amount you got from the government for a refund, credit, etc., will not be subject to taxation. This applies if you claimed the standard deduction on your previous year's return. Moreover, you only need to report it as federal income if you took a federal deduction for paying those taxes in the previous year. Also, if the deduction actually lowered your federal taxes. Box 3 of the form will reflect the relevant tax year.

- Example for 1099-G Box 2

Assume your state needs your employer to withhold state income taxes from your salary as well as wages. Now, instead of taking the standard deduction, if you choose to itemize deductions on Schedule A. Then, the IRS will permit you to subtract the state income taxes that you have paid.

The overall amount of state income tax withheld from your pay will surpass the tax amount you are actually liable to pay at the year's end.

For instance, assume that for state income tax, an amount of $5,000 is withheld from your 2023 wages.

- You will observe that you are only liable to pay $3,500 once you are done preparing your state income tax return.

- You must receive a refund from the state of

$1,500 in 2024.- ( $5,000 withheld - $3,500 owed = $1,500 refunded).

If you have prepared your federal income tax return for 2023 and claimed a deduction for state income taxes of $5,000. Also, if this reduces your federal tax liability.

- You will have to account for some or all of the $1,500 refund you receive in 2024 as income. This is because you took a full deduction for the $5,000, but later received $1,500 back in 2024. If your 2023 federal tax return was fully benefited by the $5,000 state tax deduction. Then, you must include the entire $1,500 refund. Moreover, if you only benefited from a portion of the $5,000 state tax deduction, then you would only need to report a portion of the $1,500 refund.

You don't need to report the amounts in Box 2 if in the prior year, you:

- Did not benefit from deducting state income tax

- Opted for the standard deduction instead of itemizing your deductions.

If Box 8 of your 1099-G is checked, it shows that the amounts listed in Box 2 pertain to a trade or business you conduct.

** Tip: Ensure to check Form 1099-G thoroughly. The government reports that to enjoy pandemic-related unemployment benefits, organized groups provided fraudulent claims. Box 1 might contain funds you didn't receive or that exceed the funds you actually got because of fraud.

Other 1099-G Boxes

The form has nine other boxes that may reflect amounts or other information:

- Box 4, 10a, 10b, and 11 show details about the federal, state, and local income taxes withheld from any government payments you have received.

- Box 5 outlines specific trade adjustments.

- Box 6 exhibits any taxable grants you acquire from any government agency.

- Box 7 shows the payments you get from the Department of Agriculture.

- Box 9 reflects the market gain on specific loan types that can be accessed only by farmers.

Since each state has the option to issue its own version of the form, not all 1099-G forms will be the same. So, the 1099-G form might not contain all the boxes mentioned above.

1099-G and Unemployment Fraud

The federal and state governments increased the number of workers who could claim the unemployment insurance benefits when the pandemic was going on. Also, they increased the amount of such benefits as a response to the pandemic.

However, due to this, fraud-related unemployment also saw a rise. Organized groupus started using stolen data to steal identities and provide fraudulent claims regarding unemployment insurance benefits.

How Can I Know If I Have Fallen Victim to Unemployment Identity Theft?

The following are some indicators that you can use to determine if you have fallen victim to a fraudulent unemployment claim:

- You get an email from the government agency about an unemployment insurance claim or payment that wasn't submitted or received by you.

- Your employer sent you a notice stating that a request for details regarding an unemployment claim was received in your name while you were still working.

- You received a Form 1099-G that reports in Box 1 unemployment insurance benefits that you never received. or an amount more than what you actually received within the year.

Although you might have claimed and received unemployment insurance benefits, ensure to cross-check the information on your Form 1099-G. In case your identity was stolen and someone submitted a fraudulent claim on your behalf. Then, there is a chance that the amount mentioned in Box 1 might be overstated.

If you were also a victim of unemployment benefits fraud, it's vital to take necessary actions. You need to report this fraud to the state where it occurred and rectify any tax forms you may have received because of a fraudulent claim.

You may also visit the website for victims of unemployment fraud provided by the US Department of Labour. The website contains detailed information on unemployment identity fraud. It provides key steps to help the victims address the issues that might arise due to identity theft.

Now, after reading this, you can determine whether you are a victim or not. However, the question is how you will file taxes if you have a form stating income that you never got. Also, you know that it was reported to the IRS. Consider these steps:

- When such a case arises, the IRS asks the taxpayers to provide an accurate tax return. It means you only need to report the income you have received. This is irrespective of whether you have received a corrected 1099-G from the state yet.

- After that, connect with the state agency that issued the Form 1099-G right away. Request for a revised Form 1099-G indicating that you haven't claimed or received these benefits.

To Conclude

Form 1099-G is essential to ensure taxpayers report some government payments accurately. Such as unemployment compensation, state or local income tax refunds. There is no need to be scared if you have received this Form 1099-G. Simply understand its purpose to avoid errors and any potential penalties that might be incurred during tax season.

Double-check all the details provided on the Form. Also, seek professional guidance if you are unsure about how to report this income. Talking about professionals, Savetaxs tops the list. With years of knowledge and expertise in this field, our team will ensure to resolve all your queries.

We can help you determine whether you are a victim of unemployment fraud, how to report government payments on Form 1099-G, and much more. Connect with our team right away or whenever required, as we are actively working 24*7 across all time zones.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- IRS Form 1099-INT: What It Is & Who Needs to File It?

- Form W-9: Who Can File And How to File It

- 1099 Form: Overview, Types, Uses, and Who Receives It.

- All You Need to Know About a W-2 Form

- What is IRS Form 1099-C: Cancellation of Debt

- What Is The Difference Between a 1099 and a W-2 Tax Forms

- A Comprehensive Guide to W-8 Form

- Form 1099-NEC: Purpose and Requirement

- What is IRS Form 1099-A?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1752921287.webp)

_1765974748.webp)

_1767080655.webp)

_1767789828.png)

_1760618042.webp)

_1766742512.webp)

_1756729655.webp)