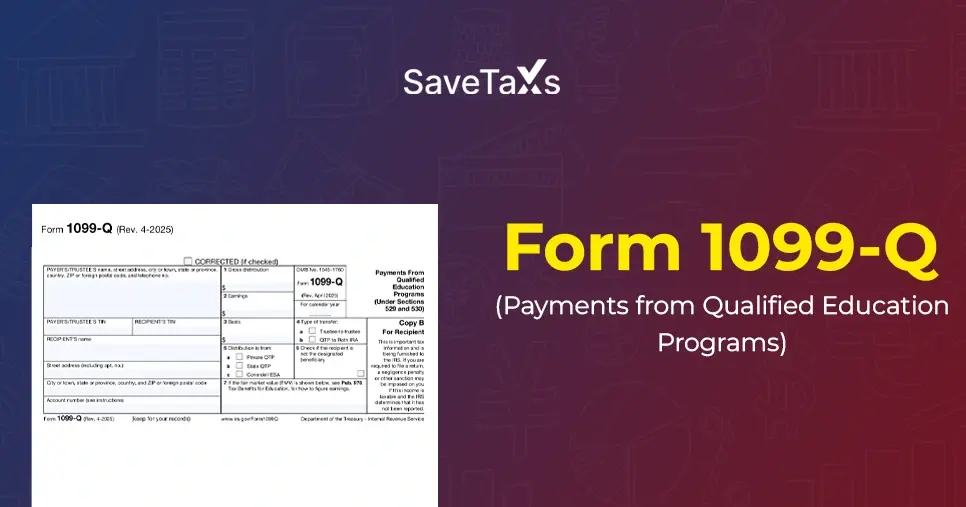

Form 1099-Q is an IRS tax form sent to students who received distributions from qualified education programs. It includes education programs like a 529 plan or a Coverdell education savings account (ESA or CESA). This form consists of the distribution details that you get from your qualified learning program.

Are you also out of your tax-free education account, paying your education expenses? Then, at the end of the year, you may also get this form from your administrator. Furthermore, knowing about the tax implications of these distributions is important. It helps in avoiding tax penalties and increases your education-related benefits.

Here, to provide you with an understanding of the Form 1099-Q, we have mentioned all the information about it on this blog. So, read on and learn when and how to include this form in your tax return.

Key Takeaways

- Individuals who receive money from a 529 plan or a Coverdell education savings account get Form 1099-Q.

- The form consists of the details of your total withdrawals, including your basis and earnings.

- Individuals who receive this form need to mention the information on it in their tax return. It is generally done when the use of the distribution is made for non-qualifying expenses.

- If your distribution is equal to or less than the qualifying educational expenses, then you do not need to mention it as your income. However, if the distribution amount is more than your expenses, it is taxable and subject to a penalty.

- Form 1099-Q each year sent by the account manager to the beneficiary or the account owner. This depends on who gets the distribution.

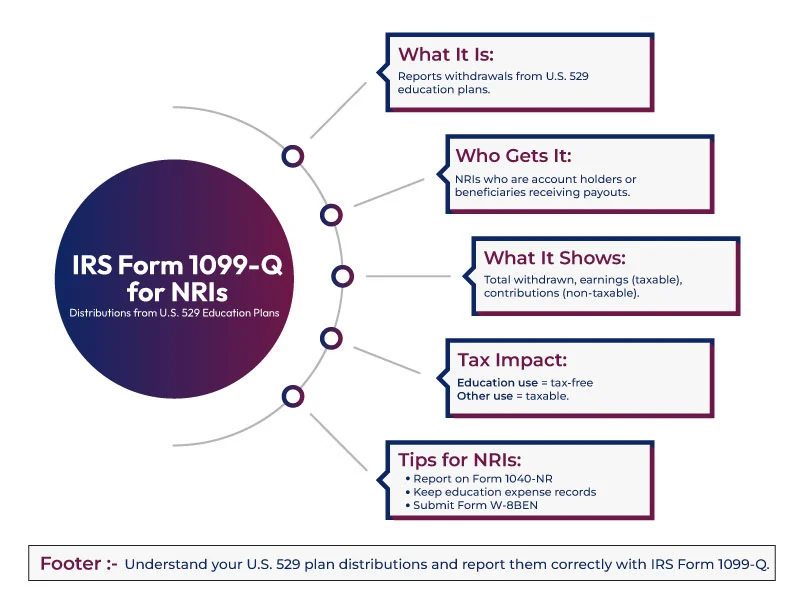

What is IRS Form 1099-Q?

The IRS Form 1099-Q tax form reports the distributions from qualified education programs. This form is issued to individuals who received payments from qualified education programs. This includes Coverdell Education savings accounts (ESAs) and 529 plans.

These distributions, including rollovers, can be taxable. Additionally, using the information from the IRS, you should determine the tax liability of any distribution. Then, this form is used by taxpayers for filing both their state and federal tax returns if the distributions are taxable.

Further, depending on how the money is spent by the account holder, taxes are imposed on the distribution. Depending on the withdrawals made, the details mentioned on the Form 1099-Q should be reported by the IRS and state agencies.

For instance, one year ago, a parent for their children set up a Coverdell ESA plan. During college, the child uses the payments from this qualified education program for tuition expenses. Here, the child will get a copy of Form 1099-Q from his college account administrator.

This was all about IRS Form 1099-Q. Moving ahead, let's know the different types of education programs included in this form.

Types of Education Programs Included in Form 1099Q

At present, there are two types of qualified education programs included in Form 1099-Q. These are Coverdell ESA and 529 plans. Although the tax-free treatment of both forms is the same at the time of distribution. However, there are several differences in these accounts. Want to know what they are? Read the next section and get your answers.

Coverdell ESA

Here is everything that you need to know about the Coverdell ESA qualified education program.

- These CESA accounts can:

- Like a self-directed IRA, these programs also contain self-directed investments. In this, you get the option to select the investment and the amount you want to keep in account.

- This is used for college expenses as well as K-12 education costs.

- With no income limit, contributions can be made to trusts and corporations.

The contribution limits of Coverdell ESA include:

- Across all Coverdell accounts, per year $2000 per student.

- Contributions are only available for students who are 18 or under.

- Once the aggregated gross income of the contributor is more than $110000 (single) or $220000 (jointly filing), a reduction in maximum contribution is allowed.

529 Plan

Here are all things about the 529 plan:

- The plan administrator chooses the investments.

- This plan offers prepaid tuition plans. Additionally, it consists of tax-free savings plans.

- It limits the choices of educational institutions, specifically for those of one institution or state.

- This plan is only applicable to college expenses.

- There are no contribution limits in this plan. However, if the contribution from one individual is more than $14000 in one year, the money may be gift tax.

- The 529 plan has no income limits.

- Additionally, for designated students, there is no age limit.

- This plan may qualify for state tax-free status and federal tax-free status.

This was all about different types of educational programs included in Form 1099-Q. Moving ahead, let's know who can file this form.

Who Can File Form 1099-Q?

The Form 1099-Q is generally filed by the employee or administrator who handles and manages the qualified education programs. They are accountable for sending a copy of the filled form to the IRS and the beneficiary. Here, the beneficiary is the one who receives the distribution. This form can also be filed by anyone who has made a distribution from a 529 plan. It is also called a qualified tuition program (QTP).

QTPs and CEASs are investment accounts designed to be used for qualified higher education expenses. A Form 1099-Q determines the amount made over the year being stated from the accounts in gross distribution. These are then compared to the incurred educational expenses over the year.

In case the qualified education expenses are less than the gross distribution, then the excess distribution amount is taxable. Considering this, it should be reported on the tax return of the taxpayer. However, if the educational expenses are more than the distribution. In this scenario, the excess amount can be used to claim the Education Tax Credit.

This was all about who can file Form 1099-Q. Moving further, let's know who receives this form.

Who Receives Form 1099-Q?

Generally, the Form 1099-Q is given to the beneficiary student. Additionally, the taxable amount of the distribution is stated in the income tax return of the beneficiary. Here, the distributions that are used for the payment of non-qualified expenses are liable to be taxed. Additionally, a penalty of 10% is also imposed on the earnings portion of the amount withdrawn.

Further, there is often confusion about who uses this form during their tax return, i.e., the beneficiary student or the account owner. Here, the account owner can be a parent or other relative. Considering this, the individual who gets the funds and whose Social Security number is stated on the form can use it on their ITR.

Generally, if a student receives the distribution, then they pay very less or no tax. However, it is not the same case for someone other than students using the distribution. Also, the younger students often fall below the threshold limit of a federal income tax return.

So, it totally depends on the individual who receives the funds and whose SSN is stated in the form to get the Form 1099-Q. Moving ahead, let's know how to fill out this form.

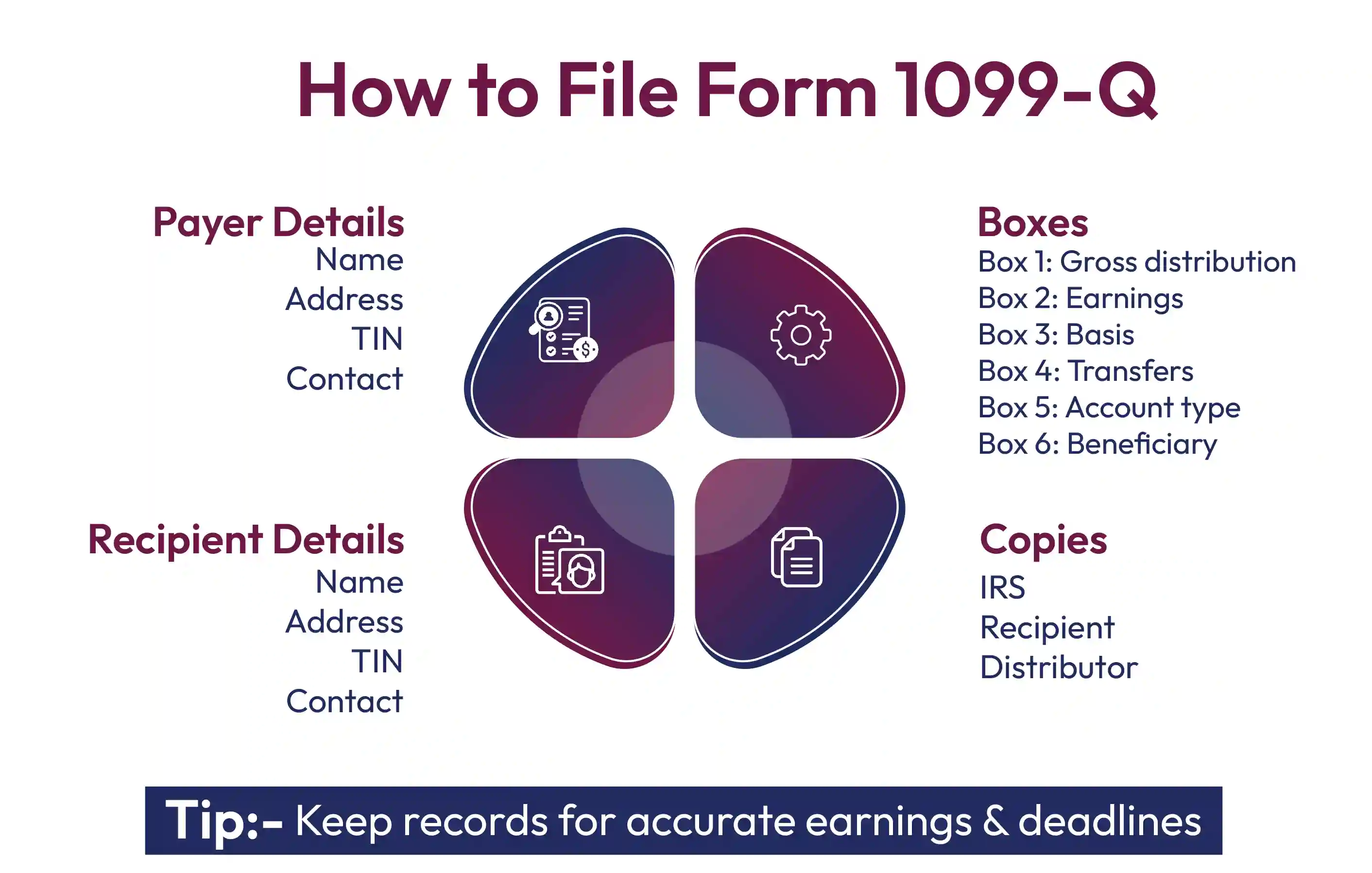

How to File Form 1099-Q?

To fill out Form 1099-Q, you need to mention the name and address of the payer/ trustee. Along with it, you also need to mention the tax identification number (TIN) and contact number. Additionally, you also need to provide the complete details of the recipients in the form. It includes the name, address, contact number, account number, and TIN for individuals, which is generally a Social Security number. Furthermore, the form also involves six numbered boxes:

- Box 1: Box 1 consists of gross distribution income. For QTPs, it includes in-kind or cash distributions for tuition waivers, payment vouchers, tuition certificates or credits, and similar items. Apart from this, it also includes refunds to the designated beneficiary and account owner. Further, for ESAs, it includes withdrawal of additional contributions plus earnings, refunds, and payment upon disability.

- Box 2: Here, you see your total amount of earnings.

- Box 3: This box, listed in box 1, shows your basis in the gross distribution. Here, the amount should be equal to the box 1 amount minus the box 2 amount.

- Box 4: This box shows you direct transfers. For QTP, from one QTP to another or from one QTP to an ABLE account. For ESAs, from one ESA to another ESA or from one ESA to a QTP. Furthermore, for the transfer between qualified education programs, you need to consider the following things:

- You should get a statement from the distribution program reflecting the earnings portion of the distribution.

- Whichever is earlier, this statement is due within 1 month of the distribution or by January 10.

- Use the details correctly to calculate the earnings.

- Box 5: This box states the type of account.

- Box 6: Under a Coverdell ESA or QTP, this box checks whether the recipient is a designated beneficiary or not.

Furthermore, individuals who fill out this form, in the blank space, can mention a distribution code below boxes 5 and 6. The distributor files three copies of the form. The first copy of the files with the IRS, the second copy is sent to you, and the third copy is retained by the distributor. Generally, you receive the form in your email.

This was all about how to fill out Form 1090-Q and the boxes it consists of. Moving further, let's know the tax implications for the beneficiary.

Tax Implications of Beneficiary

For beneficiaries, many of the qualified education programs, the amount stated on the Form 1090-Q is not mentioned in their tax return. However, if the total distribution in the tax year is more than your qualified education expenses. In this scenario, you need to mention some of the earnings stated in box 2 as your taxable income. Additionally, you also need to pay an extra 10% on it.

Here, your adjusted expenses will be equal to the total of your qualified expenses minus the tax-free assistance you get, such as Pell grants & scholarships. Confused? Let's better understand it with an example.

For instance, your qualified education expenses are $10,000, and from a Pell grant, you get $2000. Additionally, both boxes, i.e., 1 and 2, in your Form 1099-Q report $8000 gross distribution and earnings of $1000. Here, your adjusted qualified education expenses are $8000. This means that in your tax return, you did not need to report any distribution you received from an education program.

This was all about the tax implications of the beneficiary. Moving ahead, when you receive this Form 1090-Q.

When Will You Get Form 1099-Q?

You generally receive the Form 1099-Q in any year when you do a fund transfer between your accounts or take a distribution. Your administrator sent you this form for your qualified tuition plans. Typically, you get this form no longer than early February, following the end of the tax year.

Further, administrators should also provide a copy of each form to the IRS by March 31 if it is sent electronically or February 28 if sent through courier.

Final Thoughts

Lastly, IRS Form 1099-Q- Payments for qualified education programs ensures you are paying the correct amount of taxes on your distributions received. If the form shows, you owe any taxes, then you need to include that amount on your federal and state tax returns.

Furthermore, if you are still confused about this form and looking for assistance, connect with Savetaxs. We have a team of professional tax advisors who can help you with your query. Also, assist you in filing your IRS and claiming the available tax refunds. So, do consider us if you are looking for reliable tax services in the US.

Mr Vikram brings in more than ten years of experience in US Taxation. He is also an EA mentor and instructor. The expertise of Mr. Agrawal includes accounting, bookkeeping, Tax preparation, small business tax, personal tax planning, income tax, financial advisory services, and retirement planning.

- 1099 Form: Overview, Types, Uses, and Who Receives It.

- IRS Form 1099-Q: Payments from Qualified Education Programs

- What Is The Difference Between a 1099 and a W-2 Tax Forms

- Understanding the Purpose of IRS Form 1099-MISC

- A Comprehensive Guide to W-8 Form

- Form W-9: Who Can File And How to File It

- What is a 1099-G Tax Form?

- What is IRS Form 1099-C: Cancellation of Debt

- What is IRS Form 1099-A?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767077669.webp)

_1767955810.png)

_1768221427.webp)

_1756816946.webp)