- What is an RFC Account in India?

- What are the Features and Benefits of an RFC Account in India?

- What are the Permissible Credits and Debits in an RFC Account?

- What is the Eligibility Criteria for an RFC Account?

- What are the Documents Required to Open an RFC Account?

- Resident Foreign Currency (RFC) Fixed Deposit

- Resident Foreign Currency (RFC) Tax Implications

- The Bottom Line

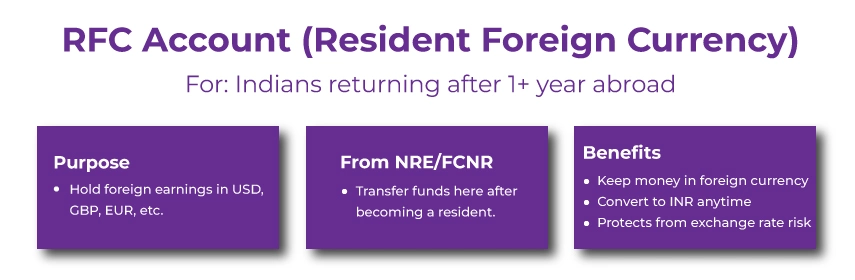

If you are an NRI planning to return to India, you might face confusion regarding what to do with your foreign currency earnings. You are allowed to hold your foreign currency in an RFC (Resident Foreign Currency) account in India

An RFC account is a bank account type in India that permits resident Indians to hold funds in a foreign currency. It can include US Dollars, Euros, or Pounds, without the need to convert them to Indian Rupees. These accounts are specifically designed for NRIs returning to India with the motive to settle permanently in India after staying abroad for at least a year.

This account allows them to manage their foreign earnings and investments effectively while staying in India. It offers the flexibility to convert the money into Indian Rupees whenever required. Funds held in these accounts are fully repatriable without any restrictions, including principal and interest. Keep reading to know more about an RFC account.

- An RFC account is a type of bank account in India in which you can hold money in foreign currency without converting it to Indian Rupees.

- You can convert the foreign currency into Indian rupees whenever required at the prevailing exchange rate.

- Funds held in an RFC account are fully repatriable, including principal and interest amount.

- Your RFC deposits are covered by the Deposit Insurance and Credit Guarantee Corporation (DICGC) for a limit of 5 lakhs per depositor per bank.

- You can deposit your foreign currency funds in an RFC fixed deposit for a fixed period of time and earn interest on it.

- Taxation on an RFC account is decided based on your residential status and the source of income.

What is an RFC Account in India?

RFC stands for Resident Foreign Currency, which is a bank account type that allows you to hold money in foreign currency in India. You can open an RFC account when you move back to India permanently after staying abroad for a continuous period of one or more years.

If you have earnings in foreign currency or assets abroad and you wish to hold them in the same currency, then an RFC account can be useful. The account can be opened and maintained in any freely convertible foreign currency based on the bank you choose. It can include the US Dollar, British Pound, Euro, etc.

You can no longer hold your NRE (Non-Resident External) or FCNR (Foreign Currency Non-Resident) account after moving back to India. You will be required to transfer the funds from these accounts to the RFC account. Additionally, you can convert your foreign currency into Indian Rupees whenever you need to at the prevailing exchange rate.

What are the Features and Benefits of an RFC Account in India?

Here are some of the common features and benefits of having an RFC account in India:

- Avoid Exchange Rate Fluctuations: You can keep your foreign currency in an RFC account without needing to convert it into Indian Rupees. This helps you avoid the worry about exchange rate fluctuations and losses.

- DICGC Deposits: The Deposit Insurance and Credit Guarantee Corporation (DICGC) covers your RFC deposits for up to a limit of Rs. 5 lakhs each depositor per bank.

- Several Purposes: An RFC account can be used for various purposes, like covering expenses in India or abroad, investing in shares, securities, or mutual funds. It can also include making donations or gifts to relatives or charities in India or abroad.

- Freely Repatriable: This account is fully repatriable, which means you can transfer funds to any foreign country without any restrictions. Additionally, you can convert the funds into Indian rupees whenever required at the prevailing exchange rate.

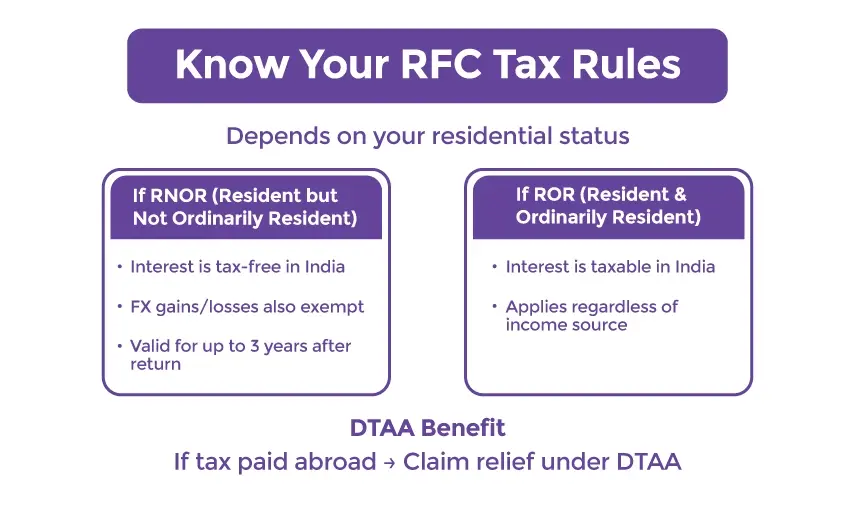

- Tax Benefits: Based on your residential status and the source of income, you can claim tax benefits on your RFC account. If you are an RNOR (Resident but not an Ordinarily Resident) in India, you can claim tax exemption on the interest earned on your RFC account and on the foreign exchange gains or losses arising from the account.

- Tax-Exemption: Assume you are a Resident and Ordinarily Resident (ROR) in India. Then, you can claim tax exemption on the interest acquired on your RFC account. It applies if the income is derived from specific sources, such as pension, dividends, interest, etc., from abroad.

What are the Permissible Credits and Debits in an RFC Account?

The table below shows the credits and debits that are permitted in an RFC account:

| Credits | Debits |

|---|---|

| Transfer balances kept in NRE/FCNR accounts upon arrival in India. | If you become an NRI, transfer balances from RFC to an NRE/FCNR account. |

| Any foreign exchange acquired from selling assets abroad, such as shares and securities, immovable property, and business investments. | For expenses and investments to be made in India. |

| Personal cheque drawn on foreign assets, traveler's cheque, and foreign currency notes. | Maintenance of dependents or for any personal purposes abroad. |

| Any income you derive from your foreign assets. It can include pension, dividends, and interest. | For any transfers or investments abroad. |

What is the Eligibility Criteria for an RFC Account?

An RFC account can be accessed by an individual returning to India after staying abroad. It can include NRIs, Persons of Indian origin, and Overseas Citizens of India who are interested in retaining foreign currency in India.

NRIs who receive foreign exchange remittance need an RFC to manage their foreign income in India. It can include pensions, salaries, or proceeds acquired from overseas and assets. Here are the eligibility criteria that one must meet to open an RFC account:

- NRIs/OCIs who returned permanently to India.

- NRIs/OCIs who have moved to India on or after the 18th of April, 1992.

- NRIs/OCIs who have stayed outside India for at least a year before their return.

What are the Documents Required to Open an RFC Account?

You must submit the following documents to the bank to open an RFC account in India:

- Copy of passport

- Account opening form

- RFC declaration form

- Passport-size photograph

- Copy of PAN or Form 60 (in case you don't have a PAN)

- Copy of a valid visa and immigration stamps (proof of foreign stay for at least one year).

Resident Foreign Currency (RFC) Fixed Deposit

An RFC fixed deposit is a type of term deposit account. It allows you to deposit your foreign currency funds for a fixed time period and earn interest on them. You can open an RFC account fixed deposit account using any currencies that the bank allows for RFC accounts.

You have the option to select the tenure of your RFC fixed deposit. It can range from one year to three years. Additionally, you may renew the account upon maturity or withdraw it prematurely, subject to the terms and conditions of the chosen bank.

Resident Foreign Currency (RFC) Tax Implications

Tax implications on an RFC account depend on your residential status and the income source. You can claim tax exemption on the interest derived on your RFC account if you are an RNOR in India. Also, the same applies to the foreign exchange gains or losses arising from the account.

You can claim this exemption for the period during which you have the RNOR status. Usually, it can be for up to three years from the date of your return to India. Now, if you are an ROR, you need to pay tax on the interest acquired on your RFC account, irrespective of the income source.

However, in case you have paid tax on the same income in a foreign country. Then, you may claim relief from double taxation under the DTAA (Double Taxation Avoidance Agreement) between India and that country.

The Bottom Line

An RFC account is a perfect financial tool for NRIs who are moving back to India permanently. It provides a strategic way to manage foreign currency earnings. The account offers flexibility in repatriation, protection from currency fluctuations, and investment opportunities. The funds in an RFC account are fully and freely repatriable without restrictions. Remember, an RFC account is not for NRIs living abroad. Instead, it is for individuals who have returned to India and are now considered residents under the FEMA Act.

Furthermore, if you need more assistance or have any more doubts with an RFC account, look for an expert. One such expert is Savetaxs, who has been helping NRIs for a decade now. We have a team of experts who bring over 30 years of combined expertise and skills. We are working 24*7 across all time zones, so contact us right away.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Navneet brings in more than 12 years of experience as a US Tax and ITIN Expert. Additionally, he has expertise in accounting, finance, taxation, financial analysis, budgeting, and risk management.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

The permissible kinds of credits include the following:

- Foreign exchange from the sale of overseas assets.

- Balances transferred from your NRE or FCNR accounts.

- Income from foreign sources, like dividends, interest, and pensions.

- Some jurisdictions may also need you to publish a notice of your DBA in a local newspaper.

You can withdraw the funds to use for:

- remittances

- investments abroad

- personal expenses in India or abroad

- Maintenance of dependents overseas

_1764918370.webp)

_1764137986.webp)

_1763555884.webp)

_1756467732.webp)