The traditional IRA Tax deduction offers two key benefits to retirement savers. The first is that it offers you a tax deduction on your contributions made towards your IRA accounts. The second benefit is that you do not need to pay tax on your growing investment until you make the withdrawal. Thus, both benefits together reduce your tax liabilities.

However, not every contribution you make towards a traditional IRA offers you tax benefits. It is available to high-income individuals and employees who have a retirement plan at work. Additionally, it depends on your tax filing status. In this blog, you will get all the information about the traditional IRA tax deduction. So, read on and know about them in detail.

- Traditional IRA tax deduction helps you save taxes on your contributions that you made towards your retirement plans.

- Every individual can contribute to their retirement plan. However but not all are eligible to claim the deduction. It depends on several factors, such as tax filing status and the income level of the taxpayer.

- Each year, the deduction amount is stated by the IRS, and it is changed every tax year. For instance, the traditional IRA contribution limits are $7000 for individuals below 50 years and $8000 for those 50 years or older for 2025.

- Further, there are other tax deduction options, such as HSA, 401(k), 403(b), or nondeductible IRA, also available. So, if you are not able to claim taxes on a traditional IRA, you can consider these.

Are Traditional IRA Tax Deductible?

Yes, generally, the traditional individual retirement accounts (IRA) are tax-deductible. It helps you to decrease your tax obligations dollar for dollar by your contribution amount made towards an IRA. The IRA traditional tax deduction is available on your federal tax return. When filing it, you can claim the contribution.

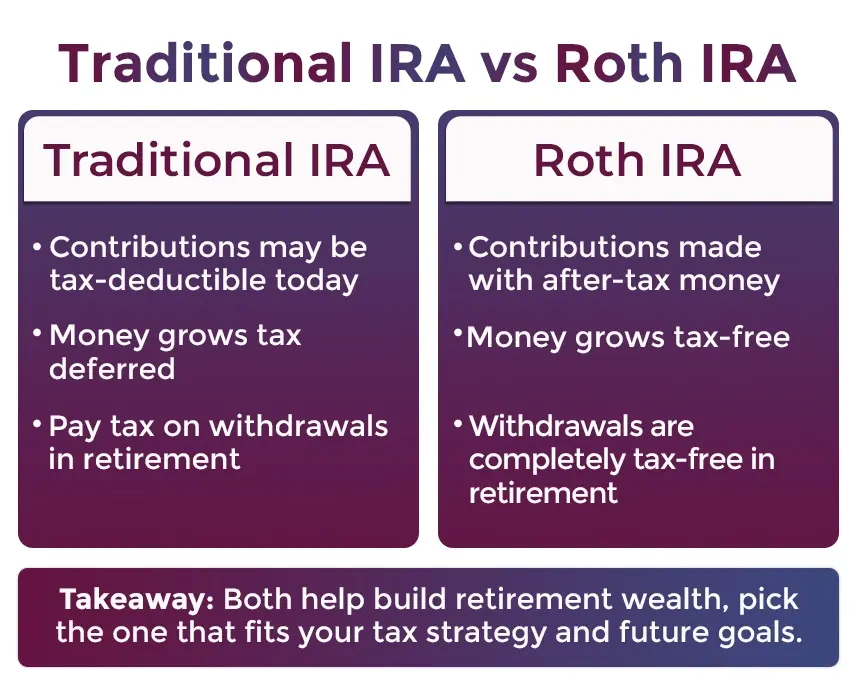

However, based on the type of IRA and your financial circumstances, the IRA tax deduction rules vary. For example, compared to Roth IRA contributions, traditional IRA contributions are tax-deductible.

Moving further, let's know about them in more detail.

Roth IRA Tax Deduction

Compared to the traditional IRA tax deduction, the Roth IRA tax contribution is not tax-deductible. However, in your retirement, Roth IRA contributions offer you several benefits. It includes tax-free withdrawals, tax-free investment growth, and no required minimum distributions (RMDs).

The Roth IRA tax deduction is determined based on your tax filing status and modified adjusted gross income (MAGI).

Traditional IRA Tax Deduction

Like the Roth IRA contribution, the traditional IRA tax deduction depends on your tax filing status and MAGI. Additionally, the traditional IRA contribution limits also depend on whether you or your spouse has a workplace retirement plan. These are the following conditions for it:

- Do Not Have a Retirement Plan: If you or your spouse does not have a retirement plan, then you can claim the full contribution amount on your traditional IRA tax.

- Have a Retirement Plan: If you or your spouse has an employer retirement plan, then you can still claim the traditional IRA contributions. However, here the tax deduction will depend on your income. Additionally, whether the contributions qualify as partially or completely nondeductible IRA contributions.

This was all about Roth and traditional IRA tax deduction. Moving further, let's know the traditional IRA contribution limits for 2024-2025.

Non-resident aliens can also claim a traditional IRA tax deduction in the US. However, for this, they need to have "Effectively Connected Income" (ECI) in the US. It is because the traditional IRA tax deduction applies to the ECI portion of their gross income. Additionally, the IRA contribution should be made with the earned ECI.

Traditional IRA Contribution Limits 2024-2025

Since every year the IRS updates the tax deduction limits for most tax filers. Considering this, it is vital to know the taxpayer whether or not their contribution amount is deductible or not based on their income or filing status for the year. Here, the table below shows the 2024 and 2025 traditional IRA deduction limits:

| Tax Deductibility of Traditional IRA Contributions for Tax Year 2024- 2025 | |||

|---|---|---|---|

| Status | Modified Adjusted Gross Income (MAGI) 2025 | Modified Adjusted Gross Income (MAGI) 2024 | Traditional IRA Tax Deduction Allowed |

|

Single |

$79,000 or less |

$77,000 or less |

Complete tax deduction on IRA contribution of up to $7000. Additionally, if yoy are 50 years or older, you receive $800 tax deduction. |

|

Between $79,000 and $89,000 |

Between $77,000 and $87,000 |

Based on your modified adjusted gross income (MAGI) partial tax deduction is available. |

|

|

$89,000 or more |

$87,000 or more |

No tax deduction. |

|

|

Married filing jointly and have a retirement plan at work |

$126,000 or less |

$123,000 or less |

Up to $7000 full tax deduction is available on an IRA traditional contribution. Also, if you are 50 years or older, you can claim up to $8000 tax deduction. |

|

Between $126,000 and $146,000 |

Between $123,000 and $143,000 |

Depending on your modified adjusted gross income (MAGI), a partial tax deduction is available. |

|

|

$146,000 or more |

$143,000 or more |

No tax deduction. |

|

|

Married filing jointly, and the spouse has a retirement plan at work |

$236,000 or less |

$230,000 or less |

You can claim a full deduction of up to $7000 on your contribution. Further, if you are 50 years or older, you can claim up to $8000 on your traditional IRA tax contribution. |

|

Between $236,000 and $246,000 |

Between $230,000 and $240,000 |

Depending on your modified adjusted gross income (MAGI), a partial tax contribution amount is deductible. |

|

|

$246,000 or more |

$240,000 or more |

No tax deduction available. |

|

|

Married filing separately |

Less than $10,000 |

Less than $10,000 |

The partial tax amount is available on your IRA tax contribution based on your modified adjusted gross income. |

|

$10,000 or more |

$10,000 or more |

No tax deduction is available on an IRA contribution. |

|

Here, the deducted amount limit does not impact your annual contribution amount. However, you cannot claim more tax deductions than your contribution to the IRA that year.

Additionally, when choosing an IRA, you should not completely concentrate on whether the contribution is tax-deductible or not. You should also consider other factors. It includes liquidity needs, RMDs, future income projections, legacy goals, and taxes on withdrawals.

This was all about the traditional IRA contribution tax deduction limits of 2024 and 2025. Moving further, let's know what is SEP-IRA contributions tax deduction.

What Is SEP-IRA Contributions Tax Deduction?

A Simplified Employee Pension (SEP) helps business owners, self-employed individuals, or freelance workers to contribute to a SEP-IRA plan. Further, the contributions to these accounts up to the contribution limit are tax-deductible.

Considering this, the yearly SEP-IRA contribution limits differ from Roth and traditional IRA tax deductions. Additionally, the tax deduction limit of SEP-IRA contribution is the lesser of:

- $70,000 in 2025 ($69,000 in 2024).

- 25% of your compensation (20% compensation if you are self-employed).

So, it was all about the SEP-IRA contribution tax deduction available for self-employed individuals, business owners, and freelance workers. Moving ahead, let's know how much tax you can save from your IRA contributions.

How Much Taxes Are Saved from IRA Contributions?

The traditional IRA tax deduction depends on several factors. It includes:

- Coverage of Workplace Retirement Plan: As stated above, if you or your spouse has a retirement plan at work, you may not claim the tax deduction.

- Income Level: The tax deduction amount also depends on your modified adjusted gross income (MAGI). It decides whether you will receive a complete, partial, or no tax deduction.

- Tax Bracket: If you come in a higher tax bracket, it means you will save more dollars on your tax deduction amount.

- Filing Status: Your tax savings deduction also depends on your tax filing status.

- Age: Additionally, if you are 50 years or older, then you can also get an additional $1000 contribution, boosting your potential tax savings.

These were some of the factors that impact your traditional IRA tax deduction savings. Moving further, let's look at the alternatives to the traditional IRA tax.

What Are the Alternatives to the Traditional IRA Tax?

If you cannot take advantage of the traditional IRA tax deduction, there are other retirement savings options also available. These are as follows:

- Health Savings Account (HSA): If you have a high-deductible health plan, then under the HSA, you can also claim a tax deduction. It helps you in tax-free growth, withdrawals, and deduct contributions on eligible medical expenses.

- Workplace Retirement Plan: Workplace retirement plans include a 401(k), 403(b), or other similar employer retirement plans that you can claim. These retirement plans generally provide higher tax contribution limits and employer tax-matching contributions.

- Nondeductible IRA: A nondeductible IRA is more suitable for higher-income earners. For tax-free growth, it helps them perform a backdoor Roth conversion. It is a strategy generally used by high-income people who, because of having an income more than a certain limit, cannot contribute to a Roth IRA.

Considering the above information, if you do not qualify for a traditional IRA tax deduction, you can claim from any of the retirement options.

Final Thoughts

Lastly, the traditional IRA tax deduction helps you save taxes on your contributions you made to your retirement plan. However, unlike the contribution, the tax deduction is not available for everyone. Several factors, like your tax filing status and income level, decide whether you qualify for it or not.

Here, the complete blog was all about the traditional IRA tax deduction and its contribution limits. Further, if you need any assistance in claiming these tax deductions, connect with Savetaxs. We have a team of tax experts who, with their knowledge, help you claim the deduction and boost your tax savings.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- What Is Earned Income & the Earned Income Credit?

- Self Employment Tax: Meaning & How To File It

- IRS Tax Credit vs Tax Deduction

- Difference Between Residents And Non-Residents Aliens And Their Taxes

- Standard Deduction vs Itemized Deduction - Which One To Choose

- What is Adjusted Gross Income (AGI)?

- What is modified Adjusted Gross Income (MAGI)

- 9 US States With No Income Tax

- Are Medical Expenses Tax Deductible in the US?

- Know Your Tax Deadlines for 2025: When and Where to File?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767003468.png)

_1766059659.webp)

_1767696432.webp)