- Letter of Intimation u/s 143(1)

- When Does One Receive an Intimation U/s 143(1)?

- Centralized Processing Center

- Preliminary Assessment Under Section 143(1)

- Nature of Adjustments Under 143(1)

- Time Limit for Issue of 143(1)

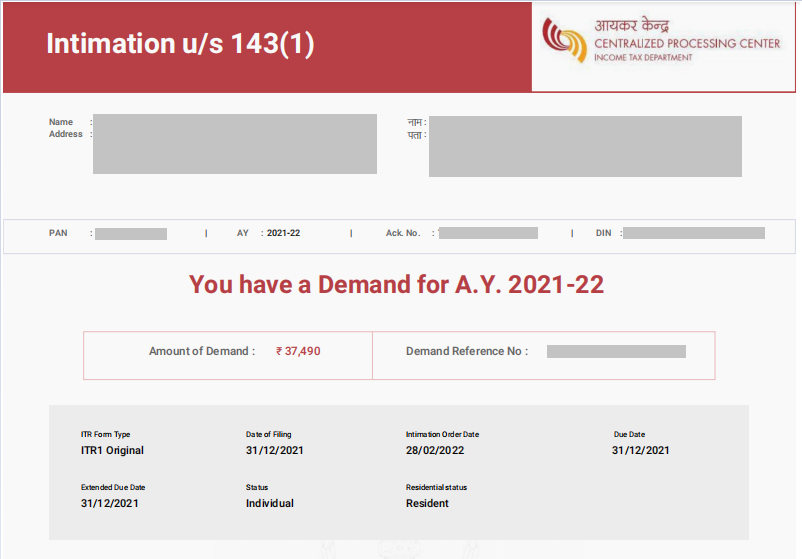

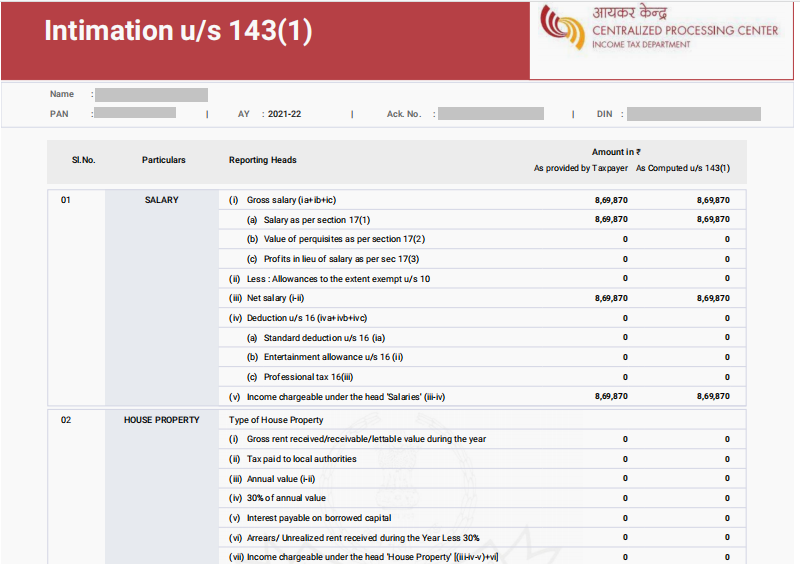

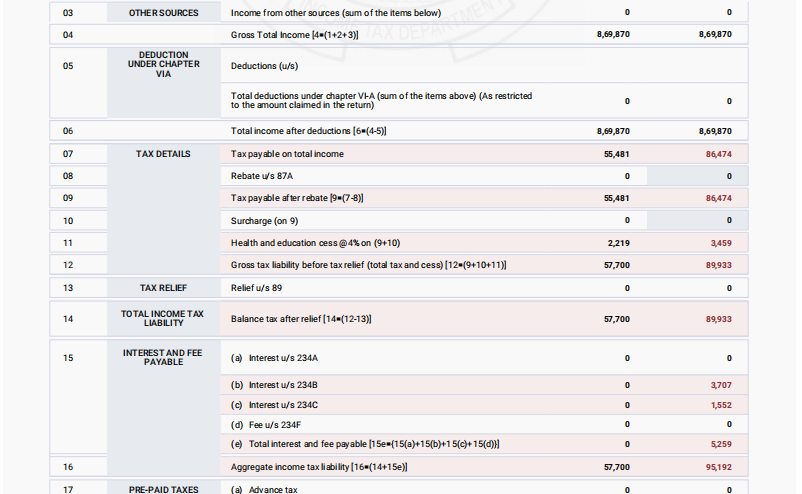

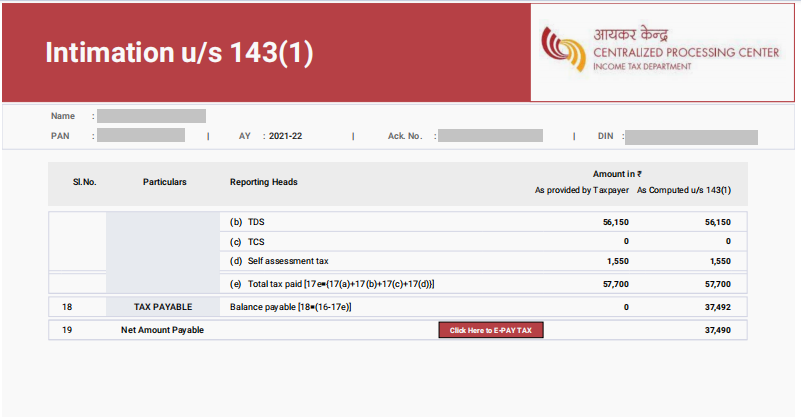

- Sample of an Intimation Under 143(1)

- What is the Password for Intimation u/s 143(1)?

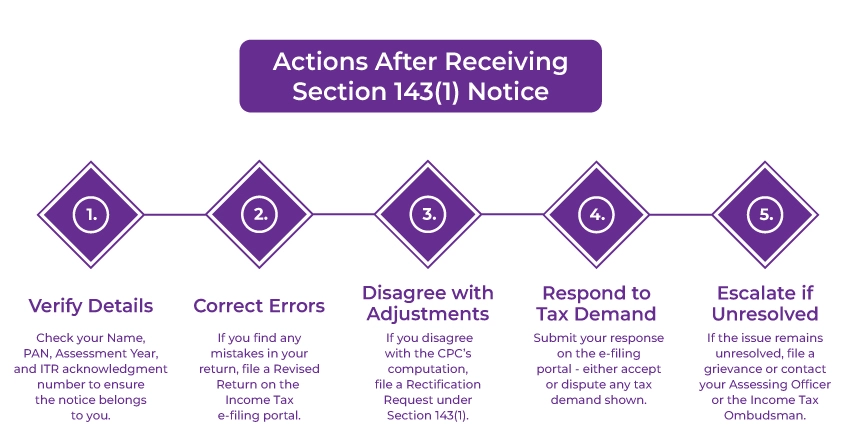

- Action to be Taken by the Taxpayer after Receiving a 143(1)

- Points to Check When You Receive an Intimation u/s 143(1)

- The Bottom Line

The income tax returns of a taxpayer are first collected electronically at the CPC (Centralised Processing Center). After the refund is processed, the IRS sends an intimation to the taxpayers under section 143(1) of the Income Tax Act. It includes several information, such as the ITR acknowledgment number, breakdown of your income details as filed in your ITR, and as computed by the department.

If there is a discrepancy between the calculations in your filed ITR and those processed by the department. Then, the intimation is required to be responded to accordingly. The filed ITR must be processed within 9 months from the financial year end from which the return is filed.

In this blog, we will explore the various aspects of intimation under section 143(1). We will also learn why it is issued, its time limits, how to respond, and more.

- Section 143(1) deals with the preliminary assessment of your filed income tax return (ITR) by the Income Tax Department.

- The notice states arithmetical errors, internal inconsistencies, mismatches in tax computations, and issues with verifying TDS/TCS credits and tax payments.

- An intimation notice will be sent to the taxpayer if any discrepancies are found.

- The intimation can lead to a refund, demand for additional tax, or confirmation that the return has been accepted as filed.

- The taxpayer must respond to this notice within 30 days if required and if there is any mismatch.

- The ITR intimation password is a combination of your PAN (in lowercase) and date of birth (DDMMYYYY) without spaces.

Letter of Intimation u/s 143(1)

An income tax return may be filed voluntarily under Section 139. If not, then it can be filed on demand by the income tax department under Section 142(1).

The assessment process involves the income tax department evaluating the taxpayer's return. This examination is referred to as an assessment. The IT department conducts a preliminary evaluation of all returns submitted. Also, they inform taxpayers of the outcomes of such an assessment.

This process mainly focuses on identifying arithmetic errors, internal inconsistencies, tax calculation, and tax payment verification. The preliminary evaluation is entirely computerised (automated). It is handled by the Central Processing Centre (CPC).

The system then generates the intimation under section 143(1). It typically shows obvious mistakes determined by the mainframe system. Generally, the intimation u/s 143(1) includes the following information:

- Refund sequence number

- Tax calculation as provided by you in the return of income

- Tax as calculated under section 143(1) of the Income Tax Act

- Permanent information of the taxpayer, such as name and address

- ITR filing details, like acknowledgment number, filing date, etc.

**The deadline for processing the return is set at the 31st of March, 2024. However, the cases that have been incorrectly invalidated due to technical glitches will be processed by 31st March, 2026.

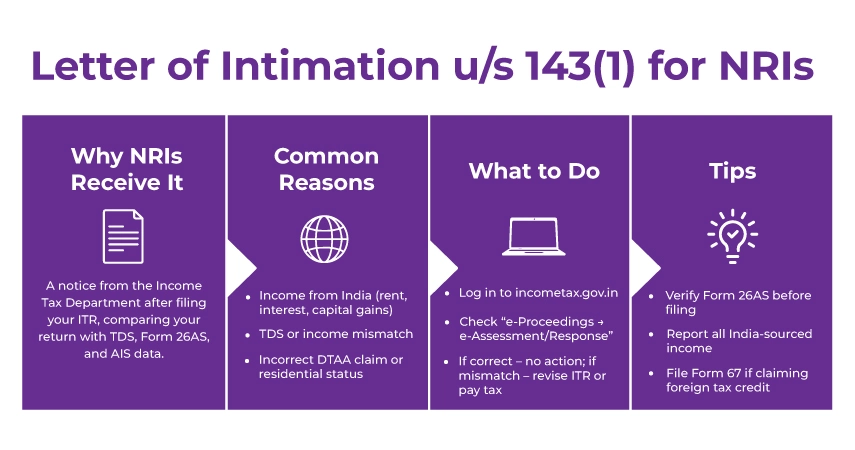

An NRI can also receive an Intimation Under Section 143(1) of the IT Act after filing their ITR, as it is an automated communication sent after the CPC processes the ITR. The process is the same for NRIs as for resident taxpayers. They might receive discrepancies in income data, arithmetical errors, wrong claims, a mismatch in TDS, etc.

When Does One Receive an Intimation U/s 143(1)?

An intimation under Section 143(1) is sent to every taxpayer once their income tax return has been successfully processed.

This process is automated and involves verifying arithmetical accuracy using the information available to the department. Also, the details included in the return, and compliance with income laws. By using all this information, the system generates a comparison report.

This automation significantly reduces the manual workload of income tax officers. The following are the main situations for receiving an intimation under Section 143(1):

Tax Shortfall: If a taxpayer owes additional tax, it will display the due amount along with a challan for payment.

Tax Refund: If the taxpayer has overpaid their taxes, the intimation will indicate a tax refund. The refund will be issued only when the amount exceeds Rs. 100.

Acknowledgement Notice: The intimation serves as an acknowledgment that the assessing officer has found the ITR consistent. A notice will be sent in such a case. Also, no separate 143(1) intimation is sent under such situations. The taxpayer must consider the ITR V acknowledgement of filing the income return as the intimation notice.

Centralized Processing Center

Due to the increasing volume of Income Tax Returns, the department has been unable to process them. To address this, the Finance Act 2008 authorized the Central Board of Direct Taxes (CBDT). They asked CBDT to make a scheme for the centralised processing to resolve tax liabilities or refunds due to taxpayers quickly.

Following the recommendations from the Technical Advisory Groups, it was decided that CPC at Bangalore would process paper and e-returns. Also, this was done without any direct interaction with taxpayers and was free from jurisdiction constraints.

This CPC project benefits both citizens and the tax department. Citizens enjoy faster and more streamlined processing of their returns. In addition, the department can offload the preliminary assessments that can be automated. It allowed them to focus more on complex tasks.

Any communication from the income tax department can cause panic for taxpayers. However, Section 143(1) intimation is not something to stress over.

Preliminary Assessment Under Section 143(1)

The CPC's initial processing of returns is entirely automated. Additionally, the Section 143(1) intimation is generated by a computer system. The CPC verifies the data in each tax return against information in the department's records. It includes Form 26AS generated through the details provided by TDS returns, etc. This notice points out apparent mistakes found in the ITR filed.

- After you are done filing your income tax return, the IT department's computerized system recomputes your total income or loss based on the records. Then it compares this with the details you provided in the return.

- The intimation you receive will include two columns:

- As provided by the taxpayer in the return of income

- As calculated under Section 143(1).

- The system compares major categories such as:

- Gross total income

- Income under different heads

- Taxes paid (TDS, advance tax, self-assessment tax).

- Deductions claimed under Chapter VIA (such as 80C, 80D, etc.)

- Depending on the comparisons, the system makes appropriate adjustments under Section 143(1) to determine your final tax liability or refund.

- The changes are made only after the department informs you of the proposed adjustments through email or in writing. They use the contact details you provided in your return to connect with you and send these details.

- If you respond within 30 days of receiving the intimation, your inputs will be considered before the final adjustments are made. If not, the proposed adjustments will be finalized and incorporated.

- Once your final liability is calculated, the system adjusts it against TDS, advance tax, and any other relief under Section 90 or 91.

- In case applicable, an intimation is then sent to you. The following are the types of intimations that you may receive:

- Intimation determining refund: Issued when a refund is due, either because no discrepancy was found or after adjustments. Also, after considering taxes and interest that the taxpayer already pays.

- Intimation with no demand or no refund: It happens when the department accepts your return as filed without making any changes.

- Intimation determining demand: It is issued in case a discrepancy is found, also, if an additional tax is payable after adjustments u/s 143(1).

- The department will send you a demand notice if a tax demand is raised. If a refund is due, it will be credited to your account.

Nature of Adjustments Under 143(1)

Under Section 143(1), the total income or loss is calculated after making the following adjustments:

- Arithmetical Errors: It means any calculation errors in the return.

- Wrong Claims: Any claim that is incorrect based on the details provided in the return. It may include the following:

- Claims that are not consistent with other entries in the return. It can include another entry of the same or some other items in such a return. Such as deducting income from other sources from business income. However, not declared under the "Income from other sources" section.

- Suppose you try to carry forward losses from previous financial years. However, the return for that year was filed after the deadline. Then, the set-off of such losses will not be allowed.

- Any expense indicated in the audit report but not mentioned in the return will face disallowance.

Time Limit for Issue of 143(1)

Section 143(1) intimation can be sent only up to 9 months from the end of the financial year in which the return is filed.

For Instance,

- Suppose you filed your return for the year 2023-2024 in July 2024. Then, the financial year will end on 31st March,2025. It means you can issue the intimation for up to 9 months from 31st March, which is 31st December, 2025.

- If you don't receive any intimation during this period, it means no adjustments were made to your return, and no changes to your tax liability or tax refund. Additionally, in such a case, the filed acknowledgment itself will be considered as Section 143(1) intimation.

- At last, you must not ignore this Income Tax notice. You need to submit a response within the specified time duration in such a notice (if any action is required).

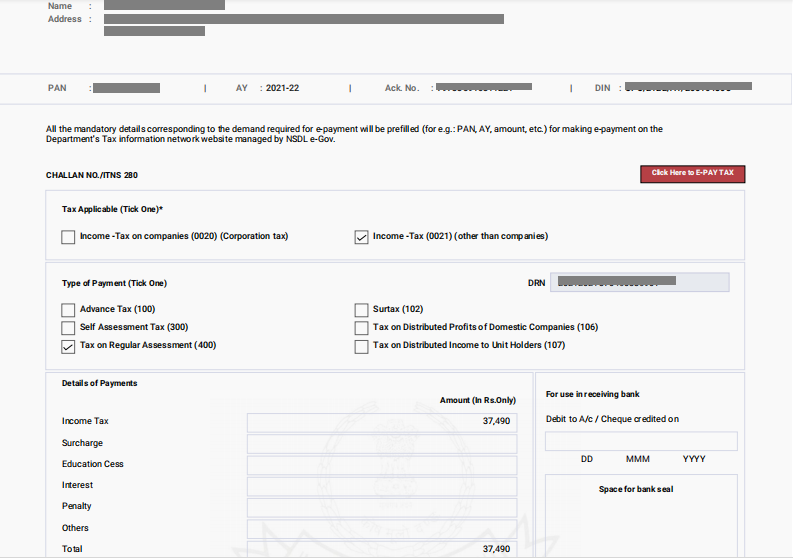

Sample of an Intimation Under 143(1)

What is the Password for Intimation u/s 143(1)?

You will need a password to check the intimation you receive u/s 143(1) as it will be password-protected. The ITR intimation password will be your PAN number in lowercase, followed by your birth date. Enter your birth date in DDMMYYYY format without any spaces.

For example, assuming that your PAN number is EFGHI5678K and your date of birth is 08/05/2003. Then, your password for intimation u/s 143(1) will be "efghi5678k08052003.

Action to be Taken by the Taxpayer after Receiving a 143(1)

The taxpayer must take the following actions after receiving an intimation under section 143(1):

- Firstly, check the Section 143(1) intimation to ensure the document pertains to your return. Also, the details provided relate to the same financial year as specified in 143(1). Review the name, PAN, address, assessment year, and e-filing acknowledgment number.

- If you find any mistakes in your return based on the 143(1). Then, you can rectify them by filing a revised return on the income tax e-filing website.

- If you find that there are no mistakes. However, you disagree with the adjustments made by the CPC/computerized system. You can also file an online rectification application under Section 143(1). It will help you correct the errors in the Section 143(1) intimation.

- In addition, submit your response on the e-filing portal regarding any tax demand. Ensure to indicate whether you agree or disagree with the same.

- Now, if you are not satisfied with the processing of your rectification return by CPC, then you can file online grievances or connect with your assessing officer. You can file a complaint with the Income Tax Ombudsman in case you don't receive satisfactory action from the CPC/assessing officer.

If a taxpayer agrees to the tax demand issued by the income tax department, the taxpayer must pay the taxes. Ensure to choose "tax on regular assessment (400) under "type of payment" filed in the challan when paying tax on demand raised under this section.

Points to Check When You Receive an Intimation u/s 143(1)

Ensure to check the following points when you get an intimation under section 143(1):

- The intimation contains your name.

- It has a document identification number.

- All income is appropriately mentioned under the relevant head.

- The income of one head is not considered under another head or repeated elsewhere.

- Any relief u/s 89,90/90A.91 or any rebate that you have claimed or allowable is included in the intimation.

- TDS/TCS claimed advance tax paid, self-assessment tax paid in the calculation by CPC.

- Your claimed deductions under 80C and other sections of Chapter VI A are included.

The Bottom Line

An intimation under section 143(1) is more like a formal communication from the tax department. They highlight their conclusions after assessing your ITR. Understanding the intimation u/s 143(1) can save you from unnecessary stress and lawsuits.

Consider seeking help from a professional who can assist you in responding to these notices correctly. You don't need to scroll through various websites, as Savetaxs can be your one-stop destination for all your tax-related issues. Our team of experienced CAs and tax experts will provide you with personalised assistance. We will help you gather all required documents and ensure timely responses to avoid any hassles or penalties. Please don't give it a second thought, connect with us and enjoy convenience, expertise, and high-quality tax assistance right away.

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

- A Comprehensive Guide on the DTAA between India and the USA?

- What is the Double Tax Avoidance Agreement (DTAA) Between India and Singapore?

- What is a Tax Residency Certificate (TRC) and How to Get It?

- TDS on Sale of Property by NRIs in India

- TDS Deduction on Rental Property Owned by NRI

- Section 195 of Income Tax Act - TDS Applicability for NRI

- Double Tax Avoidance Agreement (DTAA) Between India and UK

- What is Double Taxation Avoidance Agreement (DTAA)? How NRIs can Claim Benefits Under DTAA

- How to Claim TDS Refund for an NRI?

- Sections 90, 90A & 91 of the Income Tax Act for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

Follow these steps if you received a demand notice:

- Firstly, check the reason for tax liability, and if you agree with the tax demand, you will likely need to pay the tax.

- Opt the tax on regular assessment (400) under the payment type in the challan. In case you don't agree with the demand, provide a response for the same.

To file rectification for intimation under section 143, follow these steps:

- Log in to your account

- Go to "My account" and select "Rectification"

- Fill in all the required details

- Click on Submit.

_1760618042.webp)

-DEDUCTION-ON-HOSUING-LOAN_1756903528.webp)

_1768807342.webp)