- What is Section 115F of the Income Tax Act, 1961?

- Who Can Claim Tax Exemptions Under Section 115F?

- Key Conditions and Requirements to Claim Tax Exemption Under Section 115F

- How to Claim Tax Exemption Under Section 115F?

- Benefits of Section 115F of NRIs

- Clause 215: Propose Updates for Section 115F

- Final Thoughts

Section 115F of the Income Tax Act 1961 is designed for Non-resident Indians (NRIs). Under this section, they can claim tax exemption on long-term capital gains (LTCG) from investments made in India. However, NRIs need to fulfill certain conditions.

This blog provides you with all the information about Section 115F and how NRIs can save taxes on their LTCG through it. So, let's start reading.

- Section 115F of the Income Tax Act, 1961, is only available to NRIs. It provides them with a tax break on the capital gains they received from the sale of their foreign exchange asset.

- To claim the tax benefits under this section, NRIs need to fulfill certain conditions. This includes the sale of foreign exchange assets and, within six months of transfer, reinvestment in an Indian asset.

- There are also certain conditions that NRIs need to fulfill to claim tax exemption under section 115F. These are meeting the reinvestment deadline (six months), lock-in period, investing in specified assets, and maintaining NRI status.

- Further, there are several benefits to using section 115F. It helps NRIs in paying zero tax on their long-term capital, it is legal and permitted, and more.

- Additionally, using Clause 215, certain changes were also proposed for section 115F in the 2025 Income Tax Bill, making it a more suitable option for NRIs.

What is Section 115F of the Income Tax Act, 1961?

Section 115F of the Income Tax Act, 1961, is a tax exemption available on long-term capital gains (LTCG) from investments. This section is only available for non-resident Indians (NRIs). It is a highly effective tool for tax planning that helps NRIs in cross-border investment. However, to claim this tax deduction, NRIs need to fulfill the following conditions:

- Sell a foreign exchange asset. It includes government securities, listed equity shares of Indian companies, public sector debentures and bonds, and more.

- Within six months of the transfer, reinvest the net sale consideration in eligible Indian assets.

This was all about section 115F of the Income Tax Act, 1961. This section aims to encourage foreign investment in India. Additionally, provide an easy tax regime for NRIs. Moving ahead, let's know who can claim tax exemptions under this section.

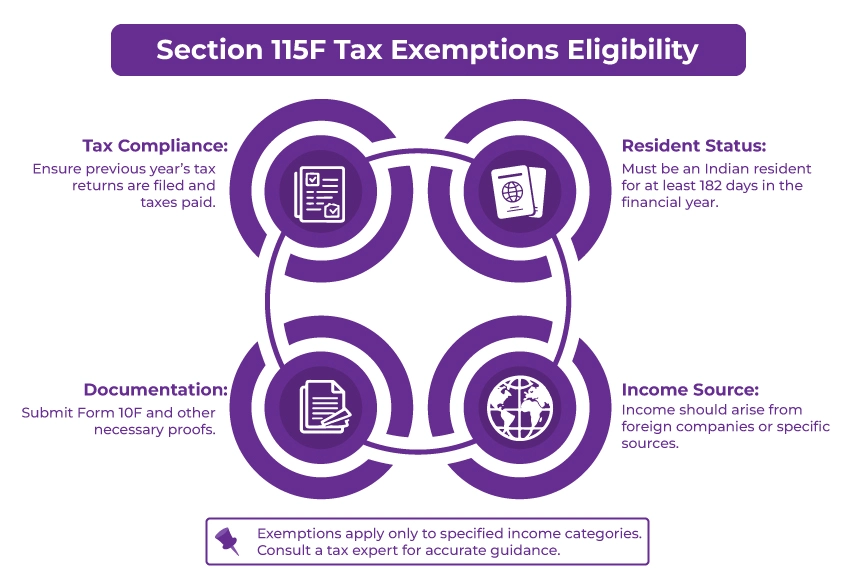

Who Can Claim Tax Exemptions Under Section 115F?

As mentioned earlier, the tax exemptions under section 115F on long-term capital gains (LTCG) are only available for NRIs. However, to avail the benefits of this section, they need to fulfill certain conditions. These are as follows:

- They should not have a permanent establishment in India.

- The income should not be from any business set-up in India.

- Additionally, the income, other than investment, should not be from any source of income in India.

The above-stated specifications certify that NRIs with passive income from their Indian investments can claim the tax exemption under section 115F. Additionally, the applicable tax rate under this section is 20%. It is more than the tax rates imposed on Indian residents. Moving further, now, let's know what the specific conditions/ requirements are for NRIs to avail tax benefits under this section.

Key Conditions and Requirements to Claim Tax Exemption Under Section 115F

There are four key conditions that NRIs need to fulfill to claim tax exemption under section 115F. These are as follows:

- The deadline for reinvestment is six months after the transfer of the capital asset. Considering this, a delay in the reinvestment may result in disqualifying you from claiming tax exemption.

- The reinvestment should be made on assets stated under section 115F. In case you reinvest your money in unlisted shares, property, mutual funds, or more, you will no longer be eligible to save tax.

- The reinvested capital assets should be held with you for a minimum of 3 years (36 months) from the day of purchase. Premature sale leads to cancellation of the tax exemption. Additionally, on the exempted amount, tax will be imposed.

- You should use a foreign remittance or NRE/ FCNR account to make the reinvestment in India. In simple words, foreign exchange should be used for reinvestment.

These are the key requirements/ conditions that, as an NRI, you need to fulfill to claim tax exemption under section 115F. Further, during this period, you need to maintain your NRI status. You may also ask for the FIRC certificate, retain bank records, and investment documents to prove your NRI status during the period.

Moving ahead, let's know how to claim the tax exemption under Section 115F.

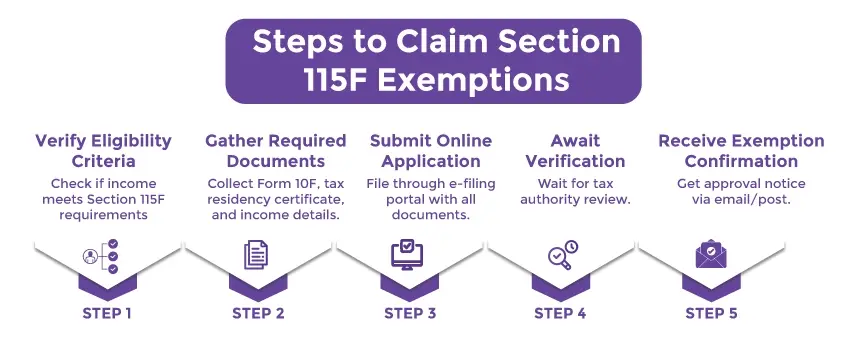

How to Claim Tax Exemption Under Section 115F?

Follow the steps below to claim the tax exemption under section 115F of the Income Tax Act, 1961:

- Step 1: Check the eligibility criteria to determine whether you qualify for Section 115F or not. It includes

- Determining your capital gain from foreign investment exchange.

- Within six months, reinvest the net sale consideration in eligible assets.

- Step 2: Gather all the required documents. It includes Form 10F, investment proofs, bank statements, details of sale, and reinvestment receipts. Additionally, maintain your NRI status during this period.

- Step 3: Fill out the ITR form using the e-filing income tax portal. Additionally, during your ITR filing, with the required documents, claim your tax exemption under section 115F.

- Step 4: Wait for the tax authority to review your application.

- Step 5: The tax authority will provide you with the confirmation via email or post.

This is how you can claim a tax exemption under section 115F. Confused? Let's understand with an example.

Suppose a person named Anita is an NRI. Three years back, in India, she purchased listed equity shares of an Indian company, and now she has sold those shares at a value of Rs 6 crore. The original price of these shares during the purchase was Rs 3 crore. Considering this, Anita earned Rs 3 crore as long-term capital gain from these shares.

Further, to claim the tax exemption under section 115F, within four months, she reinvested Rs. 4.5 crore in buying shares of another Indian company. So, this was all the information. Now, let's calculate the tax exemption amount under Section 115F on LTCG.

Formula: Exempt LTCG = (Reinvested amount / Net Sale Value) * Total long-term capital gain

Exempt LTCG = (Rs 4.5 crore / Rs. 6 crore) * Rs 3 crore = Rs. 2.25 crore

Taxable LTCG = (Rs 3 crore - Rs 2.25 crore) = Rs 75 lakh

Saved tax: Assuming post-indexation, the LTCG tax rate is 20% = Rs 2.25 crore * 20% = Rs 40 Lakh

So, this is how using section 115F, NRIs claim tax exemption on their long-term capital gain. Moving further, let's know the ax benefits of this section.

Benefits of Section 115F of NRIs

Here is the list of key benefits section 115F of the Income Tax Act, 1961, offers to NRIs:

- Under the Income Tax Act, 1961, this section is completely legal and permitted.

- Under this section, NRIs do not need to pay tax on their long-term capital gains from foreign exchange assets.

- Efficient reinvestment option for NRIs into the Indian economy.

- After claiming tax exemption under this section, later, NRIs do not need to file tax refunds.

- This is an ideal option for NRIs who want to rotate capital from government bonds, Indian shares, or deposits.

So, here is how, apart from saving tax, section 115F helps NRIs in India. Moving ahead, let's know the changes stated in Clause 215 in the 2025 Income Tax Bill for this section.

Clause 215: Propose Updates for Section 115F

The 2025 Income Tax Bill, using Clause 215, proposes the following updates in Section 115F:

- Wider eligibility. This means availing the tax exemption under section 115F to not only NRIs but also to all non-residents. It aims to boost the investment of foreigners in India.

- Increasing the reinvestment window. Increasing from six months to the CBDT notification.

- Offering more options for investments such as REITS, mutual funds, and more.

So, these are some of the updates stated under Clause 215 for section 115F.

Final Thoughts

Lastly, from the above information, it is clear that Section 115F of the Income Tax Act, 1961, is a special tax regime for NRIs who have passive income from Indian investments. This section makes the requirements of tax compliance easier for NRIs. Additionally, provide them with more attractive investment options. Well, it is not a tax evasion but a tax optimization tool for NRIs.

Further, if you are planning to sell your Indian assets, connect with Savetaxs. We have a team of experts who will assist you in maximizing your post-income tax returns. Additionally, if you want, they will also help you with tax planning.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- How to Respond to Notice Under Section 143(2)?

- Section 80GGC of Income Tax Act: Deduction Limit and Exceptions

- All About Section 40(a)(i) Of The Income Tax Act

- Section 194N- TDS on Cash Withdrawal

- All You Need to Know About Section 22 of the Income Tax Act

- Income Tax Surcharge Rate & Marginal Relief for AY 2025-26

- Intimation Under Section 143(1) of Income Tax Act – ITR Intimation Password

- Understanding Section 10 of the Income Tax Act

- Short Term Capital Gain on Shares (Section 111A of Income Tax Act) - STCG Tax Rate and Calculation

- Returning to India After Retirement: Tax Planning for NRIs

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766559165.png)

_1768633699.png)

_1768304909.webp)

_1754564786.webp)

_1766396437.webp)

_1767789828.png)