An Aadhaar card for NRIs is a 12-digit unique identification number issued by the UIDAI. This document is quite relevant and essential in India, as it is required for various activities, such as opening a bank account or filing income tax returns.

Although an Aadhaar card is not mandatory for NRIs, having one makes your financial transactions easier, such as opening a bank account, linking your Aadhaar to a bank account for easier transactions, or engaging in property transactions in India.

In this blog, we will discuss the importance of Aadhaar cards for NRIs, including eligibility criteria, required documents, enrollment process, and more.

- An NRI Aadhaar card is a unique 12-digit identification number issued by UIDAI.

- An NRI can use an NRI Aadhaar card to open bank accounts, file income tax returns, and deal in real estate in India.

- To apply for an Aadhaar card in India, NRIs are subject to the 182-day residence rule, which has now been relaxed for NRIs holding a valid Indian Passport.

- NRIs are exempted from mandatorily linking their PAN and Aadhaar card, provided they do not have an Aadhaar card. If an NRI has already applied for an Aadhaar card, they must link it to their PAN card.

Importance Of Aadhaar Card For NRIs

An Aadhar card is important for NRIs for various reasons, such as:

- An Aadhaar card or an e-Aadhaar card helps NRIs speed up their KYC process for any transaction in India.

- NRI Aadhar card serves as proof of their identity in India for foreign nationals.

- An NRI Aadhar card is essential for opening a bank account or completing paperwork related to real estate. Additionally, NRIs must have an Aadhaar card to be employed in India, especially in the government sector.

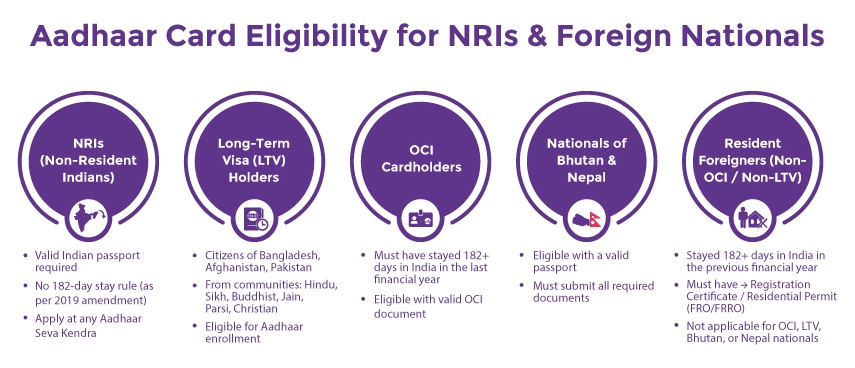

Eligibility Criteria For Aadhaar Card For NRIs

The following is the eligibility criteria for an Aadhar card for NRIs.

Non-Resident Indian (NRIs).

A person, whether an adult or a minor, with a valid Indian passport can apply for an Aadhaar card at any Aadhaar Seva Kendra in India.

Additionally, NRIs must be physically present in India for at least 182 days in a fiscal year before applying for an Aadhaar card.

However, please ensure that, as per the new amendment made by the Honorable Finance Minister, Mrs. Nirmala Sitharam, in her 2019 Budget speech, NRIs with valid Indian passports can be enrolled in the Aadhaar Yojana without having to complete the mandatory 180-day time limit.

Overseas Citizen of India (OCI).

Any OCI cardholder who has stayed in India for a minimum of 182 days in the last financial year can apply for their Aadhaar card.

Long-Term Visa Holders (LTV Holders).

Long-term visa holders from countries such as Bangladesh, Afghanistan, or Pakistan, mainly belonging to the minor communities of Hindus, Sikhs, Buddhists, Jains, Parsis, and Christians, can apply for their Aadhaar card in India.

Nationals of Bhutan and Nepal.

With a valid passport and other required documents, the nationals of Nepal and Bhutan are eligible to apply for an Aadhaar card.

Resident Foreigners

Any other foreign resident who has stayed in India for more than 182 days in the last financial year can also apply for an Aadhar card.

However, resident foreigners must have a valid Registration Certificate or a residential Permit issued by FRO/FRRO.

Additionally, these resident foreigners must not have an OCI or LTV document and must not be nationals from Bhutan or Nepal.

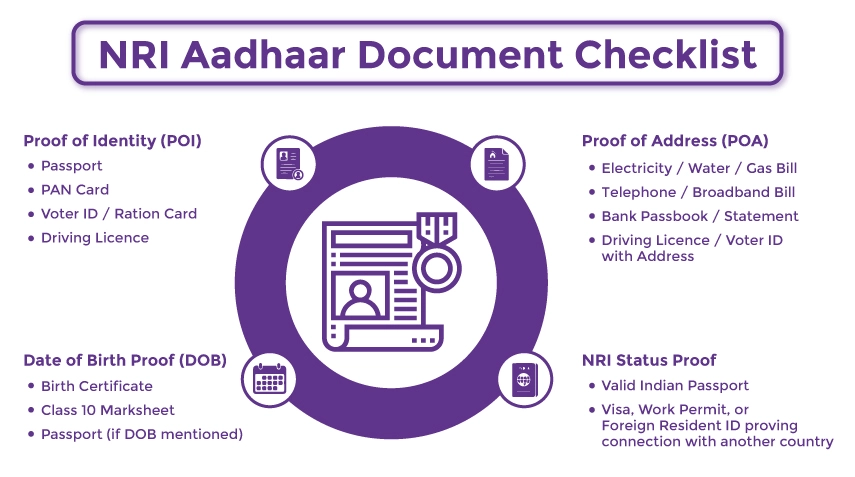

Documents Required For Aadhaar For NRIs

To obtain an Aadhaar card in India, NRIs need certain basic documents. The documents accepted by the Unique Identification Authority of India, UIDAI, for NRI Aadhaar are:

Proof of Residence: Any document that verifies your address, such as a bill for electricity, gas, or another service. Additionally, you can use your driver's licence, voter ID, or another form of ID.

Birth Certificate: Any document that proves your DOB. Such as your 10th class marksheet or even your birth certificate.

Proof of Identity: You can use your voter ID card, ration card, or PAN card. However, a driver's license will also be a valid proof of your identity in India.

NRI Identity: Aadhaar card applicants must provide the required documents to prove their connection with the other country. Please ensure these documents are in order, as government officials in India will check their validity.

Kids of NRIs Applying For Aadhar Card

If the child is below the age of five years, one of his/her parents or guardians must authenticate on behalf of the child and provide consent for the enrolment of the minor's Aadhaar card by signing the enrolment form.

Additionally, for the NRI child, their birth certificate is an essential document as proof of their identity.

File NRI ITR with 100% accuracy.

How NRIs Can Apply For an Aadhar Card

NRIs need to follow a simple procedure to obtain an Aadhaar card. The process is somewhat similar to that of Indian residents. The entire process for an NRI Aadhaar card takes about 90 days, and the applicant must provide biometric identification.

Here's the step-by-step guide for NRIs, OCI cardholders, and other resident foreigners:

1: Book an appointment: To avoid standing in long queues, you should book an appointment for Aadhar enrollment at an Aadhar Seva Kendra.

To book an appointment, visit the UIDAI's official website and select the "Book an Appointment" option. Fill in all the required information and schedule a visit.

2: Required Documents: Keep all the essential documents, as per your applicant type, ready.

3: Fill in the enrollment form: Complete the entire enrollment form, and please ensure that, as an NRI, you have to provide your email ID as well in the form. To fill the form, you can download the Aadhar enrollment form from the official website of UIDAI.

There are different Aadhaar enrolment forms depending on whether you are a non-resident or a resident.

- Form 1: For NRIs having address proof in India.

- Form 2: For NRIs having address proof outside India.

- Form 7: For other resident foreign nationals.

4: Visit The Aadhaar Seva Kendra: At the scheduled date and time, visit the chosen Aadhaar Seva Kendra with all your relevant documents and completed enrolment form.

5: Enroll in as per your applicant type (NRI/OCI/LTV, etc):

Inform the operator about your residential status and ask them to enrol you accordingly.

6: Biometric Capture: Complete the entire biometric capture process.

7: Verify the Details: After completing the entire process, check all the details on the screen, both in English and the local language, before you let the operator submit your information.

8: Collect the enrollment slip: Upon submission, collect your enrollment or the acknowledgement slip, which will have a 14-digit enrollment ID, date, time, and stamp. Ensure you keep the slip with your safety, as you can check your Aadhaar card status using the enrollment ID number online.

Struggling with NRI Banking Compliance? Book NRI Banking Services Consultancy In A Click.

Aadhar Update Rules For NRIs

As an NRI, please ensure that if you move abroad or return to India permanently, you will also have to update your Aadhaar card information accordingly.

Update your address, mobile number, email, passport reissue, and so on.

The Bottom Line

Although an Aadhaar card for NRIs is not mandatory, it offers many benefits. Ensure that Aadhaar cards are not proof of Indian citizenship for NRIs.

If you need any guidance on the NRI Aadhaar card process or an expert consultation on anything related to this matter, connect with Savetaxs. We have a team of professionals with expertise in NRI taxation and financial-related issues.

Connect with us today as we serve our clients 24/7 across all time zones.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Duplicate PAN Card Application Process For NRIs and Indian Citizens

- What is the Importance of Aadhaar and PAN Card for NRIs?

- Why NRI Need A PAN Card Even If They Don't Pay Tax In India?

- How to Apply for a Lost or Damaged PAN Card?

- PAN Card Surrender For NRIs and Indian Residents

- PAN vs TAN: Key Difference You Should Know

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1766561286.webp)

_1767333184.png)

_1767696432.webp)