WhatsApp Community

- Whatsapp CommunityWhatsapp Community

Connect with us in just a click!

- Chat WhatsappChat Whatsapp

Fast replies, simple and direct!

The Three R's of investing are Research, Risk, and Reward.

The highlights from the Reserve Bank of India's research report state that NRI investment in Indian has doubled in 2024, reaching 7.82 billion USD between April and August, with the outstanding total now at nearly $159 billion USD.

Amid global chaos, India's economy is growing steadily and sustainably and has become a preferred investment destination for NRIs. Hence, in this guide, we will discuss the top 10 NRI investment options in India, including their taxation and compliance requirements.

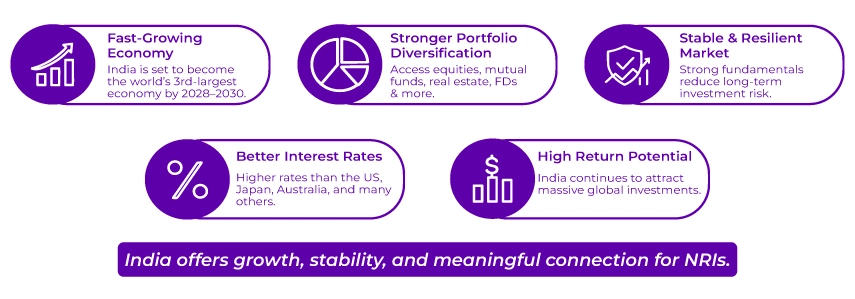

India's economy is among the fastest-growing and is projected to become the world's third-largest by 2028-2030. This rapid growth has made India an enticing global investment destination for NRIs.

For NRIs, investing in India is more than financial benefits; it's about staying connected to their roots while contributing to their home country's economic growth.

Given India's robust, rapidly transforming economy, NRIs must invest in India for the following reasons:

One of the key reasons NRIs invest in India is to diversify their portfolios across different market segments. Diversification helps you minimize the overall risk.

India offers an array of investment options for NRIs, such as:

The Investment Avenue in India offers strong potential for returns. Perhaps this is why, from April 2020 to September 2023, Foreign Direct Investment (FDI) in India amounted to $953.143 billion and has been growing annually.

Banks in India offer better interest rates than those in the US, Australia, Japan, Saudi Arabia, China, and many other countries. This might sound surprising, and many NRIs aren't even aware of this fact.

For example, the United States Bank does not offer interest rates above 2-3%, and in Japan, interest rates are negative.

There is no doubt that India's economy is among the most stable in the world. Hence, investing in a stable country reduces risk even when markets are volatile.

The list of reasons why, as an NRI, you should invest in India is endless. It all boils down to one thing: Research, Research as much as you can about the economy of India, and you yourself will be surprised to know that the economy of your home country has a lot to offer.

Right from safe investment bets like fixed deposits and government bonds to high-return options like fractional real estate, REITs, and equities, the investment options for NRIs in India are wider and smarter than ever.

The following are 10 investment options for NRIs, along with their estimated returns, tax implications, and rules, to help you grow wealth in your home country while living abroad.

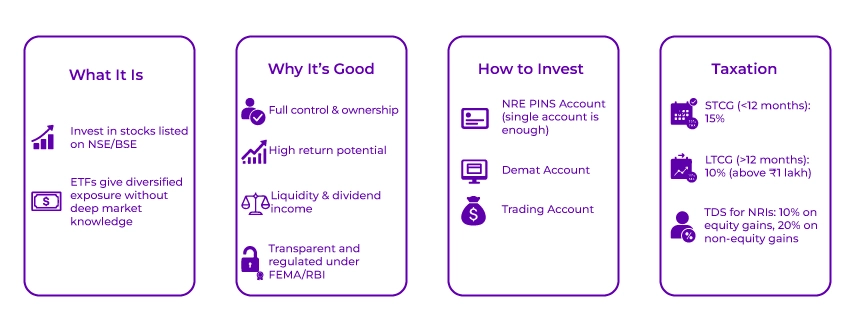

When you invest in direct equity investments in India as an NRI, it's like you are driving India's economic growth story.

Well, direct equity investment for NRIs means investing in listed securities traded on Indian stock exchanges, such as BSE (Bombay Stock Exchange) and NSE (National Stock Exchange).

Exchange-traded funds, or ETFs, offer another way to combine the best of both stocks and mutual funds. ETFs invest across bonds, money market instruments, and shares, making them accessible to you even if you lack the core stock market knowledge.

As an NRI, when you invest in India, you must follow the regulatory framework set by the Reserve Bank of India and the guidelines rolled out by the Office of Foreign Exchange Management (FEMA).

It is good because of the ownership and control you have with direct equity investments: you can choose which stocks to buy and when to sell. Additionally, direct equity investment also offers high potential returns, liquidity, dividend income, and transparency, which is the cherry on the cake.

To invest in direct equity, you need.

However, as per recent RBI guidelines, you do not need separate NRO PINS accounts and NRE PINS accounts; only one NRE PINS account is sufficient.

The capital gains here are classified as.

TDS for NRIs of 10% applies to equity-related gains, and 20% to non-equity-related gains.

File Your NRI ITR Online Hassle-Free And With Expert Assistance.

As an NRI investor, if you're seeking professional management and do not need any direct stock selection complexity, the mutual fund is your pick. This investment option stands out as one of the most practical options for NRIs aiming for long-term growth.

The mutual fund collects money from different non-resident investors to build a diversified portfolio of bonds, stocks, and other related securities.

Here, the mutual fund manager will be responsible for managing your investment in the mutual fund scheme. They will allocate your money into different instruments such as money market instruments, equity, or debt. Now, the professional mutual fund manager handles the investment decisions here. This brings in the expertise particularly needed for managing investments abroad.

So, depending on your potential return expectation, risk appetite, and the goal of the investment, you can choose any mutual fund.

It is excellent for NRI investors for multiple reasons, such as.

To invest in MFs, you need to complete the mandatory SEBI KYC process. Here you'll be needing.

Now open the designated NRI accounts, and once your account is ready, you can invest in mutual funds through AMC websites, registrar platforms, stock exchange facilities, and mutual fund utilities.

For mutual funds, the tax treatment for NRIs depends on the fund type and the holding period.

Whereas with respect to debt funds.

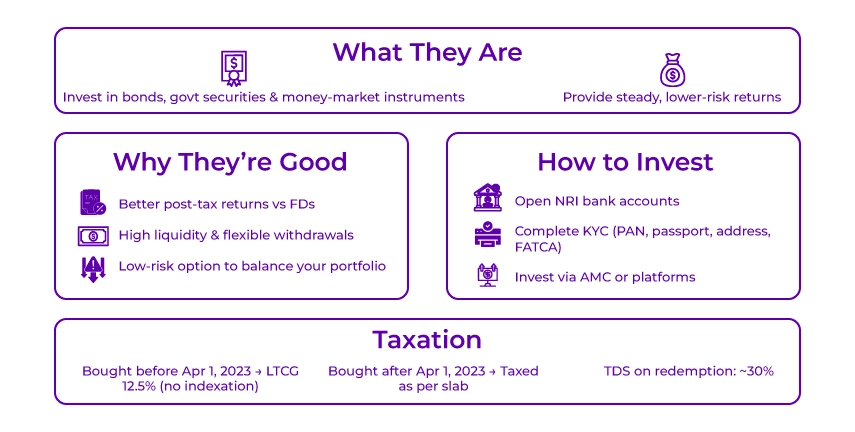

This type of mutual fund is ideal for NRIs seeking a lower-risk investment product with stable returns. Debt mutual funds offer a balanced approach to wealth creation while keeping risk at a manageable level.

Debut funds are a specific type of mutual fund scheme that invests primarily in fixed-income securities, such as corporate bonds, government bonds, and other money-market instruments. These funds offer a steady income stream.

For NRI investors, debt funds are great in the following ways:

TDS on redemption is generally deducted at a rate of 30%.

If you are selling redirect resources with lower risk, NRI fixed deposits must be in your investment portfolio. You can think of these fixed deposits as a reliable, easy financial safety net designed for NRI investors seeking steady market growth.

NRI fixed deposits are of three different types.

The process to invest in NRI fixed deposits is relatively seamless.

The documentation here requires you to have a copy of your passport, valid work and residence permits, and address proofs of both overseas and Indian locations.

With NRI FDs, the tax treatment depends on what type of deposit you hold.

Connect with Savetaxs and, with expert guidance, open your NRI bank account without any issues.

Get StartedReal estate investments offer something that stocks and mutual funds cannot: a tangible asset in India. This type of investment provides both a strong emotional connection to India and substantial financial returns, making it a favorable option for NRIs planning their future in India.

Investing in real estate means owning a property in India, such as a villa, apartment, office space, house, retail outlet, or other commercial building.

As an NRI, you cannot invest in agricultural land, plantation properties, or farmhouses. However, you can inherit these properties but can not directly invest in them.

It is a great investment option for NRIs for the following reasons.

The real estate investment process follows a structured approach.

This investment product aims to solve the retirement challenges for NRIs through a restricted market-linked investment.

NPS is government-backed and offers numerous tax advantages for NRIs, as well as long-term wealth creation.

The national pension scheme was initially established in 2004 as a government-sponsored retirement plan for its employees. It later then opeded ot all the Indian citizens, including NRIs.

This National Pension Scheme is managed by the Pension Fund Regulatory and Development Authority (PFRDA). Here, your investment occurs in two stages: accumulation, where you contribute regularly to the scheme, and withdrawal, when you have access to the funds at maturity.

It is excellent for NRIs because:

To invest in NPS, you must be between 18 and 60 years old. Please note that PIOs are not eligible to open an NPS account, whereas OCI holders are. The documents that you will need to invest are.

You can start with an account opening of Rs 500 and can then maintain an annual contribution of Rs 6,000.

When you invest in NPS, you get tax benefits under the old regime, which allows the deduction of up to Rs 1,50,000 under Section 80CCD(1), plus an additional Rs 50,000 under Section 80CCD (1B).

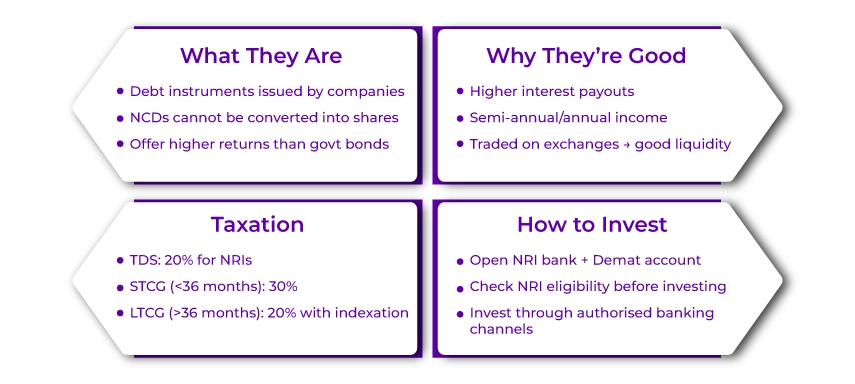

Corporate bonds and Non-Convertible Debentures (NCDs) provide a fixed-income investment channel for NRIs looking to diversify their portfolios in India.

To put it simply, corporate bonds are debt instruments used by both public and private companies to raise capital for expansion, operations, and other business needs.

These bonds are known for offering higher returns than government bonds, but they do carry greater risk. Whereas NCDs are a specific debt instrument that cannot be converted into equity shares of the issuing company.

From higher returns to semi-annual or annual interest payments that help you have a steady income stream, these bonds are a preferred option for NRI investment in India.

Additionally, these securities can be traded on the stock market, which ensures liquidity whenever needed.

To invest in corporate bonds:

Inevitably, investing in gold has been a tradition in India, and even in today's volatile market, it acts as your financial anchor.

With ETFs and digital gold, NRIs can invest in gold beyond traditional jewelry. Exchange-traded funds (ETFs) are a specific type of mutual fund traded on stock exchanges that track the price of gold, with each unit representing 1 gram of 99.5% pure gold.

Digital gold gives you the flexibility to purchase gold online in denominations as small as 1 Rs. Additionally, these digital goods are secured in insured vaults on your behalf.

Gold has been the unsaid king of the investment world since the beginning of human existence. It is excellent for NRIs.

This investment option combines the best of life insurance and investment opportunities in one package.

ULIPs split your insurance premium for two purposes. The first part of your money goes toward your life insurance coverage, while the remaining part is invested in market-linked funds.

You can think of this investment product as two engines running in tandem: one protects your family's financial future, and the other grows your wealth through market-linked funds.

When investing in ULIPs, you need basic identity and address proof, along with income documents and a PAN Card.

The premium payment can be made through your NRI accounts, online wallets, international credit cards, and internet banking.

PMS offers tailored services for high-net-worth NRIs who need expert-backed guidance in the Indian market.

The portfolio management services, as the name suggests, provide NRIs with professional investment management, with a portfolio manager overseeing their portfolio based on their risk appetite and long-term financial goals.

As per SEBI guidelines, a minimum investment of Rs 50 lakh is required to open a PMS account.

The investment process here involves.

TDS applies to the NRI portfolio. However, the TDS rate depends on your country of residence.

We at Savetaxs offer personalized investment strategies for NRIs, tailored to their risk appetite and financial goals.

To start investing in India as an NRI, all it takes is careful planning and a well-thought-out approach to grow your wealth while staying close to your roots.

These were the top 10 NRI investment options that you can choose to invest in India. Apart from the ones mentioned above, you can also invest in Sovereign Gold Bonds (SGBs), Fractional real Estate Ownership, REITs (Real Estate Investment Trusts), and Alternative Investment funds.

The only way to build a successful investment portfolio is to find what best fits your financial goals and invest wisely. If you lack core knowledge of the investment sector, it's best to seek professional help from an NRI investment strategist who is also well-versed in cross-border taxation.

One such expert for NRIs is Savetaxs. We have been helping NRIs across 90+ countries build their investment portfolios in India. Our portfolio and fund managers bring extensive knowledge and a decade of experience across all investment avenues in India.

Connect with us today as we serve our clients 24/7 across all time zones.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and can help make accurate decisions and maintain accuracy throughout the process.

Speak to our experts and get personalized solutions for your NRI tax needs

Mr Manish is a financial professional with over 10 years of experience in strategic financial planning, performance analysis, and compliance across different sectors, including Agriculture, Pharma, Manufacturing, & Oil and Gas. Mr Prajapati has a knack for managing financial accounts, driving business growth by optimizing cost efficiency and regulatory compliance. Additionally, he has expertise in developing financial models, preparing detailed cash flow statements, and closing the balance sheets.

Investing in India is beneficial for NRIs for multiple reasons, including a diversified portfolio, strong potential returns, current advantages, and more. The list goes on.

Yes, NRIs can invest in mutual funds in India.

Yes, you can invest in SIPs while staying abroad.

Yes, NRIs can open a demat account.

Yes, NRIs can invest in the Indian stock market.