Alternative Investment Funds (AIFs) for NRIs are privately pooled investment vehicles in India that collect money from sophisticated investors. The funds are invested in non-traditional assets like private equity, venture capital, real estate, etc., potentially offering higher returns.

These funds are governed by the Securities and Exchange Board of India (SEBI). AIFs have longer lock-in periods, typically ranging from 3-10 years, and have a minimum investment requirement of Rs. 1 crore. A Non-Resident Indian (NRI) can invest in an AIF through NRE/NRO accounts with an authorized Indian bank.

An NRI must complete KYC and comply with FEMA regulations to be eligible to invest in an AIF. The process to invest in AIFs requires specific documents, adhering to minimum investment thresholds, and routing funds via specified bank accounts. In this blog, we will discuss how an NRI can invest in an AIF in India.

- AIFs are SEBI-regulated, privately pooled investment vehicles that collect money from high-net investors.

- An NRI can invest in an AIF via NRE/NRO accounts with full KYC and FEMA compliance.

- AIFs have a minimum investment requirement of Rs. 1 crore is mandatory (Rs. 25 lakh for employees/directors of the fund).

- These funds have longer lock-in periods, ranging from 3-10 years.

- Notarized or banker-attested documents and a FEMA declaration are crucial for AIF investors.

- An NRI investing in an AIF will face specific TDS rates ranging from 10% -30%.

What are Alternative Investment Funds (AIFs)?

According to the Securities and Exchange Board of India (SEBI), an AIF (Alternative Investment Fund) is a privately pooled investment vehicle established or registered in India. These funds raise funds from sophisticated investors, both Indian and foreign, to invest based on a defined investment policy for the benefit of its investors.

AIF offers numerous strategic benefits for Non-Resident Indian (NRI) investors. Unlike mutual funds, AIFs focus on assets that are typically absent from traditional financial markets. These funds provide access to unique investment opportunities, including startups, private equity, and venture capital.

Generally, they are structured as closed-ended funds with investment tenures ranging from 3 to 10 years, allowing fund managers the necessary time to implement their strategies and generate returns.

Can NRIs Invest in AIFs in India?

Alternative investment funds are open to investments from all Indian residents, including Non-Resident Indians (NRIs), Persons of Indian Origin (PIOs), and Overseas Citizens of India (OCIs), with units being issued to investors. However, the fund manager's compliance policies may impose some restrictions on investments originating from certain geographical locations. Moreover, to invest in an AIF, you need to fulfill some eligibility criteria.

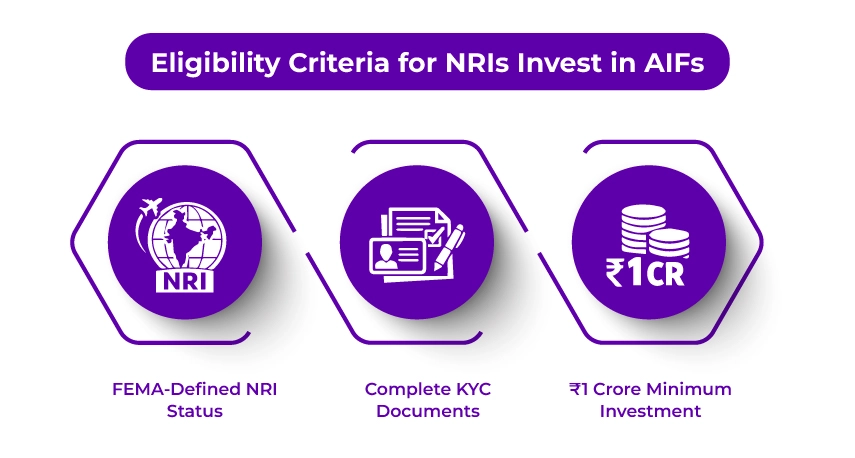

Eligibility Criteria for NRIs Seeking to Invest in AIFs

NRIs must meet the following eligibility requirements to invest in an AIF:

- Have the NRI status as defined under the Foreign Exchange Management Act (FEMA).

- Complete your KYC (Know Your Customer) by providing the necessary documents like a PAN card, passport, overseas address proof, and a photograph.

- Every NRI must invest at least Rs. 1 crore in an AIF, ensuring it remains exclusive to sophisticated and high-net worth investors.

What are the Benefits of AIFs for NRIs?

Alternative Investment Funds (AIFs) offer several benefits for the NRIs, some of which are as follows:

- It permits NRIs to take part in India's growth story by investing in various sectors that might not be easily accessed through other investment options.

- These funds offer exposure to a variety of asset classes, helping reduce portfolio risk.

- Unlike traditional investments, it offers higher potential returns through investments in niche sectors and active management.

Avoid tax filing stress and ensure accuracy by letting experts handle your return.

How Can NRIs Invest in AIFs in India?

Follow the steps below if you are an NRI looking to invest in Alternative Investment Funds in India:

Check Eligibility

First, you must ensure that you meet the required eligibility criteria. According to the Foreign Exchange Management Act (FEMA), NRIs can invest in all categories of AIFs by purchasing units.

For KYC compliance, you will need to provide documents such as your PAN card, passport, proof of overseas address, and a recent photograph.

Set Up Your Banking

You will need to open either an NRE (Non-Resident External) or an NRO (Non-Resident Ordinary) account with a registered Indian bank. Additionally, a Portfolio Investment Scheme (PIS) account is necessary as per the Reserve Bank of India (RBI) guidelines. Keep in mind that you can only maintain one PIS account at a time.

Fulfilling Investment Minimums

Most AIFs require a minimum investment of Rs. 1 crore. However, employees or directors of the AIF or its manager can invest a lower amount of Rs. 25 lakh. Typically, these funds also impose a 3-year lock-in period.

Documentation Requirement

A FEMA declaration is essential for AIF investors. Make sure all the documents are notarized or banker-attested when they are sent from abroad.

Fund Transfer

Once your documents are verified, you can transfer your funds from your NRE/NRO account to the specified AIF document. An NRE account is preferable for overseas earnings, as it offers complete repatriation benefits (both principal and interest) and remains tax-exempt in India.

Alternative Route: GIFT City

NRI families can also access the Indian capital markets through GIFT City by setting up a non-retail AIF or Fund of Funds. This option requires:

- Registration with the International Financial Services Centers Authority (IFSCA)

- Registration with SEBI as a foreign portfolio investor (Category I or II) for investments in the Indian capital markets.

What are the Tax Rules for AIF for NRIs in India?

Tax considerations are crucial when making informed decisions regarding your investments in AIFs. The taxation framework for AIFs in India is defined by specific regulations that significantly impact your return as an NRI investor.

In India, different categories of AIFs are subject to different tax regimes. Category I and II AIFs benefit from a favorable "pass-through" status, meaning the income generated (not including business income) is directly passed to you as the investor. This avoids taxation at the fund level. Conversely, Category III AIFs are subject to taxation at the fund level under applicable tax rates.

As an NRI investor, you will face specific tax deducted at source (TDS) rates for your AIF investments, which can range from 10% to 30%. You may also take advantage of the Double Taxation Avoidance Agreement (DTAA) between India and your country of residence, which could reduce your tax burden or allow you to claim credits for the taxes paid in India when filing ITR in your home country.

To access these benefits, obtaining a Tax Residency Certificate from your country is essential.

Additionally, the Reserve Bank of India (RBI) regulates the repatriation of returns from your AIF investments. Income from Category I and II AIFs can be repatriated freely after tax obligations are met, while Category III AIFs may require you to fulfill additional criteria for repatriation.

Enjoy stress-free tax filing and maximize your refund with a dedicated expert.

Final Thoughts

An NRI can grow their investment portfolio in India's growing economy by investing in AIFs. Unlike traditional markets, it gives access to various investment opportunities under SEBI. A minimum investment of Rs. 1 crore in an AIF is mandatory, as it indicates a focus on high-net-worth and institutional investors. Additionally, these funds have a more extended lock-in period, typically ranging from 3-10 years. So, these are ideal for NRIs seeking long-term financial planning.

Moreover, to navigate the complex regulations of investing in an AIF, seek expert assistance from Savetaxs. We have a team of experts who can assist you in selecting the most suitable AIF category for your financial goals and help you stay compliant with the rules. You can remain confident that you are availing of all the benefits and managing all the tax implications. Reach out to us now and broaden your portfolio by investing in AIF.

Note: This guide is for information purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- How Can NRIs Invest In Indian Stock Market

- Demat Account For NRIs - Application Process, Benefits & More

- Top 5 Problems NRI Face While Investing In India

- The Hidden Tax Burden of Investing in US Stocks for Indian Investors

- Can NRIs Invest In Unlisted Shares In India? An Easy Guide

- NRI Investment in SGrBs Through IFSC

- Registering a Will in India: Key Tips for NRIs

- Sending Money to India from Abroad: A Complete Guide for NRIs

- Foreign Investment Opportunities for NRIs: RBI FEMA Rules for Derivatives

- Investing in REITs as an NRI in India- Complete Guide

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767333184.png)

-DEDUCTION-ON-HOSUING-LOAN_1756903528.webp)

_1765974748.webp)

_1766742512.webp)

_1767164087.webp)