Indians are settling abroad for strong earning potential, better work-life balance, a higher quality of life, and maybe clean air. The "push" factors from India and the "pull" factors from foreign countries make one change their residential status.

However, when you settle abroad and attain NRI status, a lot of administrative tasks come along the way. And one such unavoidable task is changing your PAN card status to NRI.

In this blog, we will discuss the essential steps to update your PAN status to NRI through the Income Tax e-filing Portal, including the required documents, the application process, and why you should change your PAN status to NRI.

- Upon attaining the NRI residential status, changing PAN status to NRI is a mandatory administrative task.

- Incorrect residential status can lead to non-compliance issues, including misclassification of income, potential tax disputes, and problems with cross-border financial transactions.

- Updating PAN status to NRI through the Income Tax Portal is one of the most NRI-friendly ways to do so.

- A correct PAN residential status is essential for tax compliance, cross-border financial transactions, legal documents, and to avoid legal complications.

Why You Should Change PAN Status To NRI

Changing your PAN resident status after becoming an NRI is more than just a bureaucratic formality.

Updating your PAN card for NRI status helps you in:

- Avoiding higher TDS rates (30% or more).

- Claiming tax benefits that are available for NRIs. With an incorrect residential status, you cannot claim any tax benefits for NRIs.

- Open NRE/NRO bank accounts.

- Invest in Indian securities such as mutual funds, Shares, FDs, and more as an NRI.

- Avoid compliance issues with the Indian Income Tax Department.

And the list keeps on going.

Compliance Issues Due To Incorrect Residential Status on PAN

An incorrect residential status can lead to the following financial and legal implications:

- Misclassification of Income.

- Tax Disputes.

- International financial dealings become even more complicated.

- Risk of penalty notices.

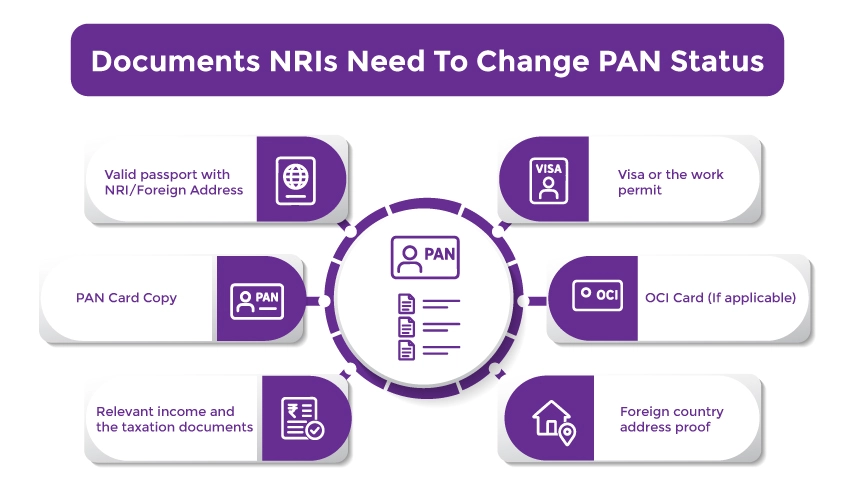

Documents NRIs Need To Change PAN Status To NRI

Keep the following documents handy to change your PAN Status to NRI.

- Valid passport with NRI/Foreign Address Proof.

- Visa or the work permit.

- Foreign country address proof.

- OCI Card (If applicable).

- Relevant income and the taxation documents

- PAN Card Copy

Step-by-Step Process To Change PAN Status To NRI

The following is the detailed process for updating your NRI PAN online. The process would take hardly a few minutes, but it will save you from lakhs of penalties in the future.

Step 1: Get all the Required Documents in order.

Keep the clear scans (PDF/JPEG) of the required documents handy.

Step 2: Update PAN Residential Status In "My Profile"

To do so:

- Go to the Income Tax e-filing portal.

- Log in to the portal using your PAN as your user ID and your password (reset it or register if needed).

- From the dashboard, click on "My Profile".

- Click "Edit" in the profile section.

- Change "Residential Status" to "Non-Resident" and save.

Please note that doing this is not always sufficient to change your status. The Income Tax Department of India usually asks you for your documents via an AO or a Grievance to be marked as an NRI.

Step 3: Find Your Jurisdictional Assessing Officer (AO)

- On the same portal, now use the functionality of: Know Your AO" (often found under the "quick links" section).

- Enter the PAN and mobile number -> Continue -> Enter the OTP -> Validate.

- Please note down the AO's name, designation, email, and address for reference in your application.

Step 4.1: Submit Required Documents Via Grievance (Online Method)

Submitting your documents via Grievance is usually one of the easiest and NRI-friendly routes. To do so:

1: Log in to the income tax portal.

2: From the menu, go to the Grievance / e-Nivaran / e-filing "Grievances section.

3: Create a new grievance and select:

- Department: Assessing Officer (or equivalent options).

- Category/Sub Category: "Others" or "PAN / Profile - Residential Status Change", as available.

4: Now, you have to clearly mention in the description "Update PAN residential status from Resident to Non-Resident Indian (NRI)" and mention your:

- PAN, full name, Date of Birth.

- Date from which you are classified as an NRI as per the Indian Tax Law.

- Reason (employment abroad, business, education, or other).

5: Upload all the required document scans you have prepared in Step 1.

6: Submit the grievance and save the associated reference number for tracking your application further.

The processing time for the application through this method can take 7 to 30 business days, provided all the documents you have provided are accurate and the AO's workload.

Step 4.2: Submit to AO By Post Or Physically

1: Write a letter to your Jurisdictional AO. In the letter, you'll request the AO to change your PAN card's residential status from Resident to NRI. Ensure to add the brief facts to back your request, and the date from which you have been classified as NRI.

2: Attach the self-attested copies of all the required documents.

3: If you are using the foreign citizenship ID or foreign taxpayer ID as proof of your residential status as NRI, please ensure to get it attested by the Indian embassy/Consulate before attesting it to your letter.

4: Send the set of documents and letter to the AO's office by:

- In-Person submission, or

- Speed Post/ courier from abroad, or

- Through an authorised representative in India.

Step 5: Track Your Application

You must track your grievance online under the Grievance section using the reference number you have noted in step 4.1 until it shows resolved.

Then, after a few days, log in again, go to the MY PROFILE, and check your residential status, which now must be shown as "Non-Resident" and that the PAN is operative and, wherever applicable, exempted for linking Aadhaar.

If the status remains unchanged, follow up by:

Raise another grievance that refers to the one you made earlier. Or,

Email/call the AO; the regional grievance contact is listed on the Income Tax Department's help pages.

File your NRI ITR with Savetaxs CA-powered expertise.

How Do I Know If My PAN Status Is Updated?

NRIs can use any of the following methods to check whether their PAN status has been updated.

Method 1: Check on the Income Tax Portal Profile

Log in to the income tax e-filing portal and go to:

My profile -> Personal Details.

Here you must see:

Residential Status: Non-resident.

Aadhaar linking requirement: Not applicable/exempt for many NRIs.

Now, if your profile still shows you as a resident, or the portal keeps asking you to link Aadhaar, it simply means the backend update hasn't been completed yet.

Method 2: Check CYKC (Central KYC) Status

Bank and other financial institutions are likely to update your PAN details in the Central KYC registry. Now, if the backend update is successful, your CKYC will show you as.

- KYC Type: NRI

- And your overseas address will be reflected as your primary address.

On the contrary, if your NRI PAN KYC Update is not done; the CKYC will reflect:

- Resident status, or

- Indian address as primary

Meaning the backed PAN tagging is still pending in your case.

Method 3: Check Your Mutual Fund KYC Status

As an NRI, if you are investing in Indian mutual funds, your KYC status will automatically sync with PAN and CKYC.

A successfully updated PAN will display.

- KYC Status: verified - NRI.

- Your overseas address

- And lastly, FATCA/CRS details updated.

Now, if your mutual fund provider or the KYC agency still marks you as a Resident, it means your PAN status has not been fully updated.

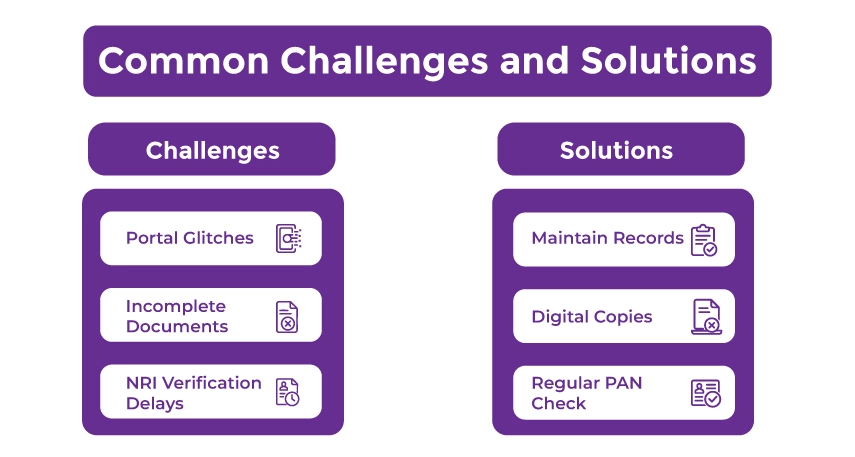

Common Challenges and Solutions to Them

As an NRI, changing your PAN status to NRI can be a tedious task due to the following potential roadblocks:

- Technical glitches on the online portal.

- Your documentation could be incomplete or inappropriate.

- For NRI verification, delays can happen.

Solutions to Avoid These Roadblocks:

- NRIs, specifically, it is essential for you to maintain accurate records.

- You must keep every document digitally as well.

- And lastly, regularly check the status of your PAN Card for NRI.

Connect with expert NRI income tax consultants in India and get personal tax filing, planning, and advisory services.

The Bottom Line

Upon becoming an NRI, you must update your PAN status to NRI. Sooner or later, you have to update it, or else your financial link to India will be affected, and you won't be able to conduct any financial transactions there. Additionally, incorrect residential status on the PAN card for NRI attracts penalties and may result in non-compliance with Indian taxation laws.

Yes, we understand the entire process might seem overwhelming, but if you follow the steps outlined here for "how to update NRI status in PAN Card" carefully, you can easily complete the update.

However, if you are not sure about the process, it is advisable to consult an NRI taxation expert. These experts will get you through the process like a cake walk.

One such NRI taxation expert in India is Savetaxs. We have been helping NRIs from 90+ countries with their cross-border tax compliance worldwide.

Our experts bring in more than 30 years of combined experience to the table. These experts will consult you and help you change your PAN status to NRI.

Connect with us as we serve our clients 24/7 across all time zones.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Why NRI Need A PAN Card Even If They Don't Pay Tax In India?

- How to Apply for an OCI Card from the USA?

- PAN Card Correction/Update Online: How to Change Name, Address, DOB and Mobile Number in Pan Card?

- PAN Card Surrender For NRIs and Indian Residents

- PAN Card 2.0: Features, Process, Benefits and More

- PAN vs TAN: Key Difference You Should Know

- PAN Card Form 49A: How to Fill Pan Card Form 49A and 49AA?

- Duplicate PAN Card Application Process For NRIs and Indian Citizens

- Aadhaar Card For NRIs In India

- How to Apply for a Lost or Damaged PAN Card?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1752921287.webp)

_1767099354.png)

-plan_1761282887.webp)