- Key Takeaways

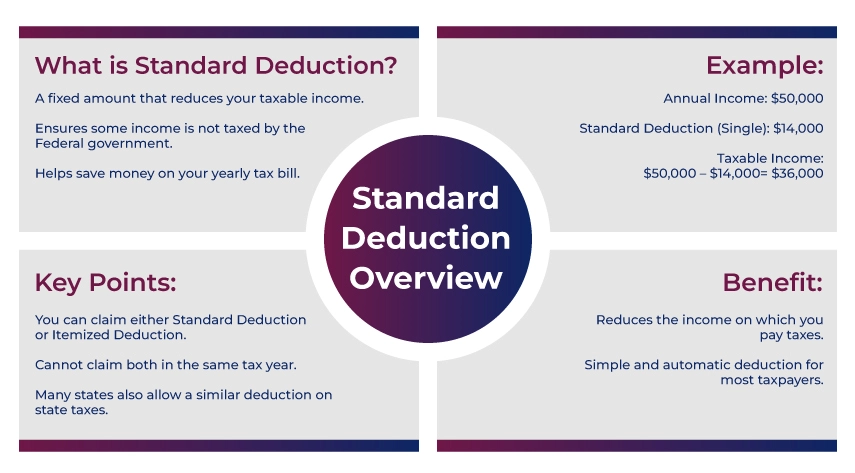

- What is the Standard Deduction

- Standard Deduction Amount For 2025-2026 Tax Year

- Who Can't Claim The Standard Deduction

- Difference Between The Standard Deductions vs Itemized Deductions

- Is It Better To Use The Standard Deduction or the Itemized Deduction?

- What Happens When The Standard Deduction Is More Than My Income?

- The Bottom Line

The standard deduction is a flat amount that is deducted from your taxable income, potentially reducing your overall taxable income. The amount that will be deducted is set by the IRS and could vary depending on the tax filing year and the tax filing status of the taxpayer.

When you file your taxes, you can claim either an itemized deduction or a standard deduction. Now, if you choose to claim a standard education, you cannot claim an itemized one. This might sound a little confusing here, but by the end of this blog, you will know what the standard edition is and how you can reduce your overall tax bill from it.

Key Takeaways

- The standard deduction is a dollar amount set by the IRS that most taxpayers can deduct from their overall taxable income.

- The deduction amount has the potential to significantly reduce your overall taxable income by a fixed amount.

- Every year, the amount of the standard deduction goes up to keep up with the rising inflation.

- Taxpayers who are 65 years old or blind are qualified for a higher deduction amount. Providing them with some extra relief.

- There are two cases under which you cannot claim the standard deduction: If you are married filing separately and your spouse chose to itemize deductions. Secondly, you can claim the standard deduction if you are a nonresident alien.

What is the Standard Deduction

The standard deduction ensures that the taxpayer has some income that is not subject to federal taxes. Such deduction offers a good tax break, potentially reducing your taxable income and helping you save a little on your yearly tax bill.

As a taxpayer, you have the option of claiming either the standard deduction or the itemized deduction. However, as per the IRS, claiming both types of deductions in the same year is not permitted.

Many states levy state income tax on the personal income of the individual. They also allow claiming something similar to the standard deduction on the state income tax return as well.

Standard Deduction Amount For 2025-2026 Tax Year

Here is a table rundown of the standard deduction 2025 rates for four of the most common tax filing statuses.

| Filing Status | Standard Deduction Amount |

|---|---|

| Single | $15,750 |

| Married Filing Jointly | $31,500 |

| Married Filing Separately | $15,750 |

| Head of Household | $23,625 |

Now, taxpayers who are 65 or older, or have a spouse who falls in any one of such categories, can claim a raised standard tax deduction. The raise amount is as follows.

| Filing Status | The extra amount that will be added to the standard deduction |

|---|---|

| Single filer or head of household: Blind or age 65 or older | $2,000 |

|

Single or head of household: Blind and age 65 or older |

$4,000 |

|

Married filing jointly or separately: Blind or age 65 or older |

$1,600 (per person who falls into any one of the categories) |

|

Married filing jointly or separately: Blind and 65 or older |

$3,200 (per person who falls into both categories) |

Please note: The IRS permits he blind adjustment for people who are either partially or totally blind. The tax code states that the "partly blind" meaning is having a field of vision or not more than 20 degrees, or the corrected vision must not be better than 20/200. To back your raised standard deduction claim, you will need a certified letterhead statement from an eye doctor.

(Put it in a box; same as TurboTax)

A Savetax Tip: Choosing itemized deduction over the standard deduction will only make sense if your total deductible expenses are higher than the amount of the standard deduction. Take the help of a tax professional in making this calculation.

Who Can't Claim The Standard Deduction

Certain types of taxpayers cannot claim the standard deduction. They are:

- If you are married and filing a separate tax return, and your spouse itemizes the deduction on their return.

- You also can't claim the standard deduction if you or your spouse (filing jointly) were a nonresident alien at any time during the tax year.

- Lastly, if you have changed your annual accounting period and the return covers less than 12 months, then in this case, you cannot claim the standard deduction tax break.

Difference Between The Standard Deductions vs Itemized Deductions

The difference between the standard deduction and the itemized deduction is as follows.

The standard deduction is a dollar amount fixed by the IRS that is deducted from the overall taxable income. In comparison, an itemized deduction permits you to account for all the eligible deductions individually.

Schedule A is used to itemize the deduction. The schedule allows you to enter the individual amounts of the expenses that fit into the categories mentioned there. Such expense categories could be the details and medical expenses, gifts made to the charity, and more.

Is It Better To Use The Standard Deduction or the Itemized Deduction?

Claiming standard deductions over the itemized deduction is much simpler. The IRS advises that a taxpayer must take the time to calculate the number of see which option of deduction brings them better and offer deduction relief (Savetaxs will do this for you).

As a taxpayer, you can consider itemizing your deductions if you made charitable donations, paid mortgage interest on property taxes, or have had massive out-of-pocket medical expenses.

What Happens When The Standard Deduction Is More Than My Income?

If the standard deduction of an individual is more than or equal to their annual earned income, then three scenarios may apply.

1: In some instances, if your income is less than or equal to the standard deduction amount, then you do not need to file the income tax return.

For example, the standard deduction is $15,750 for the single filer, and you have earned less than $15,750 annually. Then you might not ned to file the tax return. However, this is not the case with every taxpayer. See the next point for clarification.

2: You still have to file the income tax return if your annual earnings are less than the amount of the standard deduction, based on the amount of income you have earned in the tax year.

For example, suppose you are a self-employed non-dialing earning self-employment income. In that case, you will have to file the tax return if your earned annual income is over the self-employment income reporting threshold.

3: If you have a lot of money for the tax year, you need to file a tax return even if your income is less than the standard deduction.

4: If you are eligible for the refundable tax credit, then you must file the income tax return to take advantage of the return you are eligible for based on the tax credits.

The Bottom Line

Standard deductions are a great way to lower your overall taxable income. For 2025 and 2026, the standard deduction amount varies by the filing status of the taxpayer, along with additional consideration for age and disability.

You, as a taxpayer, will need to choose whether you are going with an itemized deduction or the standard one. However, to choose one, you need to run the numbers accurately to see which one of the deductions offers you greater benefits according to your filing status and income.

IRS recommends talking to a professional tax expert to calculate your income, expenses, and choose the right deduction method for yourself. One such tax expert is Savetaxs, who has now helped thousands of US citizens and residents with their tax returns.

We provide end-to-end assistance with all taxation-related services. Connect with us and let's get you a significant tax break.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767170479.png)

_1758631896.webp)

_1768474831.webp)

_1767955810.png)