- What is the Definition of NRI as per the Income Tax Act?

- Tax Rules for NRIs Returning to India

- What Happens When You Lose Your NRI/ NOR Status?

- Bank Accounts/ Deposits in India: RBI Regulations and Tax Implications for NRIs

- Things an NRI Needs to Consider After Returning to India

- Do NRI Life Insurance Plans Help NRIs in Saving Income Tax?

- Final Thoughts

Moving back to your home country comes with mixed emotions of excitement and apprehension. If you are a non-resident Indian (NRI) planning to return to India, then you need to follow some tax rules and regulations. To help you out, we have mentioned the tax rules for NRIs returning to India in this blog. This further helps you in facilitating a seamless and quick transition.

Read further to gain complete details on tax planning and tax rules for NRIs returning to India.

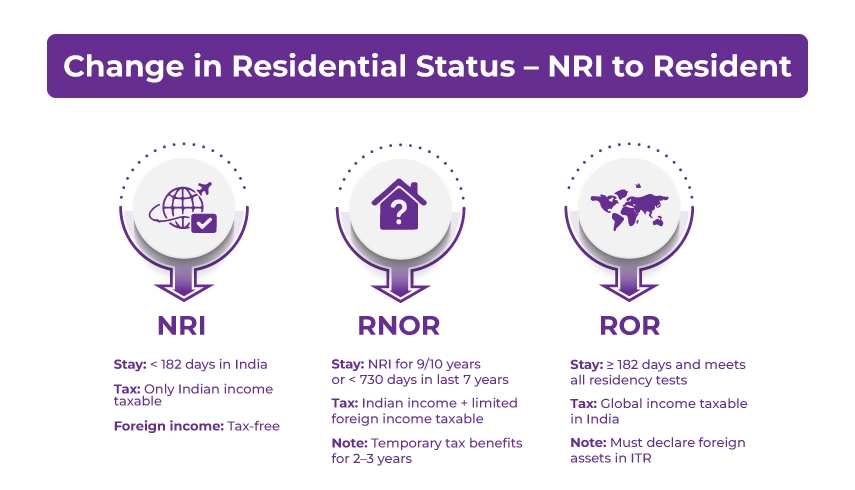

- The tax rules for NRIs returning to Indian depend on their residential status, i.e., NRI, RNOR, ROR.

- Under the RNOR status, an NRI gets the option to manage his/her assets with several tax benefits.

- The RNOR status offers tax exemption on foreign income and tax-free interest on FCNR accounts to NRIs.

- Upon conversion of RNOR to ROR, all foreign income of NRIs becomes taxable in India. For instance, rent from immovable property in India, interest from foreign dividends and bank accounts, and more. Also, NRIs are no longer eligible to claim the DTAA benefits.

- As per the RBI guidelines, NRIs need to convert their NRI bank accounts to savings accounts upon getting the ROR status.

- Additionally, through NRI life insurance plans, under section 80C of the IT Act, NRIs can save tax on premiums.

What is the Definition of NRI as per the Income Tax Act?

According to the Income Tax Act, 1961, an individual will be considered a Non-Resident Indian if he/she does not satisfy the following conditions:

- If during the previous year, he/she stayed in India for 182 days.

- If he/she were in India for 60 days or more in the relevant financial year. Additionally, lived here for 365 days or more during the last four years preceding the previous year.

Therefore, if you stay in India for less than 182 days in a financial year, then you will be considered an NRI. Further, an NRI can be considered as a resident but not ordinary resident (RNOR) in India, if they meet the conditions.

Resident But Not Ordinary Resident in India (RNOR)

As per section 6(6)(a) of the Income Tax Act, a person will be considered as RNOR for a given financial year if they fulfill the following conditions:

- An individual in 9 out of 10 years, preceding the relevant financial year, has been an NRI.

- In the 7 years preceding the relevant fiscal year, should have stayed in the country for less than 730 days.

Once you return to India for up to three years, you can remain with your RNOR status. Additionally, like an NRI, you pay taxes on the income that you earn or receive in India. After three years of staying in India, your status changes to ordinarily resident (ROR). Considering this, like the resident Indians, the same taxation rules will apply to you.

This was all about the definition of NRI as per the Income Tax Act. Moving ahead, let's know about the taxation of NRI income in India after returning here.

Tax Rules for NRIs Returning to India

As mentioned above, on returning to India, once your RNOR status changes to ROR, the same taxation rules apply to you as to Indian residents. Additionally, you are also not able to claim the tax benefits available for NRIs and RNOR. Considering this, before your NRI or an RNOR status changes to ROR, you should do proper tax planning. Further, let's know the tax benefits available for an NRI or an RNOR to enjoy in India:

- Tax exemption on dividends or interest earned on securities/ deposits held overseas.

- Tax exemption available for rental income on property located overseas.

- Tax exemptions on capital gains you earned outside India on financial or fixed assets held overseas.

- Tax exemptions are available on a pension withdrawal from a retirement account or pension scheme held abroad.

- Tax exemption on interest received from Resident Foreign Currency and Foreign Currency Non-Resident deposits.

Further, the income earned by an NRI in India is taxable here. However, the NRI is not liable to pay taxes in India on income earned overseas.

So these were some of the tax rules for NRIs returning to India. Moving further, let's know what happens when you lose your NRI/ NOR status.

What Happens When You Lose Your NRI/ NOR Status?

After returning to India, if you lose your NRI/RNOR status, your tax and financial liabilities shift dramatically. Considering this, to comply with Indian laws, you should change your residential status with your Indian bank. Here are the following changes you face when you lose your NRI/ NOR status:

- On your global income, you are liable to pay taxes in India.

- Once you gain the ROR status, you are no longer eligible to claim the NRI tax benefits under the Double Taxation Avoidance Agreement (DTAA).

- You need to disclose your foreign assets and income when filing your tax returns in India.

- The tax exemptions that were available previously on interest from FCNR deposits and NRE accounts have become subject to tax in India.

- Additionally, as per the Reserve Bank of India (RBI), upon your return, you need to inform your bank of your residential status.

- Should convert your NRO and NRE accounts into savings accounts.

These are some of the changes that occur when you lose your NRI/RNOR status. Further, if you plan to sell a property you have abroad or want to withdraw an amount from your abroad retirement account. In this scenario, it is advisable to do this before your RNOR status changes to ROR. It helps you in paying taxes in India.

Now, moving ahead, let's know about the RBI regulations and tax implications applicable to NRIs returning to India permanently.

Bank Accounts/ Deposits in India: RBI Regulations and Tax Implications for NRIs

The RBI regulations and tax implications on NRIs for their bank accounts/ deposits in India are as follows:

| Account Type | RBI Guidelines (2025) | Income Tax Provisions (2025) |

|---|---|---|

| NRO Deposits | Should be converted into a resident account. | As per the resident income tax slab, it is taxable in India. Considering this, under the NRO status, TDS was deducted as NRI, and now it will be applicable as per the resident. Therefore, less TDS will be charged on conversion. |

| NRE Deposits | Convert the account into either a resident account or transfer the funds to RFC. | Till your RNOR status, it is tax-exempt. After changing into ROR, the interest earned from this account is fully taxable. |

| FCNR Deposits | This can be maintained till its maturity date. After that, it should either be converted to RFC or resident. | Tax exemption is applicable till the RNOR status. Once the RNOR status changes to ROR, interest earned on these funds is taxable in India. |

| Resident Foreign Currency Account (RFC) | In this account, you can receive FCNR deposits, NRE deposits, and Foreign inward remittances. This is a foreign currency account, and in this, your money is freely repatriable. | Till you have RNOR status, you do not need to pay tax on your earned interest. However, once your status changes to ROR, the interest becomes taxable. |

So, this is how RBI regulations and tax implications are imposed on the bank accounts/ deposits of NRIs once their status changes to ROR. Further, let's know the RBI regulations and tax implications on the assets NRIs hold outside India.

Assets Outside India- RBI Regulations and Tax Implications

RBI regulations and tax implications on assets of NRIs outside India are as follows:

| Bank Account | RBI Guidelines (FEMA) | Income Tax Provisions |

|---|---|---|

| Foreign Security (shares, and more) | If it was held during the period of NRI, then you may hold this after coming back to India. | Till the NRI and RNOR status, capital gain/ dividend income earned from these assets is not taxable. Additionally, till your RNOR status, you do not need to mention them in your ITR. |

| Immovable Property Outside India | If the immovable property outside India is purchased when the status was NRI, then you may hold it. | Till your NRI and RNOR status, you do not need to pay tax on your rental/ other income from your immovable property outside India. Additionally, you do not need to mention the income from these in your ITR till your RNOR status. |

This was about the RBI regulations and tax implications on assets that NRIs hold outside India. Moving further, let's know the things NRIs need to consider after moving back to India.

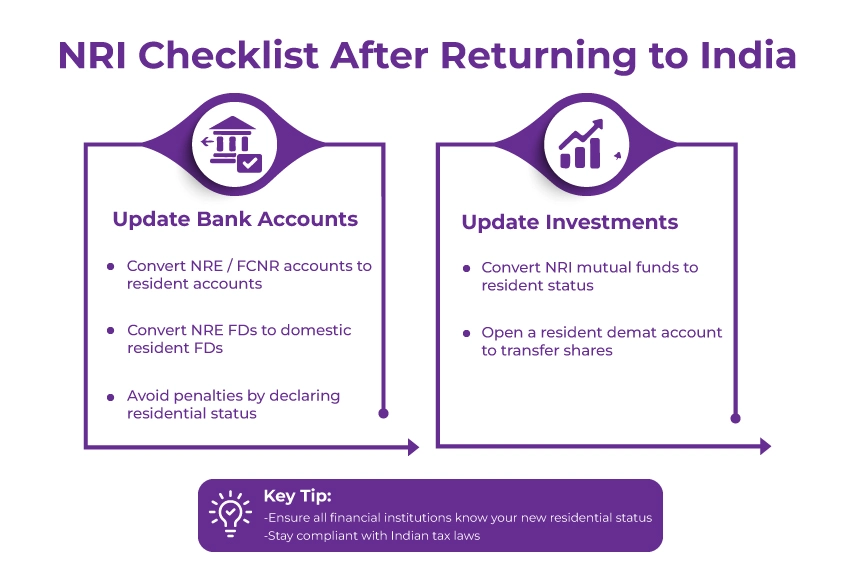

Things an NRI Needs to Consider After Returning to India

Here are the following things that NRIs need to consider after returning to India:

- Inform the financial institutions about their residential status in India. Additionally, converting their NRE/ FCNR account to a resident account. If they fail to do so, they face a penalty for not declaring NRI status.

- Further, for mutual fund investment, get your status updates as an Indian resident. Further, for transferring shares from your NRI demat account, open a resident demat account.

- Also, for the same interest rate, you can convert your NRE FD into a domestic resident FD.

So, this is what NRIs need to consider after returning to India to stay compliant with the Indian tax laws. Moving ahead, let's know whether life insurance plans of NRIs help them in saving income tax or not.

Do NRI Life Insurance Plans Help NRIs in Saving Income Tax?

Yes, NRI life insurance plans help NRIs in saving on income tax. It helps them in getting tax benefits while securing the lives of their loved ones, even when they do not live in India. Further, in the following two ways, NRIs can avail the tax benefits with an NRI insurance plan:

- Tax Deduction Under Section 80C: Under Section 80C of the Income Tax Act, 1961, you can claim up to INR 1,50,000. This tax deduction applies to the premium NRIs pay towards their life insurance plans.

- Tax-Exempt Proceeds: Under Section 10(10D) of the Income Tax Act, the maturity amount or death benefits received from the insurance plan are not taxed.

So, from the above information, it is clear that NRI life insurance plans help NRIs returning to India save their tax.

Final Thoughts

Lastly, this was your complete guide for tax rules for NRIs returning to India. From the blog, it is clear, to ensure compliance with the Indian tax regulations, managing your finances is vital. Also, to avoid any kind of tax penalty, any changes in your residential status, you should notify your bank and financial institutions.

Further, if you still have some confusion about the tax rules for NRIs returning to India, connect with Savetaxs. We have a team of experts who will solve all your queries related to you. Additionally, the experts will also help you with better tax planning.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CA, CS, CPA, or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Shaw brings 8 years of experience in auditing and taxation. He has a deep understanding of disciplinary regulations and delivers comprehensive auditing services to businesses and individuals. From financial auditing to tax planning, risk assessment, and financial reporting. Mr Shaw's expertise is impeccable.

- A Complete Guide for NRIs Returning to India from Australia

- US Social Security Taxation for NRIs Returning to India

- USA Rental Income Tax for RORs in India

- A Complete Guide for NRIs Returning to India from the USA

- A Guide for NRIs Returning to India from UAE

- Best Cities to Settle After Returning to India

- NRIs Returning from Canada to India- A Comprehensive Guide

- Returning to India from Malaysia - A Guide for NRIs

- 529 Plan For NRIs Returning Back To India - Is It Still Worth It?

- A Guide for NRIs Returning to India from the UK

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767780160.webp)

_1766644785.png)

_1766561286.webp)

_1768211318.webp)