The United States has a multi-level income tax structure under which the federal, state, and local governments impose taxes. The federal tax is imposed by the national government of the United States, whereas individual state governments levy state taxes.

However, federal and state income taxes are parallel in a way that both apply a percentage rate to the taxpayer's income. Here, we will explore the key differences between federal vs. state taxes.

Key Takeaways

- The federal government and most states in the United States have income taxes.

- The tax rules and the tax rate differ between the federal system and the individual states.

- Federal taxes follow the progressive income tax meaning that high tax rates are imposed on higher income levels.

- Some states follow the progressive tax system while others follow the flat rate tax system.

State Income Tax

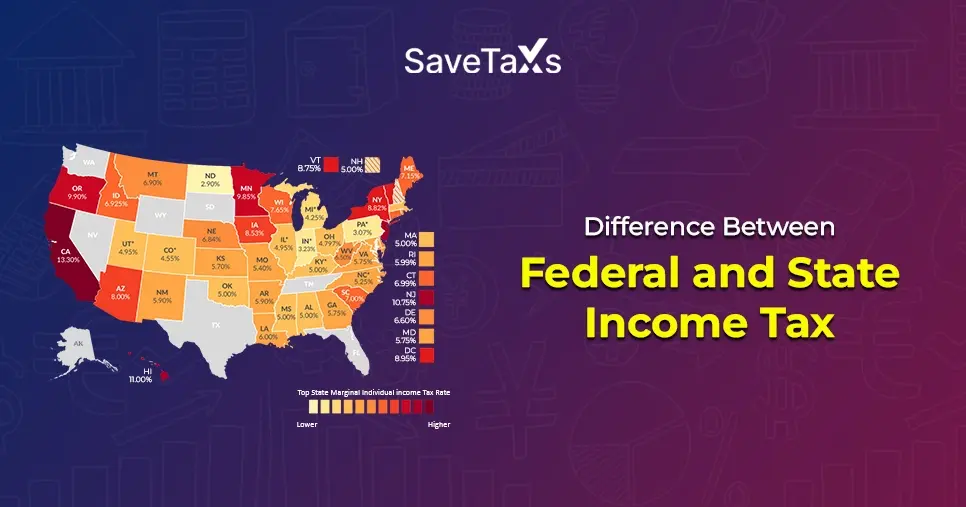

The state Income tax provision and the tax rates vary from state to state. Most states have either a progressive income tax system or a flat income tax system.

A Flat income tax system is also known as a single tax rate structure. This means that only a single tax rate is applied to all taxpayers regardless of the income they earn. Additionally, it does not allow tax exemptions, deductions, or tax credits.

States that use Flat Tax Rates

As of 2024, in the United States, there are 12 flat tax states. They are: Arizone (2.5%), Colorado (4.4%), Idaho (5.8%), Illinois (4.95%), Indiana (3.05%), Kentucky (4.0%), Michigan (4.25%), Mississippi (4.7%), North Carolina (4.5%), Pennsylvania (3.07%), and Utah (4.65%).

Flat tax rates in Washington apply only to the capital gains income of the taxpayer with high earnings.

Progressive Income Tax

The progressive tax states are those that use a progressive tax rate, meaning taxpayers pay more tax as their income increases. The progressive income tax structure is also used in the federal income tax system.

A few states, based on their respective marginal tax bracket for this purpose, apply the federal tax code, but many states execute their own.

US States with Little or No Income Tax

Florida, Alaska, Nevada, New Hampshire, South Dakota, Texas, Tennessee, Washington, and Wyoming do not tax their residents.

In a nutshell, at the state level, some states use a flat tax rate, while others employ a progressive income tax system, with some having no state income tax.

Federal Income Tax

The Internal Revenue Code (IRC) imposes the federal income tax rules on the annual income of taxpayers. Federal income tax applies to every source of income that is computed in a taxpayer's taxable income, like capital gains or wages.

The US taxation law has established seven income tax brackets, ranging from 10% to 37%, to specify which portion of income falls under each bracket.

Authority and the Tax Rates

At the federal income tax level, the tax rates are imposed by Congress, and the same tax rates are applicable across the United States. In contrast, we know that for state taxes, the state legislature decides the tax rates, which tend to vary from state to state.

Federal tax rates are progressive, meaning that higher incomes come with higher taxes. The taxpayer's income falls into the income tax bracket enacted by the federal government, and then the tax rate to be imposed is determined.

Here is the Breakdown of the Federal Tax Rates as per all the Categories:

Filing Status: Single (Unmarried Individuals)

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | $0 - $11,925 |

| 12% | $11,926 - $48,475 |

| 22% | $48,476 - $103,350 |

| 24% | $103,351 - $197,300 |

| 32% | $197,301 - $250,525 |

| 35% | $250,526 - $626,350 |

| 37% | $626,351 and above |

The standard Deduction is $15,000

Filing Status: Married Filing Jointly (or Qualifying Surviving Spouse)

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | $0 - $23,850 |

| 12% | $23,851 - $96,950 |

| 22% | $96,951 - $206,700 |

| 24% | $206,701 - $394,600 |

| 32% | $394,601 - $501,050 |

| 35% | $501,051 - $751,600 |

| 37% | $751,601 and above |

Standard Deduction - $30,000

Filing Status: Head of Household (Unmarried with Dependents)

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | $0 - $17,000 |

| 12% | $17,001 - $64,850 |

| 22% | $64,851 - $103,350 |

| 24% | $103,351 - $197,300 |

| 32% | $197,301 - $250,000 |

| 35% | $250,501 - $626,350 |

| 37% | $626,351 and above |

Standard Deduction: $22,500

Filing Status: Married Filing Separately

| Tax Rate | Taxable Income Range |

|---|---|

| 10% | $0 - $11,925 |

| 12% | $11,926 - $48,475 |

| 22% | $48,476 - $103,350 |

| 24% | $103,351 - $197,300 |

| 32% | $197,301 - $250,525 |

| 35% | $250,526 - $375,800 |

| 37% | $375,801 and above |

Standard Deduction: $15,000

State Income Tax vs Federal Income Tax Example

To understand federal tax vs state tax, consider the example below.

Let us assume a taxpayer who lives in New Hampshire reports their earned taxable income of $75,000 annually, along with the interest income of $3,000 on their federal income tax return.

State Taxes:

New Hampshire has a $2,400 tax exemption on dividends and interest. Hence, the tax on the interest income is due in the remaining ($3000 - $2,400) = $600.

Hence, the taxpayer is liable to pay only $18 ($600 * 0.03) in the state because New Hampshire taxes the dividend and interest income only at the rate of 3% from January 1, 2024. The effective state income tax rate of the concerned exporter on their annual income of $78,000 would be 0.030%.

In a case where the same taxpayer in the example mentioned above lived in Utah, then all of their taxable income, including unearned and earned, would be subject to a flat tax rate of 4.55%. Hence, their bill of state tax will be $3549 ($78,000 * 0.0455).

Federal Tax:

Under the progressive taxation system with respect to federal taxes, this taxpayer would have paid $1,160 on the first $11,600 of his income, and this is excluding interest income, which falls under the income tax bracket of 10%.

The taxpayer would pay 12% on his income from $11,601 to $47,150 ($4,266) and 22% on income or amounts more than $47,150 ($6,127)for a federal income tax bill of $11,553.

Hence, the effective federal income tax rate would be 15.4% ($11,553 / $75,000)

Do Federal Income Taxes Differ by State Taxes?

In state vs federal income tax, the federal tax rates are based on the taxpayer's filing status and income, not on their location. And which is the same rate if deferred tax applies to everyone regardless of their residence status.

But the state taxes vary from state to state, so the total tax liability of the taxpayer will depend on where they earn their income from and where they live.

In a nutshell, the distinction between state tax vs federal tax lies in the fact that federal and state governments differ in terms of the type of income being taxed and the tax credits or deductions that are allowed.

For example, the Social Security income and pension are taxable under federal rules, although some states exempt these sources from taxation.

State Income Tax vs. Federal Income Tax: Savetaxs for the Rescue

As an NRI, you already juggle with a lot of things between your country of residence and India; let taxes not be one of those. Savetaxs, a leading NRI taxation firm helping taxpayers with Indian and US taxation. We have been helping individuals for over a decade now, and our satisfied clients speak about it all.

You don't need to search for another taxation expert to file your income tax in the US, be it the state tax or the federal taxes. Our experts will assist you in claiming all the tax deductions and exemptions you are eligible for.

Savetaxs has a team of experts that brings over 30 years of experience to the table, ensuring accurate handling of both your Indian and US taxation. Connect with us today!

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

- What Is Earned Income & the Earned Income Credit?

- Know Your Tax Deadlines for 2025: When and Where to File?

- New Tax Laws 2025: Tax Brackets and Deductions

- What is IRS Tax Form 1120?

- What is Form 1040-NR

- Standard Deduction vs Itemized Deduction - Which One To Choose

- 9 US States With No Income Tax

- Everything to Know About the 1040-SR Form for Filing Seniors

- Difference Between Residents And Non-Residents Aliens And Their Taxes

- What is Adjusted Gross Income (AGI)?

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!