- Key Takeaways

- What is a Charitable Donation?

- Are Charitable Donations Tax-Deductible?

- Qualified Organizations Acceptable for Tax-Deductible Donations

- How to Claim Tax-Deductible Donations?

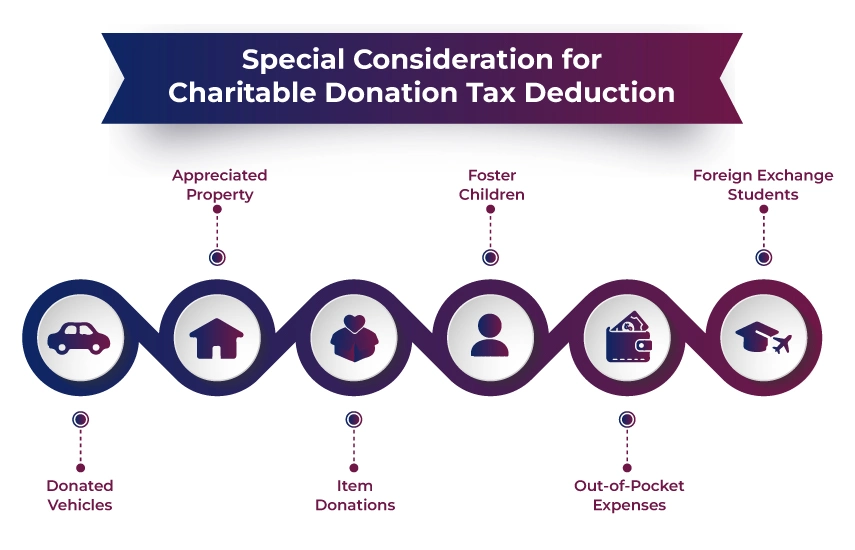

- Special Consideration for Charitable Donation Tax Deduction

- How Do Tax Deductions on Donations Work?

- Final Thoughts

Charity donations are generally tax-deductible in the US if you itemize your deductions. Well, many people in the US are not aware of this. Understanding how these deductions work can help you increase your giving. Additionally, applying for tax-deductible donations also reduces your taxable income.

Are you also one of those who love supporting causes and helping the community? If so, you will be glad to know your generosity also provides you with some tax benefits. However, for this, you need to fulfill certain conditions. Want to know what they are? This blog consists of all the information about the tax-deductible donations. So read on and claim your tax benefit.

Key Takeaways

- When you itemize your deduction, you can get valuable tax deductions from your charity donations.

- It includes both cash and non-cash contributions made to a qualified organization.

- To claim tax-deductible donations, it is vital to have proper documentation.

- Gifts of clothing, household goods, cash, and even real estate are tax-deductible.

- The recipient of your charitable donation should have a tax-exempt status, i.e., 501(c)(3).

What is a Charitable Donation?

A charitable donation or contribution is a gift of goods or money that you make towards a tax-exempt organization. It may further reduce your taxable income. Additionally, in return for your gift, you don't receive anything.

The tax-deductible donations can include property investment, monetary gifts, or kind of contribution stated as a tax exemption under Section 501(c)(3). Furthermore, as mentioned above, charitable donations not only help in supporting the needy but also assist donors in claiming tax benefits.

So, in simple words, charitable donations are gifts that you provide to help the community or support the cause, and in return for them, you do not take any money. The charitable donations can be anything, such as clothing, cash, household goods, or even property.

This was all about charitable donations. Moving ahead, let's know whether these donations are tax-deductible or not.

Are Charitable Donations Tax-Deductible?

Yes, in many cases, charitable donations are tax-deductible. For instance, when you donate something to a qualifying organization, you can claim a deduction from your taxable income. However, for this, first you need to itemize deductions on your income tax return.

In general, via charitable donations, you can deduct a maximum of 60% of your adjusted gross income (AGI). Further, depending on your contribution type and the organization, this can be limited to 20%, 30% or 50%. Here, the tax deduction limit is imposed on all contributions that you make throughout the year. Additionally, the number of organizations does not matter in this.

Considering this, donations more than the limit from your income tax return can often be deducted over the next five years. Also, till they have gone through the carryover process. However, certain limitations and conditions apply to it that you will read in the next sections.

So, this was all about whether the charitable donations are tax-deductible or not. Moving further, let's know the qualified organizations that are acceptable for tax deduction.

Charitable donations can be tax-deductible for NRAs (Non-Resident Aliens). However, the specifics may vary based on where you pay taxes and the country you make donations in. An NR is not allowed to claim a tax deduction in one country for a donation made directly to a charity in another country.

Qualified Organizations Acceptable for Tax-Deductible Donations

As mentioned above, the IRS has some guidelines for tax-deductible donations and where they go. Considering this, you cannot write off any expenses. The first thing in this is that you can only deduct the donations that you made towards qualified organizations. This means it does not count the donations that you have directly given to needy individuals.

To provide you with an idea, here is the list of charitable organizations that qualify you for tax-deductible donations:

- Charity groups

- Non-profit schools

- Churches, temples, mosques, synagogues, and other religious organizations

- Volunteer fire departments

- Nonprofit hospitals

- Public parks and recreation facilities

- 501(c)(3) organizations

- Veterans and certain cultural groups

These are the qualified organizations that help you claim tax-deductible donations.

Now, let's know the donations that do not count as charitable donations.

- Gifts made to individuals

- Amount paid to social and sport clubs, civic leagues, chambers of commerce, and labor unions.

- Money paid for a lottery ticket, raffle, or bingo

- Gifts made to most foreign organizations

- Donations given to political candidates or groups running for public office

- Gifts made to groups that work for personal profit

- Amounts paid for tuition

- Gifts made to groups that aim to lobby for changes in the law

- Value of blood donated to blood banks

So, this was all about the qualified organizations that help in claiming tax-deductible donations. Moving further, let's know how to claim tax-deductible donations.

How to Claim Tax-Deductible Donations?

To claim charitable contributions, you need to first itemize your deductions on your tax return. However, this disqualifies you from claiming your standard deduction. For this, you need to mention your total itemized deductions, which also include your charitable donations.

However, to include that amount in your itemized return, it should be more than your standard deduction. If not, then you can take the standard deduction. Further, let's know how you can claim tax-deductible donations.

Calculate the Value of Your Donation

The donation type you made and the organization it goes to determine how much can be deducted. Generally, for cash contributions, you can deduct up to 60% of your AGI. For non-cash donations, it is limited to 20%, 30% and 50%.

Additionally, tax deductions cannot be more than 50% of your AGI if they are non-cash donations. Within that, the overall limit for gifting an appreciated property cannot be more than 30% of your AGI. Here, the appreciated property means a property within a time whose value increases.

Further, donations made to organizations like Veteran groups cannot be more than:

- 20% of your AGI on gifts of appreciated property

- 30% of your adjusted gross income

Gather the Required Documents

Gather and keep all the documents that support your donations. This may include acknowledgment letters, receipts, bank statements, or any other donation proof.

Accurate record-keeping is vital to prove contributions are made to qualified charitable organizations. Additionally, the requirements of record-keeping donations differ depending on the donation type and amount.

Moving further, let's know the rules of charitable donation tax deduction for cash and non-cash contributions.

Rules of Charitable Donation Tax Deduction for Money Donations

Donations through cash, credit or debit card, cheque, or automatic bank withdrawals that directly go to a non-profit organization are called money donations. However, if you accept something in return for your money donation, you cannot write off the complete amount. Additionally, you do not need to reduce your donation amount if one of these things applies (for 2024):

- The fair market value (FMV) is not more than the lesser of:

- $132

- 2% of the payment

- If both statements are correct:

- The minimum payment is $66

- The only benefit you get is token items bearing the logo of the organization, and the aggregate price is not more than $13.20

- With a request for a donation, the organization provides out free, unordered items

- The annual payment is $75 or less. Additionally, the donation does not provide you with certain privileges and rights, such as a discounted admission to a concert.

Cash Donations of Less Than $250

A cash donation under $250 made towards a qualified non-profit organization is one of the few charitable contributions that you can take without a receipt. However, for this, you need to provide your bank records to claim the deduction. It includes a credit card statement, payroll deduction record, bank statement, or canceled cheque. Considering this, written records like personal notations or cheque registers are not enough proof from the donor.

Furthermore, the records show the following things:

- Name of the organization

- Date

- Donation amount

For payroll deductions, if you have the following, you can prove your donations:

- Document showing the withheld amount, like a W-2 Form from your employer or a pay stub

- A pledge card or other paper that shows the organization does not offer services or goods for donations towards payroll deduction

Additionally, for cash donations made towards an unmanned location, there is an exception, such as a donation tin.

Cash Donations of $250 or More

For cash donations of $250 or more, you need to provide a receipt from the non-profit organization. You may also provide payroll deduction records. The receipt is also known as a contemporaneous written acknowledgment. This should be in writing and include the following things:

- Your cash contribution amount

- Whether or not goods or services are provided by the organization in exchange for the contribution

- Description and good faith estimate of the cost of services or goods, if any, that the organization provided in return for a donation.

- The date of your cash donation

Further, if the receipt does not mention the date of your cash donation, then provide a bank record stating the date of the donation. This document should be by your side before you file your tax return.

Rules of Charity Donation Tax Deduction for Noncash Donations

Like cash contributions, non-cash donations depend on the gift value. In simple words, depending on the amount of the donation, the documentation increases. Considering this, here are the rules about claiming a contribution with/ out a receipt.

Noncash Donations Less Than $250

The non-profit organization should provide a receipt demonstrating:

- Name and address of the organization

- Location and date of donation

- Detailed description of donated property

Although it is impractical or impossible, if you do not receive the receipt, keep a written record of your contribution. The record should include the following things:

- Name and address of the organization

- Location and date of donation

- Detailed description of the donated property

- Fair market value of the contribution when you donated. Along with this, you also need to provide an overview of how you calculated its value.

- Price or other basis, you have in the contribution, if you have. In this scenario, you should reduce the FMV by appreciation and explain how you calculate it.

You might be donating less than the full interest in the contribution. If this is the scenario, from the contribution, show the amount you are claiming as a tax deduction for the year. If the remaining interest amount has been donated, you should provide information on each contribution.

Non-cash Donations At Least $250 But Less Than $500

Gather and keep an acknowledgment or a written receipt from the non-profit organization for contributions between $250 and $500. You required this document when filing your tax return to claim a tax-deductible donation for non-cash contributions. Your donation receipt should include the following information:

- Description of contribution

- Indication of services or goods you received. Additionally, if any, other than membership benefits or certain token items

- Description and good faith estimate of the value of services or goods you get

Additionally, for each donation request, a separate statement is provided.

Non-cash Donations More Than $500 But Less Than $5,000

For non-cash donations more than $500 but less than $5000, you should provide a record and written acknowledgment. The receipt should include the following information:

- How you received the donated property (gift, inheritance, or purchase)

- When you receive it

- The price or other basis. Additionally, adjustments to the owned property for less than 1 year. Also include the price or other basis of property owned for 1 year or more.

Non-cash Donations of $5,000 or more

You can also claim a charity donation tax contribution for your non-cash single donation for one or a group of similar items. Like other non-cash donations, for this contribution, you also need to provide a written acknowledgment slip. Additionally, for contributions of $5000 or more, in some cases, you need an appraisal. Here is when you need appraisals:

- If the value of the single or group of similar donated items is more than $5,000.

- Household items or clothing items valued more than $500 that are not in good condition. For instance, vintage clothing.

- Stock not publicly traded costs $5000 or more. Considering this, for publicly traded securities, you do not need to provide a written appraisal.

Furthermore, if you overstated the donated property, you owe a tax penalty. Also, you cannot include the cost of the required appraisal in your charitable donation.

Check Whether to File Form 8283 or Not

If your non-cash donation costs $500 or more and you want to claim a tax deduction for it, you need to fill out Form 8283. This form helps you in reporting details about tax-deductible donations. While filing the form, provide complete information about the donated item. It includes the cost, description, or adjusted basis, when and how you gave it, and more. Also, a charitable organization, after getting the donation, in Part IV of the form, should provide a donation acknowledgment.

Complete and File Schedule A with Tax Return

As stated above, to get tax-deductible donations, using Schedule A, Form 1040, you need to itemize your deductions. In the form, Schedule A mentions your itemized deductions. It includes the complete information on your charitable contributions. So, to ensure accuracy, fill out the form carefully. Considering this, on Schedule A, cash donations are stated on line 11, and non-cash donations are stated on line 12.

This is how, using the above-mentioned information, you can claim tax-deductible donations. Now, moving ahead, let's know the special considerations for these donations.

Special Consideration for Charitable Donation Tax Deduction

For charitable donations like vehicles and appreciated property, there are some special considerations. These things you need to consider while claiming tax deductions on these items. So, read on and know what they are.

Donated Vehicles

When you donate a vehicle to a qualified non-charitable organization, you need to follow special rules. In case the charity sells your donated vehicle, within 30 days of its sale, you should get a Form 1098-C from it. This form shows you the selling price of the vehicle and the tax amount you can deduct.

However, in this, there is one exception. If the value of the claimed car is $500 or less, you can deduct the complete value of the donated vehicle. Deduct the fair market value of the vehicle at the time of donation if the organization:

- Fix up the vehicle and sell it

- Uses it in charitable operations

- Give it to a needy person

- Make some improvements to the vehicle

Appreciated Property

When you donate appreciated property like real estate, antiques, and art, the tax-deductible rules get more difficult. The tax deduction on your property depends partially. For instance, if the donated property is from ordinary income or capital gain.

Item Donations

Like donating money, donating property also helps you claim a tax deduction. Generally, property donations include household and clothing goods. The tax write-off for these properties is their fair market value at the time of donation.

Foster Children

If you have a foster child by your side, you can deduct some of the money you provide for them as a donation to the charity. You can subtract the price, which is more than the reimbursement you get. However, it is only available for those taxpayers who are not in the business or trade of offering foster care.

Out-of-Pocket Expenses

For a qualified organization, if you work voluntarily, you can deduct the mentioned things at 14 cents a mile. Here, the stated things are as of 2024.

- The price and care of the special uniform you wear while performing your duties.

- Mileage cost, if, while doing the volunteer work for the school or hospital, you use your car.

- Parking fee, public transportation cost, or tolls while transferring donated goods or doing volunteer work.

- Mileage cost for the miles you drive from one charity to another place to drop off the donated goods.

Foreign Exchange Students

If a foreign student lives in your home and he/she enrolled in a qualified learning program, you can claim a charitable deduction. However, for this, the student should be American or from any other foreign country. Additionally, he/she should be a full-time student of an elementary or high school.

You can claim up to $50 per month for what you spend on the student. It includes the tuition fee, books, clothing, and more. To know how many $50 allotments you can claim, count the months or 15 days or more that the student lives with you.

This was all about the special consideration for tax-deductible donations. Moving further, let's know how this deduction works.

How Do Tax Deductions on Donations Work?

As stated above, through tax deduction on donations, you can reduce your taxable income by the donated amount to the qualified organization. It helps you in significant savings, specifically for taxpayers with higher income tax brackets. The charitable tax deduction works by decreasing your adjusted gross income (AGI). It reduces your tax liability.

Furthermore, to claim tax on donated items, on Schedule A of Form 1040, you need to claim it as an itemized deduction. Considering this, the tax deduction amount depends on your tax bracket. However, the annual tax breaks may vary depending on the situation of the individual and on other tax deductions.

Additionally, itemizing is a more time-consuming process than claiming the Standard deduction. Also, if you have more standard deduction than the total of your itemized deductions, claiming it is more beneficial. Furthermore, to provide you with an idea, here are the standard deduction amounts for 2025, by filing status:

| Tax Filing Status | Tax Deduction Amount |

|---|---|

| Single | $15,750 |

| Married Filing Separately | $15,750 |

| Head of Household | $23,625 |

| Married Filing Jointly | $31,500 |

| Surviving Spouses | $31,500 |

So, this is how tax deduction works for charitable contributions. Further, it is advisable according to your tax benefits claim standard deduction or itemized deduction.

Final Thoughts

Lastly, this was all about the tax-deductible donations and how you can claim these deductions for charitable contributions. These offer different tax benefits to CCPCs and sole proprietors. However, donating as an individual generally provides more tax advantages.

Furthermore, looking for assistance in claiming more charitable deductions? Connect with Savetaxs, and let our team guide you throughout the process while following the IRS requirements. With the right information and support, taxation becomes simpler.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult either a CPA or a professional tax expert from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr Varun is a tax expert with over 13 years of experience in US taxation, accounting, bookkeeping, and payroll. Mr Gupta has not prepared and reviewed over 5000 individual and corporate tax returns for CPA firms and businesses.

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1767339016.png)