Tax breaks are typically divided into two categories: tax credits and tax deductions (tax write-offs). A tax deduction reduces your taxable income, which means lower tax liability, whereas a credit directly cuts your tax bill.

Not sure about the tax deductions you qualify for? Then you are in the right place. Check out this blog and learn about the popular tax write-offs and breaks. Additionally, you also know how to claim them. So read on and get all the details about tax deductions and tax breaks for 2025.

- Apart from the Standard Deduction, there are several tax deductions also available that taxpayers are unaware of. The importance of knowing about these can boost your tax savings and lower your tax liability.

- For several everyday expenses, taxpayers can claim tax deductions. It includes IRA contributions, out-of-pocket medical expenses, student loan interest, insurance premiums, and more.

- Self-employed individuals have access to various tax deductions that are introduced for them. It includes home offices, qualified business income, health insurance premiums, and more.

- Further, many tax deductions require individuals to itemize their deductions. For instance, mortgage interest, dental and medical expenses, gifts to charity, state and local taxes, and more. However, itemizing deductions is only beneficial when the total of them is more than the Standard Deduction.

What is a Tax Write-off? What Taxes Can You Write Off as a Deduction?

Tax write-off is considered a synonym of tax deductions. Also, the "tax write-offs" word is not used by the IRS in the Internal Revenue Code. So, in simple words, a tax write-off is an expense that helps taxpayers in reducing their taxable income. In contrast to this, a tax credit is a tax reduction that is directly subtracted from your tax bill.

Further, every individual looks for easy tax write-offs that can reduce their tax bill. Surprisingly, there are various tax deductions available to claim if you know about them. Want to know about the common tax deductions that you can claim and reduce your taxable income? Read the next section and get your answers.

The available tax deductions for a non-resident in the U.S. depend on whether the income is considered “effectively connected” with U.S. trade or business. Generally, you cannot claim tax deductions on income that is not connected with your U.S. business activities. However, some are eligible for itemized deductions. An NRI's eligibility to claim tax deductions in the U.S. depends on their tax residency status.

Common Tax Deductions (Tax Write-offs) and Tax Breaks

Well, indeed, most people are not aware that apart from the Standard Deduction, there are several more that they can claim. To help people like you, we have listed 25 popular tax deductions and tax breaks for 2025. So read on and reduce your tax liability.

Sales or State Income Tax Deduction

Do you know that when filing your federal income tax return, you have two tax deduction options? Considering this, on your federal return, you can either claim a sales tax deduction or a state income tax deduction.

For most taxpayers, deducting state income tax is more beneficial. However, if you live in a place where there is no income tax, then sales tax is a good option. Also, the sales tax is a good option if, in the tax year, you have made a big purchase. For instance, you bought a car. In this scenario, writing off the sales tax will be a good option, even if you have paid off your state income taxes.

Though you need to fulfill some requirements to claim these tax deductions. First, you need to itemize your deduction. It means that you cannot claim the Standard Deduction. Second, your tax deduction for all local and state taxes is capped at $10,000 and $5000 if you are married but filing taxes separately. This was for the year 2024. For the year 2025, the amount increases to $40,000. However, for taxpayers with a modified adjusted gross income of more than $50,000 ($25,000 for a married couple filing taxes separately) is reduced.

Property Tax Deduction

Property taxes, like real estate and personal taxes, can also be claimed for deduction. However, as mentioned above, to claim these tax deductions, you need to itemize. Additionally, all local and state taxes, including property taxes, are combined. Considering this, they are capped at $10,000 ($5000 if you are married and file taxes separately) for 2024. Like the above tax deduction, for 2025, this tax amount increases to $40,000. However, individuals with modified gross income more than $50,0000 or $25,000 for married filing taxes separately, this amount is reduced.

Home Mortgage Interest Deduction

The mortgage interest deduction is a way that makes the ownership of a home more affordable to taxpayers. It shortens the federal income tax paid by the qualifying homeowners by reducing their taxable income. It is done by subtracting the mortgage interest paid by homeowners. Additionally, you can also deduct the interest to the extent you used the loan to buy, construct, or improve the home.

Further, depending on when the mortgage is taken, there are limits on the amount of the loan. Generally, you can only deduct home mortgage interest when:

- After December 15, 2017, $750,000 of a mortgage was taken out. Also, if married and filing taxes separately, the amount is $375,000.

- On or before December 15, 2017, $1,000,000 of a mortgage was taken out. Additionally, if you are married and filing the taxes separately, the amount is $500,000.

Additionally, generally, mortgage points are also tax-deductible.

Student Loan Interest Deduction

The student loan interest deduction is only for taxpayers who are legally accountable for paying the student loan. Considering this, individuals can deduct up to $2500 of the interest on the paid loans. So, if your student loan is paid by your parents or someone else, they can claim this deduction.

Additionally, you can also claim this deduction if you are legally obliged to pay this loan. Further, to claim this tax deduction, you do not need to itemize.

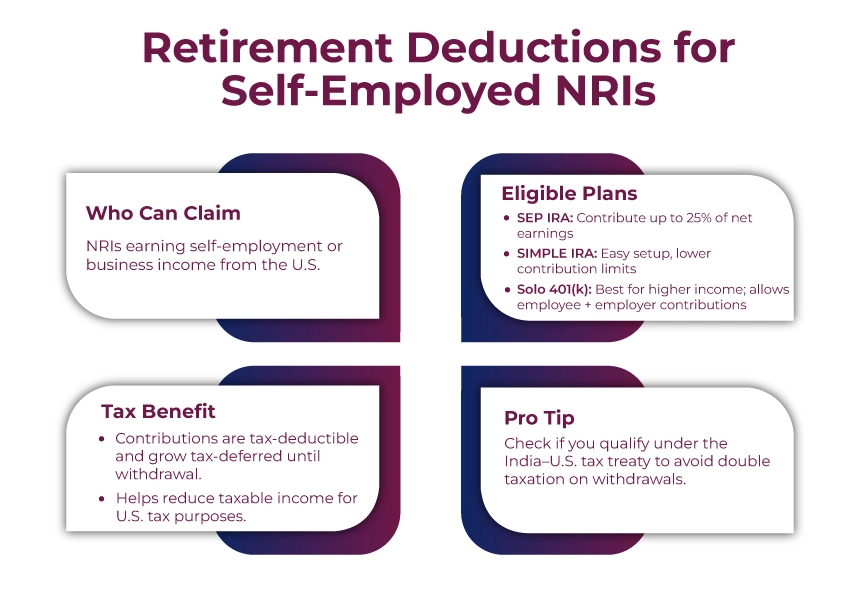

Self-Employed SEP, SIMPLE, and Qualified Plans Deduction

Self-employed people also need to save for their retirement. Considering this, there are several self-employment tax deductions available for them. Additionally, special retirement plans are also designed for them. It includes:

- Solo 401(k) plans

- Simplified Employee Pension (SEP) IRAs

- Savings Incentive Match Plan for Employees (SIMPLE) IRAs

Additionally, these people can deduct contributions made to these plans up to the limit of each plan.

IRA Deduction

Even if you are decades away from your retirement age, it is not too early to start planning for your retirement savings. Also, if you are middle-aged or older, then you have only a limited time to build your savings.

For taxpayers, there is some good news. You get some tax deduction on your individual retirement account (IRA). Additionally, to claim this tax deduction, you do not need to itemize.

Considering this, for most people, the IRA tax deduction for the tax year 2024 was $7000. However, if you are 50, you can deduct an additional $1000, i.e., $8000 of "catch-up" contribution.

Furthermore, if you and your spouse already have a retirement plan at work, your IRA tax deduction may be phased out. Also, you cannot claim the tax deduction for your contributions to a Roth IRA.

Health Insurance Premiums Deduction

The best way to cover your medical expenses is with health insurance. However, if you are liable to cover the health insurance, the payments of your premium can go beyond your budget.

Dental and medical insurance premiums that are paid by you are not eligible for health insurance premium deductions. It is because of the 7.5% of adjusted gross income limit.

However, if you are self-employed and accountable for your own coverage, then you can deduct the premium cost. In this scenario, you do not need to consider the 7.5 AGI limit. Also, for the self-employed health insurance premium cost, you do not need to itemize.

Medical and Dental Expense Deduction

This is the tax deduction that most people generally do not want to take. If you qualify for the medical expense deduction, it means you have a serious health issue. However, if you are involved in a major car accident, are ill, or have other reasons for getting bigger medical bills, you might be able to claim deductions. But when you claim this deduction, you face two key limitations:

- You need to itemize your deduction so that you cannot claim the Standard Deduction.

- It is only available for medical and dental expenses that are more than 7.5 of your AGI.

For instance, suppose you itemize and have $10,000 of medical expenses that are eligible for tax deductions. Additionally, your adjusted gross income is $100,000. In this scenario, 7.5% of your AGI is $7500, i.e., $100,000 * 0.75 = $7500. Here, from your medical expenses, you can only deduct $2500 ($10,000 - $7500).

Alimony Deduction

If you are living separately or have been divorced for a while, then you can claim an alimony deduction on the amount you paid to your spouse. It is not an itemized deduction; on the same tax return, you can also claim the Standard Deduction.

Considering this, the alimony should be paid as per the separation or divorce agreement from before 2019. However, you cannot modify the agreement. For instance, modifying it as the alimony paid by you was not included in the taxable income of your spouse.

Further, you also need to provide the Social Security number of your spouse to the IRS while claiming the deduction. It will help the officials to check whether he/she is reporting the alimony as their income or not.

HSA Deduction

Do you know that with your health savings account (HSA), your healthcare expenses can be covered? These are tax-beneficial accounts that help you save for your future medical expenses.

If you have a high-deductible health plan (HDHP), you only need to put some money in your HSA. If this is the scenario, till the annual contribution limit, you can deduct the contribution made to HSA. The HSA contribution limits for 2024 were as follows:

- $4,150, if under HDHP, you have self-only coverage. For 2025, the limit increased to $4300.

- $8,300 if under an HDHP, you have family coverage. Additionally, for 2025, the limit increased to $8,550.

Further, if you are 55 years old, each year you can deduct and contribute $1,000.

Educator Expense Deduction

Many teachers spend their own money to purchase the required things for the classroom. It may look like nobody appreciates it, but the IRS does. Through the educator expense deduction, you can deduct up to $300 from your taxable income.

Additionally, if you and your spouse are both educators and file taxes jointly. In this scenario, you each get $300 deduction, which makes you eligible to claim $600 on your return.

American Opportunity Tax Credit

The American Opportunity tax credit, or AOC, helps you claim the first $2000 you spent on books, tuition, school fees, and equipment. However, it does not allow you to claim your transportation or living expenses; additionally, 25% of the future $2000 for a $2500 total.

Further, it is partially refundable. This means you can receive up to $1000 back if your tax bill, your credit is zero.

Gambling Loss Deduction

Gambling loss deduction is only applicable to the extent of the gambling winnings that you mentioned in your tax return. For instance, during the year, you only win $1000, but lose $5000 on betting. In this scenario, you can deduct only $1000 in losses. Further, to claim this tax deduction, you need to itemize.

Casualty and Theft Loss Deduction

This itemized deduction is available for the value of lost or stolen personal property during a natural disaster. For instance, floods, hurricanes, earthquakes, and more. Here, the amount of deduction is limited. Also, you can only claim a disaster or theft deduction loss to the extent that both:

- Your loss separately costs more than $100.

- During the year, your total loss amount (decreased by the $100 limit), 10% higher than your AGI.

Charitable Gift Deduction

To claim the charitable gift deduction, you need to itemize. Additionally, there are also specific income-based restrictions. For instance, you can only make a cash contribution of up to 60% of your AGI. However, for people who generally contribute to charity, this deduction is a tax break.

Additionally, if you are a volunteer worker for a charity, your unreimbursed pocket expenses are also deductible if:

- Not personal, family, or living expenses

- Directly associated with your charity services

- It occurs only because of your charity work

For instance, as a volunteer, you use your own car for charity work. In this scenario, you can deduct the related expense. These can be either:

- 14 cents per mile (it is the standard mileage rate)

- Your actual expenses for oil, gas, and the like

Additionally, you can also claim the expenses incurred in parking and tolls.

Home Office Deduction

For your business, if you regularly use part of your home, the IRS lets you write off specific home office deductions. It includes rent, real estate taxes, utilities, maintenance and repairs, and other expenses. Before the pandemic, it was not so common, but after that, lots of people now work from home. This tax deduction is only available for self-employed people.

Considering this, using one of the two ways, these people can deduct their home office deduction. They can either deduct:

- $5 for every square foot used of your home office (maximum of 300 square feet).

- The actual expenses associated with your home office. This is calculated by adding your total home expenses and then multiplying by the part of your home used for business.

This deduction on Schedule C of Form 1040 is claimed as a business expense. So, to claim this tax write off you do not need to itemize.

Jury Duty Pay Deduction

You get payment for serving on a jury; on that money, you need to pay tax. Additionally, because of your jury duty, if you miss your work, you still get your regular salary. It will also be taxed.

However, if you had to hand over your jury duty payment to your employer because of your work absence, you still get the payment. In this case, on your tax return, you can deduct your jury payment. Further, to claim the jury duty pay deduction, you do not need to itemize.

Qualified Business Income Deduction

The Qualified Business Income Deduction (QBI) is also called Section 199A of the Internal Revenue Code. It was introduced by the 2017 Tax Cuts and Jobs Act (TCJA). Additionally, it was made permanent by the One Big Beautiful Bill Act (OBBBA). This tax deduction allows small business owners and the self-employed to claim 20% of their qualified business income. It is generally the net total of loss, gain, income, and deduction from any qualified business or trade.

However, for specific service-oriented business owners, this deduction is nil or $0 if their income is more than the specific limit. For instance, accountants, lawyers, financial planners, doctors, and more. For 2024, the phase-out starts when before the deduction the taxable income is more than:

- For joint tax filers $383,900

- For other taxpayers $191,950

To claim QBI, you do not need to itemize. However, unlike other non-itemized deductions, it is stated after the line for AGI on your tax return. Hence not reduce your AGI.

Business Deductions for the Self-Employed

Self-employed people can also deduct both their ordinary and necessary business expenses. Here, ordinary expenses are those that are very common and accepted in your business field. Additionally, necessary expenses are those that are appropriate and helpful in your business. The common business expenses include the following:

- Cars and trucks

- Taxes and licenses

- Advertising

- Depreciation

- Supplies

- Commissions and fees

- Insurance

- Legal and professional services

- Travel

- Wages

- Employee benefit programs

- Office space

- Utilities

- Interest

- Rent

- Mortgages

- Repairs and maintenance

Additionally, under the business deductions cost of goods sold can also be claimed. Further, like the home office deduction, these expenses are also stated on Schedule C (Form 1040). Also, you do not need to itemize them to claim a deduction.

Self-Employment Tax Deduction

Do you know, self-employed people have to pay 15.3% of their taxable income for Medicare and Social Security taxes? This is known as the self-employment tax. This tax is the combined amount of ordinary tax paid by both the employer and employee.

However, to provide some tax relief to self-employed people, the IRS offers them a self-employment tax deduction. Under this, you can deduct 50% of this tax from your taxable income. It is generally 7.65% of your employer's part. Additionally, you can claim this deduction whether or not you itemize or take the standard deduction.

Adoption Credit

The adoption credit is a tax break that helps you cover a specific amount per qualified adopted child. This tax credit starts to incrementally reduce at certain levels of income. Additionally, phases out when your modified adjusted gross income is more than the threshold of a particular tax year.

Considering this, for the year 2025, the max credit is out at $17,280 with up to a refundable $5000. Further, at a MAGI of $259,190 or more, the adoption tax credit phases out.

Child Tax Credit

The child tax credit, or CTC, is available for families who have children below the age of 17. For 2025, with $1700 being refundable potentially, you get a credit of up to $2200 per child.

To claim the child tax credit, you need to fulfill certain conditions. First, it should match the stated income requirements (if filing jointly, whether your or your spouse should qualify for it). Secondly, your child should have a Social Security number.

Tip Income Deduction

Starting in 2025, without itemizing on their returns, individuals may be able to claim up to $25,000 of certain tips from their income. However, if your MAGI is more than the existing limit, not all tips will apply, and the tax deduction will be reduced. For singles, the income limit is $150,000, and for joint filers, it is $300,000.

Overtime Pay Deduction

In 2025, you can also claim your overtime pay deduction, even if you do not itemize. This tax deduction is limited. For single filers, it is $12,500, and for married filers, it is $25,000. Additionally, to claim this deduction, you should fulfill the income requirement. For single tax filers, the modified adjusted gross income should not be more than $150,000. Additionally, for married joint filers, the modified adjusted gross income should not be more than $300,000.

Home Energy Tax Credits (Limited)

The US federal government, for investing in energy-efficient purchases or upgrades, offers customers two types of energy credits. These are as follows:

- Residential Energy Tax Credit: It is also known as the solar tax credit. This tax credit can be claimed for solar energy systems that are installed and purchased before December 31, 2025. Through this tax credit, you can claim up to 30% of your installation cost.

- Energy Efficient Home Improvement Credit: This tax credit allows individuals who have bought qualifying home upgrades to claim a tax credit. It includes energy-efficient doors, windows, and heat pumps. Through this tax credit, you can claim up to $3200 when filing your tax returns.

However, these tax credit benefits from 2026 will no longer be available to taxpayers.

These were some of the popular tax deductions and tax breaks that you can claim in the US when filing your tax returns. Moving further, let's know how you can claim tax deductions.

Types of Tax Deductions and How to Claim?

There are two ways in the US through which you can claim tax deductions. The first one is the standard deduction, and the second is itemized deductions. However, you cannot claim both deductions. Further, let's know about them in detail.

- Standard Deduction: This tax deduction is directly deducted from your AGI. Here, the tax amount depends on your filing status. For instance, single taxpayers in 2025 under the standard deduction can claim up to $15,750 from their taxable income.

- Itemized Deductions: This tax deduction lets you cut off your income by taking the available tax credits that you are eligible for. The more tax credits you can claim, the less you will pay the income taxes. Considering this, there are several tax deductions available to claim. However, all of them have their separate rules. For instance, charitable donations, mortgage interest, and unreimbursed medical expenses.

So, as per your tax situation, you can claim any of the above-mentioned tax deductions. Now, moving ahead, let's know what are above-the-line deductions are.

What Are Above-the-Line Deductions?

Contributions made by the taxpayers on a health savings account, retirement account, or student loan interest payments are known as above-the-line deductions. In simple words, you can consider them as "adjustments" to your taxable income.

To know your adjusted gross income, these tax deductions are subtracted from your total income. Here, determining your adjusted gross income is vital. It is because it is the basis of your tax deductions and tax credits. Additionally, AGI is the starting point of your tax liability.

So, this is what above-the-line deductions are.

Final Thoughts

Lastly, these were some of the popular tax deductions (tax write-offs) and tax breaks available for taxpayers in 2025. Beyond these tax deductions, you can also deduct things like accountant fees, repairs, or more for business equipment. Additionally, some expenses may be amortized or depreciated rather than deducted from your taxable income.

Further, if you are not sure about what expenses are tax-deductible or need help in claiming a tax credit, connect with Savetaxs. We have a team of professionals who will assist you in claiming the available deduction and reducing your tax liability. Also, they can guide you in your tax planning. So, why wait? Contact us today and solve any tax-related query.

Miss Sanskriti is a certified Tax Expert. She has her expertise in US GAAP, Taxation, SOX, IRS, Accounting, and Auditing standards. Miss Saxena is an intellectual blend of a high-end auditor, tax consultant, and accountant

- IRA vs 401k : A Clear Difference

- 2025 Roth IRA Income and Contribution Limits

- State And Local Tax (SALT) Deductions

- Understanding Itemized Tax Deductions

- The Full List Of 20 Tax Deductions For Self-Employed People

- IRS Capital Gains Tax: Short and Long-Term Rates for 2024-2025

- Understanding Standard Tax Deduction

- Tax-Deductible Donations: Rules for Charitable Contributions

- Married Filing Taxes Jointly vs. Separately

- IRS Tax Credit vs Tax Deduction

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1756816946.webp)

_1764918370.webp)

_1752921287.webp)