- What is Section 194I?

- What Does the Word "Rent" Mean Under Section 194I?

- Who is Responsible for Deducting TDS Under Section 194I?

- When to Deduct TDS Under Section 194I?

- TDS on Rent

- When TDS Under Section 194I is Not Required?

- No Deduction or Lower Deduction Under Section 197

- Time Limit for Depositing TDS

- Consequences of Non-Deduction or Non-Payment of TDS

- Specific Circumstances – TDS Under Section 194I

- TDS on Advance Rent

- To Conclude

Section 194I mandates the deduction of tax on rent payments, with a rate of 2% for rent paid for the use of plant, machinery, or equipment, and 10% for rent paid for the use of land, buildings, or furniture and fittings.

TDS must be deducted if the total rent paid in a financial year exceeds Rs. 2,40,000 (current threshold under Section 194I).

This requirement applies to any individual or HUF whose accounts are subject to tax audit (i.e., business turnover above Rs. 1 crore or professional receipts above Rs. 50 lakhs in the preceding financial year).

When rent is paid to a Non-Resident Indian (NRI), TDS is deducted under Section 195, not Section 194I. TDS is typically 30% plus applicable surcharge and cess, subject to DTAA relief. There is no minimum TDS threshold when paying rent to an NRI. Let's learn more about Section 194I.

What is Section 194I?

Section 194I of the Income Tax Act requires the deduction of Tax Deducted at Source (TDS) on rent paid for the use of plant, machinery, or equipment at 2%, and 10% for rent paid for land, buildings (including factory buildings), or furniture and fittings.

TDS under this section is applicable if the annual rent exceeds Rs. 2,40,000.

This is the currently applicable threshold as per Income Tax provisions.

The provisions of Section 194I apply to individuals and HUFs only if they were subject to tax audit in the previous financial year.

Note: Individuals and HUFs not liable for tax audit will instead deduct TDS under Section 194-IB @ 5% if the monthly rent exceeds Rs. 50,000.

If rent is paid to an NRI (Non-Resident Indian), TDS must be deducted under Section 195, at 30% plus surcharge and cess, without any threshold limit.

What Does the Word "Rent" Mean Under Section 194I?

Under Section 194I, rent means any payment made under:

- Tenancy

- Lease

- Sub-lease

- Any other agreement or arrangement

The agreement could be for the use of:

- Land

- Building (including factory building)

- Land attached to a building (parking lot, garden, etc.)

- Machinery

- Equipment

- Plant

- Furniture or fittings

No TDS is required on refundable security deposits, as they are not income.

Advance rent (other than refundable deposits) is subject to TDS.

Rent credited to a suspense account is also subject to TDS.

Simplify Your NRI Tax Compliance. Get Expert Help Today

Who is Responsible for Deducting TDS Under Section 194I?

TDS must be deducted if the total annual rent exceeds Rs. 2,40,000.

For individuals/HUFs not covered under Section 194I, TDS must be deducted under Section 194-IB @ 5% when rent exceeds Rs. 50,000 per month.

When to Deduct TDS Under Section 194I?

TDS must be deducted at the earlier of:

- When rent is credited to the payee, or

- At the time of payment

Threshold Limit for Section 194I

TDS is not required if the total rent does not exceed Rs. 2,40,000 in a financial year.

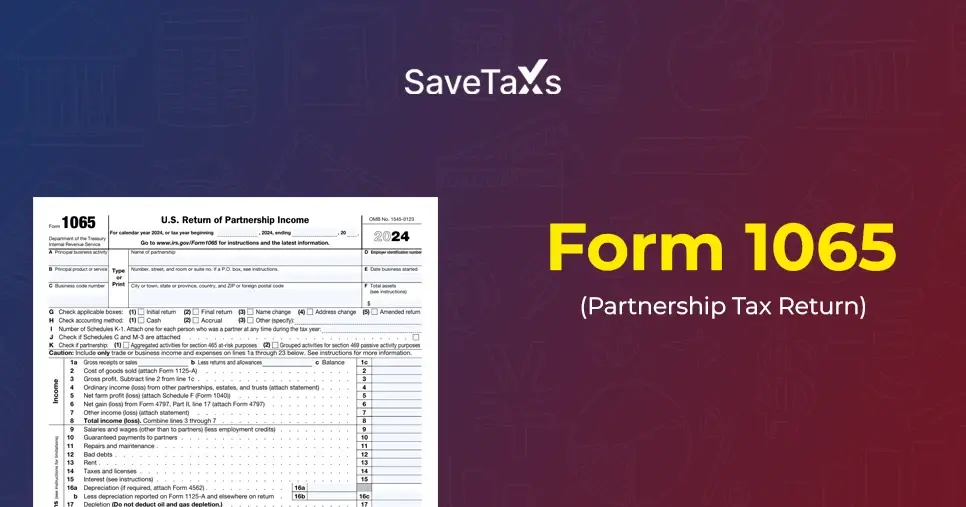

TDS on Rent

| S. No. | Payment Nature | Rates |

|---|---|---|

| 1. | Rent of plant, equipment, and machinery | 2% |

| 2. | Rent of land, building, furniture, or fittings | 10% |

Note:

- TDS is deducted at the prescribed rates.

- If the landlord does not provide PAN, TDS must be deducted at 20% (Section 206AA).

TDS Rate for Rent Paid to NRI

Rent paid to an NRI is taxable under Section 195, not Section 194I.

TDS rate:

- 30% + surcharge + 4% health & education cess

- No threshold limit

- DTAA rates may apply

The payer must also obtain a TAN and file Form 15CA/CB if required.

Example

Payer: XYZ Pvt Ltd

Receiver: Mr. Arjun (Resident)

Monthly Rent: Rs. 75,000

Since annual rent exceeds Rs. 2,40,000, XYZ Pvt Ltd must deduct 10% TDS.

Yearly rent: Rs. 9,00,000

Monthly TDS: Rs. 7,500

Net monthly payout: Rs. 67,500

When TDS Under Section 194I is Not Required?

TDS is not required:

- When the tenant is an individual/HUF not subject to tax audit

- When they instead deduct TDS under Section 194-IB (if applicable)

- Payments between a film distributor and an exhibitor that do not involve renting the cinema premises

No Deduction or Lower Deduction Under Section 197

- Regarding deduction under Section 197 for tax at source, a payee may file Form 13 with the Assessing Officer to request either a lower deduction or no deduction of TDS.

- If the AO is convinced that the total income warrants no deduction of tax or deduction at a lower rate, they may issue a certificate in Form 15AA directly to the payer.

Time Limit for Depositing TDS

- TDS deducted must be deposited within 7 days from the end of the month.

- For deductions in March, the due date is April 30.

- Quarterly TDS returns must be filed within specified deadlines.

Additionally, it is crucial to file quarterly TDS statements on time.

Consequences of Non-Deduction or Non-Payment of TDS

- 1% per month interest for non-deduction

- 1.5% per month interest for deduction, but non-payment

Specific Circumstances – TDS Under Section 194I

Income from Letting Out of Factory Building

- In relation to TDS under Section 194I, specific conditions apply for income from the letting of a factory building. Generally, rent earned from such a building is considered business income for the owner. However, in certain instances, it may qualify as property income for the lessor.

- In these cases, the payments, despite being categorized as business income for the lessor, for which he is responsible for advance tax payments and reporting the rental income, are still subject to tax deduction at source (TDS).

Including Service Charges

Service charges from business centers also come under the definition of rent, as they fall under payments by "whatever is named".

Separate Persons for Building & Furniture

When a building is rented out by one party and furnished by another, the payee must deduct tax under Section 194I from the rent paid/credited to both the building and furniture owners separately.

Rent Not Payable Monthly

Regarding rent that is not paid monthly, Section 194I does not require a tax deduction to occur on a month-to-month basis. If rent crediting occurs quarterly, deductions should align with this and must be made every quarter only. Similarly, if the rent is paid annually, the deduction should be taken once a year based on the actual payment or credit.

Cold Storage Facility Charges

- For cold storage facilities where milk, ice cream, and vegetables are stored, payments may be labeled as charges for use of the plant rather than for the use of the building itself.

- Cold storage qualifies as a plant. However, since the agreements between customers and cold storage owners are primarily contractual, it makes Section 194C applicable.

Association Paying Hall Rent

When an association of persons pays hall rent, they have a tax deduction obligation, provided that payments exceed Rs. 50,000 monthly, as they are considered a different kind of assessee from an individual or an HUF (Hindu Undivided Family).

Payment to Hotels for Seminars

Premises + catering:

- Catering → Section 194C

- Premises (if separately billed) → Section 194I

TDS on Advance Rent

When the advance rent is paid to the landlord, TDS must also be deducted. However, certain exceptions exist for calculating TDS on advance rent, which are as follows:

- If the advance rent paid applies to the next financial year, TDS will be applicable only on earnings from that year.

- When a rental agreement is cancelled after the advance payment of rent and the deduction of TDS, the balance must be refunded to the tenants. This cancellation should be noted in the landlord's income tax return (ITR) submitted for TDS deduction.

- A TDS certificate is required to be issued quarterly as Form 16A for every payment apart from salary.

To Conclude

When making rent payments, it is vital to deduct the TDS appropriately, either at 2% or at 10% as applicable, when the payment exceeds the Rs. 50,000 threshold. Failing to deduct TDS may result in disallowances, while delays in deduction and payments can incur late payment interest and penalties. To avoid such penalties, Savetaxs comes to your rescue. We have a team of professionals who have been helping individuals with taxation services for decades. Don't wait anymore, we are actively working 24*7 across all time zones to assist you with everything and provide you with the best quality service possible.

Note: This guide is for informational purposes only. The views expressed in this guide are personal and do not constitute the views of Savetaxs. Savetaxs or the author will not be responsible for any direct or indirect loss incurred by the reader for taking any decision based on the information or the contents. It is advisable to consult with either a Chartered Accountant (CA) or a professional Company Secretary (CS) from the Savetaxs team, as they are familiar with the current regulations and help you make accurate decisions and maintain accuracy throughout the whole process.

Mr. Ritesh has 20 years of experience in taxation, accounting, business planning, organizational structuring, international trade financing, acquisitions, legal and secretarial services, MIS development, and a host of other areas. Mr Jain is a powerhouse of all things taxation.

- Form 27Q Simplified For NRIs- TDS Return on Payments

- What is a Tax Residency Certificate (TRC) and How to Get It?

- NRI Selling Property in India

- How to Claim TDS Refund for an NRI?

- TDS on Sale of Property by NRIs in India

- A Guide on the Types of TDS (Tax Deducted at Source) in India

- Form 26AS for Indians and NRIs: What It Is & Why It Matters?

- TDS Deduction on Rental Property Owned by NRI

- Digital Signature Certificate (DSC)

- Section 195 of Income Tax Act - TDS Applicability for NRI

Want to read more? Explore Blogs

Frequently Asked Questions

No matter what your source of income is, we've got you covered. There’s a plan for everybody!

_1754564786.webp)

_1759750925.webp)